Part 3: Reporting on the services we delivered

In this Part, we report on the services that we were funded to deliver in 2018/19 and how well we delivered those services.

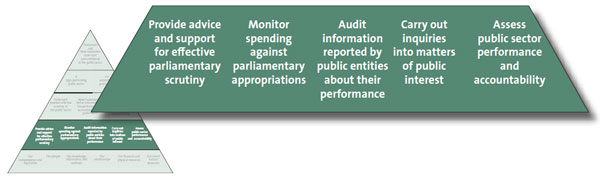

The services that we are funded to deliver are described in the highlighted layer of our performance framework as shown.

How our work is funded

Our services are funded through appropriations for Vote Audit. In the table below, we show the linkages between our services and our appropriations.

| Our services | Our appropriations |

|---|---|

| Provide advice and support for effective parliamentary scrutiny. Our advice to select committees |

Statutory Auditor Function MCA MCA means multi-category appropriation – more than one aspect of our work is covered by this appropriation |

| Monitor spending against parliamentary appropriations. Our Controller function |

Statutory Auditor Function MCA |

| Audit information reported by public entities about their performance. Our annual audits of public entities |

Audit and Assurance Services RDA RDA means revenue-dependent appropriation – the amount of money depends on the audit fees charged for audits of public entities Audit and Assurance Services This appropriation is funded by the Crown, not by the small entities that we audit |

| Carry out inquiries into matters of public interest. Our inquiries |

Statutory Auditor Function MCA |

| Assess public sector performance and accountability. Our performance audits and special studies |

Statutory Auditor Function MCA |

We provide more information about our other two appropriations: Remuneration of Auditor-General and Deputy Auditor-General PLA (permanent legislative authority) and Controller and Auditor-General – Capital Expenditure PLA – at the end of Part 3.

Appropriation statements

The following statements report information about the expenses and capital expenditure incurred against each appropriation administered by the Office for the year ended 30 June 2019.

Statement of budgeted and actual expenses and capital expenditure incurred against appropriations, for the year ended 30 June 2019

This statement reports actual expenses incurred against each appropriation administered by the Office.

End-of-year performance information for all appropriations is reported in this annual report.

| Annual and permanent appropriations for Vote Audit | Actual 2018/19 $000 | Actual 2017/18 $000 | Main Estimates 2018/19 $000* | Supplementary Estimates 2018/19 $000* | Main Estimates 2019/20 $000* |

|---|---|---|---|---|---|

| Output expenses | |||||

| Audit and Assurance Services RDA** | 82,570 | 83,614 | 80,481 | 80,500 | 81,617 |

| Audit and Assurance Services | 150 | 150 | 1,650 | 1,550 | 1,850 |

| Total appropriations for output expenses | 82,720 | 83,764 | 82,131 | 82,050 | 83,467 |

| Other expenses | |||||

| Remuneration of Auditor-General and Deputy Auditor-General PLA*** | 1,064 | 739 | 1,052 | 1,064 | 1,064 |

| Multi-category appropriations | |||||

| Statutory Auditor Function MCA | |||||

| Performance Audits and Inquiries | 6,226 | 6,080 | 6,576 | 6,576 | 9,939 |

| Supporting Accountability to Parliament | 3,444 | 3,195 | 3,278 | 3,278 | 4,937 |

| Total Statutory Auditor Function MCA | 9,670 | 9,275 | 9,854 | 9,854 | 14,876 |

| Total appropriations for operating expenditure | 93,454 | 93,778 | 93,037 | 92,968 | 99,407 |

| Capital expenditure | |||||

| Controller and Auditor-General Capital Expenditure PLA**** | 1,090 | 968 | 1,266 | 1,388 | 1,737 |

| Total annual and permanent appropriations | 94,544 | 94,746 | 94,303 | 94,356 | 101,144 |

* All Estimates information is unaudited. The figures under Main Estimates 2018/19 reflect the forecasts published in Budget 2018 and in the Office's 2017/18 annual report, and the figures under Supplementary Estimates 2018/19 reflect the updated forecasts published in Budget 2019.

** The Office is permitted to incur expenditure up to the amount of revenue earned for this appropriation. In 2018/19, revenue under this appropriation was $82.602 million – see page 23, Financial performance for Audit and Assurance Services RDA.

*** Costs incurred pursuant to clause 5 of Schedule 3 of the Public Audit Act 2001.

**** Costs incurred pursuant to section 24(1) of the Public Finance Act 1989.

Statement of expenses and capital expenditure incurred without, or in excess of, appropriation or other authority, for the year ended 30 June 2019

The Office did not incur any expenses or capital expenditure without, or in excess of, appropriation or other authority for the year ended 30 June 2019 (2018: Nil).

Statement of capital injections without, or in excess of, appropriation or other authority, for the year ended 30 June 2019

The Office did not receive any capital injections without, or in excess of, appropriation or other authority for the year ended 30 June 2019 (2018: Nil).

Statutory Auditor Function MCA

About the appropriation Statutory Auditor Function MCA

The purpose of this appropriation is to support Parliament in ensuring accountability for the use of public resources. It includes two categories:

Supporting Accountability to Parliament

This category is limited to reporting to Parliament and others as appropriate on matters arising from audits and inquiries, reporting to and advising select committees, and advising other agencies in New Zealand and abroad to support Parliament and the public in holding public entities to account for the use of public resources.

