Part 8: Results of tertiary education institution audits for 2008

8.1

This Part provides some background information about tertiary education institutions (TEIs) and their operating environment. It sets out the results of our annual audits of TEIs for 2008, including a summary of our audit findings about the quality of TEIs' procurement policies and capital asset management.

8.2

Unlike most other public entities, the financial year for TEIs (and schools) ends on 31 December each year. This aligns with their academic teaching year.

What is the tertiary education institution sector?

8.3

The New Zealand tertiary education system includes all post-school education and training, from university research and diploma and degree study courses to industry training. In 2009/10, government expenditure on tertiary education will total about $2.9 billion (excluding GST).1 The tertiary education sector includes both public TEIs and private sector providers.

8.4

There are 31 public TEIs providing training, education, and research services in New Zealand.2 The TEI sector has three distinct sub-sectors universities (of which there are eight), institutes of technology and polytechnics (20), and wānanga (three). Each TEI sub-sector tends to describe itself as distinct from the other two TEI sub-sectors. The TEI sub-sectors have established "umbrella" bodies to represent the interests of their member organisations, foster collaboration, and facilitate a point of contact with external stakeholders. TEIs also maintain relationships in their own right with stakeholders.

8.5

In addition, many TEIs have established subsidiary organisations to carry out activities consistent with the functions and duties of a TEI, having decided that these activities can be more sensibly managed in a separate legal structure. For example, a number of the TEIs have established research companies, scholarship trusts, childcare centres, and student hostel accommodation centres.

Governance and accountability arrangements

8.6

TEIs are Crown entities3 independently governed by councils whose functions are set out in the Education Act 1989 (the Act). The precise constitution of each TEI council differs. For the 2008 financial year, each TEI council consisted of not fewer than 12 members nor more than 20 members. Most councillors are elected or appointed by stakeholder groups, although four are appointed by the Minister for Tertiary Education (the Minister). We note that the Education (Polytechnics) Amendment Act 2009 will change the constitution of councils for institutes of technology and polytechnics, with effect from 1 May 2010. The constitution of these Councils will reduce from 12-20 members to eight. Four members will be appointed by the Minister, and the other four members will be appointed by the institutes of technology and polytechnics, in keeping with their statutes.4

8.7

Unlike some other classes of Crown entities, TEIs are not directly accountable to a Minister of the Crown. However, the Crown monitors the performance and viability of the TEI sector through the activities of the Ministry of Education (the Ministry), the Tertiary Education Commission (the TEC), and the New Zealand Qualifications Authority (NZQA). We discuss the broad role of each of these agencies in paragraphs 8.11-8.16.

8.8

In certain circumstances, the Crown may actively support TEI councils to govern their institutions. Sections 195A to 195D and 222A to 222E of the Act set out a graduated set of formal intervention powers that allow for different levels of support, according to the TEIs' individual situations. The powers range from requiring a TEI to provide specified information about the operation, management, or financial position of the TEI at a given time, to dissolving the TEI council and appointing a Commissioner to govern the TEI.

Roles and responsibilities of tertiary education institutions

8.9

Section 159ABA of the Act sets out the planning, funding, and monitoring framework of the tertiary education sector. This framework requires TEIs to prepare plans (currently called Investment Plans) that set out TEIs' responses to the Government's tertiary education priorities and to stakeholder needs. The Investment Plans establish the levels of Crown funding for the TEIs. TEIs are also required to prepare an annual report that includes, among other information, a set of audited financial statements and statement of service performance.5

8.10

Sections 180 and 181 of the Act set out the functions and duties of each TEI council. These functions include appointing a Chief Executive, and ensuring that TEIs are managed in keeping with their Investment Plans. In discharging their functions, TEI councils must ensure that TEIs strive to attain the highest standards of excellence in education, training, and research, and operate in a financially responsible manner that ensures the efficient use of resources and the long-term viability of the TEI.

Other agencies with a role in the tertiary education institution sector

8.11

Three central government education agencies have a significant influence on the operation of the TEI sector.

