Part 4: Results from our audits and financial trends

4.1

For 2022/23, we issued unmodified (“clean”) opinions in the audit reports for the five responsible authorities we looked at. This means that we were able to gain assurance that the financial statements were fairly stated and met the requirements of the applicable financial reporting framework.

Control environment

4.2

During our audits of the responsible authorities we looked at internal controls relevant to the audit, including controls designed to prevent or detect material misstatements in the financial statements. We identified risks with internal controls across most of the authorities, specifically for the approval of journal entries and for segregating duties (separating roles to reduce the risk of error or fraud), which has been acknowledged.15 These are known control vulnerabilities for smaller organisations.

Auditing service performance

4.3

Responsible authorities do not have a legislative requirement to report service performance information. The Medical Council voluntarily reported on its service performance for 2022/23, which formed part of its annual audit.

4.4

The performance measures the Medical Council included in its annual report reflected its three strategic priorities, which are set out in its strategic plan for 2022-2027.

4.5

Under each strategic priority, the Medical Council outlined long-term outcomes, medium-term intentions, and short-term outputs. The long-term outcomes cover intentions such as ensuring that members of the public have increased trust in the medical profession, Māori experience cultural safety when receiving health services from doctors, and the Council’s registration policies are fit for purpose and responsive to the changing nature of the medical workforce.

4.6

The Medical Council also provides commentary and progress indicator keys for each objective. It is transparent about what went well and what needs further improvement.

4.7

This serves as a good example for the other responsible authorities, if they choose to report on their service performance information in the future.

Financial trends

Increases in total revenue

4.8

Responsible authorities are charitable organisations registered under the Charities Act 2005. They do not receive regular government funding. Most responsible authorities collect revenue by charging annual practicing certificate fees. They also collect revenue through disciplinary levies and recoveries16 and other income such as interest earned from investments or cash reserves.

4.9

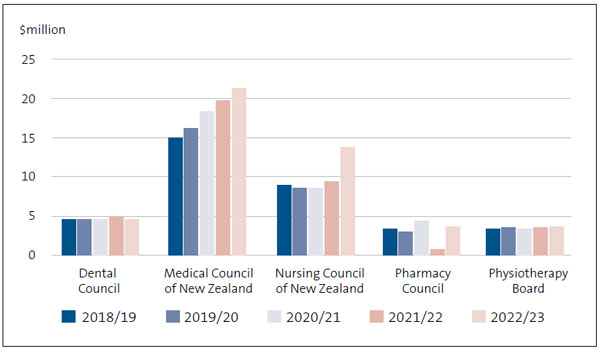

Overall, total revenue increased slightly in 2022/23 compared with the previous year (see Figure 2). Total revenue in 2022/23 was $47 million. However, it is difficult to make a comparison because the Pharmacy Council changed its balance date in 2021/22, which meant that it only reported results for nine months (see paragraphs 4.16 and 4.17).

4.10

The Medical Council and the Nursing Council had the biggest increases in total revenue in 2022/23. The Medical Council reported an 8% increase in total revenue in 2022/23 compared with the previous year (an increase in total revenue of $1.6 million) while the Nursing Council reported a 46% increase (an increase in total revenue of $4.33 million).

Figure 2

Total revenue reported by the five authorities we looked at, 2018/19 to 2022/23

4.11

The Nursing Council attributes its increase in total revenue for 2022/23 to the significant growth of applications from internationally qualified nurses applying to register in New Zealand. For 2022/23, the Nursing Council received 9675 international applications – a 201% increase from 2021/22. The Nursing Council attributed the increase to intentional international recruitment by the health sector, post-Covid-19 demand, changes to immigration settings, and New Zealand’s reputation as a safe workplace (especially during the Covid-19 pandemic).

4.12

The Nursing Council approved an increase to the annual practicing certificate fee in December 2021, before the surge in applications from internationally qualified nurses. This fee increase was the first since 2011, from $110 to $130 (an 18% increase with effect from July 2022).

4.13

Changes in revenue streams across the five responsible authorities resulted in an overall increase in revenue earned from annual practicing certificates and other fees related to registration,17 increasing to $37.19 million in 2022/23. This is 79% of all revenue.

