Controller update: April 2024

Introduction

We have a strong interest in New Zealanders’ trust and confidence in the public sector. A key element in that is our “Controller” role, in which we check whether government spending is properly authorised and within the law.1 This update covers the six months ended 31 December 2023.

Key points

- The 2023/24 Budget allowed spending of up to $178.2 billion, with an additional $28.5 billion authorised under the second Imprest Supply Act.

- Almost all government spending for the first six months of 2023/24 was properly authorised and within the law.

- The single confirmed instance of unappropriated expenditure relates to a provision of $494.5 million for government assistance to local councils after the North Island weather events.

Our role

The Controller and Auditor-General is often referred to as the public “watchdog” on government spending. An important part of the watchdog role is the Controller function.

In this Controller role, we provide assurance to Parliament and the public that the Government has spent public money in line with the authority provided by Parliament.

The Controller and Auditor-General carries out the Controller role throughout the year and reports more fully to Parliament and the public after the end of the financial year to 30 June.2

How was expenditure authorised for 2023/24?

A central feature of New Zealand’s parliamentary democracy is the requirement that all expenditure by the Government needs to be authorised by Parliament. Parliament authorises most Crown spending through the annual Act that gives effect to the Government’s Budget – the annual Appropriation (Estimates) Act.

However, the Appropriation (Estimates) Act is typically passed two or three months into the financial year – the current Act did not come into effect until 25 August 2023.3 As a result:

- To authorise government spending from 1 July to 24 August 2023, Parliament enacted the first Imprest Supply Act for the year.4

- To authorise the annual Budget, Parliament enacted the main Appropriation (Estimates) Act (effective from 25 August 2023).5

- To allow for spending from 25 August 2023 that is not included in the Budget, Parliament enacted a second Imprest Supply Act for the year.6

The first Imprest Supply Act

Because the Act authorising the Budget 2023 spending wasn’t passed until late August, Parliament provided “interim authority” to the Government through the first Imprest Supply Act for the year. This is normal, and it happens every year.

The first Imprest Supply Act allowed the Government to spend money from the start of the financial year until the Budget was passed. Imprest Supply Acts are typically not very prescriptive. The first Act for 2023/24 allowed the Government to incur expenses of up to $27 billion, to incur capital expenditure of up to $9 billion, and to make capital injections7 of up to $1 billion.

These figures are generally based on a proportion of the annual Budget, and the main purpose of the Act is to allow the Government to spend in line with its Budget before receiving “appropriation” for that spending through the subsequent Appropriation (Estimates) Act.

Our Controller work

Our Controller work for 2023/24 began in October, when we received information on government spending from the Treasury. We carried out checks to determine whether government spending from 1 July to 24 August 2023 was within the three spending limits that the first Imprest Supply Act specified.

We determined that the Government had complied with the Imprest Supply (First for 2023/24) Act 2023.

The main Appropriation Act

The legislation that enacted the Government’s 2023/24 Budget came into force on 25 August 2023. This Act authorises most of the spending included in the Government’s Budget in the form of annual appropriations.8, 9 The total budgeted spending for all appropriations in Budget 2023 was $178.2 billion.10

Our Controller work

Each month from October to June, the Treasury is required to report to the Auditor-General (in his capacity as Controller) the amount of spending authorised under each appropriation and the amount of spending incurred for each appropriation to date.11

We use the information that the Treasury provides to monitor government spending throughout the year. We examine the information for any issues arising and determine whether public spending remains within the limits that Parliament authorised.

The second Imprest Supply Act

The changing nature of government activities and unexpected demands mean that it is rarely possible to foresee all future expenses and capital expenditure for the year. For this reason, Parliament provided the Government with additional spending authority through the second Imprest Supply Act for 2023/24. This Act authorises spending additional to that in the main Appropriation Act from 25 August 2023 to 30 June 2024. This is also normal and happens every year.

The second Imprest Supply Act gives the Government room to respond to any changes since it put the Budget together by allowing for spending that it might not have envisaged at that time. It provides the Government with some (limited) flexibility to reprioritise its spending during the year as circumstances change.12

As with the first Imprest Supply Act, the second Act is not very prescriptive. The second Act for 2023/24 allows the Government to incur expenses of up to $16 billion, to incur capital expenditure of up to $11.5 billion, and to make capital injections of up to $1 billion, in addition to that authorised under the main Appropriation Act (an additional 16%).

Parliament expects the Government to carefully control the use of the authority it provides to incur spending not included in the initial Budget (that is, changes to levels of existing authorities and any new spending). The Government does this by applying Cabinet rules.

