Part 5: The audit reports we issued

5.1

Every year, we issue an independent opinion on each council's financial statements and performance information (statements of service performance). This information is an important part of the council's annual report and its accountability to its community.

5.2

An audit opinion lets the reader know whether they can rely on the audited information in the council's annual report (including whether the council's reported performance in the annual report fairly reflects their actual performance for the year).

5.3

In this Part, we discuss:

- when councils adopted their 30 June 2023 annual reports and whether they met the deadlines for doing so;

- the type of audit reports we issued;

- the emphasis of matter paragraphs we issued; and

- the key audit matters that the auditor of Auckland Council is required to report on.

When councils adopted their 2022/23 annual reports

5.4

The Local Government Act 2002 requires councils to:

- complete and adopt an annual report that contains audited financial statements and service performance information within four months of the end of the financial year;

- make the audited annual report publicly available within one month of adopting it; and

- make an audited summary of the annual report publicly available within one month of adopting the annual report.

5.5

In our article "Results of the 2021/22 council audits", we reported a change in timeliness for councils adopting their annual reports.63 We observed that this reflected the ongoing effects of the Covid-19 pandemic, even though the reporting time frames had been extended.64

5.6

For 2022/23, reporting time frames returned to normal. This was in accordance with the Local Government Act 2002,65 which required the removal of the two-month extension put in place during the Covid-19 pandemic.

5.7

In 2022/23, 22 councils (28%) had their audit opinions signed after the reporting deadline, compared to 35 councils (45%) in 2021/22. Reasons for this included:

- resourcing constraints that councils experienced during the audit and that affected audit delivery and readiness;

- councils' capacity and capability affected by short-staffed teams;

- requests to the audit team to prioritise audits of long-term plans; and

- delays caused by third parties (such as valuers not being able to provide their valuation in time).

5.8

When we wrote this report, two councils were yet to complete their annual audits.66

5.9

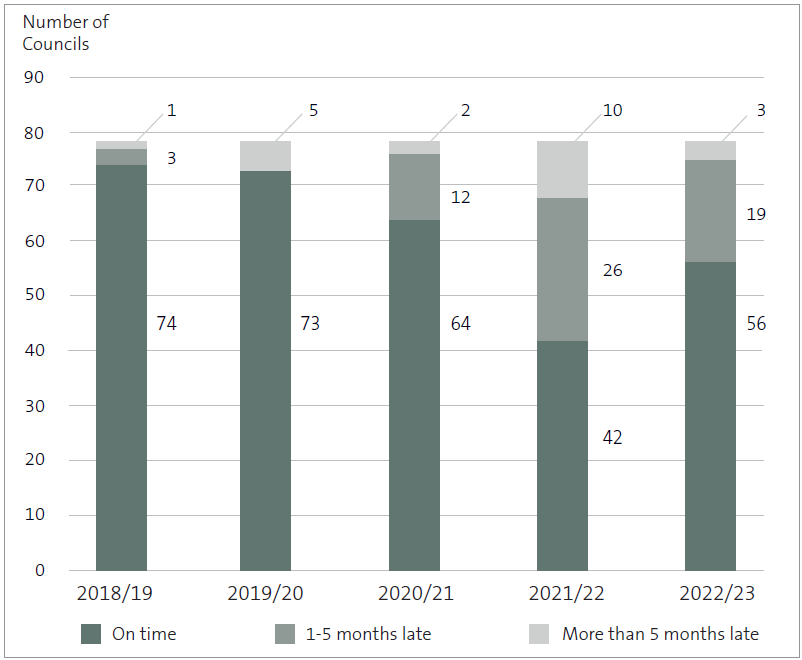

Although timeliness of reporting remains an issue, it is improving. Most councils completed and adopted their annual reports in line with section 98(3) of the Local Government Act 2002. Figure 24 shows how many councils adopted their annual reports on time from 2018/19 to 2022/23.

Figure 24

When councils adopted their annual reports, 2018/19 to 2022/23

Note: The statutory time frame was extended to 31 December for 2020/21 and 2021/22 because of the Covid-19 pandemic.

