Part 4: How councils manage their assets

4.1

In this Part, we consider how councils manage their assets. We discuss:

- our observations of councils' capital expenditure forecasts;

- what the risks in delivering councils' forecast capital expenditure are;

- whether councils are planning to reinvest enough in their assets; and

- whether councils have enough knowledge of their critical assets to inform asset reinvestment in a timely manner.

Councils' capital expenditure forecasts

There has been a significant increase in capital expenditure forecasts

4.2

Councils' capital expenditure forecasts in the 2021-31 long-term plans are significantly higher than the 2018-28 long-term plans – a 42% increase overall.

4.3

Figure 12 shows that councils are forecasting to spend $77.2 billion on capital expenditure programmes for the duration of their long-term plans. This is an average of $7.7 billion a year during the next 10 years and is significantly higher than what councils have forecast in the past.

Figure 12

Forecast capital expenditure in the 2021-31 long-term plans, compared to 2018-28 long-term plans

| Capital expenditure | 2018-28 long-term plan (billions) | 2021-31 long-term plan (billions) | % increase |

|---|---|---|---|

| Meet additional demand | $12.4 | $18.2 | 47% |

| Improve level of service | $18.6 | $26.5 | 42% |

| Renew existing assets | $23.5 | $32.5 | 36% |

| Total | $54.5 | $77.2 | 42% |

4.4

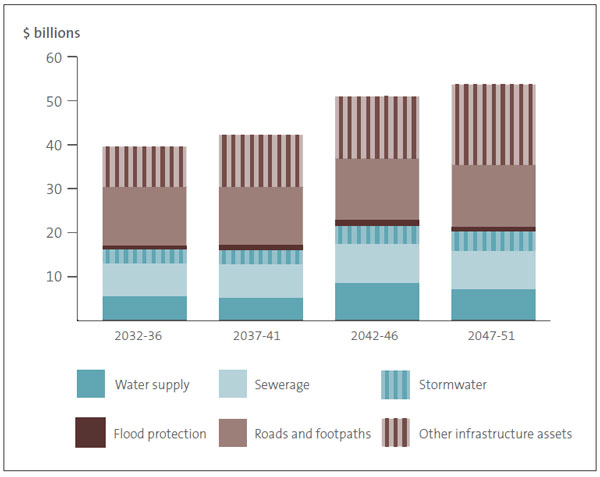

As well as the increase in capital expenditure in the 10 years covered by the long-term plan, the increase in capital expenditure forecasts for the medium to long term is expected to continue to rise significantly.

4.5

Collectively, councils included $39.5 billion of forecast capital expenditure in their infrastructure strategies for the five years between 1 July 2031 and 30 June 2036 – that is, $7.9 billion each year. This increases to $56 billion for the five years between 1 July 2046 and 30 June 2051 – that is, $11.2 billion each year.

4.6

This does not reflect the entire forecast spending on capital. It shows only the total forecast capital expenditure disclosed in the infrastructure strategies, which relates to specific categories of assets (see Part 3).

4.7

Further, councils were not always explicit about whether the forecast expenditure had been adjusted for inflation. As a result, the forecast capital expenditure could be significantly higher than what is set out in Figure 13.

4.8

In paragraphs 3.31 and 3.32, we said that councils could do more to better integrate their financial and infrastructure strategies with their long-term plans. The continued increase in capital expenditure forecast in the infrastructure strategies reflects the need for clear disclosures in the infrastructure strategies about how councils plan to fund expenditure over the long term.

Figure 13

Proposed spending on capital by all councils in years 11 to 30 of their 2021-51 infrastructure strategies

Councils risk not delivering their large forecast capital expenditure programmes

4.9

The increase in capital expenditure is not a new trend. For example, the forecast capital expenditure in the 2018-28 long-term plans was a 31% increase from forecast capital expenditure in the 2015-25 long-term plans.

4.10

In the past, councils have struggled to deliver their planned capital expenditure programmes.21 Most councils did not deliver their total capital budgets in 2019/20. The total actual capital expenditure for 2019/20 was $5.14 billion. This was the highest amount councils had spent on their assets compared to the previous eight years – but it equated to only 79%22 of budgeted expenditure for that year.23 The 2019/20 achievement is similar to that of previous years, which on average delivered about 80% of the planned capital expenditure programme in any given year.

4.11

The local government sector acknowledges that delivering capital expenditure programmes is a sector-wide strategic issue.

What is driving the increase in capital expenditure programmes?