4.14

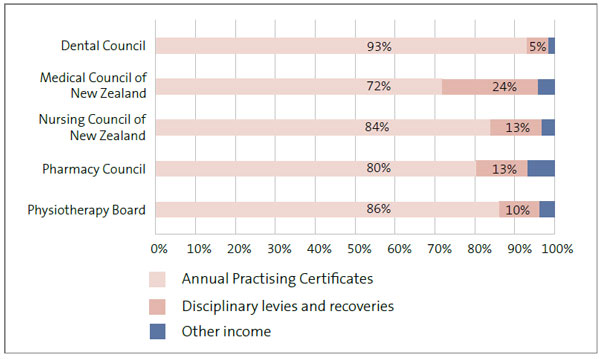

Generally, the percentages of revenue earned from the major revenue streams remained broadly consistent with the previous year. As shown in Figure 3, the revenue sources were similar between the five responsible authorities, although the Dental Council received a smaller proportion of their revenue from disciplinary levies and recoveries than the other responsible authorities.

Figure 3

Revenue sources for the five authorities we looked at, 2022/23

4.15

A more detailed breakdown of total revenue is outlined in Figure 4.

Figure 4

Type and amount of revenue for the five responsible authorities we looked at, 2022/23

| Revenue from annual practicing certificates and other fees related to registration $million |

Revenue from disciplinary levies and recoveries $million |

Revenue from other income $million |

Total revenue $million |

|

|---|---|---|---|---|

| Dental Council | 4.24 | 0.25 | 0.07 | 4.56 |

| Medical Council of New Zealand | 15.28 | 5.09 | 0.91 | 21.28 |

| Nursing Council of New Zealand | 11.52 | 1.87 | 0.37 | 13.76 |

| Pharmacy Council | 2.93 | 0.47 | 0.25 | 3.65 |

| Physiotherapy Board | 3.22 | 0.38 | 0.15 | 3.75 |

| Total by revenue type | 37.19 | 8.06 | 1.75 | 47.00 |

Significant deficits

4.16

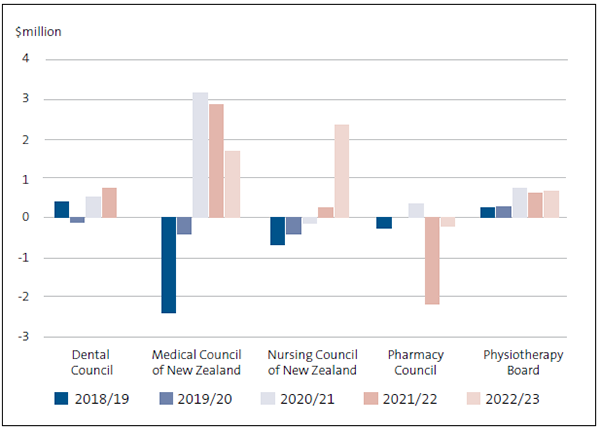

The Pharmacy Council reported a deficit of $2.15 million in 2021/22 (see Figure 5). This was because it moved from a 30 June balance date to a 31 March balance date, so the financial year ending 31 March 2022 was only nine months. This change was to better align its financial statements with the annual practising certificate recertification period and simplify its year-end financial reporting.

4.17

The change to a 31 March balance date affected the Pharmacy Council’s 2021/22 budget. Because of the new financial year end date, revenue received in March 2022 for the 2022/23 recertification year (starting 1 April 2022) was recorded as income in advance. It is recorded this way because of accounting standards requirements.

4.18

The Medical Council reported a deficit in 2018/19 of $2.38 million. This was because of expenses incurred after the 2016 Kaikōura earthquakes, which damaged the premises it leased.

Figure 5

Surpluses and deficits reported by the five authorities we looked at, 2018/19 to 2022/23

Surplus and financial reserves

4.19

The Physiotherapy Board reported surpluses from 2018/19 to 2022/23, ranging from $0.24 million in 2018/19 to 0.66 million in 2022/23.

4.20

In 2022/23, the Nursing Council reported a surplus of $2.36 million compared with $0.25 million in the previous year. This was due to a significant increase in revenue from applications by internationally qualified nurses and an increase in annual practising fees (see paragraphs 4.11 and 4.12).

