Part 4: The Controller function

4.1

The Controller function is an important part of the Auditor-General's work. It supports the fundamental principle of Parliamentary control over government expenditure.

4.2

Under New Zealand's constitutional and legal system, the Government needs Parliament's approval to:

- make laws;

- impose taxes on people to raise public funds;

- borrow money; and

- spend public money.6

4.3

Parliament's approval to incur expenditure is mainly provided through appropriations, which are authorised in advance through the annual Budget process and annual Acts of Parliament.7 When the Government wants to incur expenditure not yet authorised in an Appropriation Act, it can draw on the Parliamentary authority provided in an Imprest Supply Act. Expenditure can be authorised in advance through permanent legislation. Some expenditure can also be approved retrospectively.

4.4

The incidence of unappropriated expenditure reached an historical low in 2020/21, with 11 instances. The number of instances has risen slightly since then (to 16 in 2022/23), but it remains low. The amount of unappropriated expenditure as a percentage of the Government's budget was 0.19% of the budgeted expenditure (2021/22: 0.1%).

4.5

In this Part, we discuss:

- why the Controller work is important;

- how much public expenditure was unappropriated in 2022/23 and why;

- how 2022/23 compares with previous years;

- the reasons for unappropriated expenditure over the last eight years; and

- a summary of work we carried out in 2022/23 to discharge the Controller function.

Why the Controller work is important

4.6

Appropriations ensure that Parliament, on behalf of the public, has adequate control over how the Government plans to spend public money. Appropriations also ensure that the Government can be subsequently held to account for how it has used that money.

4.7

Most of the Crown's funding is obtained through taxes. Parliament and the public are entitled to assurance that the Government is spending public money as authorised by Parliament.8

4.8

As the Controller, the Auditor-General helps maintain the transparency and legitimacy of the public finance system. The Auditor-General provides an important check on the system on behalf of Parliament and the public by providing independent assurance that the expenditure is within authority. The Auditor-General also provides assurance that any government expenditure without authority has been identified and dealt with appropriately. As an Officer of Parliament, the Auditor-General is independent of the Government.

4.9

In the Appendix, we explain how public expenditure is authorised, who is responsible for managing it, and the Controller's role in checking it.

How much public expenditure incurred in 2022/23 was unappropriated

4.10

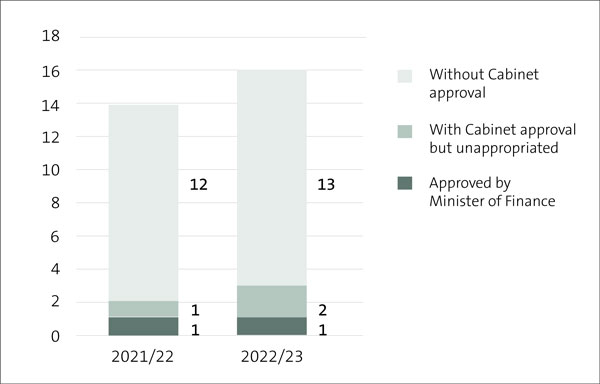

The Government's financial statements for the year ended 30 June 2023 report 16 instances of unappropriated expenditure (2021/22: 14 instances (revised)). Expenditure incurred above or beyond appropriation for the 2022/23 year was $346.7 million (2021/22: $169.1 million). Figure 1 shows a breakdown of unappropriated expenditure categories.9

4.11

The unappropriated expenditure categories shown in Figure 1 fall into three broader categories:

- approved by the Minister of Finance (Category A);

- with Cabinet approval (Categories B and C); and

- without prior Cabinet approval (Categories D, E, and F).

Figure 1

Unappropriated expenditure incurred for the year ended 30 June 2023

| Category | Unappropriated expenditure by category | 2022/23 Number |

2022/23 $million |

2022/23 Votes |

|---|---|---|---|---|

| A | Approved by the Minister of Finance under section 26B of the Public Finance Act 1989 | 1 | 1 | Customs |

| B | With Cabinet authority to use imprest supply but in excess of appropriation before the end of the financial year | 2 | 1 | Conservation |

| C | With Cabinet authority to use imprest supply but without appropriation before the end of the financial year | - | - | |

| D | In excess of appropriation and without prior Cabinet authority to use imprest supply | 7 | 333 | Conservation, Health, Revenue |

| E | Outside scope of an appropriation and without prior Cabinet authority to use imprest supply | 4 | 2 | Social Development, Education |

| F | Without appropriation and without prior Cabinet authority to use imprest supply | 2 | 11 | Corrections; Business, Science and Innovation |

| Total | 16 | 347* |

* The total does not tally because amounts are rounded to the nearest million.