4.12

We looked at the proportion of 2021-31 forecast capital expenditure by type of capital expenditure for all councils.

4.13

Renewing or replacing existing assets makes up 42% of councils' planned capital expenditure. More than a third of capital expenditure is to improve current levels of service, and 24% of forecast capital expenditure is for new infrastructure to meet additional demand (growth). These proportions are broadly unchanged from the 2018-28 long-term plans.

4.14

Councils must respond to growth and changes in levels of service, including regulatory changes. It is also important that councils continue to renew and invest in their current infrastructure or face the risk of critical infrastructure assets starting to fail.

4.15

Figure 14 shows the proportion of forecast capital spending by subsector (see Appendix 2 for the list of subsectors and which councils are in each).

Figure 14

Proportion of 2021-31 forecast capital expenditure by subsector and type of capital expenditure

| Capital expenditure | Auckland* | Metro** | Provincial | Regional | Rural |

|---|---|---|---|---|---|

| Meet additional demand | 29% | 25% | 16% | 15% | 8% |

| Improve level of service | 30% | 38% | 37% | 42% | 29% |

| Renewal existing assets | 41% | 37% | 47% | 43% | 63% |

* Auckland is considered separately from other metropolitan councils because of its size.

** Excluding Auckland Council.

4.16

The proportion of capital expenditure for these three categories is relatively consistent for all subsectors except for rural councils. The proportions for rural councils have not changed significantly during the last three long-term plan rounds.

4.17

For example, in the 2015-25 long-term plans, rural councils forecast that they would spend 73% of their capital expenditure on replacing existing assets. They forecast to spend 69% on this in the 2018-28 long-term plans.

4.18

Rural councils generally have a smaller ratepayer base and, in many instances, do not experience high levels of growth. Therefore, they tend to focus on investing in renewing existing assets.

4.19

Regional councils had the highest proportion of capital expenditure planned for improved levels of service. This was for several reasons, including upgrades to flood protection assets to provide increased resilience to the impacts of climate change.

What are the risks to councils delivering their capital expenditure programmes?

4.20

As mentioned in paragraph 4.10, councils have historically struggled to deliver their capital expenditure programmes. From the analysis we completed in our previous reports and speaking to practitioners in the sector, we have found several reasons for this.

4.21

Some delays can be attributed to the time it takes to receive consents. More recently, the Covid-19 pandemic has added another layer of complexity, with supply chain issues delaying the delivery of raw materials and adding to cost pressures.

4.22

In our view, the failure to deliver capital expenditure programmes suggests that some councils have not had enough project management capacity and capability to deliver their programmes.

4.23

The already tight labour market and historically low unemployment is contributing to staff capacity and recruitment issues. We also heard from the sector that the uncertainty created by the current reform agenda (three waters reforms, the reform of the Resource Management Act, and the future for local government review) is making it difficult for councils to attract and retain staff. Because the future is so uncertain, councils are seeing high turnover. In some instances, the turnover is in very senior roles.

4.24

When we completed our audits of the 2021-31 long-term plans, our concern was whether the amount of forecast capital work is achievable given the constraints we already see in the market and the context of the current operating environment. Central government and the private sector have their own significant infrastructure programmes. All will be competing for similar resources.

How did our auditors respond?

4.25

We considered the ability of councils to deliver their planned capital expenditure programmes as an audit risk. In response to that risk, we set expectations of what we felt was reasonable for each council to achieve.

4.26

We first considered how well individual councils had met their previous capital expenditure forecasts. Then we considered how much the capital expenditure forecast had increased compared to previous budgets and actual delivery. For significant increases in capital expenditure forecasts, we sought to understand what changes to their processes councils were planning to help them achieve their planned capital expenditure programme.

4.27

We did not identify any individual councils with capital expenditure programmes that we considered unreasonable. However, given the amount of uncertainty in the operating environment and the number of variables in delivering such ambitious capital expenditure programmes, we emphasised high levels of uncertainty about the delivery of the capital expenditure programme in our audit reports for 30 councils.

4.28

In our view, it was fundamental that ratepayers understood the uncertainty of the delivery of these capital expenditure programmes. There are several reasons for this.

4.29

A council that is unable to deliver planned projects could affect current levels of service or mean that the infrastructure needed to meet forecast growth is not delivered. Councils will also set their rates based on the assumption that they will deliver all their planned capital expenditure.