Ministry of Education

8.12

The Ministry prepares strategic policy for the tertiary education sector, carries out relevant research and analysis, and monitors the performance and capacity of the TEC and NZQA. The Ministry has few direct relationship with TEIs.

Tertiary Education Commission

8.13

The TEC interacts more directly with TEIs than the Ministry. The TEC is responsible for leading the Government's relationship with the tertiary education sector. The TEC implements the Government's Tertiary Education Strategy (the strategy – see paragraph 8.18). The TEC works with TEIs (and also the private providers of tertiary education) to agree Investment Plans that outline how they respond to the strategy.

8.14

The TEC's chief executive has statutory responsibilities for monitoring and assessing the operations and ongoing viability of TEIs. To do this, the TEC:

- monitors TEIs' finances, governance, and management;

- advises the Minister on appointments to TEI councils;

- supports the development of TEIs' governance and management capability; and

- provides statutory intervention advice to the Minister and implements any decisions made by the Minister.

8.15

The TEC meets regularly with TEIs to discuss their strategies, financial management issues, and risks.

New Zealand Qualifications Authority

8.16

NZQA's primary function is to co-ordinate the administration and quality assurance of national qualifications. NZQA has an overarching quality assurance role in tertiary education and is responsible for conducting quality assurance in all tertiary education organisations except universities.6 The Government has recently revised its quality assurance arrangements for the tertiary education sector, which NZQA is now implementing.7

Recent changes to the operating environment

8.17

In recent years, significant policy changes have been implemented in the tertiary education sector and further work is under way to give effect to the policies of the current Government. Changes already made affect the role of TEIs, the ways TEIs are funded, and the way quality assurance is carried out. Further changes will be implemented in the next five years, with an immediate focus on the institutes of technology and polytechnics sub-sector in 2010. The focus of the ongoing reform process is to make tertiary education more relevant and more efficient, so that it meets the needs of students, the labour market, and the economy.8

8.18

In December 2009, the Government released its 2010–2015 Tertiary Education Strategy for the tertiary education system.9 The strategy outlines the Government's priorities for the next five years and how it will achieve them. The Government expects the tertiary education system to:

- provide New Zealanders of all backgrounds with opportunities to gain world-class skills and knowledge;

- raise the skills and knowledge of the current and future workforce to meet labour market demands and social needs;

- produce high-quality research to build on New Zealand's knowledge base, respond to the needs of the economy, and address environmental and social challenges; and

- enable Māori to enjoy educational success as Māori.10

8.19

As a result of these reforms, TEIs are responsible for responding to government direction and to regional and national stakeholders, by preparing and agreeing an Investment Plan with the TEC. Investment Plans cover the provision of education, training, and research, and the development of new or enhanced capability by each TEI. Given the current economic conditions, the TEC is expecting that TEIs will make trade-offs within the total funding allocated to best meet the needs of students, business, iwi, and communities.

8.20

Government expenditure levels on tertiary education are based on a three-year funding path under the Investment Plan model. The funding path is based on a range of factors, including expected demographic changes, student demand, and competing priorities for funding within and outside the education sector. Funding supports what is agreed in Investment Plans, and future funding is influenced by how well TEIs perform against their Investment Plans.

8.21

Investment Plans were in place for all TEIs in 2008.

How tertiary education institutions are funded

Tertiary education funding system

8.22

The Government determines both the total level of funding and the amount available for each tertiary education sub-sector. During 2008/09, the Government provided funding of about $2.3 billion to TEIs, most of which is administered by the TEC. This funding is distributed through a number of different funding mechanisms. Most funding is distributed through a bulk funding arrangement, involving a small number of separate but closely related funds discussed in Figure 29. These funds are all linked to Investment Plans and have a three-year baseline that is updated at each Budget.

