Part 2: What did our audit reports say?

2.1

In this Part, we set out the results of the 2021 school audits and the results of any audits for previous years that we have completed since our report on the 2020 school audits.

2.2

We issued a “standard” unmodified audit report for most schools. This means that, in our opinion, the financial statements for those schools fairly reflect their transactions for the year and their financial position at the end of the year.

2.3

Our “non-standard” audit reports include modified audit opinions or paragraphs drawing the readers’ attention to important matters. We explain these further below.

Modified audit opinions

2.4

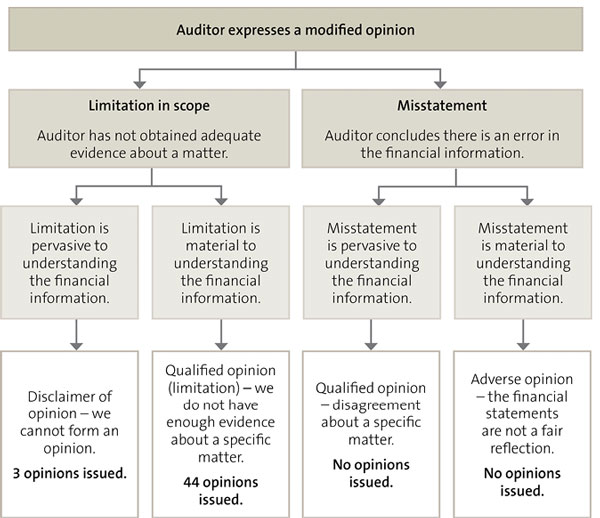

We issue modified audit opinions if we cannot get enough evidence about a matter or if we conclude that there is an unadjusted error in the financial information, and if that uncertainty or error is significant enough to change a reader’s view of the financial statements.

2.5

Figure 2 explains the different types of modified audit opinions and why we issue them. It also summarises the modified audit opinions we have issued since our last report on the results of the 2020 schools audits.

Figure 2

Types of modified opinions

2.6

Of the completed audits for 2021, 31 audit reports had a modified audit opinion. We also issued 16 modified opinions for previous-year audits that were outstanding since our last report. This is about the same number of modified audit opinions we issued last year. However, it is an increase on the number of modified audit opinions we typically issued before 2020. It still remains a small percentage (2%) of all audit opinions that we issue to schools.

2.7

Of the 31 audit reports with a modified opinion, 10 were also modified in the previous year or years. We explain the types of modified opinions that we issued below.2

Disclaimers of opinion

2.8

We issue a disclaimer of opinion when we cannot get enough audit evidence to express an opinion. This is serious because we cannot confirm that the school’s financial statements are a fair reflection of its transactions and balances. We issued a disclaimer of opinion on the financial statements of two schools for three audits. These were all for previous-year audits.

2.9

In December 2021, we completed the audits of Te Kura Kaupapa Māori o Takapau for 2017 and 2018 and issued a disclaimer of opinion for both years.

2.10

We issued a disclaimer of opinion for these two years because the financial service provider for Te Kura Kaupapa Māori o Takapau introduced a new accounting system in August 2018 and all the accounting data and supporting documents stored on the previous accounting system were lost. The kura also did not keep a copy of the accounting data and supporting documents. This financial service provider has since ceased to operate. This meant that financial statements could not be readily prepared for 2017 and 2018.

2.11

We issued a disclaimer of opinion for the 2015 financial statements of Te Kura o Waikaremoana. This was because instances of fraud were identified over a number of years, including 2015, that related to kura funds used for payments of a personal nature and theft of money by creating fictitious invoices. The New Zealand Police carried out an investigation, which resulted in the perpetrators being prosecuted and found guilty by the court. However, the investigation was only into transactions for the 2016 and 2017 years. Therefore, the amount and impact of the fraud on the 2015 financial statements is not known.

2.12

We also drew attention to disclosures outlining that the kura breached the law by failing to meet the statutory reporting deadline, not convening board meetings at the required frequency, appointing ineligible trustees to the Board of Trustees, and not including a KiwiSport report or an analysis of variance in its annual report.

Limitation of scope

2.13

We issue a “limitation of scope” qualified opinion when we cannot get enough evidence about one or more aspects of a school’s financial statements. The audit report explains what aspect of a school’s financial statements we could not get enough audit evidence on. We explain the types of limitations of scope that we reported on this year.