5.10

In 2022/23, 56 of the 78 councils adopted their annual report on time and 19 councils were one to five months late. This is an improvement on 2021/22, when 42 councils adopted their annual report on time and 26 councils were one to five months late.

5.11

In 2021/22, 76 councils (97%) made their annual reports publicly available within a month of adoption and 70 councils (89%) released their summary annual reports on time. In 2022/23, 71 councils (91%) made their annual reports publicly available within a month of adoption and 67 councils (85%) released their summary annual reports on time.

The types of audit reports we issued

5.12

In 2022/23, we issued audit reports for 76 councils' financial statements and performance information (compared to 78 in 2021/22).

5.13

An audit report will be either standard or non-standard.67 A non-standard audit report is one that contains:

- a qualified audit opinion; and/or

- an "emphasis of matter" paragraph.

5.14

If a material aspect of a council's financial statements or performance information does not comply with accounting standards or the council cannot provide evidence to support that information, we issue a qualified audit opinion. A qualified audit opinion does not mean that the issue is pervasive; it just means that the auditor disagrees with a specific aspect of the audited information.

5.15

We issued 22 qualified audit opinions on councils' financial statements and performance information for 2022/23.68

5.16

An auditor might also include an emphasis of matter paragraph in the audit report. An emphasis of matter paragraph does not mean that the auditor has found anything wrong.

5.17

Instead, the auditor is drawing attention to a matter or matters presented or disclosed that are of such importance that they are fundamental to the reader's understanding of the audited information. Paragraph 5.91 describes the emphasis of matter paragraphs we issued in 2022/23.

5.18

An audit report can contain one or more qualified audit opinions and/or one or more emphasis of matter paragraphs.

5.19

Figure 25 summarises the audit reports we issued to councils in 2021/22 and 2022/23.

Figure 25

The type of audit reports issued in 2021/22 and 2022/23

| Type of audit report | 2021/22 | 2022/23 |

|---|---|---|

| Standard audit report | 8 | 8 |

| Unmodified audit opinion that included one or more emphasis of matter paragraphs | 49 | 46 |

| Qualified audit opinions | 21 | 22 |

| Total reports issued | 78 | 76* |

* When we wrote this report, the audits of the annual reports of Buller District Council and West Coast Regional Council were still in arrears.

5.20

In the last four years, we have seen a significant increase in the number of non-standard audit opinions. This highlights the increasingly complex and uncertain environment that councils operate in.

Audits and the statement of service performance

5.21

The statement of service performance includes important information about the services a council provides to its community and what the council has achieved. A council's performance information should tell a coherent story about:

- the services it delivers and why it delivers them;

- the standards it is looking to meet in delivering those services; and

- what difference it intends to make for its community.

5.22

We often refer to the statement of service performance as non-financial performance reporting. Good quality non-financial performance reporting should provide enough information for a reader to determine what the council has achieved in the year and what the council needs to improve.

5.23

Twenty of the 22 qualified audit opinions we issued in 2022/23 related to the statement of service performance (compared to 17 in 2021/22). In our last three reports on local government audit results, most qualified audit opinions related to issues with councils' performance information.

5.24

As we have previously reported, the large number of qualified audit opinions on councils' service performance information indicates that many council performance reporting systems are not fit for purpose. Weaknesses in these systems make it challenging for councils to report on their performance completely and accurately, which could make communities lose confidence in their council's reporting.

5.25

We want to see councils improve their performance reporting systems so they are robust and produce reliable information. Without effective performance reporting systems, councils will find it difficult to clearly understand their performance and where they need to focus their resources to maintain appropriate levels of service.

5.26

Ineffective performance reporting systems also mean that councils are not clearly or accurately reporting their performance, which makes it difficult for their communities to hold them to account.

5.27

In January 2024, we published "Local government planning and reporting on performance". This guidance is intended to support local government to improve its performance reporting.