Figure 29

Description of the broad funding system for the tertiary education sector

| The Student Achievement Component ($1,604 million in 2009/10) is the most significant part of the tertiary funding system. It is the single largest source of revenue for universities, wānanga, and institutes of technology and polytechnics.* It provides subsidies for teaching and learning in mainstream tertiary qualifications (with most learners also paying tuition fees). Allocations are based on total student enrolments agreed in Investment Plans, and are calculated using a sophisticated formula with funding rates that vary significantly by the type of qualification and for each part of the sector. The Tertiary Education Organisation Component ($662 million) provides funding (mainly for universities, wānanga, and institutes of technology and polytechnics) to support a range of core roles, capability needs, and innovation not directly related to student enrolments. There are six elements within this component, of which the largest two are:

|

*It is also allocated to many private training establishments and other tertiary education providers.

Source: Vote Education – see www.treasury.govt.nz/budget/2009/estimates/est09educ.pdf, pages 5-7.

TEI revenue sources

8.23

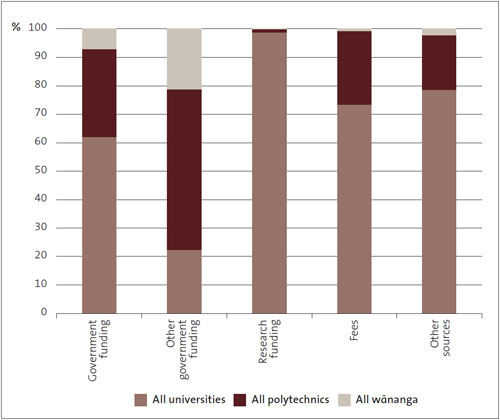

TEIs receive revenue from government funding, research funding, fees, and other sources. Figure 30 shows that universities consume a significant proportion of government grant and research funding. By comparison, institutes of technology and polytechnics consume the largest proportion of "Other Government Funding".11 Student fees are also a considerable source of revenue for universities and polytechnics, but make up only a small proportion of revenue for wānanga.

Figure 30

Funding for tertiary education institutions by revenue source for 2008

Summary of tertiary education institutions' 2008 financial performance

8.24

TEIs are required to keep proper accounting records and prepare annual financial statements. Figure 31 summarises the financial performance of the 31 TEIs for the year ended 31 December 2008.