Approved by the Minister of Finance (Category A)

4.12

Small overruns of expenditure in the last three months of the financial year (that is, within $10,000 or 2% of the appropriation) may be approved by the Minister of Finance under section 26B of the Public Finance Act. Although unappropriated, expenditure approved under section 26B is lawful.

4.13

There was one instance of unappropriated expenditure authorised under this section for 2022/23 (2021/22: One instance).

With Cabinet approval (Categories B and C):

4.14

When it is anticipated that expenditure will be above or beyond the appropriation limits, departments should seek prior Cabinet approval to use imprest supply for the expenditure not covered by appropriations.

4.15

However, the use of imprest supply is an interim authority (the second annual Imprest Supply Act expires on 30 June each year), so all expenditure using this authority must also be appropriated through an Act of Parliament by 30 June (see the Appendix for how appropriations work).

4.16

Sometimes Cabinet's approval to use imprest supply is obtained, but the extra expenditure is not included in an Appropriation Act before the end of the financial year, so the expenditure remains unappropriated.10

4.17

There were two instances of unappropriated expenditure in this category in 2022/23 (2021/22: One instance).

Without prior Cabinet approval (Categories D, E, and F)

4.18

For 2022/23, the Government's financial statements report 13 instances of expenditure incurred above or beyond the appropriation limits without any authority at the time it was incurred. The expenditure was without Parliamentary appropriation and without Cabinet's prior approval to use imprest supply (2021/22: 12 instances).

4.19

Figure 2 shows a slight increase in the incidence of unappropriated expenditure in 2022/23, with two more instances than for 2021/22 (see Figure 5 for an eight-year time series).

Figure 2

Number of instances of unappropriated expenditure for 2021/22 and 2022/23

4.20

Figure 3 compares the dollar amounts of unappropriated expenditure for 2021/22 and 2022/23. The amount of unappropriated expenditure in 2022/23 ($346.7 million) was more than double that for 2021/22 ($169.1 million).11

Figure 3

Amount of unappropriated expenditure for 2021/22 and 2022/23

4.21

Expenditure outside the bounds of the appropriations tends to be relatively low. The dollar value of unappropriated expenditure doubled in 2022/23 and, accordingly, it has doubled as a percentage of the Government's budget. The $346.7 million for 2022/23 was 0.19% of the Government's final budgeted amount for that year, compared with 0.1% for 2021/22.

4.22

The higher dollar amount is attributed to one instance, in Vote Revenue. The expense associated with writing down the book value of debtors (that is, the debt impairment and debt write-off expense) exceeded the amount appropriated for this purpose by $282.6 million. This constitutes 81.5% of the $346.7 million of unappropriated expenditure for 2022/23.

4.23

Without this single Vote Revenue item, the value of unappropriated expenditure would have been the lowest in the last seven years.

Why the expenditure was unappropriated

4.24

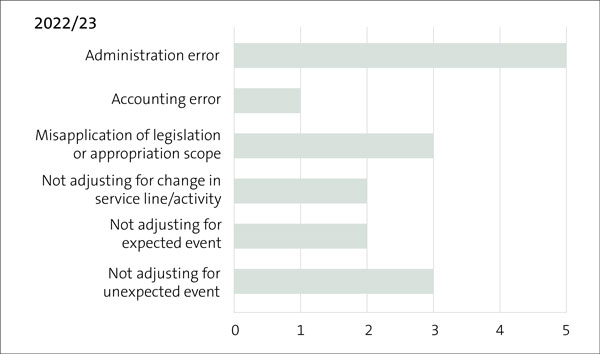

Figure 4 assigns the instances of unappropriated expenditure into the six categories that describe why the unappropriated expenditure came about in 2022/23.

4.25

Once again, and disappointingly, administrative errors continue to feature: five of the sixteen instances resulted from administrative oversights, but they account for 5% of the value of unappropriated expenditure.

4.26

Unexpected events gave rise to three instances, amounting to 81.7% of the value of unappropriated expenditure.