Performance reporting systems

5.28

For the past six years, Kaikōura District Council has not had reliable systems and processes to accurately report on more than a quarter of its performance measures.69 In 2022/23, the Council made slight improvements. However, as in 2021/22, the Council could not report any performance information or reported incomplete performance information for three material measures.

Performance measures about three waters

5.29

The Secretary for Local Government sets rules for how councils report on their performance in providing drinking water, wastewater, and stormwater services. The Department of Internal Affairs has issued guidance to help councils apply these rules, including how to count complaints.

5.30

The mandatory performance measures include the total number of complaints (for every 1000 properties connected) that councils received about:

- drinking water clarity, taste, odour, pressure or flow, and continuity of supply, and the council's response to any of these issues;

- sewage odour and sewerage system faults and blockages, and the council's response to issues with the sewerage system; and

- the performance of the stormwater system.

5.31

We identified issues with the information about these performance measures that 14 councils reported. The issues were with:

- the total number of complaints received for water supply, wastewater, and stormwater; and

- the quality of comparative year information about maintenance of the reticulation network for water supply.

5.32

We issued a qualified audit report to these councils for not meeting these reporting obligations.70

5.33

In 2021/22, we issued this qualified audit opinion to 13 councils. Two councils that received this qualified audit opinion in 2021/22 (Rangitīkei District Council and Southland District Council) have resolved the issue and did not receive a qualified opinion this year.

5.34

We issued this qualified audit opinion to three additional councils (Napier City Council, Whakatāne District Council, and Whanganui District Council) for 2022/23. These councils had incomplete records of complaints, so we could not determine whether the results the councils reported for these performance measures were correct.

5.35

In 2021/22, Horowhenua District Council and Tararua District Council could not provide enough evidence about the number of complaints they received about water supply, wastewater, and stormwater services or their response. Both councils resolved the issue for 2022/23, but we still issued a qualified audit opinion because the current year performance information could not be directly compared to the reported 2021/22 information.

5.36

Four of the 14 councils that received qualified audit opinions are shareholders of Wellington Water Limited.71 Those four councils used information from their own systems in combination with information provided by Wellington Water Limited to report the results for the performance measures. We could not gain assurance over the completeness and accuracy of the reported results.72

5.37

In 2021/22, we issued a qualified audit opinion to Porirua City Council, one of Wellington Water's shareholding councils. However, in 2022/23, the Council made significant efforts to improve the level of information that its new system recorded for water complaints. This meant that the Council's 2022/23 information was correct, but it still received a qualification on its comparative information for 2021/22.

5.38

We also issued qualified opinions to Hastings District Council and Napier City Council for other water-related measures.

5.39

Hastings District Council could not provide enough evidence for the water loss percentage it reported.73 In 2021/22, the Council used alternative measurement techniques to measure water loss percentage. However, the Council could not confirm the accuracy of that measure.

5.40

Napier City Council was unable to accurately report on fault response times for each of the three waters services for 2021/22 and 2022/23.

5.41

This is the third year we have issued multiple qualified audit opinions relating to the Department of Internal Affairs' mandatory performance measures. These measures are important because they make transparent the number of complaints from ratepayers about water services and the scale of the issues that are complained about.

5.42

These findings highlight the need for councils to invest in fit-for-purpose systems and controls to enable them to deliver consistent, high-quality critical lifeline services to their communities.

Greenhouse gas emissions

5.43

Councils are giving greater consideration to how their GHG emissions affect the climate. For example, councils are measuring and reporting on their GHG emissions. The 2022/23 audit results show that this trend continues. This is also evident in the increased number of emphasis of matter paragraphs we issued on this topic (see paragraphs 5.95-5.98).

5.44

Quantifying GHG emissions is subject to uncertainty. This is because the scientific knowledge and methodologies to determine emission factors and processes to calculate or estimate quantities of GHG sources are still evolving. GHG reporting and assurance standards are also evolving.

5.45

We issued qualified audit opinions about their reporting of GHG emissions to:

- Greater Wellington Regional Council;

- Upper Hutt City Council; and

- Wellington City Council.

