Part 1: Our audit of the Government’s financial statements

1.1

In this Part, we describe the key audit matters and risks arising from our audit of the Financial Statements of the Government of New Zealand (the Government’s financial statements).

1.2

New Zealand is fortunate in having a public finance system that regularly reports on government financial performance. This includes a requirement under the Public Finance Act 1989 to publish the Government’s audited annual financial statements.

1.3

The Government’s financial statements consolidate the financial results of all government departments, State-owned enterprises, Crown entities (including schools and Crown research institutes), Officers of Parliament, Schedule 4 entities,1 the New Zealand Superannuation Fund, and the Reserve Bank.

1.4

The Treasury prepares the Government’s financial statements soon after the end of the financial year.2 The financial statements are audited by 30 September and published in October, which is faster than many comparable jurisdictions.3

1.5

The Government’s financial statements are consistent with generally accepted accounting practice. They include information about the Government’s revenue, expenses, and liabilities, the value of its assets, and an account of the Government’s net worth. This information allows Parliament, the public, and the international community to scrutinise the Government’s financial performance and position.

1.6

Our audit report for 2023/24 included an unmodified opinion. This means that we were satisfied that the financial statements present fairly the Government’s financial performance and position for the year, and that they comply with generally accepted accounting practice.

The Government’s financial performance and position at 30 June 2024

1.7

In 2023/24, the Government’s financial statements were affected by both domestic and global factors. Higher inflation and interest rates affected tax revenue, the valuation of assets, and the costs of delivering services.

1.8

Throughout the year, inflation was at higher levels than in recent times.4 To drive down inflation, the Reserve Bank kept the Official Cash Rate at 5.5% throughout the year (which is the highest it has been since 2008).5 Both had an impact on the Government’s financial position.

1.9

The Government’s revenue was higher than forecast, at $167.3 billion.

1.10

Tax revenue increased by 7.3% ($119.9 billion compared to $111.7 billion in 2022/23). Notable changes to tax revenue included a 10.3% increase in in-source deductions (such as PAYE) due to continued wage growth and increases in other direct taxes, mainly comprising resident withholding tax (which increased by 86.2%). This reflected growth in tax paid on interest income owing to higher interest rates experienced throughout 2023/24 and dividends due to higher-than expected dividend distributions. Goods and Services Tax (GST) revenue increased by 4.1% due to an increase in private consumption.6

1.11

The sales of goods and services increased by 14.5% to $25.1 billion. This was largely due to the increase in revenue earned by electricity generators, driven by higher wholesale electricity prices.7

1.12

Total expenses increased by 11.3% ($180.1 billion compared to $161.8 billion in 2022/23).8 The increase in expenses was due to a range of reasons, including an 8.1% increase in transfer payments and subsidies (such as New Zealand Superannuation payments) to $41.9 billion and personnel expenses increasing by 8.4% to $39.1 billion.9

1.13

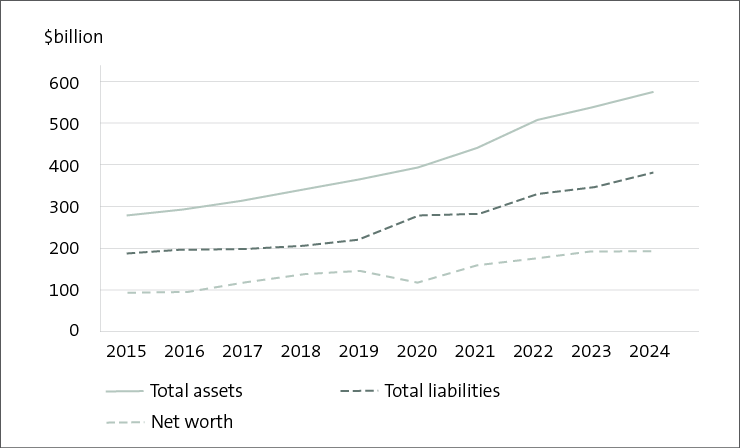

The total value of government-owned assets was $570.9 billion ($536.7 billion in 2022/23), comprising property, plant, and equipment (50%), financial assets (45%), and other assets (5%).10 The value of property, plant, and equipment increased by $16.4 billion to $283.8 billion, due mainly to changes in the valuations of buildings, electricity generation, state highways, and land assets.