Figure 4

Reasons for unappropriated expenditure in 2022/23, by number of instances

Administration error

4.27

Five instances of unappropriated expenditure resulted from administrative errors in Vote Conservation, Vote Corrections, and Vote Business, Science and Innovation.

4.28

For the second year running, the Department of Conservation has failed to properly manage expenditure authorised under the Community Conservation Funds appropriation. The Community Conservation Funds appropriation authorises the payment of grants for community groups and private landowners to work on public and private land, to assist with pest and weed control, fencing, and other biodiversity management actions, and to support community biodiversity restoration initiatives.

4.29

An expense transfer from 2022/23 to 2023/24 was calculated incorrectly, and this reduced the expenditure limit of the appropriation by more than intended. The Department of Conservation sought and obtained Cabinet authority to use imprest supply. Up to that point, $998,000 had been incurred without Cabinet authority, with a further $103,000 incurred with Cabinet authority but nonetheless unappropriated.12

4.30

The Department of Conservation made a similar mistake in the Management of Recreational Opportunities appropriation. An expense transfer between appropriations within Vote Conservation was calculated incorrectly, and this reduced the expenditure limit of the Management of Recreational Opportunities appropriation by more than intended. As a result, the Department incurred $5.128 million in excess of the appropriation limit.

4.31

If activities authorised for a particular financial year are delayed or otherwise deferred, it is common for government departments13 to request an in-principle expense transfer (IPET), to transfer funding to the following financial year. If the transfer is granted in principle, the department must seek confirmation of the transfer during that (following) financial year. If confirmed, the department will need to seek approval under imprest supply to incur the expenditure, unless the expenditure is already covered by the Appropriation Act for that year.

4.32

Between-year expense transfers are usually confirmed and authorised under the Imprest Supply Act in October of each year, after the departments' financial statements have been audited and published. However, if the expenditure needs to take place before then, then departments need to secure the correct financial authority in time.

4.33

One such instance arose in 2022/23 under the Vote Corrections appropriation Waikeria Corrections and Treatment Facility, which authorises expenditure on improvements to infrastructure. Due to an administrative error, the Department of Corrections did not ensure that the expense transfer had been authorised before incurring expenditure of $649.

4.34

The New Zealand Institute for Plant and Food Research Limited is a Crown Research Institute, which focuses on breeding, pest and disease control, sustainable production, food innovation, and seafood technology. During 2022/23, authority was obtained under Vote Business, Science, and Innovation for the Crown to provide an $11 million operating grant to Plant and Food Research Limited. The grant was to provide financial support to the company in the wake of losses it suffered from the North Island weather events.

4.35

Although the appropriation covered the payment of an operating grant, the Ministry of Business, Innovation and Employment made the payment in the form of a Shareholder Subscription Agreement, which is a capital contribution from the Crown. There was no appropriation in the Vote to cover such a capital contribution, so the payment was unappropriated.

Accounting error

4.36

During 2022/23, the Department of Conservation received an appropriation to incur expenses up to $16.5 million to improve the Molesworth Recreation Reserve land. The Department made payments to compensate for the re-grassing and fertilising of pastures. It treated these payments as expenses, under the Molesworth Recreation Reserve improvements appropriation.

4.37

However, under accounting rules, the expenditure constitutes capital improvements; it is of a capital nature, not an expense. Although Vote Conservation did have a capital expenditure appropriation for the Molesworth Recreation Reserve, that appropriation authorised expenditure of only $476,000 and therefore did not cover all the capital improvement expenditure. Consequently, the Department exceeded the appropriation by $11.7 million.

Misapplication of legislation or appropriation scope

4.38

Since 1993, the Ministry of Social Development had been applying different payment criteria from that set out in legislation to a group of Accommodation Supplement recipients.14 These payments were unlawful under the Social Security Act 2018 and outside the scope of Vote Social Development's Accommodation Assistance appropriation.15

4.39

This matter was brought to our attention in mid-2022. We wrote to the Ministry of Social Development in October 2022 to outline our concerns and request that urgent action be taken to rectify the problem.

4.40

In November 2022, legislative change was enacted to align the Act with current practice. The legislative change was given Royal Assent on 25 November 2022, by which time $554,000 of Accommodation Supplement payments had been made outside the scope of appropriation during 2022/23.