This category is intended to provide advice and assistance to Parliament and our other stakeholders to assist them in their work to improve the performance and accountability of public entities. Our Controller function operates under this category and provides independent assurance to Parliament that public money has been spent lawfully and within Parliamentary authority.

Performance Audits and Inquiries

This category is limited to undertaking and reporting on performance audits and inquiries relating to public entities under the Public Audit Act 2001 and responding to requests for approvals in relation to pecuniary interest questions regulated by the Local Authorities (Members' Interests) Act 1968.

This category is intended to provide Parliament and the public with assurance about how well public entities use resources and manage a range of matters and programmes. We make recommendations where we consider that improvements can be made.

Financial performance for Statutory Auditor Function MCA

| Actual 2018/19 $000 |

Actual 2017/18 $000 |

Main Estimates 2018/19 $000* |

Supplementary Estimates 2018/19 $000* |

Main Estimates 2019/20 $000* |

|

|---|---|---|---|---|---|

| Income | |||||

| Crown | 9,611 | 9,611 | 9,611 | 9,611 | 14,633 |

| Other | 273 | 165 | 243 | 243 | 243 |

| Expenditure | (9,670) | (9,275) | (9,854) | (9,854) | (14,876) |

| Surplus | 214 | 501 | - | - | - |

* All Estimates information is unaudited. The figures under Main Estimates 2018/19 reflect the forecasts published in Budget 2018 and in the Office's 2017/18 annual report, and the figures under Supplementary Estimates 2018/19 reflect the updated forecasts published in Budget 2019.

Overall performance for Statutory Auditor Function MCA

| Performance indicator | Performance standard | 2018/19 result | 2017/18 result | 2016/17 result |

|---|---|---|---|---|

| Quality standards are consistently met: stakeholders surveyed who confirm the relevance of our work to users, and reports independently reviewed that are assessed as being of high quality. | At least 85% for stakeholders and 100% for reports | 91% for stakeholders when last assessed* 100% for reports |

91% for stakeholders when last assessed* 100% for reports |

92% for stakeholders 100% for reports |

| Process standards are consistently met: external review and internal quality assurance review confirm that our performance audit process standards are consistently complied with, and that our policies and procedures for statutory auditor functions meet relevant standards. | Confirmation by external and internal review | Confirmed for external review when last assessed** Internal review results not yet available |

Confirmed by external review when last assessed Confirmed by internal review when last assessed |

Confirmed by external review Confirmed by internal review |

* Our stakeholder surveys are carried out every two years. This result is from our 2018 survey. Our next survey is planned for 2020.

** External peer review of our performance audit function is carried out by the Australian National Audit Office every two years. This result is from the 2017 review. Results from the 2019 review are not yet available.

Overall, we are satisfied that we met our quality and process-related targets for our work to support Parliament in ensuring accountability for the use of public resources. For example, 91% of respondents in our most recent stakeholder survey confirmed the relevance and usefulness of our work. An independent assessment of two of our reports concluded that they were of high quality. The reviewers considered that the reports were well written and the recommendations were likely to lead to improvements. They made useful suggestions about how we could improve the impact of our recommendations that we are considering.

The Australian National Audit Office's most recent review of our compliance with our performance audit standards and methodology found that the two performance audit reports reviewed were supported by sufficient and appropriate audit evidence, and in the most part met the Auditor-General's Auditing Standard 5 and applicable Performance Audit Manual policies.

The services we deliver under the Statutory Auditor Function MCA appropriation

1. Provide advice and support for effective parliamentary scrutiny

| About the appropriation This service is funded through the Statutory Auditor Function MCA appropriation. The purpose of this appropriation is to support Parliament in ensuring accountability for the use of public resources. It includes a category Supporting Accountability to Parliament. This category is limited to reporting to Parliament and others as appropriate on matters arising from audits and inquiries, reporting to and advising select committees, and advising other agencies in New Zealand and abroad to support Parliament and the public in holding public entities to account for the use of public resources. This category is intended to provide advice and assistance to Parliament and our other stakeholders to assist them in their work to improve the performance and accountability of public entities. |

Scrutiny of the performance and accountability of the public sector is primarily carried out through select committees. We work closely with select committee chairs and clerks to ensure that our advice and support meet their needs.

Scrutiny of the performance and accountability of the public sector is primarily carried out through select committees. We work closely with select committee chairs and clerks to ensure that our advice and support meet their needs.

We use information from our annual audits to advise and inform Parliament about issues and risks in the public sector. We provide reports and advice to select committees to help their annual reviews of public organisations and their examination of the Estimates of Appropriations, and reports to Parliament on matters arising from our annual audits, performance audits, and other studies.

We also advise Ministers of the results of our annual audits for public organisations in their portfolio.

Performance for Provide advice and support for effective parliamentary scrutiny

| Performance indicator | Performance standard | 2018/19 result | 2017/18 result | 2016/17 result |

|---|---|---|---|---|

| Stakeholders we survey confirm that our advice assists them. | At least 85% | 77% when last assessed* | 77% | 83% |

| Select committees and other stakeholders are satisfied with the proposed work programme (as indicated by feedback on our draft annual work programme). | Stakeholders are satisfied | Stakeholders satisfied | Stakeholders satisfied | Stakeholders satisfied |

| Briefings are given to select committees at least two days before an examination, unless otherwise agreed. | 100% | 100% | 100% | 98.5% |

* Our stakeholder surveys are carried out every two years. This result is from 2018. Our next stakeholder survey is planned for 2020.