5.46

Our audit of Greater Wellington Regional Council's GHG emissions was limited for 2021/22 and 2022/23. Specifically, we were concerned about uncertainties with the Council's measurement of CO2 emissions generated from public transport services.

5.47

We issued qualified opinions in 2021/22 and 2022/23 because the Council did not provide enough evidence that its performance reporting was materially correct. This was because the Council was still developing the systems and controls needed to produce reliable evidence to support its measurement of GHG emissions.

5.48

In our 2022/23 audit report, we also drew attention to the inherent uncertainty in quantifying GHG emissions.

5.49

The uncertainty arises because the scientific knowledge and methodologies to determine the emissions factors and processes to calculate or estimate quantities of GHG sources are still evolving, as are GHG reporting and assurance standards.

5.50

Wellington City Council's performance information included a measure of the quantity of GHG emissions. The Council could not provide enough evidence to measure the GHG emissions associated with certain goods and services, including capital goods for the years ending 30 June 2022 and 30 June 2023.

5.51

In some instances, the Council used historical spend-based emission factors for measuring its GHG emissions. There was not enough evidence to show that those factors were still relevant. There was no other evidence to confirm that this was materially correct.

5.52

This meant that the scope of our audit was limited, and we issued a qualified audit opinion. We also drew attention to disclosures outlining the inherent uncertainty in the reported GHG emissions.

5.53

Upper Hutt City Council chose to include a measure of the quantity of GHG emissions in its performance information for 2022/23. This includes emissions that the Council generates directly and indirect emissions from the products and services that the Council uses.

5.54

In measuring the GHG emissions from certain goods and services purchased by the Council, including capital goods, the Council relied on spend-based emissions factors based on 2007 data. There is not enough evidence to show that these factors are relevant for measuring the Council's GHG emissions for the year ended 30 June 2023.

5.55

We were unable to get enough alternative evidence to conclude that the reported performance is materially correct. Without further modifying our opinion, we also drew attention to the inherent uncertainty of GHG disclosures.

5.56

For all three councils, we considered their performance measures on GHG emissions to be material because the councils have declared a climate emergency and because of the public interest in information about climate change.

5.57

We are currently carrying out a performance audit that looks at how well councils are implementing climate change actions. We expect our findings will support councils to engage more effectively with their communities about their climate change actions.

5.58

See Part 3 for more information about GHG reporting.

Applications for building consents

5.59

Councils have a statutory requirement to process most building consent applications within 20 working days. There is guidance on how the days should be counted.74

5.60

This timeliness requirement can indicate a council's effectiveness in responding to growth. This is because the timely processing of building consent applications indicates how responsive councils are to an increasing demand for infrastructure.

5.61

The two councils that received a qualified audit opinion for 2021/22 also received a qualified audit opinion for 2022/23.

5.62

Dunedin City Council received a qualified audit opinion for 2021/22. The Council had not been counting days taken to process building consent applications in accordance with the guidance. For 2022/23, we could determine that the Council had resolved the issue.

5.63

However, the Council had not recalculated the 2021/22 comparative year information for the timeliness of processing building consent applications (in keeping with the guidance). Therefore, our comparative year work was limited, and we had to issue a qualified audit opinion.

5.64

Manawatū District Council also received a qualified audit opinion for processing building and resource consent applications within statutory time frames for 2022/23 and 2021/22.

5.65

The sample of consent applications we looked at had recorded processing times that were inconsistent with the information Manawatū District Council had to support the consent applications. The extent of the inaccuracies meant that we could not determine whether the Council's reported results for these two measures were materially correct.

Smooth travel exposure

5.66

Smooth travel exposure is a mandatory performance measure under the Non-Financial Performance Measures Rules 2013 set by the Secretary for Local Government.75 It measures the smoothness of driving on local roads, as indicated by the percentage of vehicle travel on roads that is below a defined roughness threshold.