4.41

As part of its broader response, the Ministry carried out a review of its processes for (a) minimising the risk of its practices not aligning with legislation (including the appropriation scope) and (b) resolving alignment issues when they are identified. The Ministry also began work to identify whether there were any other areas with similar characteristics to the Accommodation Supplement issue.

4.42

So far, the Ministry has identified two other areas where benefit payments were not fully aligned with the relevant authority. Out of School Care and Recreation subsidy payments are subject to a cap of 20 hours each week. Where teacher-only days happened during term time, the Ministry found payments made above the cap. This resulted in unappropriated expenditure of $89,000 against the Childcare Assistance appropriation in Vote Social Development. The Ministry also identified payments under the Training Incentive Allowance (TIA) appropriation that were not in keeping with the Training Incentive Allowance Welfare Programme. That Programme defines working age as people aged 18 to 64, and those aged over 65 who are not eligible for New Zealand Superannuation. Payments were made to 16- and 17-year-olds ($155,000 in 2021/22 and $160,000 in 2022/23), who are ineligible for the allowance.

4.43

The Ministry states on page 203 of its 2022/23 annual report that the age criteria did not align to the policy intent of TIA nor to the agreed operational policy design settings for this type of assistance, which was to also support eligible clients aged 16 to 17 years old. This alignment issue was identified in May 2023, and a temporary suspension of new and existing TIA payments to young people aged 16 to 17 under this welfare programme was put in place until the legislation could be changed.

4.44

We support the Ministry's efforts to identify and correct cases where current practice has diverged from the legislative or regulatory requirements.

Change in activity

4.45

Two instances of unappropriated expenditure in 2022/23 resulted from government departments changing their activity without ensuring they had parliamentary authority to cover the expenditure.

4.46

In protecting the New Zealand border, the New Zealand Customs Service (Customs) carries out clearance and enforcement activities relating to travellers and goods. Parliament authorises expenditure on these activities mainly through separate appropriations for travellers and goods respectively.

4.47

The increase in international travel following the Covid-19 pandemic created airport congestion. Customs staff were reassigned to traveller clearance activities to deal with the increase in traveller numbers. This resulted in expenditure exceeding the Travellers Clearance and Enforcement appropriation by $532,000. The Minister of Finance authorised the excess expenditure under section 26B of the Public Finance Act 1989. This means that the excess expenditure was lawful, albeit unappropriated. The expenditure will be "confirmed" in the next Appropriation (Confirmation and Validation) Act.

4.48

The School Lunch Programme appropriation category in Vote Education is limited to "providing school lunches to students in schools and kura with high concentrations of disadvantage". During 2022/23, the Ministry of Education made $1.1 million in payments to cover fixed costs incurred by school lunch programme providers that were unable to deliver school lunches because of the North Island weather events and various teachers' strikes. Subsidising providers' fixed costs is outside the scope of the appropriation and, as such, the Ministry did not have the authority to make those payments.

4.49

Compensating school lunch providers in this way follows on from the Ministry's practice during the 2021 Covid-19 lockdowns. At that time, Ministry also paid providers to deliver community food parcels to families. Although meeting a need, it was also outside the scope of the appropriation. The 2022/23 financial statements of the Government reports $7.4 million of unappropriated expenditure for both types of payment during 2021/22.

Not adjusting for expected event

4.50

Whenever the value of a Crown asset reduces, it is an expense to the Crown. Most expenses require appropriation, including those resulting from asset devaluations. One such instance relates to impairments to the value of public conservation land.

4.51

In 2022/23, Vote Conservation had an appropriation for impairments to the value of public conservation land to be transferred to iwi as part of the Treaty of Waitangi Settlements. The appropriation authorised impairment expenses up to $5.97 million. During the year, the Department of Conservation reviewed the accounting treatment of previous Treaty settlements. It identified instances where the carrying value of the land, going back several years, needed to be written down. The expense from the write-downs of these historical value impairments exceeded the appropriation by $32.13 million.

4.52

In Vote Health, the International Health Organisations appropriation authorises the Government's contribution to the World Health Organization. An increase in membership fees, coupled with a foreign exchange rate rise, resulted in expenditure exceeding the appropriation by $47,000.

Unexpected event

4.53

As explained above, asset write-downs result in expenses, and the Crown must receive an appropriation (or other authority) from Parliament to incur expenses. Two of the three unexpected events that led to unappropriated expenditure in 2022/23 were from writing down the carrying value of debtors by amounts that exceeded the appropriation.