Locally raised funds

2.14

If a school receives funds from its community, it is important that it has appropriate controls to correctly record all the money it receives. In Figure 3, we list the schools that we could not get enough evidence on the amount of funding raised locally.

Figure 3

Schools that were issued a “limitation of scope” opinion about locally raised funds in their audit report

We were unable to get enough evidence that the revenue from locally raised funds recorded in the financial statements of the following schools, and organisations related to schools, was fairly stated.

| 2021 audits | Previous year audits |

|---|---|

| Gore High School Foundation | Gore High School Foundation (2019 and 2020) |

| Linkwater School | Pukekohe Intermediate School (2018 and 2019) |

| Pukekohe North School | Te Kura Kaupapa Māori o Takapau (2016) |

| Pukenui School (Te Kuiti) | Waatea School (2019 and 2020) |

| The Taumarunui High School Community Trust | |

| Woodend School |

2.15

For three of the audits in Figure 3, the controls for recording revenue donations were limited. Therefore, there was no practical way for the auditors to confirm that all donations were included in the financial statements.

2.16

For eight of the audits in Figure 3, controls over the receipt of fundraising revenue were limited. Therefore, there were no satisfactory audit procedures that the auditor could adopt to independently confirm that the receipts from fundraising revenue were properly recorded.

2.17

For two of the audits in Figure 3, the controls over the receipt of revenue from international students was limited. Therefore, there was no practical way for the auditors to confirm that all international student revenue was properly recorded.

Cyclical maintenance

2.18

Schools are required to maintain the buildings that the Ministry of Education or their proprietor (if they are a state-integrated school) provides them. Schools receive funding to maintain their property as part of their operations grant.

2.19

Certain types of maintenance, such as painting the exterior, are needed only periodically. Schools must recognise their obligation to carry out this maintenance as a provision for cyclical maintenance in their financial statements. This provides for the cost of future maintenance required.

2.20

The boards of schools are responsible for calculating their cyclical maintenance provision based on the best information available. For several years, we have found that some boards do not have appropriate evidence that their cyclical maintenance provision is based on reasonable assumptions about future maintenance requirements.

2.21

During 2021, 26 audit opinions with a limitation of scope for cyclical maintenance were issued (23 were for the 2021 audits and three were for the 2020 audits). The 26 audit opinions issued in 2021 compares to 23 issued in the 2020 year and two in the 2019 year.

2.22

Recent changes to auditing standards have required our auditors to get more information from school boards about the information underlying the cyclical maintenance provision. This is to help auditors understand the method, assumptions, and data used by the school board to estimate the provision. Our auditors found that this information was not always readily available, and this has contributed to additional qualifications.

2.23

Figure 4 lists the schools that did not have enough evidence for auditors to form an opinion about cyclical maintenance for the 2021 and 2020 audits.

2.24

There could be situations where a school is uncertain about whether it needs to maintain its buildings because it has significant building works planned. Because of this, the school might not be able to estimate its future obligations for cyclical maintenance. When this is the case, we would expect the school to explain why it does not have a cyclical maintenance provision in its financial statements. We draw attention to these disclosures in our audit report because we consider them to be useful information for readers (see paragraph 2.42).

2.25

We discuss cyclical maintenance in more detail in paragraphs 4.17-4.25.

Figure 4

Schools with “limitation of scope” opinions about cyclical maintenance

| 2021 audits | 2020 audits |

|---|---|

| Aranga School | Cheviot Area School |

| Aria School | Reefton Area School |

| Centennial Park School | Te Rā Waldorf School |

| Cheviot Area School | |

| Christchurch South Karamata Intermediate School | |

| Forrest Hill School | |

| John Paul College | |

| Kaitoke School (Claris) | |

| Mount Richmond School | |

| Okiwi School | |

| Otewa School | |

| Parakai School | |

| Piopio Primary School | |

| Putere School | |

| Rangiora Borough School | |

| Riwaka School | |

| Sacred Heart School (Reefton) | |

| Saint Mary's School (Blenheim) | |

| Te Kura Kaupapa Māori o Taumarere | |

| Te Kura Toitu o Te Whaiti-nui-a-Toi | |

| Te Rā Waldorf School | |

| Te Waha o Rerekohu Combined Schools Board | |

| Waitomo Caves School |

Other types of limitations of scope

Expenses

2.26

Te Kura Kaupapa Māori o Ngati Kahungunu Ki Heretaunga was issued a qualified opinion for the 2018 year because the auditor could not verify some spending that was under the direct control of the Board. This limitation arose because the Board did not maintain adequate supporting documentation for payments or evidence of approval.