In 2018/19, we provided advice to select committees in support of 116 annual reviews, 63 Estimates of Appropriation examinations, and 6 sector briefings. This is a significant increase over previous years (2017/18: 97, 57, and 7 respectively).

Our work is increasing in scale and complexity. Select committees are responding to the Government's greater emphasis on cross-portfolio delivery by reviewing proposed spending across different votes. For example, we supported select committees when they examined proposed appropriations for the Provincial Growth Fund and the Joint Venture on Domestic Violence. These appropriations covered multiple votes with a number of Responsible Ministers. We expect that this type of work will increase.

Historically, we have presented reports to the House of Representatives and responded subsequently to requests from select committees to brief them on the key points. Frequently, these requests have not been made until some time after the report has been presented.

For our report on long-term plans of local authorities – Matters arising from our audits of the 2018-28 long term plans – the Speaker of the House of Representatives hosted an event where the Auditor-General briefed members on the report shortly before it was presented in February 2019. This provided an opportunity for all members, regardless of their select committee, to hear and ask questions about a report of interest to them and their constituents. These briefings have continued in 2019/20.

During the year, we also contributed to a report commissioned to provide ideas for the triennial review of Parliament's Standing Orders and contribute to public debate on enhancing the quality of the country's long-term governance. The report, Foresight, insight and oversight: Enhancing long-term governance through better parliamentary scrutiny, suggested reforms that could change how we work with and for Parliament. We will follow developments closely.

Our international contribution

Each year, we contribute to the international auditing community, particularly in the Pacific region. We aim to strengthen public sector accountability and promote good governance by sharing our skills, knowledge, and expertise with other audit bodies throughout the world.

We take part in international efforts to develop accounting and auditing guidance and standards, and we are active members of the International Organisation of Supreme Audit Institutions (INTOSAI) and the Global Audit Leadership Forum. For example, one of our senior staff members represents New Zealand on the International Public Sector Accounting Standards Board, and we contribute to international public sector auditing standard setting through our membership of INTOSAI's Forum for International Pronouncements. This year, we were part of the international peer review team that reviewed the Office of the Auditor-General of Canada.

Our largest time and resource commitments are to the Pacific Association of Supreme Audit Institutions (PASAI), which is the regional body of INTOSAI focused on the Pacific. The Auditor-General of New Zealand is the Secretary-General of PASAI.

Through our commitment to PASAI, we support accountability, transparency, and good governance in the Pacific, which in turn helps to ensure stability in the Pacific and accountability for the resources that New Zealand invests in the region.

Our work with PASAI is funded by a contract with the Ministry of Foreign Affairs and Trade.

The Auditor-General is also the Auditor-General of Niue and Tokelau under their respective accountability arrangements.

2. Monitor spending against parliamentary appropriations

| About the appropriation This service is funded through the Statutory Auditor Function MCA appropriation. The purpose of this appropriation is to support Parliament in ensuring accountability for the use of public resources. It includes a category Supporting Accountability to Parliament. This category is intended to provide advice and assistance to Parliament and our other stakeholders to assist them in their work to improve the performance and accountability of public entities. Our Controller function provides independent assurance to Parliament that public money has been spent lawfully and within Parliamentary authority. |

Our Controller function provides independent assurance to Parliament that expenditure by government departments and Offices of Parliament is lawful, and is within the scope, amount, and period of the appropriation or other authority.

Our Controller function provides independent assurance to Parliament that expenditure by government departments and Offices of Parliament is lawful, and is within the scope, amount, and period of the appropriation or other authority.

We carry out procedures for the Controller function in keeping with The Auditor-General's Auditing Standards and a Memorandum of Understanding with the Treasury. We review monthly reports that the Treasury provides. We inform the Treasury of any problems and advise the action that needs to be taken. We report on our findings.

Each year, we report to Parliament on any significant matters related to the Controller function. Our report on the results of the 2017/18 central government audits showed that there were 10 instances of unauthorised expenditure, amounting to $69 million (2016/17: 8 instances amounting to $90 million). This equated to 0.07% of the total spending approved in Budget 2017.

This year we introduced a new report to inform the public about our Controller work. We published the Controller update: July to December 2018 on our website. This report provided an interim account of our work and findings for the first half of the year.

We reported on two matters of public spending without authority. The Ministry of Social Development (MSD) had applied money to situations not covered by the law. Some of MSD's winter energy payments were unlawful because they were made outside MSD's legal mandate. They were also made without Parliament's authority to spend and were therefore unappropriated expenditure.

On a separate matter, an error in the paperwork for authority to spend meant that the Ministry of Business, Innovation and Employment spent money on administration of the Provincial Growth Fund before proper authority was in place.

