Part 4: What we must manage well

There are six key resources (or capitals) that we must manage well to improve our organisation and support the delivery of our strategic intentions to 2025.

The six key resources are:

- Our independence and reputation;

- Our people;

- Our knowledge, information, and methods;

- Our relationships;

- Our financial and physical resources; and

- Our use of natural resources.

Our Organisation Development Plan 2018-21 is structured around these resources to ensure that we are focused on the most important areas we need to develop as an Office over the next four years.

We provide below a description of each resource, and how it creates value for us.

OUR INDEPENDENCE AND REPUTATION

OUR INDEPENDENCE AND REPUTATION

Our independence and strong mandate that underpin all our work and activities.

Our independence is fundamental to everything we do and to our ability to create value over time. The main purpose of our governing legislation – the Public Audit Act 2001 – is to enable us to provide Parliament with an independent view on how the public sector is operating. Our independence is given statutory recognition and protection under our legislation, which is critical to exercising our ongoing role as an Officer of Parliament.

We cannot do our work without being, and being seen to be, independent. Each year, we scrutinise and apply professional judgement to financial audits of the entire public sector – about 3600 public entities – along with numerous performance audits and inquiries, and advice to parliamentary select committees about the Government's proposed spending and audit results.

Our work gives Parliament and New Zealanders an independent view about public sector performance and accountability, and enables Parliament and the New Zealand public to hold public entities to account for their performance.

Our reputation is critical to maintaining Parliament's and the public's trust and confidence in our work. As we cannot enforce our recommendations, our ability to influence is critical. We aim to be trusted, impartial, and authoritative.

How we protect our independence and reputation

We identify loss of independence and reputation as two of our more significant strategic risks. We manage these risks through the processes that support our work.

We have high expectations of the independence standards that auditors who work for us must meet. These standards are described in The Auditor-General's Auditing Standards. They exceed the minimum independence standards required of auditors operating in the private sector.

All our auditors are expected to have a very good understanding of the requirements and the consequences of not meeting the expected standards. We provide advice, training, and support to help our auditors in maintaining their independence.

Our independence requirements limit the additional work that can be carried out for public entities by auditors who work for us. This mitigates the risk that other work could be seen to compromise the auditor's objectivity and diminish the standing and value of the auditor's report.

We have a range of systems and processes in place to identify and mitigate risks to our independence and reputation. Formal declarations of our independence are required for every audit or assurance engagement we carry out. We continually assess the more challenging independence situations and their resolution, and we have monitoring systems to ensure that staff with independence conflicts are not involved in those public entities. The effective relationships we have with public entities and select committees help us to manage reputational risks.

In addition, effective working relationships with all contracted auditors who work for the Auditor-General help to ensure that any potentially difficult independence situations are communicated and resolved before they become a problem.

OUR PEOPLE

OUR PEOPLE

Our skills, competence, and engagement that enable us to deliver high-quality work.

The experience, knowledge, skills, and commitment of our people are vital to our work and our ability to deliver on our statutory responsibilities and our strategic intentions. It is essential that we attract, develop, and retain talented staff.

As at 30 June 2018, we employed 397 people from diverse backgrounds and experiences, in two business units – the Office of the Auditor-General (OAG) and Audit New Zealand. A shared corporate services team supports both business units. The Auditor-General also contracts auditors from over 35 private sector accounting firms to carry out annual audits on the Auditor-General's behalf. Our website has more detailed information about our staff profile (see oag.govt.nz/our-people/staff-profile).

We promote an organisational culture where people matter. A culture based on trust, respect, inclusiveness, and valuing each person's contribution. We consider this is fundamental to actively engaging, motivating, retaining, and enabling our people to do their best work. We seek independent advice about remuneration in comparable roles, so we can be confident that we are paying our people fairly. We intend to seek external advice to better understand whether we have a gender pay difference, and how we might address it if necessary.