4.30

In some instances, not delivering their capital expenditure programmes could mean that critical assets may not be renewed in time, leading to asset failure. This would ultimately cost ratepayers more in the long run.

4.31

When capital expenditure programmes are not delivered as planned, councils risk losing the trust and confidence of their communities.

What are councils doing differently to help them achieve their capital expenditure programmes?

4.32

Through our audit work, we gained an understanding of what changes to their processes councils were planning to help them achieve their capital expenditure programmes.

4.33

In some instances, we identified innovative approaches. For example, we saw examples of councils working together and communicating more proactively with contractors. We also saw councils actively improve their procurement policies and practices, as well as their business case processes, to enable better project prioritisation and management.

4.34

In our view, this should lead to councils having more realistic time frames for completing some projects and enable them to plan more effectively.

4.35

Some councils were bringing forward their planning and resource consent processes. Our auditors received more comfort, in the earlier forecast years, where projects had already gained the required consents and/or had contracts signed for the projects to begin.

4.36

We also saw examples of councils providing more dedicated resources to project delivery – for example, by developing or expanding project management offices. One council opted to contract out these services so that it could draw on the right level of expertise.

4.37

In our view, risk management has never been more important. In our 2021 report Our observations on local government risk management practices, we stated that effective risk management is a critical part of successfully delivering an organisation's strategy. When risk is not managed effectively, assets or projects can fail. This can erode the public's trust and confidence in an organisation.

4.38

Councils need to have robust project management frameworks in place to help manage delivery risk. Having clear planning and procurement strategies, well defined roles and responsibilities, and good project governance will be critical to effectively managing delivery risks. Elected members will need timely project performance data to enable effective decision-making.

4.39

The sector should be commended for more explicitly considering the risks of non-delivery and improving its existing processes to help deliver its capital expenditure programmes. It is important that councils prepare capital expenditure programmes that they can reasonably achieve and are accountable for.

4.40

This is an area that senior management and elected members must continue to monitor. We have seen positive improvements in delivering capital expenditure programmes when councils take steps to actively monitor their performance in delivering their programmes in a timely manner.

4.41

We will continue to monitor and report on councils' progress to deliver their capital expenditure programmes.

Are councils reinvesting enough in their existing assets?

4.42

We have previously reported our concerns that many councils are not adequately reinvesting in their assets.24

4.43

In our report on matters arising from the 2015-25 long-term plans, we considered the link between spending on capital for renewing and replacing existing assets and provision of funding through depreciation.25 We compared renewals spending to depreciation on the basis that depreciation is a reasonable estimate of the consumption of the service potential inherent in the asset.

4.44

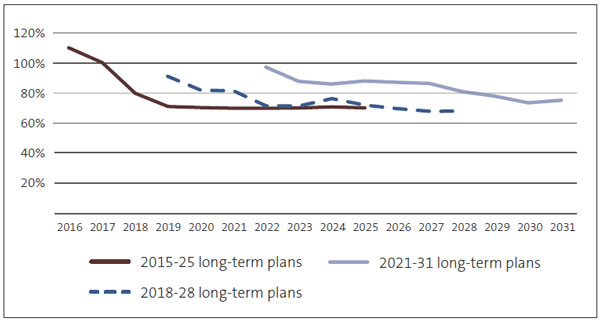

When we have compared spending on renewals with the depreciation charge, we see that the spending on renewals continues to be lower. We describe this apparent underinvestment as the "renewals gap".

4.45

In Figure 15, we set out forecast capital expenditure for renewals compared to the forecast depreciation for the last three long-term plan rounds. The graph shows that forecast renewals for the 2021-31 long-term plans remains lower than forecast deprecation for the period of the long-term plan.

4.46

However, we can also see that, for the years in common, councils are forecasting to invest more in their assets than in previous long-term plans. This is a positive change, assuming that councils deliver this planned investment.

Figure 15

Forecast renewal capital expenditure compared to forecast depreciation for all councils for the 2021-31, 2018-28, and 2015-25 long-term plans

The 2021-31 proportion of forecast renewal expenditure to forecast depreciation declines from just under 100% in 2021/22 to just under 80% in 2030/31. The proportion is relatively steady for 2022/23 to 2026/27 at 90%. For the years in common, the 2021-31 proportion is higher than what councils forecast in the 2018-28 and 2015-25 long-term plans.

4.47

In Figure 16, we set out the proportion of forecast renewal expenditure to forecast depreciation for councils' main infrastructure activities from the 2021-31 and 2018-28 long-term plans. Councils are now planning to spend more on renewing their water supply networks compared to the associated depreciation charge. We are encouraged by this.