Performance for Monitor spending against parliamentary appropriations

| Performance indicator | Performance standard | 2018/19 result | 2017/18 result | 2016/17 result |

|---|---|---|---|---|

| Controller function: monthly statements provided by the Treasury are reviewed for the period September to June inclusive. Advice of issues arising and action to be taken is provided to the Treasury and appointed auditors within five working days of receipt of the statement. | All procedures are followed, and agreed time frames are met. | All procedures were followed, and agreed time frames were met. | All procedures were followed, and agreed time frames were met. | All procedures were followed, and agreed time frames were met. |

3. Carry out inquiries into matters of public interest

| About the appropriation This service is funded through the Statutory Auditor Function MCA appropriation. The purpose of this appropriation is to support Parliament in ensuring accountability for the use of public resources. It includes a category Performance Audits and Inquiries. This category is limited to undertaking and reporting on performance audits and inquiries relating to public entities under the Public Audit Act 2001 and responding to requests for approvals in relation to pecuniary interest questions regulated by the Local Authorities (Members' Interests) Act 1968. This category is intended to provide Parliament and the public with assurance about how well public entities use resources and manage a range of matters and programmes. We make recommendations where we consider that improvements can be made. |

The Public Audit Act 2001 allows the Auditor-General to carry out an inquiry into any matter concerning a public organisation's use of resources. Possible inquiries can arise from our audit or other work, requests from members of Parliament or a public organisation, or concerns raised by the public. Our inquiries work is often reactive to matters of current public concern.

The Public Audit Act 2001 allows the Auditor-General to carry out an inquiry into any matter concerning a public organisation's use of resources. Possible inquiries can arise from our audit or other work, requests from members of Parliament or a public organisation, or concerns raised by the public. Our inquiries work is often reactive to matters of current public concern.

Performance for Carry out inquiries into matters of public interest

| Performance indicator | Performance standard | 2018/19 result | 2017/18 result | 2016/17 result |

|---|---|---|---|---|

| Entities accept the key recommendations made in our reports, and the recommendations influence improvement. | As assessed in follow-up reports | Achieved for inquiries | Achieved for inquiries | Achieved for inquiries |

| Findings on inquiries are reported to the relevant parties within three months for routine inquiries, within six months for significant inquiries, and within 12 months for major inquiries. | At least 80% | Routine inquiries 67% | Routine inquiries 80% | Routine inquiries 76% |

| At least 80% | Significant inquiries 50% | No significant inquiries carried out | Significant inquiries 50% | |

| At least 80% | Major inquiries 0% |

Major inquiries 0% |

Major inquiries 0% |

|

| Local Authorities (Members' Interests) Act 1968 matters that are completed within 30 working days. | At least 80% | 92% | 91% | 88% |

In 2018/19, we completed work on 45 routine inquiries (including protected disclosures and inquiry-related correspondence), two significant inquiries, and two major inquiries. Inquiries that we decide to inquire into are categorised as "routine", "significant", or "major", depending on how complex the matter is and how long it is likely to take to consider and report about it.

In our report, Inquiry into the procurement of works at Franz Josef by the Westland District Council, we looked at the Council's construction of a stopbank at Franz Josef. Our report contains strong messages about the ends not justifying the means.

Regardless of a perceived sense of urgency, the Council should have complied with the Local Government Act 2002 and the Resource Management Act 1991 and given more attention to the fact that the role of elected members is to govern and not manage. It should have better managed the conflicts of interest, and should have been able to show that public money was well spent and that good procurement practice (to support good decisions) was followed. Several aspects of the process that the Council followed were not acceptable for a public organisation.

We reported to the Waikato Institute of Technology (Wintec) about our additional assurance work carried out on travel expenses and redundancy and severance payments. Our work examined executive travel to Hong Kong and China. Our report outlined that Wintec was in many cases not able to account for the public money it had spent.

The report also outlined what is expected of public organisations when they are spending public money on travel, such as having good records of what the money has been spent on, and being able to show who travelled, that the trip had a clear and approved purpose, and that policies were followed.

Our work reinforced the principle that public organisations need to be good stewards of public money. They should be able to demonstrate that they are spending it well. Getting the basics right helps to build trust and confidence in the public sector.

There are often ongoing effects from our work. For example, discussions continue at select committees, and at central and local government levels, about the lessons from our inquiry work this year. Questions about governance, procurement process and capability, and management of local emergencies and risks are still being considered.

It is challenging to balance the obligations of fairness and natural justice inherent in our work with the increasing volume and complexity of the matters we consider. Our inquiries work is not as timely as we would like. We did not meet our timeliness targets for the three inquiry categories. Of our routine inquiries, 67% (30 of 45) were completed within three months. One of our two significant inquiries was completed within six months, and neither of our two major inquiries were completed within our 12-months target.

We intend to improve how we carry out our initial assessment of matters so that we can make faster progress, and improve the impact of our work. We also plan to increase investment in our inquiries work to help address our timeliness challenges.

Local Authorities (Members' Interests) Act 1968

The Auditor-General also administers the Local Authorities (Members' Interests) Act 1968 (LAMIA), which regulates pecuniary interest matters in local government. This year, we received 37 applications for approval under the Act, and 21 requests for guidance. We measure our timeliness for LAMIA matters from the point where we have all the information we require to carry out our work. This year, we completed 34 out of the 37 enquiries (92%) within our target of 30 working days. We also carried out 7 investigations into potential breaches of the Act.

4. Assess public performance and accountability

| About the appropriation This service is funded through the Statutory Auditor Function MCA appropriation. The purpose of this appropriation is to support Parliament in ensuring accountability for the use of public resources. It includes a category Performance Audits and Inquiries. This category is limited to undertaking and reporting on performance audits and inquiries relating to public entities under the Public Audit Act 2001 and responding to requests for approvals in relation to pecuniary interest questions regulated by the Local Authorities (Members' Interests) Act 1968. This category is intended to provide Parliament and the public with assurance about how well public entities use resources and manage a range of matters and programmes. We make recommendations where we consider that improvements can be made. |

The Public Audit Act 2001 allows the Auditor-General to assess the performance and accountability of public organisations, particular sectors, or the public sector as a whole.