We recognise the importance of regularly monitoring our culture and the engagement of our people, and responding to their feedback to strengthen our organisational culture. Our new employee engagement, culture, and continuous involvement survey has enabled us to identify areas to improve our culture and engagement, as well as other aspects of our business. We continue to prioritise our investment in the systems, tools, and equipment that our people need to do their jobs safely and efficiently. Development of our People strategy will start soon and will ensure that we are well positioned to meet our future capability challenges and opportunities.

We consider equality of employment opportunity critical to creating a workplace that enables all our staff to contribute to their full potential. The principles and practice of equal employment opportunities (EEO) are embedded in our human resources policies. Through our work on EEO, we aim to better understand how we can eliminate discrimination, and promote equity and diversity in our workplace. We are developing a flexible working arrangements policy and guidelines, and working on a plan to improve our Māori cultural competency and use of te reo Māori.

We continue to develop the skills and capability of our people to achieve our strategic objectives and strongly position ourselves to meet future challenges and changes in auditing. We encourage and support learning and development through on-the-job learning and formal training. Some of our people have been seconded internally, externally, and internationally. We also have staff who have been seconded to us from outside the Office to exchange skills and knowledge.

We are accredited as a Recognised Training Employer by Chartered Accountants Australia and New Zealand. We provide practical experience and support for over 30 new graduates each year as they work and study to become chartered accountants. Our people also hold many other professional accreditations and memberships. Some of our people have roles in international auditing organisations.

OUR KNOWLEDGE, INFORMATION, AND METHODS

OUR KNOWLEDGE, INFORMATION, AND METHODS

Our collective knowledge and expertise about the public sector.

Our mandate and independence gives us access to a wealth of information, which we collect and analyse as we carry out audits and our other work. This information, the knowledge we gain from it, and the methods we use to store, analyse, and share it are vital to our role and our ability to create value and insight.

We take our responsibilities for protecting and managing that information seriously. Our business processes and systems protect access to the information we gather and help us to actively monitor and manage any risks to our independence.

Our people and their skills and experience – alongside professional standards – help to identify the information we need to collect. Our methods help to protect the quality of what we collect. We invest in and continue to upgrade our systems and tools to effectively manage and protect our information, and enable us to improve our insights from the information we collect.

The unique view we have of the entire public sector and our professional judgement enable us to draw insights that can help to improve the performance of the public sector. We also contribute internationally – our approaches are often held up as examples for others to follow, and other audit offices come to learn from us. For example, we share our knowledge, information and advice with other audit organisations throughout the world, particularly in the Pacific.

The quality of the relationships we have with others and the ways we communicate help us to use our knowledge to best effect – influencing public entities to make the improvements that our work has identified as necessary.

Our organisation development plan is ensuring that we continue to improve our systems and our capability to analyse and use data differently. Doing so is essential to making full use of the wealth of information we have access to. We are also exploring ways to make our information more accessible while considering how to improve our reporting practices to ensure that they will be fit-for-purpose for the next generation of New Zealanders.

We know that there are risks to our systems so we take active steps to mitigate them, including keeping our disaster recovery and business continuity plans up to date. There are also risks to our capacity and methods. We are actively considering how fit-for-purpose our approaches and practices will be as we prepare to move into the next quarter of the 21st century.

OUR RELATIONSHIPS

OUR RELATIONSHIPS

Our mutually productive and respectful relationships with all our stakeholders.

Effective working relationships with our many stakeholders are essential to our work and our ability to create value. Our most important external relationships are with Parliament, the organisations that we audit, and other audit institutions around the world (particularly in the Pacific).

As an independent Officer of Parliament, the Office cannot operate without the trust and confidence of Parliament.

Our people advise Parliamentary select committees in support of their work to hold the public sector to account. We help the committees to scrutinise the performance of public organisations on behalf of Parliament. We work hard to support Parliament while maintaining our independence from the Government and the organisations that we audit.

Our relationships with the public entities that we audit support the flow of information, intelligence, and reports that collectively improve efficiencies and, through our recommendations, the delivery of services to New Zealanders.