4.54

When Ruapehu Alpine Lifts Limited entered liquidation, the Department of Conservation needed to write off the debt owing to the Crown. The Provision for Bad Debts and Doubtful Debts appropriation was insufficient to cover the debt write-off, resulting in $425,000 exceeding the appropriated amount.

4.55

Economic conditions, including the effects of the North Island weather events, led to a significant increase in the level of Crown debt across all tax types, Kiwisaver, and Working for Families in the final quarter of 2022/23. This increased the level of debt impairment and debt write-off expense beyond the amount anticipated for 2022/23, to $1,467.6 million, which was $282.6 million higher than the appropriation limit (see also paragraph 4.22).

4.56

The costs of defending and settling health and disability-related legal claims against the Crown exceeded the appropriation in 2022/23. Costs totalling $1.95 million included litigation expenses relating to Covid-19, which was more difficult to predict than most other types of expenditure. As a result, the Vote Health Legal Expenses appropriation was exceeded by $145,000.

How 2022/23 compares with previous years

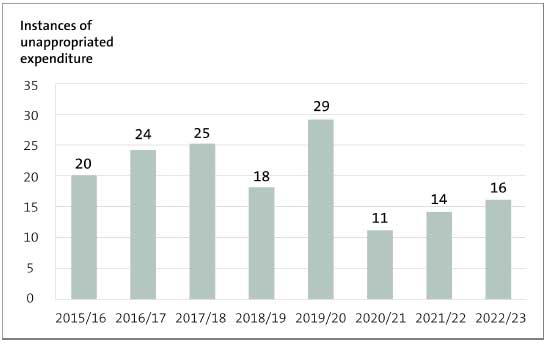

4.57

There has been a steady increase in the number of instances of unappropriated expenditure since the historical low of 11 instances in 2020/21, rising to 16 in 2022/23 (see Figure 5). Nevertheless, the number of instances reported in the Government's financial statements for the three years 2020/21 to 2022/23 are the three lowest so far this century.

Figure 5

Number of instances of unappropriated expenditure, from 2015/16 to 2022/23

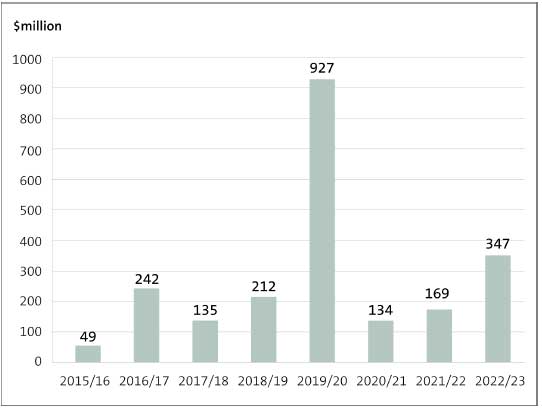

4.58

Figure 6 shows the dollar amount of unappropriated expenditure incurred during the last eight years. The dollar amount of unappropriated expenditure tends not to correlate with the number of instances. Apart from an outlier year (2019/20), which is mostly attributable to one instance ($676.8 million), the value of unappropriated expenditure follows the usual fluctuations over time.

4.59

As explained in paragraph 4.22, 81.5% of unappropriated expenditure for 2022/23 was attributable to just one item – debt write-offs and write-downs under Vote Revenue, resulting from economic conditions, including the effects of the North Island weather events in early 2023.

Figure 6

Amount of unappropriated expenditure, from 2015/16 to 2022/23

Reasons for unappropriated expenditure over time

4.60

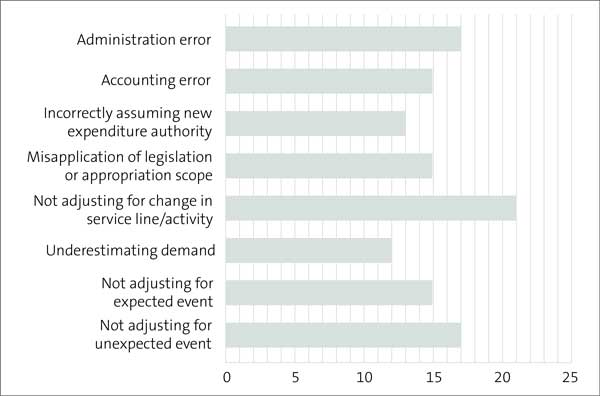

Figure 7 shows the causes of unappropriated expenditure over an eight-year period and the frequency of occurrences.