The Public Audit Act 2001 allows the Auditor-General to assess the performance and accountability of public organisations, particular sectors, or the public sector as a whole.

Our work includes evaluation and assessment work, special studies, and advice and recommendations for improvement.

Performance for Assess public sector performance and accountability

| Performance indicator | Performance standard | 2018/19 result | 2017/18 result | 2016/17 result |

|---|---|---|---|---|

| Entities accept the key recommendations made in our reports, and the recommendations influence improvement. | As assessed in follow-up reports | Achieved for performance audits | Achieved for performance audits | Achieved for performance audits |

| Projects in the programme of work under this output class that are delivered within their planned time frames. | At least 75% | 31% | 20% | 39% |

Every year, we carry out a wide range of work to assess public sector performance and accountability. We identify and prioritise work that we consider will best contribute to achieving our impacts and our ultimate outcome – that Parliament and New Zealanders can have trust and confidence in the public sector.

After consulting with Parliament on our proposed programme of work, we publish the work we intend to carry out in our annual plan. In 2018/19, we completed reports on a range of matters. Appendix 4 lists those reports, which are all available on our website. Our progress with the performance audits and other work in our 2018/19 work programme is outlined in Appendix 5.

Performance audits are an important part of our work programme. They enable us to delve more deeply into particular areas of performance than is possible through our annual audits. Their purpose is to influence improved public sector performance and provide assurance to Parliament, public organisations and the public that public organisations are delivering what they have been set up and funded to do.

Each year, we assess the progress public organisations make in acting on the recommendations from a selection of our previous performance audits. The selection of audits we follow up is based on the significance of the areas identified for improvement in the performance audit report, the time that has elapsed since our recommendations were made, and the resources we have available to assess progress.

Generally, we follow up after 18 to 24 months. This allows the entity time to make any necessary changes. Sometimes, changes in the organisation's operating environment mean that we delay our follow-up assessments or that we refocus them. We will continue to monitor the implementation of our recommendations.

Timeliness of our work

Timeliness of completing our work remains a focus. We aim to deliver at least 75% within their planned time frames.

This year, we did not achieve our timeliness target. Only 31% of our projects (5 out of 16) were delivered within their planned time frames. Another 56% of projects (9 out of 16) were delivered within three months of our planned time frames. When added together, 87% of our projects were delivered within their planned time frames or within three months of their planned time frames.

The projects in our work programme can be complex and involve managing many dependencies that can affect timeliness. We will continue to look for ways to make the insights from our work available in a timely way, including better management of the dependencies that can affect the timeliness of our project completion.

Audit and Assurance Services RDA

| About the appropriation Audit and Assurance Services RDA This appropriation is limited to audit and related assurance services as authorised by statute. It provides for audit services to all public entities (except smaller public entities, such as cemetery trusts and reserve boards) and other audit-related assurance services. The audit services we provide are funded by audit fees charged to public entities. |

Financial performance for Audit and Assurance Services (RDA)

| Actual 2018/19 $000 |

Actual 2017/18 $000 |

Main Estimates 2018/19 $000* |

Supplementary Estimates 2018/19 $000* |

Main Estimates 2019/20 $000* |

|

|---|---|---|---|---|---|

| Income from third parties | 82,602 | 84,496 | 80,481 | 80,500 | 81,617 |

| Expenditure | (82,570) | (83,614) | (80,481) | (80,500) | (81,617) |

| Surplus** | 32 | 882 | - | - | - |

* All Estimates information is unaudited. The figures under Main Estimates 2018/19 reflect the forecasts published in Budget 2018 and in the Office's 2017/18 annual report, and the figures under Supplementary Estimates 2018/19 reflect the updated forecasts published in Budget 2019.

** Note 15 in the notes to the financial statements provides more information about transfer of surpluses and deficits to and from the Office's memorandum account.

Audit and Assurance Services (RDA) revenue was $2.1 million higher than in the Supplementary Estimates, due to higher estimated value of work to date on audits that were under way at 30 June 2019, and improved cost recovery on audits. Costs were also $2.1 million higher than in the Supplementary Estimates, due to the equivalent higher costs of audits completed by contracted audit service providers, and higher operating costs in Audit New Zealand.

Because this is a revenue-dependent appropriation, expenditure appropriations for this output class are capped at the revenue total for the year. In years where there is a deficit, the remainder of the costs relating to these outputs are reported in the Audit and Assurance Services appropriation below. Surpluses are held in a memorandum account for use in future years where a deficit arises.