5.67

All local councils are required to report on smooth travel exposure in their annual report. In 2022/23, we issued a qualified audit opinion to three councils for their smooth travel exposure performance measures.

5.68

For Dunedin City Council, we could not get assurance over the accuracy of the performance measure on smooth travel exposure for 2022/23. During our audit, we found that the average daily traffic count and vehicle kilometres travelled data entered into the Council's road assessment and maintenance management database differed from the source data that the Council's independent contractor supplied.

5.69

The Council could not explain why these were different. As a result, our work was limited, and there were no practicable audit procedures we could apply to get assurance over the accuracy of smooth travel exposure reported against the performance measure.

5.70

For Invercargill City Council, our audit was limited because we could not get enough audit evidence of the performance measure for the accuracy of smooth travel exposure. The Council did not maintain an accurate record of the traffic count data used to calculate it.

5.71

Because the Council could not provide enough audit evidence for a material performance measure and the possible effects of the misstatements could be material, we issued a qualified audit opinion.

5.72

Palmerston North City Council had not carried out a road smoothness survey within the last two years. As a result, this was the third consecutive year that the Council used outdated road smoothness survey results, and we issued a qualified audit opinion.

Residents survey

5.73

Carterton District Council's performance framework includes several performance measures that are based on satisfaction surveys completed by residents in the district. The Council decided not to carry out its resident satisfaction surveys for 2022/23. Instead, it reported results from the previous year's survey, with a disclosure explaining why it had not carried out the surveys.

5.74

Carterton has 12 resident satisfaction survey measures. We do not consider that any of these measures are material individually. However, the cumulative impact of not meeting these measures is material.

5.75

Because of this, Carterton District Council's performance information was limited. We issued a qualified audit opinion because actual levels of resident satisfaction might differ from those reported. Resident satisfaction is an important part of the Council's performance information because it indicates the quality of the services provided to residents.

Audits and the financial statements

5.76

Seven councils received qualified audit opinions on asset valuation aspects of their financial statements. They were:

- Dunedin City Council;

- Hawke's Bay Regional Council;

- Invercargill City Council;

- Kaikōura District Council;

- Napier City Council;

- Marlborough District Council; and

- Waitaki District Council.

Qualified audit opinions because of asset valuations

5.77

Asset valuations are a critical part of effective and efficient asset management. Asset valuations reflect the actual cost to renew and replace assets. They assist councils in assessing the condition and performance of their assets to inform their planning for repairing and replacing community-funded assets.

5.78

Accounting standards require councils that measure assets at fair value to carry out revaluations on a regular basis to ensure that revalued assets are not included at a value that is materially different to their fair value.

5.79

Revaluations also provide councils with more realistic costs for delivering services. This keeps councils accountable to their communities for their financial decisions and resource management.

5.80

Asset valuations can directly affect the accuracy of a council's balance sheet and its ability to provision accurately for service costs and the future needs of its community. Councils have assets that are worth a significant amount of money, and an inaccurate asset valuation can result in a material misstatement of a council's financial statements.

5.81

For Hawke's Bay Regional Council, our audit was limited because of the valuation and impairment of infrastructure assets that were damaged by Cyclone Gabrielle. The Council and Group's infrastructure asset valuations were based on an external valuation done in 2020.

5.82

The Council and Group recognised an impairment on the stop banks infrastructure assets based on the amount of repair costs incurred up to 31 August 2023 after Cyclone Gabrielle. As a result of the damage and the method the Council and Group used to calculate the impairment and market changes since the last valuation, the fair value of the infrastructure assets could differ significantly from their recorded carrying value. For these reasons, we could not get enough audit evidence of the fair value of the assets as at 30 June 2023.

5.83

We issued Napier City Council and Waitaki District Council with similar qualified audit opinions. This was because (based on an analysis of relevant indices and advice to the councils from independent expert valuers) there was evidence that there could be a material change in the fair value of their water supply, wastewater, and stormwater assets, operational land and buildings, and, for Waitaki District Council, roading.