Good relationships are particularly important when we raise adverse audit findings or discuss complex and technical accounting issues with the public entities we are auditing. Such issues will often not be clear-cut; they can demand much discussion and usually require careful judgement. Although organisations might not always agree with our findings and recommendations, a respectful and trusting relationship helps support this part of the audit process.

Our relationships with other stakeholders also serve to strengthen public sector accountability and promote good governance. For example, we share our skills, information, and advice with other audit organisations throughout the world, particularly in the Pacific. We take part in international auditing conferences, peer review organisations like ours, and host international visitors. We work with other integrity and accountability agencies – for example Transparency International New Zealand – to influence transparency and accountability in the public sector.

Our Strategy aims to increase the impact of our work. This will require us to improve some of our current relationships and develop new relationships where we currently have limited contact, for example, with citizens and iwi groups. We intend to engage more widely on our proposed work programme and use different ways to ensure that our work reaches those who can make the changes required to improve public services.

We regularly check – formally and informally – that our stakeholders are satisfied with the relationships they have with us.

One of the challenges to maintaining effective relationships is the pace and scale of change in the public sector. High staff turnover, large-scale organisational transformation programmes, and increasingly complex institutional arrangements all require effort to ensure that our staff are engaging with the right people at the right time. We actively monitor risk across all the organisations we audit.

The challenges also provide opportunities for new or improved ways of working with others. We want to make better use of our oversight of the entire public sector so that we can take more of an active "thought leadership" role and to collaborate with others to discuss ways to improve New Zealand's public management and accountability system.

Our people are at the heart of our effective relationships. Our organisation development plan aims to ensure that our people have the skills, resources, and systems necessary to make the most of the relationships that we have with our key stakeholders.

OUR FINANCIAL AND PHYSICAL RESOURCES

OUR FINANCIAL AND PHYSICAL RESOURCES

Our use of financial and physical resources to support our work.

The financial and physical resources we use are essential to our work.

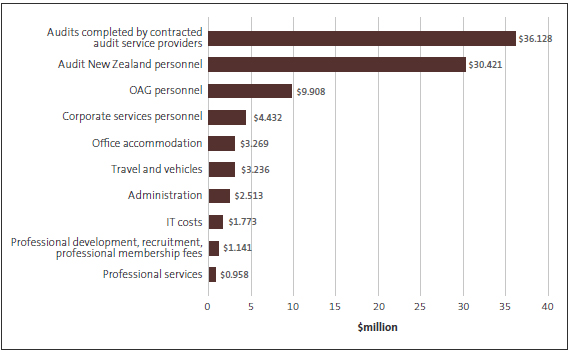

Operating costs

Most of our costs are staff-related. Other costs include office accommodation, costs of providing information technology systems, and travel for auditors to work at the premises of the organisations they are auditing.

How our operating funding was spent in 2017/18

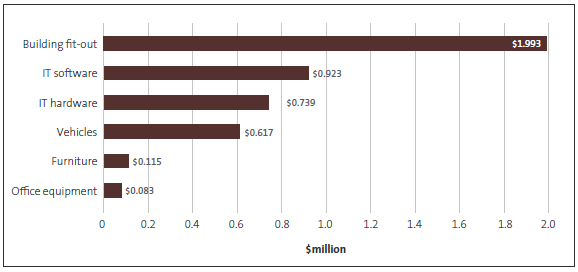

Physical assets and software

We cannot deliver value without investing in the assets that support our work.

Building fit-out across our seven offices is our largest physical asset.

We acquire and maintain our own information technology hardware and software, and maintain vehicles because our staff travel widely for their work.

Our capital expenditure programme is funded through depreciation and amortisation of existing assets. This funding allows for replacement of our assets, but does not always allow for investing in new technology to improve our systems. We will need extra funds for this in coming years.