Audit and Assurance Services

| About the appropriation Audit and Assurance Services This appropriation is limited to the performance of audit and related assurance services as required or authorised by statute. It provides for audit and related assurance services of smaller entities, such as cemetery trusts and reserve boards, which are funded by the Crown rather than by audit fees charged to these entities. This appropriation also provides for when costs exceed revenue under the Audit and Assurance Services RDA. These deficits are funded by prior-year surpluses from this output class, which are held in the Office's memorandum account. |

Financial performance for Audit and Assurance Services

| Actual 2018/19 $000 |

Actual 2017/18 $000 |

Main Estimates 2018/19 $000* |

Supplementary Estimates 2018/19 $000* |

Main Estimates 2019/20 $000* |

|

|---|---|---|---|---|---|

| Income | 150 | 150 | 150 | 150 | 150 |

| Expenditure | (150) | (150) | (1,650) | (1,550) | (1,850) |

| (Deficit)** | - | - | (1,500) | (1,400) | (1,700) |

* All Estimates information is unaudited. The figures under Main Estimates 2018/19 reflect the forecasts published in Budget 2018 and in the Office's 2017/18 annual report, and the figures under Supplementary Estimates 2018/19 reflect the updated forecasts published in Budget 2019.

** Note 15 to the financial statements provides more information about transfer of surpluses and deficits to and from the Office's memorandum account.

The higher expenditure appropriations in the Estimates provide a buffer to cover potential deficits on the Audit and Assurance Services RDA output class. Deficits are reported through this appropriation and are funded by the Audit and Assurance Services memorandum account.

A combined view of the financial performance for the two appropriations is shown below:

Combined financial performance for Audit and Assurance RDA and Audit and Assurance Services

| Actual 2018/19 $000 |

Actual 2017/18 $000 |

Main Estimates 2018/19 $000* |

Supplementary Estimates 2018/19 $000* |

Main Estimates 2019/20 $000* |

|

|---|---|---|---|---|---|

| Income | 150 | 150 | 150 | 150 | 150 |

| Income from third parties | 82,602 | 84,496 | 80,481 | 80,500 | 81,617 |

| Total Income | 82,752 | 84,646 | 80,631 | 80,650 | 81,767 |

| Expenditure | (82,720) | (83,764) | (82,131) | (82,050) | (83,467) |

| Surplus/(Deficit)** | 32 | 882 | (1,500) | (1,400) | (1,700) |

* All Estimates information is unaudited. The figures under Main Estimates 2018/19 reflect the forecasts published in Budget 2018 and in the Office's 2017/18 annual report, and the figures under Supplementary Estimates 2018/19 reflect the updated forecasts published in Budget 2019.

** Forecast deficits are funded by the Office's memorandum account, which is explained further in Note 15 in the notes to the financial statements.

The services we deliver under the appropriations Audit and Assurance Services RDA and Audit and Assurance Services

5. Audit information reported by public entities about their performance

| About the appropriation This service is funded through both the Audit and Assurance Services RDA and Audit and Assurance Services appropriations. The purpose of the Audit and Assurance Services RDA appropriation is to provide audit services to all public entities and other audit-related assurance services. These audit services are funded by audit fees charged to public entities. The purpose of the Audit and Assurance Services appropriation is to provide for audit and related assurance services of smaller entities, such as cemetery trusts and reserve boards, which are funded by the Crown rather than by audit fees. |

Our annual audits are fundamental to all we do and to New Zealand's public accountability system. Every year, we audit the financial reports of every public organisation that is required to have an audit – from large government departments, local authorities, and district health boards to every state school and licensing trust. In 2018/19, our annual audits and other assurance services accounted for 89% of our total operating expenditure.

Our annual audits are fundamental to all we do and to New Zealand's public accountability system. Every year, we audit the financial reports of every public organisation that is required to have an audit – from large government departments, local authorities, and district health boards to every state school and licensing trust. In 2018/19, our annual audits and other assurance services accounted for 89% of our total operating expenditure.

We use information from our annual audits to help us advise Parliament and others, and to assist our other work. For Parliament and New Zealanders to have trust and confidence in the public sector, public organisations must provide reliable, meaningful and timely information so that they can be held accountable.

These are important indicators of a high-performing and accountable public sector. We expect public organisations to respond to our audit recommendations to improve their systems and controls, and prepare their reports within statutory time frames.

Performance for Audit information reported by public entities about their performance

| Performance indicator | Performance standard |

2018/19 result |

2017/18 result |

2016/17 result |

|---|---|---|---|---|

| Public entities' audited reports are signed within the statutory time frame. | At least 80%* | 81% | 83% | 80% |

| Audit reports not signed within the statutory time frame are because of inaction on our part. | Less than 15%** | 19% | 23% | 14% |

| Management reports are issued within six weeks of issuing the audit report. | 100% | 97% | 95% | 96% |

| Long-term plan (LTP) audit opinions are signed by 30 June (unless held up by the local authority). | Not applicable as not an LTP year | Not assessed, as not an LTP year | 97% | Not assessed, as not an LTP year |

| Long-term plan (LTP) management reports are provided to local authorities. | Not applicable as not an LTP year | Not assessed, as not an LTP year | 100% | Not assessed, as not an LTP year |

| Annual independent review confirms the probity and objectivity of the methods and processes we use to allocate and tender audits, and monitor the reasonableness of audit fees. | Confirmation by annual independent review | Confirmed by annual independent review (See Appendix 2) | Confirmed by annual independent review | Confirmed by annual independent review |

| Percentage of respondents from our satisfaction survey of public entities who are satisfied with their audit (including the expertise of audit staff and the public entity's relationship with those staff). | At least 85% | 76% | 80%*** | Results not comparable |

| Percentage of respondents from our satisfaction survey of public entities who are satisfied with the usefulness of the management report they receive**** | At least 70% | 69% | 76% | Results not comparable |

| Appointed auditors who have a quality assurance grade of at least "satisfactory", based on our most recent quality assurance review. | 100% | 94% | 95% | 97% |

* We revised this performance standard from 75% in 2016/17 and 2017/18 to 80% in 2018/19.