4.21

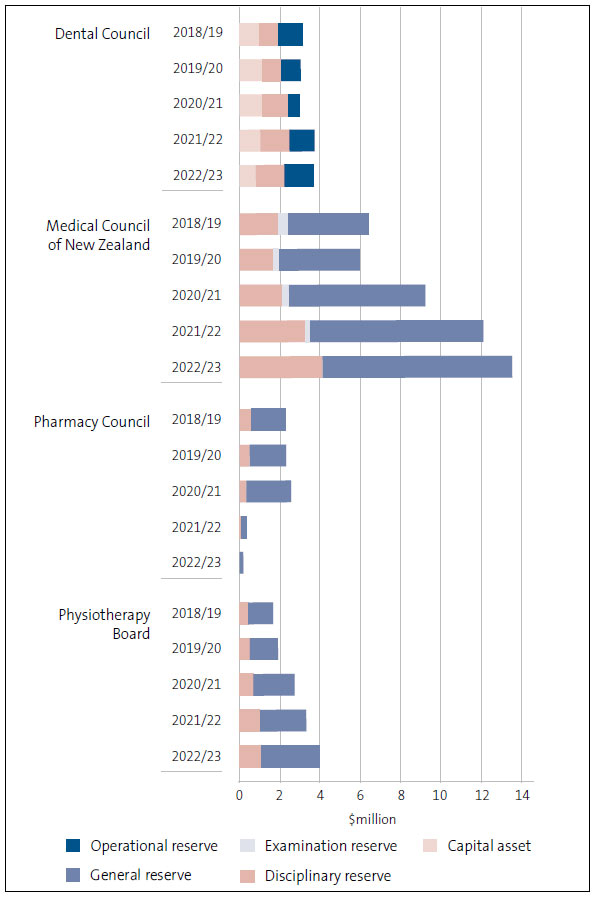

The Medical Council made surpluses of $3.17 million, $2.84 million, and $1.68 million in the last three financial years (see Figure 5). The Medical Council’s general reserve increased from $4.03 million in 2018/19 to $9.40 million in 2022/23. In our 2022/23 audit, we highlighted that the Medical Council’s level of reserves exceeded the target range established in its financial policy.

4.22

Reserves are a portion of an organisation’s financial surplus that is set aside for future purposes. It is good practice to hold reserves to cover unexpected costs, replace capital equipment, and make new investments.

4.23

The Medical Council is reviewing its reserves policy and considering unexpected costs and necessary investments for business transformation and capital replacement projects. It is also working towards establishing a capital asset and replacement reserve to improve transparency about its reserves.

4.24

Managing reserves can be challenging for the responsible authorities because disciplinary cases can be unexpected and expensive. It is important that the responsible authorities continue to follow and regularly review their reserves policies to guide decisions about fee setting, investments, and expenditure. For greater transparency, the responsible authorities could specify in their annual report the types of reserves they hold (including the target level) and how the reserves are used each year.

4.25

Four of the five responsible authorities disaggregated their reserves into specific types, such as disciplinary reserves and examination reserves, and reserves for different sub-specialities, such as capital assets reported by the Dental Council. Figure 6 shows the breakdown of the reserves over time.

Figure 6

Reserves held by the Dental Council, the Medical Council, the Pharmacy Council, and the Physiotherapy Board, 2018/19 to 2022/23

Note: The Nursing Council is not included in this figure because it did not disaggregate its reserves.

For 2022/23, the Medical Council reported an examination reserve of $0.16 million and the Pharmacy Council reported a disciplinary reserve of $0.58 million.

4.26

Given the responsible authorities are not-for-profit organisations, a large reserve can indicate that fees might not be set at a level that fairly recovers costs. This can result in inequities, with current practitioners potentially subsidising the costs of future practitioners.

| Recommendation 4 |

|---|

We recommend that responsible authorities consider specifying the types of financial reserves they hold and their reserves policies in their annual reports. This will provide transparency on decisions about fee setting, investments, and expenditure. |

15: For the Medical Council, risks related to the approval of journal entries and segregating duties were not noted in the 2022/23 audit report.

16: The disciplinary levy is a standard fee that funds the costs of investigations, prosecutions, and hearings. Disciplinary recoveries are fees paid by individual health practitioners who are subject to disciplinary proceedings.

17: Other fees include registration fees, overseas registration fees, and non-practising fees.