Net value of our physical and intangible assets

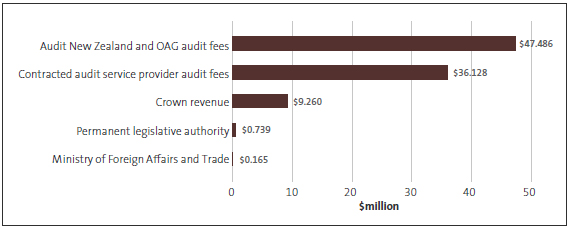

How we are funded

Audit New Zealand and our contracted audit service providers charge fees for the audits they carry out for the Auditor-General. A proportion of annual audit fees are passed on to the OAG, and that money helps to cover the OAG's operating costs related to managing the auditor appointment, standard setting, reporting and other processes supporting our annual audits.

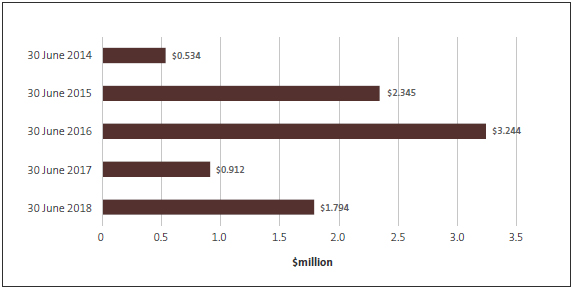

Audit New Zealand is funded by the audit fees charged to entities, which are set at a reasonable level for the audit work completed. Revenue from audit fees varies from year to year, based on the extent of audit work carried out. In some years we generate a surplus, and in other years a loss. To manage these ebbs and flows, we use a memorandum account. We put surpluses into that account so we can draw on the funds when we have a deficit – this helps us to operate sustainably. We have operated the memorandum account since 2013/14, and 2016/17 was the first year we used funds from the memorandum account to meet our costs. The following chart shows the balance of our memorandum account over time.

Memorandum account balance over time

The money we use to fund performance audits, inquiries, and support to Parliament comes from the Crown (the appropriation is called Statutory Auditor Function). A separate source of funding from the Crown (the appropriation is called Audit and Assurance Services) covers part of the cost of audits of smaller entities, such as cemetery trusts and reserve boards. The funding from both appropriations makes up Crown revenue in the following chart.

Funding from the Ministry of Foreign Affairs and Trade represents the funding provided by the New Zealand Aid Programme for our support to the PASAI secretariat.

How our operating costs were funded in 2017/18

Longer-term planning and managing risks

Every three years, we audit the long-term plans of local authorities, which means additional audit fee income every third year. This is the main cause of the surplus and deficit cycle that our memorandum account helps us to manage.

To manage the fluctuations, we regularly update our five-year forecasts for expected fees, costs, and the memorandum account balance. We also monitor our financial risks.

There are risks in securing adequate audit fees to fund our operations, and risks to the affordability of having adequate numbers of competent audit staff who can complete our audits to the required standards.

We manage these risks through prudent financial management, monitoring audit fees to ensure fairness to public entities and to auditors, our staff training programme, and ongoing work to improve the efficiency of our systems and processes.

Risks to our cash position arise from our reliance on timely invoicing and collection of audit fees, and are managed through monitoring and follow-up of audit contracts and invoicing.

OUR USE OF NATURAL RESOURCES

OUR USE OF NATURAL RESOURCES

Our use of natural resources and managing the environmental impact of our activities.

Our main environmental impact is from greenhouse gas emissions generated by the air and vehicle travel required to do our work. Despite technology advances, most auditing work is done on site so that our auditors have direct access to records and people. This means unavoidable travel. Our other work also requires travel – for example, our involvement with other audit offices in the Pacific and international auditing organisations.

We want to reduce our environmental impact, and we would like to do more. We are exploring opportunities to work in a more environmentally responsible manner and to be more efficient. We already use video conferencing extensively, and will consider how greater flexible working practices could reduce our overall environmental impact. We are assessing our current policies and practices (including our procurement policies) and will prepare a framework to measure and report our use of natural resources and effect on the environment. We will then consider options for managing and reducing our resource use and environmental impact. Over time, we plan to consider the environmental implications of the work locations of the auditors we appoint and how we could further improve our recruitment, travel, and vehicle policies.