** We revised this performance standard from less than 30% in 2016/17 and 2017/18 to less than 15% in 2018/19.

*** Due to survey methodology changes, this result differs from what we reported in 2017/18. Our survey method changed from telephone to on-line in 2016/17. This year, the survey rating scale changed from a 10-point scale to a 5-point scale. We surveyed using both scales in 2017/18 and reported the result (77%) using the 10-point scale. This year, we report the 2017/18 result using the 5-point scale (80%) to enable a comparison with 2018/19. The changes mean that the 2016/17 results are not comparable with the 2017/18 and 2018/19 results.

**** We revised this performance indicator to provide a more objective assessment of how well our management reports help public organisations improve. We explain more on page 28.

Timeliness

We expect public organisations to prepare their annual reports within statutory time frames. This year, 81% achieved this. Those that did not were mostly small public organisations such as schools, cemetery trustees, and subsidiaries of public organisations. There are a range of reasons why these organisations find it challenging to meet their reporting obligations on time. We will look at how we might address these reasons with the organisations and auditors as appropriate.

Sometimes, we are responsible for public organisations not meeting their reporting obligations on time. This year, 19% of the organisations that did not meet their timeliness obligations were due to our inaction. This was mainly because some of the firms we contract to carry out audits (our audit service providers) had difficulties resourcing the work.

We aim to have all our management reports issued within 6 weeks of issuing the audit report. This supports public organisations to action our recommendations in a timely way. This year, 97% of our management reports were issued within that time frame. Delays were caused by some late responses to matters raised in our draft management reports, and also by resourcing challenges for some of our audit service providers.

Appointing auditors and monitoring audit fees

The Auditor-General appoints auditors from Audit New Zealand and private sector auditing firms to carry out the annual audits of public entities, on his behalf. Our processes are designed to ensure that these auditors are independent, that they carry out audits of high quality, and that their audit fees are reasonable.

Every year, we commission an independent review of our processes for appointing auditors and monitoring audit fees. This year's independent review confirmed the probity and objectivity of the methods and systems that we use to allocate and/or tender audits, and to monitor the reasonableness of audit fees. Appendix 2 contains the review report.

There is pressure within the audit market for fees to increase. This pressure comes from a tight labour market, international developments that are challenging the status quo, and rising expectations of auditors – not only from the organisations being audited, but also the regulators.

To help us with our monitoring of audit fees, we periodically commission an independent effectiveness and efficiency review of Audit New Zealand, our in-house audit service provider. A review in 2018 showed that we can continue to use Audit New Zealand as a benchmark from which we can compare the pricing of private sector audit providers.

In 2018/19, fees increased due to:

- changes in the scale of operations of some organisations;

- resetting of audit fees for schools in some regions, where they were lower than necessary to retain auditors and achieve quality audits;

- variable quality of the financial statements and performance information prepared by some organisations; and

- small changes in auditor charge-out rates (the average hourly cost of carrying out audits).

Changes in audit fees from 2016/17 to 2018/19 are summarised in the following table. The figures exclude additional audit fees negotiated with a small number of public organisations as a result of unforeseen problems arising after audit fees were agreed.

Changes in audit fees, 2016/17 to 2018/19

| 2017/18 to 2018/19 | 2016/17 to 2017/18 | |||||||

|---|---|---|---|---|---|---|---|---|

| Sector | Increase in total fee | Because of changes in time | Because of changes in charge-out rate | Number of organisations* | Increase in total fee | Because of changes in time | Because of changes in charge-out rate | Number of organisations* |

| % | % | % | % | % | % | |||

| Central government | 5.4 | 9.1 | (3.7) | 328 | 1.0 | 1.1 | (0.1) | 356 |

| Local government | 2.7 | 1.2 | 1.5 | 380 | 2.7 | 0.6 | 2.1 | 401 |

| Schools | 6.0 | 5.2 | 0.8 | 2393 | 1.5 | 0.0 | 1.5 | 2404 |

| Total | 4.6 | 5.8 | (1.2) | 3101 | 1.6 | 0.8 | 0.8 | 3161 |

* The number of organisations are all those organisations where audit fees were agreed at the time our analysis was prepared. This number differs from the total number of public sector organisations referred to on page 6.

** For a number of central government organisations, auditors have proposed significantly increased audit hours. We have restricted the associated audit fee movement, effectively diluting the average hourly charge-out rates.

Our independence

Maintaining independence is fundamental to our work. The credibility of our work relies on being free from influences (real or perceived) so as to enable us to carry out our work and report without constraint. We have high standards of independence, higher than those that apply to the auditing profession generally. We ensure that our independence standards remain appropriate to our changing operating environment. We closely monitor compliance with those standards.

Satisfaction with our auditing services

Each year, our satisfaction survey assesses public organisations' satisfaction with our auditing services. We survey about 550 public organisations. The response rate is generally about 50%.

Our target for public entities' satisfaction with our audit services is that at least 85% of the entities we survey are satisfied with their audit and the expertise of our auditors. This year, we did not achieve our target. Of the entities that responded to our survey, 76% confirmed that they were satisfied with the services our auditors provide. We use our survey results to determine where we can best focus our efforts on improving our auditing services. The matters raised are generally in the value-added area. This is an ongoing challenge for auditors worldwide. The most significant value we give is of course the assurance we provide to stakeholders from the audit itself. However, we know that we can provide more insight to entities through our core audit work, and we are aiming to do that.