Fair value measurement

2.27

Napier Boys’ High School and Napier Girls’ High School each “control” charitable trusts (for financial reporting purposes). These trusts are consolidated into their financial statements, which means the transactions, assets, and liabilities of the trusts are included in the schools’ financial statements.

2.28

These trusts each hold a one-third interest in Napier High Schools Land Endowment Trusts. The Land Endowment Trust owns investment properties that are required to be valued for financial reporting purposes.

2.29

For the 2021 audits, Napier Boys’ High School and Napier Girls’ High School were issued qualified opinions because the auditors were unable to determine the fair value of the Land Endowment Trust’s investment properties. This is a requirement of the financial reporting standards applicable to schools.

Matters of importance that we draw readers’ attention to

2.30

In certain circumstances, we include comments in our audit reports to either highlight a matter referred to in the financial statements of a school or note a significant matter a school did not disclose. We do this because the information is relevant to readers’ understanding of the financial statements.

2.31

These comments are designed to highlight certain matters to assist readers of the financial statements. They are not modifications of our audit opinion. We point out information that is important to a readers’ understanding of the financial information (such as information that is a matter of public interest, a breach of legislation, or disclosures in the financial statements). This includes when we consider schools are experiencing financial difficulties (see Part 3).

2.32

We set out details of the matters we drew attention to below.

The Covid-19 Wage Subsidy Scheme

2.33

During our audits, we identified two schools that had claimed money through the Covid-19 Wage Subsidy Scheme even though they were not eligible for it. State and state-integrated schools were generally not permitted to claim money through the Covid-19 Wage Subsidy Scheme unless they had an exception from their monitoring agency (which for schools is the Ministry of Education). The Ministry provided schools with additional funding and support during 2020 and 2021 in response to Covid-19.

2.34

Marian Catholic School (Hamilton) received $10,052 through the Covid-19 Wage Subsidy Scheme because it did not receive revenue from parents for after-school care during the Alert Levels 3 and 4 lockdowns. However, the school did not meet the Ministry of Social Development’s eligibility criteria for the scheme.

2.35

The school also claimed $28,030 through the Covid-19 Wage Subsidy Scheme in 2020. The school has subsequently repaid 100% of the money, which was $38,082 in total.

2.36

The auditor drew attention to a disclosure in Te Rā School’s 2020 financial statements. The disclosure outlines that the school applied for, and received, $58,978 through the Covid-19 Wage Subsidy Scheme on behalf of Kapiti Waldorf Trust. However, the Ministry of Social Development states on its website that state sector organisations (including schools) are generally not eligible for the Covid-19 Wage Subsidy Scheme. The Kapiti Waldorf Trust, not being the registered employer, was also not eligible. No exception was sought from the Ministry of Education. Therefore, there is uncertainty over the validity of the funding received by the school.

Sensitive expenditure

2.37

Sensitive expenditure is any spending by an organisation that could be seen as giving private benefit to staff that is additional to the business benefit to the organisation. The principles that underpin decision-making about sensitive expenditure include that the expenditure has a justifiable business purpose, and that all expenditure decisions will be subject to proper authorisation and controls. For schools, this is expenditure that contributes to educational outcomes for students and is made transparently and with proper authority.

2.38

We drew attention to the Board of Shotover Primary School donating $200,000 to the Shotover Primary School Foundation, which is not a public organisation. The Foundation is related to the school, but the Board does not control the Foundation. It is not appropriate for the school to donate to a private organisation because there is no guarantee that the school will receive a benefit from those funds. The school requested the donated amount to be returned. However, at the date of the audit report, there was no agreement reached with the Foundation about repaying the donation.

2.39

We drew attention to a disclosure in the Board of Halcombe Primary School’s financial statements. The disclosure outlined that the school spent $5,070 on leaving gifts for the former principal. Using public money for gifts should be moderate, conservative, and appropriate. Although the Board approved the gifts, the school does not have a gift policy and the total amount spent was considered relatively high for a school.

2.40

We drew attention to the Board of Waiuku College’s disclosure in its financial statements outlining that the school spent $1,527 for a farewell gift and $6,909 on leaving ceremonies to farewell a former principal. The farewell gift exceeded the school's gift policy, and the amount spent for the leaving ceremonies was relatively high for a school. Spending public money on farewells and retirements should be moderate, conservative, and appropriate. The Board also used funds that were originally raised for a kapa haka trip. The school should ensure that funds are used for the intended, or similar purpose, for which they are raised. If that purpose is no longer possible, the Board should consult with those who raised the funds.