1.14

The value of financial assets increased by $16.5 billion to $257.1 billion. This increase was due to a range of factors, including a $3.7 billion increase in receivables due to an increase in tax receivables, an increase in the value of share investments of $5.4 billion driven by growth in share investments held by the New Zealand Super Fund and the Accident Compensation Corporation, and a $9.7 billion increase in marketable securities.11

1.15

Total liabilities were $379.8 billion ($345.2 billion in 2022/23), comprising borrowings (66%), insurance liabilities (18%), and other liabilities (16%). Borrowings were $24.2 billion more than in 2022/23, totalling $250.9 billion. They largely comprised Government bonds (51%), settlement deposits (15%), and Kiwi Group Capital Limited customer deposits (11%), with the remainder across several other borrowing types.12 Net core Crown debt was $175.5 billion at 30 June 2024 (42.5% of GDP) – an increase of $20.2 billion over the previous year.13

1.16

Total net worth (the difference between total assets and total liabilities) remained largely unchanged at $191 billion ($191.5 billion in 2022/23).

1.17

Figure 1 shows changes in net worth and changes to the value of assets and liabilities since 2015.14

Figure 1

Changes to net worth, assets, and liabilities since 2015

Operating context

1.18

The change in government in November 2023 brought about significant changes to priorities, initiatives, projects, programmes, and funding in the public sector.

1.19

Changes included the disestablishment of Te Aka Whai Ora – the Māori Health Authority on 30 June 2024 (its functions were folded into Health New Zealand – Te Whatu Ora and the Ministry of Health), the disestablishment of the Productivity Commission, and plans to disestablish Te Pūkenga – New Zealand Institute of Skills and Technology. The Government also established the Ministry for Regulation and the Social Investment Agency.

1.20

Government organisations were expected to find significant cost savings without affecting frontline services. As a result, many were undergoing organisational change processes and cost reduction exercises when we carried out our audits. This created more work for support functions while also directly affecting them.

1.21

We considered the potential impact of these changes on the financial statements. This included on expenditure, asset impairment, restructuring provisions, and the valuation of property, plant, and equipment.

1.22

We considered how some specific Government decisions affected financial reporting. This included the Government’s decision to cease funding for the project to replace the existing Interislander ferry fleet (the iRex project), leading to KiwiRail cancelling the project. It also included the signalled disestablishment of Te Pūkenga – New Zealand Institute of Skills and Technology. We also considered the potential effect of cost-saving initiatives on public organisations and any resulting effect on the Government’s financial statements.

1.23

We were comfortable that the disclosures for and accounting treatment of these matters were appropriate.

1.24

We experienced more delays in organisations providing financial information to auditors than in previous years and an increase in the number of adjustments needed to draft financial statements. Although this created more complexity and time pressure on preparers and auditors, we were satisfied with the integrity of the Government’s financial statements when signing our audit opinion.

Key audit matters

1.25

Our audit report on the Government’s financial statements includes a description of key audit matters. Key audit matters are those most significant in our audit of the Government’s financial statements. They are matters that we consider to be complex, to have a high degree of uncertainty, or to be important to the public because of their size or nature.

1.26

Each year, we review whether the previous year’s key audit matters remain relevant and consider whether we should include any new matters in our audit report.

1.27

We removed a key audit matter about student loans this year because we were satisfied that there were no new significant issues or judgements that needed further explanation.

1.28

We extended an existing key audit matter and added a new key audit matter.

1.29

We extended the key audit matter relating to the value of property, plant, and equipment to include the rail network because of the complexity and high level of judgement involved in the valuation of the assets involved.

1.30

We included reporting on the government’s climate change obligations as a key audit matter because of the audit effort, level of judgement involved in determining how these commitments should be reported, and the level of public interest in climate change more generally.

1.31

The complete list of key audit matters we included in our audit report for the year ended 30 June 2024 were:

- calculating the value of other persons and companies tax revenue;

- valuing property, plant, and equipment:

- land;

- state highways and the rail network; and

- electricity generation assets;

- valuing financial assets where market data is not available;

- valuing the outstanding claims liability of the Accident Compensation Corporation (ACC);

- entitlements under the Holidays Act 2003; and

- climate change obligations.

1.32

Appendix 1 provides a description of each of the recurring key audit matters and our response to auditing them. We discuss the new key audit matter about climate change below.

Climate change obligations

Why is this a key audit matter?

1.33

The implications of a changing climate and its fiscal impacts are potentially significant. In addition, the Government has committed to various actions under the Paris Agreement on Climate Change (the Paris Agreement). For these reasons there is public interest in how climate change is addressed in the Government’s financial statements.

1.34

The Paris Agreement sets the goal of holding the increase in the global average temperature rise to below 2°C above pre-industrial levels and pursuing efforts to limit it to 1.5°C.

1.35

In 2021, New Zealand updated its Nationally Determined Contribution under the Paris Agreement. New Zealand committed to a 50% reduction of net emissions below its gross 2005 level by 2030.15

1.36

To meet this commitment, New Zealand will need to reduce its domestic emissions and/or purchase carbon credits from international markets. The amount of carbon credits needed will depend on how much New Zealand reduces its domestic emissions. The cost of the carbon credits will depend on carbon prices at the time.