Implementation of our recommendations

Each year, our auditors prepare management reports that provide our findings and recommendations so that those with responsibility for making improvements can take action. As indicated in our previous annual report, we have reassessed how we measure public organisations' implementation of our recommendations.

Previously, we reported on the percentage of key recommendations in our management reports that are accepted and acted on by public organisations. To determine this, we carried out a relatively subjective desk-based assessment of whether a small sample of about 45 public organisations had accepted the key recommendations from our management reports.

To improve the objectivity of our assessment and increase the sample size, this year we revised the indicator and the methodology. Our revised indicator – the percentage of respondents from our satisfaction survey of public organisations who are satisfied with the usefulness of our management reports – provides for a more objective assessment of the difference our work makes. Through our satisfaction survey, we asked public organisations about the usefulness of our management reports. The survey provides a larger sample size and a more objective assessment based on direct feedback from public organisations.

We intend to further revise how we assess public organisations' implementation of our recommendations.

Carrying out quality assurance reviews

The quality of audit work carried out on behalf of the Auditor-General is paramount. We carry out quality assurance reviews of appointed auditors usually once every three years to ensure that they have complied with The Auditor-General's Auditing Standards. We expect all our auditors to achieve at least a "satisfactory" grade. This year, 94% of our auditors met this target. Those auditors who did not achieve a grade of at least "satisfactory" were auditors from small private sector auditing firms. We work with those auditors to address any immediate concerns and carry out a follow-up review in the following year. Where necessary, we make changes to auditors' portfolios.

The Auditor-General's Auditing Standards

The Public Audit Act 2001 requires us to report each year on any significant changes made to The Auditor-General's Auditing Standards. This year, there were no significant changes made to The Auditor-General's Auditing Standards. Effective from 1 July 2019, the Auditor-General's standard on independence was strengthened by limiting the work that audit firms can carry out in addition to the audit of public organisations, to work of an assurance nature.

Appropriations relating to all our services

About the Appropriation: Remuneration of Auditor-General and Deputy Auditor-General PLA

This appropriation is limited to remuneration expenses for the Auditor-General and the Deputy Auditor-General, as authorised by clause 5 of the Third Schedule of the Public Audit Act 2001. This permanent appropriation provides for payment to the Auditor-General and Deputy Auditor-General as determined by the Remuneration Authority.

Financial performance for Remuneration of Auditor-General and Deputy Auditor-General PLA

| Actual 2018/19 $000 |

Actual 2017/18 $000 |

Main Estimates 2018/19 $000* |

Supplementary Estimates 2018/19 $000* |

Main Estimates 2019/20 $000* |

|

|---|---|---|---|---|---|

| Income | 1,064 | 838 | 1,052 | 1,064 | 1,064 |

| Expenditure | (1,064) | (739) | (1,052) | (1,064) | (1,064) |

| Surplus | - | 99 | - | - | - |

* All Estimates information is unaudited. The figures under Main Estimates 2018/19 reflect the forecasts published in Budget 2018 and in the Office's 2017/18 annual report, and the figures under Supplementary Estimates 2018/19 reflect the updated forecasts published in Budget 2019.

The Auditor-General and Deputy Auditor-General lead the performance of the Office. The performance of the Office's activities, including this appropriation, is reflected in the information provided in this report.

| About the Appropriation: Controller and Auditor-General – Capital Expenditure PLA This appropriation is limited to the purchase of assets by, and for the use of, the Controller and Auditor-General, as authorised by section 24(1) of the Public Finance Act 1989. It is intended to achieve the renewal and replacement of assets that support the delivery of the Controller and Auditor-General's operations. |

Financial performance for Controller and Auditor-General – Capital Expenditure PLA

| Actual 2018/19 $000 |

Actual 2017/18 $000 |

Main Estimates 2018/19 $000* |

Supplementary Estimates 2018/19 $000 |

Main Estimates 2019/20 $000* |

|

|---|---|---|---|---|---|

| Property, plant, and equipment | 509 | 595 | 550 | 484 | 559 |

| Intangible assets | 242 | 313 | 260 | 448 | 950 |

| Other | 339 | 60 | 456 | 456 | 228 |

| Total Capital Expenditure | 1,090 | 968 | 1,266 | 1,388 | 1,737 |

* All Estimates information is unaudited. The figures under Main Estimates 2018/19 reflect the forecasts published in Budget 2018 and in the Office's 2017/18 annual report, and the figures under Supplementary Estimates 2018/19 reflect the updated forecasts published in Budget 2019.

Our capital expenditure programme provides for the purchase of facilities and tools to enable our staff to carry out their work – for example, hardware and software for information systems, vehicles, building fit-out, and furniture and fittings.

This year, we met our objectives for maintaining our property, plant, and equipment. Our objectives for intangible assets included completing the upgrade of the Office's document management system. This project has been delayed and is not yet complete. This is reflected in the lower expenditure on intangible assets for 2018/19 compared to the Supplementary Estimates.

Section 24(1) of the Public Finance Act 1989 allows the purchase or development of assets from working capital and asset disposal proceeds, without any further appropriation.