2.41

We highlighted that Te Kura o Kokohuia spent $15,700 on Pak’n’Save vouchers, which it gave to students and staff during the 2021 Covid-19 lockdowns. At the time of our audit, we were not provided with any evidence of the Board’s approval before purchasing the vouchers or any records of who received the vouchers. All spending by schools should have a justifiable business purpose consistent with their objectives. Because of the lack of documentation about the decision to purchase the vouchers and who received them, we were unable to see how the expenditure was directly linked to an educational purpose.

Other instances

2.42

For three schools, we drew attention to disclosures relating to their cyclical maintenance provisions: Pongakawa School, Kaikorai School, and Papatoetoe High School. These schools could not reasonably estimate their cyclical maintenance provisions because of uncertainties about future maintenance that were out of their control. The uncertainties for some of these schools arose because of weathertightness issues or because they are part of the Ministry of Education’s refurbishment and redevelopment project.

2.43

When a school closes, or is due to close, its financial statements are prepared on a disestablishment basis. This is because the school is no longer a “going concern”. This means that it can no longer be assumed that the school will continue to operate in the foreseeable future.

2.44

The 2021 audit reports for Hawera High School and Hawera Intermediate School and the 2020 audit report for Te Wharekura o Manurewa drew attention to disclosures outlining that the financial statements were prepared appropriately using the disestablishment basis.

2.45

The financial statements for Hawera High School and Hawera Intermediate School were prepared on a disestablishment basis because they stopped operating on 27 January 2023 and a new combined school (Te Paepae o Aotea) opened.

2.46

The 2020 financial statements for Te Wharekura o Manurewa were prepared on a disestablishment basis because the kura was combined into a new legal entity on 2 October 2020.

2.47

We drew attention to disclosures in Glenham School’s financial statements outlining that it requested voluntary closure from the Ministry of Education. Glenham School closed on 30 January 2023. We also drew attention to disclosures for Pukemiro School, in the 2020 audits, outlining the possible effects of the school closure on 25 July 2021.

Reporting on whether schools followed laws and regulations

2.48

As part of our audits, we consider whether schools have complied with particular laws and regulations. Although we primarily look at whether they complied with financial reporting requirements, we also consider whether they meet specific obligations required of them as public organisations.

2.49

The Education and Training Act 2020 and the Crown Entities Act 2004 are the main pieces of legislation that influence the accountability and financial management of schools.

2.50

Usually, schools disclose breaches of the Education and Training Act and the Crown Entities Act in their financial statements. However, we sometimes report on breaches in the audit report. From our 2021 school audits, we identified that:

- 14 schools (2020: 27) borrowed more money than regulation 12 of the Crown Entities (Financial powers) Regulations 2005 allows;

- one school (2020: 2) did not comply with the banking arrangements set out in section 158 of the Crown Entities Act;

- two schools (2020: 1) did not use the Ministry of Education’s payroll services to pay teachers, which section 578 of the Education and Training Act requires all schools to use for teaching staff;

- four schools (2020: 5) had board members who did not comply with rules in sections 9 and 10 of Schedule 23 of the Education and Training Act about conflicts of interest;

- four schools (2020: 1) invested money in a way that was not allowed under section 154 of the Education and Training Act;

- two schools did not comply with section 160 of the Education and Training Act because the boards entered into a lease arrangement and acquired a licence to occupy land without obtaining the approval from the Minister of Education; and

- eight schools (2020: 4) did not complete an analysis of variance report for the year ended 31 December 2021.

Audits not able to be carried out

2.51

We were unable to complete the 2016 and 2017 audits for Hato Petera College due to a lack of information. The school closed on 31 August 2018, and at that time the 2016 audit was still outstanding.

2.52

After the school closed, its physical financial records, such as invoices and payroll reports, could not be located. As a result, financial statements could not be prepared. The Ministry of Education decided that it would not be a good use of time or funds to proceed with preparing and auditing the outstanding financial statements because there would not be an acceptable level of assurance or public accountability provided.3

2: These audit reports are for 2021 unless noted otherwise.

3: As at 31 December 2015 (the last time it was audited), the net assets for Hato Petera College was ($71,920).