5.84

In 2020/21, we issued Kaikōura District Council and Invercargill City Council with similar qualified audit opinions to Napier City Council and Waitaki District Council. Both councils received qualified audit opinions on their comparative 2021/22 information.

5.85

We issued these councils with a qualified audit opinion in 2020/21 because, based on an analysis of relevant indices, there was evidence that there could be a material change in assets that had not been revalued. Because we did not know whether the 2020/21 balances were accurate, it was impracticable for us to determine the amount of the adjustment required.

5.86

Any subsequent misstatement of the carrying value from 2020/21 would consequently affect the revaluation in 2021/22. This meant we could not get enough audit evidence to support the comparative asset revaluation movement recognised in the 2022/23 financial statements, and we issued a qualified audit opinion.

5.87

Marlborough District Council revalued its water supply, wastewater, and stormwater assets as at 30 June 2022. In the previous year, there was evidence that the Council's methodology to revalue its three waters infrastructure assets as at 30 June 2022 might have resulted in the valuation being based on unit rates that did not appropriately reflect the current contract rates incurred by the Council for renewal of three waters assets.

5.88

The scope of our audit was limited, and it was impracticable to determine the amount of any adjustment that might be needed. This matter remained unresolved as at 30 June 2023.

5.89

We also issued Dunedin City Council with a qualified audit opinion on its financial statements because of a qualification on the 2021/22 comparative year information. In 2021/22, there was some evidence that the Council's methodology might have resulted in the valuation being based on replacement costs that were significantly lower than they should have been.

5.90

The Council revalued its three waters infrastructure at 30 June 2022. We got enough evidence for this valuation. However, any misstatement from 2020/21 would affect the revaluation in the statement of comprehensive revenue and expense for the comparative year ended 30 June 2022.

Emphasis of matter paragraphs

5.91

Of the 76 audit opinions we issued to councils in 2022/23, 67 (88%) included one or more emphasis of matter paragraphs. This is compared to 69 (88%) of the 78 audit opinions issued to councils in 2021/22. We include emphasis of matter paragraphs in audit reports to draw readers' attention to a disclosed matter that is fundamental to the readers' understanding.

Three Waters Reform Programme

5.92

In April 2023, the then Government proposed amendments to the Affordable Waters Reform, previously known as the Three Waters Reform.76 The key change was an increase in publicly owned water service entities from four to 10.

5.93

The water service entities' establishment dates were to be staggered, with all the water services entities intending to become operational between 1 July 2024 and 1 July 2026. However, the change in government has added uncertainty because the new Government repealed the water services reform legislation and replaced it with new proposals.

5.94

In response to these factors, we included an emphasis of matter paragraph in 64 councils' audit reports that highlighted the uncertainties about the unknown establishment date of the water service entities and the transfers of assets and other matters. In 2021/22, we included a similar emphasis of matter paragraph in 67 councils' audit reports.

Inherent uncertainties in the measurement of greenhouse gas emissions

5.95

In 2022/23, we issued nine emphasis of matter paragraphs because of the inherent uncertainties in the measurement of GHG emissions (compared to four in 2021/22).

5.96

The councils that chose to include GHG measures in their performance information were:

- Auckland Council;

- Bay of Plenty Regional Council;

- Central Otago District Council;

- Hawke's Bay Regional Council;

- Hutt City Council;

- Palmerston North City Council;

- Queenstown Lakes District Council;

- South Taranaki; and

- Waikato District Council.

5.97

In 2021/22, we issued Auckland Council, Hawke's Bay Regional Council, Palmerston North City Council, and Hutt City Council with an emphasis of matter paragraph related to GHG emissions.77

5.98

Considering the public interest in climate change information, we drew attention to disclosures outlining the uncertainty in the reported emissions. Quantifying GHG emissions is subject to inherent uncertainty because the scientific knowledge and methodologies to determine the emissions factors and processes to calculate or estimate quantities of GHG are still evolving, as are GHG reporting and assurance standards.