Figure 7

Reasons for unappropriated expenditure, from 2015/16 to 2022/23

4.61

In recent years, the most common reason for unappropriated expenditure has been departments' failures to secure authority to cover changes in the scope of their functions, service lines, activities, or in the expenditure type (21 cases, which is 17% of all cases).

4.62

Government departments need to consider the implications those changes might have for the authority needed for the expenditure. If the new activity or item of expenditure is not covered by existing appropriations, then departments will need to seek authority under imprest supply before incurring the expenditure.

4.63

It is disappointing that 26% of cases resulted from administration or accounting errors (17 and 15 cases respectively) or from other failures in appropriation management (13 cases). These should be avoidable.

4.64

Administration errors include mistakes made when seeking additional authority for expenditure between Budgets.16 Other errors are made when funding is transferred from one appropriation to another, reducing the expenditure limit of the original appropriation. In some cases, the transferred amount has been calculated incorrectly; in others, it appears that the transfer has been made without sufficient awareness of the likely future expenditure.

4.65

Government departments need to diligently manage and monitor the way that funding is moved and expenditure authorities are changed during the financial year (that is, between Budgets).

4.66

Accounting errors relate mainly to the misapplication of accounting rules, commonly referred to as "generally accepted accounting practice" (GAAP). For the most part, GAAP is specified in financial reporting standards, which determine how expenditure is recognised, classified, measured, and reported in government departments' financial statements.

4.67

The accounting treatment of an item has implications for the type of expenditure authority required. The most common problem involves determining whether expenditure is of a capital or an operating nature. Operating expenditure requires an operating expense appropriation, and capital expenditure requires a capital expenditure appropriation. If departments account for expenditure incorrectly, the subsequent correction of the error might result in expenditure not being covered by the correct appropriation type.

4.68

Government departments must ensure that the GAAP accounting implications for all expenditure are properly thought through and, in turn, that the accounting implications for appropriations are also identified and properly managed.

4.69

Over the last eight years, a failure to manage the timing of expenditure and the required authority for that expenditure resulted in 13 cases of unappropriated expenditure. The most common cause involves departments receiving Cabinet's "in principle" agreement to have funding and expenditure authority transferred from one financial year to the next (IPETs).

4.70

IPETS are not included in the annual Budget and do not authorise expenditure. All IPETs need to be formally confirmed (or otherwise) in the new financial year, usually in October. If confirmed, then the department must receive explicit approval to use imprest supply to cover that expenditure. Unappropriated expenditure arises when the department incurs the expenditure before the required authority is given.

4.71

We have been urging government departments to better manage the transfer of expenditure authority between years.

4.72

Another common cause, which is of considerable concern to us, is when government departments fail to keep expenditure within the scope of what the law allows (15 cases). Given that the Government must not incur expenditure on any activity outside the scope of those authorised by Parliament, we expect government departments to comply with the law.

4.73

Departments need to understand what their appropriations may and may not cover and regularly review their practices to ensure that they align with the relevant authorities. They also need to ensure that, when the appropriation scope is tied to legislation or regulation and the legislation or regulation has changed, practice is immediately realigned to the revised authority.

4.74

There have been 12 cases of unappropriated expenditure in the last eight years because of demand-driven expenditure exceeding the forecast expenditure. Unexpected demand can arise from situations that could not reasonably have been foreseen but can also arise from situations that should have been anticipated and provided for in advance.

4.75

Government departments need to ensure that there is sufficient authority available to cover heavily demand-driven activity.

4.76

Unappropriated expenditure due to specific events that should have been anticipated are included in the Figure 7 category, "Not adjusting for expected event" (15 cases). However, unappropriated expenditure can also arise as a direct result of unexpected events – that is, those where we would consider it unreasonable for departments to have known in advance that they would need to seek additional authority. Such events resulted in 17 cases of unappropriated expenditure over the last eight years. They can include expenses relating to sudden asset impairments, unexpected legal expenses, and obligations placed on the Crown at short notice.