4.48

In some long-term plans, councils discussed the implications of historical underinvestment in water infrastructure. This shows that councils are increasingly looking to address this.

Figure 16

The proportion of forecast renewal expenditure to forecast depreciation by core asset activity, in the 2021-31 and 2018-28 long-term plans

| Core asset activity | 2021-31 long-term plan | 2018-28 long-term plan |

|---|---|---|

| Roading | 92% | 83% |

| Water supply | 122% | 82% |

| Wastewater treatment and disposal | 99% | 67% |

| Stormwater drainage | 54% | 52% |

| Flood protection and control works | 183% | 224% |

4.49

Figure 16 shows that councils' planned reinvestment is significantly lower for stormwater assets than for other asset classes. We reported this observation in our findings from our 2018 report Managing stormwater systems to reduce the risk of flooding. In 2021, we also reported that the actual renewals expenditure for the stormwater asset class was only 39% of depreciation for 2019/20.26

4.50

This trend indicates significant underinvestment in stormwater assets. These lower levels of investment could be because councils tend to prioritise water supply and wastewater over stormwater, particularly as there are other options to manage stormwater depending on local geography (for example, through discharge to land).

4.51

Underinvestment and a lack of condition and performance information on stormwater assets (which we discuss below), combined with increasing weather events associated with climate change, could pose a significant risk for councils and their communities. We will continue to monitor and report on this.

What do councils know about the condition and performance of their critical assets?

4.52

One of our recommendations from our report on matters arising from the 2018-28 long-term plans was:

… that councils prioritise collecting condition and performance information of critical assets and, in the meantime, take a precautionary approach for significant services where the condition information of critical assets is unknown.27

4.53

We expected councils to have made progress on building their knowledge of the condition and performance of their critical assets. This was an area of focus in our audits of the 2021-31 long-term plans.

4.54

We do not expect councils to have perfect information. It would be prohibitively expensive for most councils and almost impossible to achieve. However, we continue to reinforce the importance of having good information about critical assets.

4.55

Councils need enough information to allow them to make decisions, which are informed by risk, about when to replace critical infrastructure so that existing services are maintained for their communities. The type of information needed will differ depending on the size, age, and complexity of the council's asset networks. The optimal amount of information needed to inform renewal and maintenance forecasts is a matter of judgement.

4.56

To inform our audit work, we first considered whether councils had reasonable information to inform their renewals and maintenance forecasts. In our view, reasonable information is initially understanding what assets are critical in the network, knowing the useful lives and age of those assets, and combining this information with an up-to-date assessment of the condition of those assets.

4.57

Councils could gather condition information from visual inspections. For underground infrastructure, more sophisticated condition assessments may be needed, such as smoke or laser assessments or sending a camera to visually inspect underground assets.

4.58

In our view, effective renewal strategies are based on the asset's age, condition, and performance information. The more an asset is critical to the success of the asset network, the more councils need to better understand its condition and performance information.

4.59

As an asset network becomes more complex and sophisticated, we expect a more systematic approach to capturing, recording, and using condition and performance information. Councils need to invest time and money into doing this.

4.60

For councils that did not have reasonable information, we considered whether there was enough alternative information to inform the council's renewals forecasts. This included assessing the reliability of age and remaining useful life information and the experience and knowledge of the council's asset management staff.

4.61

We then considered whether there were any known performance issues or whether the age of the assets could contribute to performance issues. Finally, we considered what the consequences would be if critical assets were to fail.

4.62

This approach enabled our auditors to determine whether the council's information about the asset's condition and performance was reasonable enough, on balance, to inform their renewals forecasts.

4.63

We observed that most councils are continuing to make progress in collecting condition and performance information about their critical assets. As a result of this, we also found that councils were clearer in their disclosures and assumptions about the condition and performance of their assets.

Councils are making progress in prioritising the collection of condition and performance information about critical assets. It is important that this continues to be a priority.

4.64

We observed that councils generally had better information about their roading assets. This is not a surprise given that water infrastructure is often underground. Information about the condition of underground assets is not easily observed, and undocumented knowledge of these assets could have been lost through staff turnover.

4.65

When it comes to the three waters, councils generally had limited knowledge about the condition and performance of their stormwater assets.

What did this mean for our audit reports?