There must be a specific Cabinet decision before the Government accesses the extra spending authority it has available through imprest supply.13 Cabinet decisions approve the use of imprest supply for each particular purpose and set the period, amount, type, and scope parameters for the spending.

As such, Cabinet approvals to use imprest supply place the same parameters on spending as the appropriations. These decisions are ultimately reflected in the appropriations when Parliament authorises the Government’s updated Budget later in the financial year.14

In this way, Cabinet controls how and when government departments can use the spending authority provided under the second Imprest Supply Act.

Our Controller work

An important part of our Controller work is checking that decisions to use the second Imprest Supply Act have been made according to the rules. Each month, we check a sample of Cabinet and joint Minister decisions to confirm that they have been properly authorised. We then check that changes affecting appropriations have been correctly recorded in the Government’s financial information system.

From that point, spending incurred under imprest supply must remain within the parameters that those Cabinet decisions set, and we monitor this as well.

Each month, we check that total spending under this Act (that is, the aggregate amount of between-Budget spending decisions) has not exceeded the legislated limits for expenses ($16 billion), capital expenditure ($11.5 billion), and capital injections ($1 billion). As at 30 December 2023, Cabinet’s new spending decisions were well within those limits.

How does 2023/24 compare with recent years?

As we mentioned above, Parliament authorised $37 billion through the first Imprest Supply Act for the year. This acted as a “stop gap” measure to allow the Government to operate until its Budget passed. This amount is in advance of, but does not add to, the Budget.

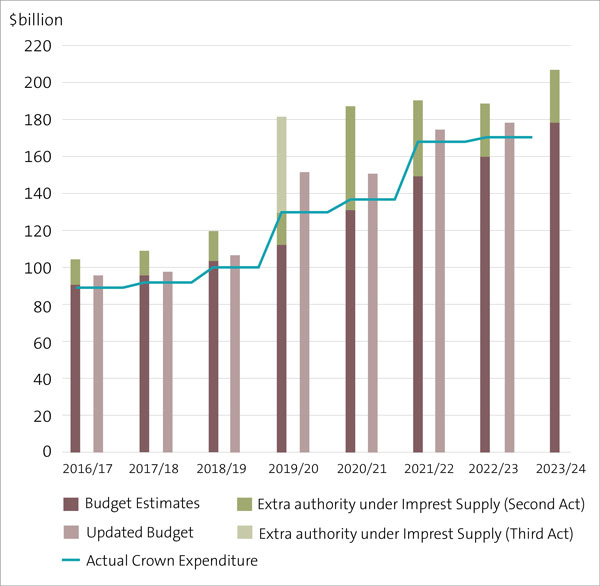

Figure 1 shows the Government’s initial budget,15 the updated Budget,16 and actual public spending for the last eight years.17

It shows that the initial spending authority that Parliament provided to the Government each year18 has increased by 98% ($102 billion) during the last eight years.

Figure 1:

The Government’s budgeted, authorised, and actual expenditure from 2016/17 to 2023/24, in $ billions

Figure 1 also shows the considerable increase in imprest supply authority in 2019/20, 2020/21, and, to a lesser extent, 2021/22. This increase was mainly in response to the Covid-19 pandemic.

In 2019/20, at the outset of the pandemic, Parliament granted the Government additional spending authority for up to $52 billion through a rarely required third annual Imprest Supply Act. This topped up the existing authority and ensured that the Government could lawfully spend what it needed to on the Covid-19 response.

Much of that extra authority was not used in 2019/20. The initial spending authority increased further in 2020/21 as the Government continued to incur expenditure on the Covid-19 response.

The actual amount of public spending incurred has increased by 94% ($84 billion) during the seven years to 2022/23 (represented by the line in Figure 1). Although actual spending has never exceeded the total authority available, there have been many instances of spending exceeding individual appropriation limits.

New Government and mini-Budget

The legislation that authorises government spending is unaffected by a change of government. Parliament authorises the Crown to incur public spending. When the government changes, the “Crown” remains the same – but the Crown appoints different Ministers to carry out the duties of executive government. During this time, our Controller work continues uninterrupted.

Nothing in the new Government’s mini-Budget needed any additional Controller scrutiny. Our monthly checks continued as usual, including our monitoring of the new Government’s changes to appropriation funding, as authorised under the second Imprest Supply Act.

Unappropriated expenditure as at 31 December 2023

A key outcome of interest to the Controller is for “government departments to reduce the instances of public spending without Parliamentary authority”. For the last three years, the Government’s financial statements have reported the lowest numbers of instances of unappropriated expenditure we have seen this century.19

So far, the low occurrence of unappropriated expenditure has continued into 2023/24. However, most instances are usually identified later in the financial year, when government departments prepare their annual reports and we complete our audits of those departments.