Work carried out to discharge the Controller function

Monitoring public expenditure

4.77

Throughout 2022/23, we monitored public expenditure to determine whether it was in line with the authority provided by Parliament.17

4.78

We checked that the amount of new "between-Budget" expenditure agreed by Cabinet18 (that is, the use of imprest supply) remained within the $28.5 billion authorised through the second annual Imprest Supply Act. For changes made during the year to individual appropriations, we checked a sample to ensure that they had been properly authorised.

Audits of government departments

4.79

We carry out the core of the Controller work through annual audits of government departments and associated interactions with those departments.19 As part of our audits, we examined the financial systems and financial records of government departments to determine whether public expenditure has been properly authorised and accounted for.

4.80

Where the Government had incurred expenditure above or beyond what Parliament had authorised, we checked that the nature and amount of unappropriated expenditure was accurately reported to Parliament and the public.20

Resolving issues arising and providing advice

4.81

Much of the Controller responsibilities include considering matters arising where the question of whether public expenditure is unauthorised is not straightforward or, at least, requires some consideration before a conclusion is drawn.

4.82

From time to time, government departments seek the Controller's view on a matter, to gain assurance about the lawfulness of its expenditure or, alternatively, to help alert it to the need to seek additional expenditure authority. At other times, our auditors, the Treasury, members of Parliament, or the news media will identify matters that prompt deeper scrutiny and consideration by our Office. Not all of our deliberations conclude that expenditure is unlawful.

4.83

One such matter concerned the Cost of Living Payment, administered by Inland Revenue. This matter came to our attention when the first payment was made in August 2022.

4.84

After gathering the necessary information and establishing the facts surrounding the payments, we concluded that the Cost of Living Payments made to overseas residents were within the scope of the appropriation. However, we raised concerns with Inland Revenue about how the eligibility criteria were applied for the Cost of Living Payment, uncertainty about how many ineligible people received the payment, and the approach to recovering payments from ineligible recipients.

4.85

Inland Revenue took action to address these problems. This included estimating the amount of ineligible payments, carrying out extra checks on people's residential status to prevent payments to customers with unconfirmed residential status, and contacting people about eligibility and repayment requirements.

Helping to improve capability and promote good appropriation management

4.86

In 2022/23, we continued to support the Treasury's Finance Development Programme by delivering seminars to government department finance professionals. In those seminars, we highlighted the importance of Parliamentary control of Crown expenditure, how the Controller function supports New Zealand's constitutional arrangements, why it is important to avoid incurring public expenditure without the proper authority, and some of the common problems that can lead to unappropriated expenditure.

6: Section 22 of the Constitution Act 1986.

7: Appropriations are authorities from Parliament that specify what the Crown may incur expenditure on (specific areas of expenditure). Most appropriations specify limits in terms of the type of expenditure (the nature of the spending), scope (what the money can be used for), dollar amount (the maximum that can be spent), and period (the time frame for which the authority is given).

8: That is, it is within the type, scope, dollar amount, and period limits authorised by Parliament.

9: New Zealand Government (2023), Financial Statements of the Government of New Zealand for the year ended 30 June 2023, pages 156-162, at treasury.govt.nz.

10: Normally through the annual Appropriation (Supplementary Estimates) Act.

11: New Zealand Government (2023), Financial Statements of the Government of New Zealand for the year ended 30 June 2023, page 156, at treasury.govt.nz.

12: Because the unappropriated expenditure is split between two categories in the Financial Statements of the Government, it has been counted as two instances.

13: For the purpose of this Part, references to government departments also refer to Officers of Parliament.

14: In these cases, the Ministry of Social Development was treating the community-based partner of those in residential care as though they were single, for the purposes of calculating their Accommodation Supplement entitlement.

15: The Ministry reported this in its 2021/22 annual report and it was reported in the financial statements of the Government for the year ended 30 June 2022. We also explained the matter in our 2021/22 report to Parliament, Observations from our central government audits: 2021/22, paragraphs 3.16 to 3.22.

16: That is, when seeking Cabinet authority to use imprest supply or seeking additional appropriation through the annual Supplementary Estimates Bill.

17: Under section 65Y of the Public Finance Act 1989.

18: Or through Cabinet delegation to joint Ministers.

19: Under section 15 of the Public Audit Act 2001.

20: That is, through our audits of the financial statements of the Government, and the financial statements of all government departments, for the year ending 30 June 2023.