4.66

In some instances, we found that councils did not have enough condition and performance information to suitably inform their renewal strategies and forecasts. In other instances, we found that councils that had condition and performance information did not use it to inform their renewal strategies and forecasts.

4.67

We issued two qualified audit opinions about asset condition and performance information.

4.68

Gore District Council received a qualified audit opinion because it did not have enough reliable information about the condition of the assets in the water supply and wastewater networks that were nearing the end of their useful lives. Further, the exact age of the assets (which are believed to be more than 60 years old) is unknown. This is because a fire destroyed the underlying infrastructure records in the 1950s.

4.69

The Council used historical failure rates of its assets to determine the investment needed to renew the networks.

4.70

We considered it unreasonable for the Council to use historical failure rates alone to develop its forecasts for renewing its networks. Planning on this basis increases the risk of asset failures, which could result in reduced levels of service and increase costs that would need to be funded through rates or debt.

4.71

The Council has started an active programme to collect better condition and performance information about its assets. This includes, for example, using closed circuit television (CCTV) surveillance camera footage to examine the condition and performance of its water and wastewater networks. The Council was collecting this information at the same time as it was preparing its 2021-31 long-term plan. Therefore, there was not enough appropriate information to inform the 2021-31 long-term plan forecasts.

4.72

Wellington City Council also received a qualified audit opinion. Many of the assets in the Council's networks are old, and a significant percentage have already passed the end of their expected useful life.

4.73

The Council's assets are managed by a third party. This third party does not use information about the condition of the three water assets to inform its investment in its three waters networks. Instead, it forecast the renewal of assets based on their age. The proposed investment was capped by what the Council considered was physically able to be delivered.

4.74

We considered this approach to be unreasonable because it could result, during the 10-year period of the long-term plan, in more asset failures, reduced levels of service, and greater costs than forecast.

4.75

We included 11 emphasis of matter paragraphs about the uncertainty of asset condition and performance information in our audit reports.

4.76

Although two councils were continuing to improve their condition and performance information, the asset condition information they used to support their planned infrastructure assets renewal programme was not complete. This increases the risk that they may not have identified some assets needing replacement.

4.77

One council based its decision on when to replace assets by continually assessing asset condition and monitoring reactive maintenance costs. However, the budget for renewing assets is based on the age of the assets. This means that there is a risk that the council may need additional funding to pay for renewals that are needed earlier than planned, which could result in an increased risk of disruption to services.

4.78

The eight remaining emphasis of matter paragraphs were related to uncertainty about three waters infrastructure assets forecasts. Although these councils are continuing to improve their information about asset condition, they primarily used age-based information to inform their three waters renewals.

4.79

Using only age-based information means that there is a higher degree of uncertainty about how the councils have prioritised their investment needs. Not using condition information increases the risk that assets are not replaced at an optimal time. This could lead to unnecessary disruption to levels of services and, ultimately, increased costs.

4.80

Hurunui District Council also received a qualified audit opinion because it did not recognise the improvements made to the inland road connecting Waiau and Kaikōura. The road was heavily damaged by the 2016 Kaikōura earthquake.

4.81

After the Kaikōura earthquake, Waka Kotahi took responsibility for maintaining, repairing, and upgrading the road. The road was formally transferred back to the Council in December 2020.

4.82

The Council does not have information about the work completed by Waka Kotahi while the road was in its ownership. Therefore, the Council cannot reliably forecast future maintenance, renewals, or deprecation associated with the road.

4.83

In our view, despite the uncertainty associated with the three waters reforms and the final decisions on asset ownership, councils need to continue investing in good asset information on behalf of their communities.

4.84

This will mean bringing together the different information sources – their own condition assessments, asset failure rates, what contractors are seeing from repairing and replacing assets, and what other councils are finding – and using this information to inform asset renewals. This will allow councils to better maintain expected levels of service for their communities and avoid costly asset failure.

21: This means that some capital projects are either delayed or not delivered.

22: This information is from the statements of cash flows of councils. It includes only the money that councils spent on purchasing property, plant, and equipment and intangible assets.

23: Office of the Auditor-General (2021), Insights into local government: 2020, page 13.

24: Office of the Auditor-General (2018), Local government: Results of the 2016/17 audits, pages 10 and 11.

25: Office of the Auditor-General (2015), Matters arising from the 2015-25 local authority long-term plans, page 10.

26: Office of the Auditor-General (2021), Insights into local government: 2020, page 16.

27: Office of the Auditor-General (2019), Matters arising from our audits of the 2018-28 long-term plans, page 7.