We can confirm one instance of unappropriated expenditure as at 31 December 2023. To account for the Government’s part of the cost-sharing agreements for flood-affected properties in the Hawke’s Bay, Tairāwhiti, and Auckland regions, the Government created a provision of $494.5 million in the Crown accounts. The provision gave rise to a Crown expense (of $494.5 million) that there was no appropriation for at the time.

On 1 June 2023 the Government announced that it would enter into a funding arrangement with councils in regions affected by the 2023 North Island cyclone and flood events. This would support them to offer voluntary buyouts to owners of Category 3 designated residential properties (where future severe weather event risk cannot be sufficiently mitigated). The Government anticipated incurring this expense in the 2022/23 financial year and, to secure Parliament’s authority for it, obtained a $500 million appropriation through the 2022/23 Appropriation (Supplementary Estimates) Act 2023.

Subsequent to the 2022/23 financial year end, it was determined that the Crown did not have a legal or constructive obligation as at 30 June 2023. In accordance with the correct accounting practice, no provision was recognised in the Government’s 2022/23 accounts and no appropriation was required.

Instead, the “obligating event” (that is, the Government’s commitment to support local authorities for the Category 3 buy-outs) arose in the 2023/24 financial year, thus giving rise to an expense requiring appropriation. However, the earlier appropriation expired on 30 June 2023, and there was no appropriation to cover this expense in the Budget for 2023/24. Further, imprest supply authority was not sought prior to the obligation arising and the expense being incurred in 2023/24. The expense was therefore incurred without appropriation.

The Crown will report the expense as unappropriated for 2023/24 under Vote Finance.

Our Controller audit work

We carry out the core of the Controller work through annual audits of government departments and our associated interactions with those departments. Our auditors examine the financial systems and records of government departments to determine whether public spending has been properly authorised and accounted for. If it has not, then our auditors will check that the nature and amount of unappropriated expenditure is accurately reported to Parliament and the public.20

For more information on our Controller work and past findings, see Part 4 of Observations from our central government work in 2022/23

1: We sometimes use the term government “spending” and public “spending” for readability reasons. This refers to public expenditure – that is, expenditure incurred by the “Crown”. In this context, “Crown” refers to Ministers and their departments.

2: See, for example, Observations from our central government work in 2022/23, Part 4.

3: The Appropriation (2023/24 Estimates) Act 2023.

4: The Imprest Supply (First for 2023/24) Act 2023 was enacted on 29 June 2023.

5: The Appropriation (2023/24 Estimates) Act 2023 was enacted on 24 August 2023 and authorises spending from 25 August 2023 to 30 June 2024. (It also authorises some spending for multi-year periods.)

6: The Imprest Supply (Second for 2023/24) Act 2023 was enacted on 24 August 2023 and provides interim authority for spending from 25 August 2023 to 30 June 2024. All spending authorised under this interim authority must be “appropriated” through an Appropriation Act before 30 June 2024.

7: A capital injection is a transfer of resources from the Crown to a government department, which increases the size of its departmental balance sheet. It represents an increase in the equity of the department and is generally provided to acquire assets for use in delivering the department’s services.

8: The Budget also includes spending authorised by other legislation.

9: An “appropriation” is a parliamentary authorisation for the Crown or an Office of Parliament to incur expenses or capital expenditure.

10: This figure includes capital injections as well as forecast expenditure for permanent and multi-year appropriations.

11: Section 65Y of the Public Finance Act 1989.

12: All governments move funding around during the year. This is done within defined limits and according to strict rules.

13: Some decisions may be made jointly by the appropriation Minister and the Minister of Finance (“joint Ministers”).

14: That is, through the Appropriation (Supplementary Estimates) Act.

15: The initial budget refers to the main Budget Estimates, as presented on Budget Day, and included in the annual Appropriation (Estimates) Acts.

16: The updated budget refers to that reflected in the Supplementary Estimates, which includes changes to spending levels and any new areas of spending since the initial budget.

17: Actual Crown expenditure is the total amount of spending incurred under each Vote. It includes inter-departmental transfers. These figures will therefore not reconcile with the consolidated Financial Statements of the Government.

18: That is, through the initial Budget Estimates and the second and third Imprest Supply Acts.

19: There were 11 instances in 2020/21, 14 instances in 2021/22, and 16 instances in 2022/23.

20: That is, through our audits of the financial statements of the Government and the financial statements of all government departments for the year ending 30 June 2024.