1.37

The Government has not recognised any liabilities in relation to its commitments to achieve its carbon targets under the Paris Agreement. Determining if, and at what point, a liability should be recognised requires judgement. In 2023/24, the Treasury carried out a further assessment about whether a liability existed at 30 June 2024. It concluded that there was no liability and provided an additional and improved disclosure about this matter in the commentary in the financial statements.16

Our audit work

1.38

There is no financial reporting standard that explicitly sets out whether or how nations should recognise their carbon reduction commitments in their financial statements. Determining at what point a liability should be recognised requires judgement and consideration of factors such as the ability of the Government to modify or change the obligation before it eventuates.

1.39

We reviewed the Treasury’s assessment of whether a liability should be recognised. We considered whether the nature of the Paris Agreement and other government commitments meant that a liability should be recognised. This included analysing whether the “present obligation” criterion for recognising a provision or disclosing a contingent liability was met.17

1.40

We also reviewed the annual financial statements of other governments to see whether they had recognised a liability for their Paris Agreement commitments. The United Kingdom, the United States of America, Canada, Australia, and Switzerland have not included any liability or contingent liability in their latest financial statements.

1.41

We were satisfied that not recognising a liability or contingent liability for the Government’s emissions reduction targets was a reasonable interpretation of the financial reporting standards, and we concluded that the disclosures were appropriate.

1.42

As estimates of potential future liabilities arising from the National Determined Contribution become more reliable, there will be more scope for information and disclosure in the Government’s financial statements. More disclosure could include more transparent reporting of the Government’s climate-related targets, its progress in achieving those targets, and the potential consequences of not achieving them.

1.43

As 2030 approaches, to plan effectively the Government will need to decide on a course of action related to the potential purchase of offshore carbon credits. Estimates of future pricing should also become more reliable as overseas markets or other ways of settling commitments develop.

1.44

We were pleased to see that the Treasury included an additional and improved disclosure this year in the commentary to the Government’s financial statements. We considered the disclosures to be appropriate, although they do not form part of the information covered in our audit opinion. We recommended that the Treasury continue to reassess annually whether the accounting treatment for climate-related matters remains appropriate and update the disclosure in the Government’s financial statements as needed.

1: Schedule 4 of the Public Finance Act 1989 includes a list of public organisations subject to certain provisions of the Crown Entities Act 2004, including fish and game councils, Reserve Boards, trusts, and other organisations. Schedule 4a of the Act has a list of companies in which the Crown is the majority or sole shareholder, and which are not listed on a registered market.

2: The Government’s financial statements are available at treasury.govt.nz.

3: For example, the Australian Government publishes its Commonwealth Consolidated Financial Statements for the year ended 30 June in December.

4: Inflation in 2023/24 was the highest it had been since 1990. See “Inflation: How has inflation changed over the years?” at rbnz.govt.nz.

5: See “Reserve Bank of New Zealand – Past monetary policy decisions” at rbnz.govt.nz.

6: See New Zealand Government (2024), Financial Statements of the Government of New Zealand for the year ended 30 June 2024, Wellington, page 9.

7: See New Zealand Government (2024), Financial Statements of the Government of New Zealand for the year ended 30 June 2024, Wellington, page 8.

8: ;See New Zealand Government (2024), Financial Statements of the Government of New Zealand for the year ended 30 June 2024, Wellington, page 40.

9: ;See New Zealand Government (2024), Financial Statements of the Government of New Zealand for the year ended 30 June 2024, Wellington, pages 10 and 11.

10: See New Zealand Government (2024), Financial Statements of the Government of New Zealand for the year ended 30 June 2024, Wellington, page 19.

11: See New Zealand Government (2024), Financial Statements of the Government of New Zealand for the year ended 30 June 2024, Wellington, page 20. Marketable securities comprise bonds, commercial paper, debentures, and similar tradable financial assets held by the Government.

12: See New Zealand Government (2024), Financial Statements of the Government of New Zealand for the year ended 30 June 2024, Wellington, pages 19 and 21.

13: See New Zealand Government (2024), Financial Statements of the Government of New Zealand for the year ended 30 June 2024, Wellington, pages 1, 5, and 7.

14: See New Zealand Government (2024), Financial Statements of the Government of New Zealand for the year ended 30 June 2024, Wellington, pages 25 and 180.

15: See “Submission under the Paris Agreement: New Zealand’s first Nationally Determined Contribution Updated 4 November 2021”, at unfccc.int.

16: See New Zealand Government (2024), Financial Statements of the Government of New Zealand for the year ended 30 June 2024, Wellington, page 23.

17: As required by accounting standards.