Uncertainties in the fair value of CentrePort Limited shares

5.99

For Manawatū-Wanganui Regional Council (Horizons), we drew attention to disclosures outlining the uncertainties over the estimation of the fair value of CentrePort Limited shares. The assumptions underpinning the valuation are sensitive to change. In 2021/22, we also drew attention to disclosures outlining the uncertainties about the estimation of the value of CentrePort Limited shares.78

Severe weather events

5.100

For Auckland Council and Nelson City Council, we drew attention to the uncertainty of the financial impact of the cost-sharing agreements with the government to co-fund the costs of recovery from the severe weather events in early 2023. Both councils agreed to consult publicly on cost-sharing arrangements with the government.

Key audit matters

5.101

The auditor of Auckland Council is required to report on "key audit matters" because Auckland Council is a Financial Markets Conduct Act 2013 reporting entity.

5.102

Key audit matters are matters that are complex, have a high degree of uncertainty, or are important to the public because of their size or nature. Auditors include them in audit reports to help readers understand the main matters that drew the auditor's attention.

5.103

The audit report for Auckland Council included the following key audit matters:

- valuation of property, plant, and equipment;

- valuation of weathertightness issues and associated building defect claims provision;

- valuation of derivatives; and

- reporting performance information about the Council's stormwater network.

63: Only 42 of the 78 councils adopted their annual report on time in 2021/22, and 10 councils were more than five months late.

64: Legislation extending the reporting time frames was passed in May 2020. The extension applied to 2020/21 and 2021/22. See the Annual Reporting and Audit Time Frames Extensions Legislation Bill 53-1 (2021) at legislation.govt.nz.

65: Section 98(3) of the Local Government Act 2002 states that each annual report must be completed and adopted by resolution within four months after the end of the financial year that it relates to. Section 98(4) of the Act states that a local authority must, within one month after adopting its annual report, make publicly available its annual report and a summary of the information in its annual report.

66: These are Buller District Council and West Coast Regional Council. The audit of Rotorua District Council was signed in May, and its annual report was made public in June 2024.

67: For a plain language explanation of audit opinions, see our blog post "The Kiwi guide to audit reports", at oag.parliament.nz.

68: Six of the 22 councils that received qualified audit opinions had more than one modification.

69: For the previous six years, the 2016 Kaikōura earthquakes impaired Kaikōura District Council's ability to measure and report against some of its performance measures. The Council's focus on emergency response and recovery has meant that it has not recorded information for management and external reporting purposes in a robust and reliable way.

70: These were Dunedin City Council, Hastings District Council, Horowhenua District Council, Hutt City Council, Napier City Council, Palmerston North City Council, Porirua City Council, South Taranaki District Council, Tararua District Council, Taupō District Council, Upper Hutt City Council, Wellington City Council, Whakatāne District Council, and Whanganui District Council.

71: These are Hutt City Council, Porirua City Council, Upper Hutt City Council, and Wellington City Council.

72: Six councils (Hutt City Council, Porirua City Council, Upper Hutt City Council, Wellington City Council, Greater Wellington Regional Council, and South Wairarapa District Council) are joint shareholders in Wellington Water Limited. A committee represented by a member of each shareholding council monitors the performance of Wellington Water Limited. Wellington Water reports its performance in providing water services to the six councils. The six councils are also required to report this performance in their respective statements of service performance.

73: Hastings District Council also had issues with the number of complaints for three waters services.

74: The Ministry of Business, Innovation and Employment has issued guidance to help councils in applying regulation 7 of the Building (Accreditation of Building Consent Authorities) Regulations 2006, including how to count the number of days for processing.

75: This is performance measure 2 (road condition). See the "Local Government Policy" section on the Department of Internal Affairs website, at dia.govt.nz.

76: Department of Internal Affairs (2024), "About the Water Services Reform Programme", at dia.govt.nz.

77: Controller and Auditor-General (2023), "Results of the 2021/22 council audits", at oag.parliament.nz.

78: Controller and Auditor-General (2023), "Results of the 2021/22 council audits", at oag.parliament.nz.