Our audit of the Government’s financial statements and our Controller function

Auditing the Government’s financial statements

Each year, we audit the Government’s financial statements. The statements consolidate the financial results of all government departments, State-owned enterprises, Crown entities (including schools and Crown research institutes), Officers of Parliament, Schedule 4 entities, the New Zealand Superannuation Fund, and the Reserve Bank.

Part 1 of our report sets out the results of our audit for 2023/24. The Government’s financial statements were affected by both domestic and global factors. Higher inflation and interest rates affected tax revenue, the valuation of assets, and the cost of delivering services.

The Government’s revenue was higher than forecast. Tax revenue increased by 7.3% and GST revenue increased by 4.1%, due to an increase in private consumption.

Net core Crown debt was $175.5 billion at 30 June 2024 (42.5% of GDP) – an increase of $20.2 billion over the previous year. Total net worth (the difference between total assets and total liabilities) remained largely unchanged at $191 billion ($191.5 billion in 2022/23).

Carrying out the Controller function

The Controller function supports the fundamental principle of Parliament’s control over government expenditure. As the Controller, the Auditor-General provides an important check on the system, on Parliament’s and the public’s behalf, by providing independent assurance that the spending is within authority.

Part 2 of our report sets out:

- why the Controller work is important;

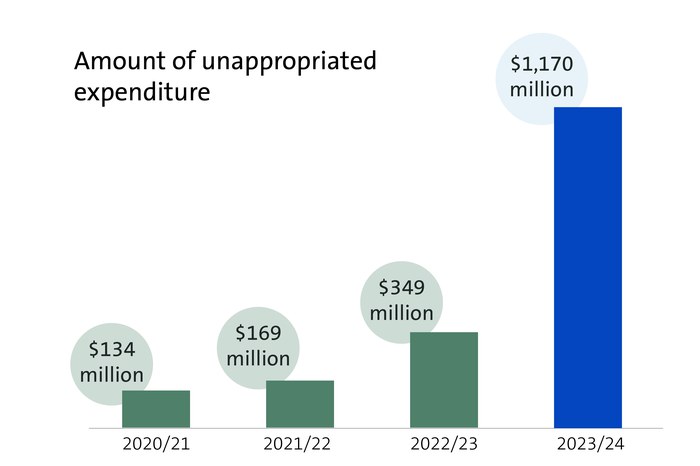

- how much public spending was unappropriated in 2023/24 and why;

- how 2023/24 compares with previous years;

- the reasons for unappropriated spending during the last nine years; and

- a summary of work we carried out in 2023/24 to discharge the Controller function.

We also discuss the use of multi-year appropriations (MYAs) for authorising public expenditure. MYAs should be used sparingly and not when an annual appropriation should be used. There has been a marked increase in the use of MYAs, from 20 in 2008 to 59 in 2016 to 167 in 2023. We have previously called for the Government to review the use of MYAs to ensure that they are being used appropriately, in line with the Treasury’s guidelines.