Figure 31

Summary of tertiary education institutions' financial performance for 2008

| Tertiary education institution | Revenue $000 |

Surplus/(Deficit) $000 |

|---|---|---|

| University of Auckland | 788,915 | 24,921 |

| University of Otago | 519,795 | 18,518 |

| University of Canterbury | 272,474 | 14,977 |

| Victoria University of Wellington | 300,993 | 9,900 |

| Massey University | 398,621 | 5,283 |

| Auckland University of Technology | 237,244 | 5,108 |

| Lincoln University | 88,753 | (1,316) |

| University of Waikato | 188,481 | (1,671) |

| Christchurch Polytechnic Institute of Technology | 82,486 | 7,926 |

| Southern Institute of Technology | 41,142 | 5,491 |

| Manukau Institute of Technology | 89,709 | 2,891 |

| Aoraki Polytechnic | 23,579 | 2,511 |

| Telford Rural Polytechnic | 12,542 | 2,044 |

| Bay of Plenty Polytechnic | 33,529 | 1,877 |

| Nelson Marlborough Institute of Technology | 49,329 | 1,553 |

| Eastern Institute of Technology | 36,015 | 1,289 |

| Waiariki Institute of Technology | 35,621 | 852 |

| Wellington Institute of Technology | 49,286 | 621 |

| Waikato Institute of Technology | 71,236 | 608 |

| The Open Polytechnic of New Zealand | 52,215 | 600 |

| Unitec New Zealand | 118,533 | (82) |

| Otago Polytechnic | 50,513 | (337) |

| Whitireia Community Polytechnic | 46,422 | (498) |

| Universal College of Learning | 51,897 | (966) |

| Northland Polytechnic | 33,800 | (1,132) |

| Tai Poutini Polytechnic | 24,374 | (1,512) |

| Tairawhiti Polytechnic | 16,270 | (1,985) |

| Western Institute of Technology at Taranaki | 23,663 | (2,748) |

| Te Wānanga o Aotearoa | 128,355 | 5,937 |

| Te Wānanga o Raukawa | 21,164 | 2,728 |

| Te Wānanga o Awanuiārangi | 22,940 | 2,078 |

| Total | 3,909,896 | 105,466 |

Source: Education Counts website – www.educationcounts.govt.nz/__data/assets/excel_doc/0011/16310/ Financial-performance-of-public-providers-TEIs.xls#FNP.1!A1.

Note: The surplus/(deficit) figures also take account of abnormal items. Some totals may not add due to rounding.

Tertiary education institutions' audit results for 2008

8.25

The Auditor-General is the auditor of all TEIs and each of their public entity subsidiaries.12 She carries out the annual audit of TEIs' financial statements and other information that each of the 31 TEIs and their subsidiaries are required to have audited. The Auditor-General's practice is to appoint auditors to conduct annual audits on her behalf.

8.26

In an annual audit, the auditor:

- examines an entity's financial statements, performance information, and other information that must be audited (statement of service performance);

- assesses the results of that examination against a recognised framework (usually generally accepted accounting practice); and

- forms and expresses an audit opinion.

8.27

The audit involves gathering all the information and explanations needed to obtain reasonable assurance that the financial statements and other information do not have material misstatements caused by fraud or error. The auditor also evaluates the overall adequacy of the presentation of information.

8.28

We issue audit opinions for each TEI (usually referred to as "the parent accounts"), for each TEI subsidiary that is also a public entity, and for the combined entities that represent the TEI group (usually referred to as "the group accounts").

Audit opinions for the year ended 31 December 2008

8.29

We issued unqualified audit opinions for 28 of the 31 TEI group accounts in 2008. This means that the financial statements that we audited complied with generally accepted accounting practice, and fairly reflected each TEI group's financial position and the results of its operations and cash flows for the year ended 31 December 2008. These audit opinions also mean that readers of the TEIs' accounts can be confident that the performance information reported by the TEIs fairly reflects their service performance achievements, as measured against the performance targets adopted for the year ended 31 December 2008.

8.30

We issued qualified audit opinions for three of the TEI group accounts in 2008. The qualifications were specific to the circumstances of each TEI.

8.31

Two TEIs' unqualified audit opinions contained explanatory paragraphs. We provide more detail about each of these "non-standard" audit opinions in Part 4 of this report.

8.32

We also issued a number of non-standard audit opinions in the broader TEI sector – on the financial statements of subsidiary public entities. Part 4 also discusses the detail of these opinions.

Areas of focus in the 2008 annual audit

8.33

Each year, we identify particular areas of focus for each annual audit. For the 2008 annual audit of TEIs, the particular areas of focus were procurement policies and capital asset management. This was the second year that we had asked our auditors to focus on these issues.

Procurement policies

8.34

Procurement covers all the business processes associated with purchasing, spanning the whole cycle from identifying needs through to the end of a service contract or the end of the useful life and subsequent disposal of an asset. We expect TEIs to follow good public sector practice when procuring goods or services.

8.35

The Government expects public entities to conduct their procurement having regard to:

- the policy principles set out in the Ministry of Economic Development's Government Procurement in New Zealand, a Policy Guide for Purchasers;

- the Auditor-General's June 2008 good practice guide, Procurement guidance for public entities;

- the Auditor-General's June 2008 good practice guide, Public sector purchases, grants, and gifts: Managing funding arrangements with external parties; and

- the Auditor-General's June 2006 good practice guide, Principles to underpin management by public entities of funding to non-government organisations.

8.36

We asked our auditors to check whether TEIs had addressed the findings and recommendations from our 2007 audit work on TEI procurement policies.

8.37

Overall, we were disappointed with the sector's progress in improving the quality of their procurement policies. A few TEIs still had no procurement policy. Some of our 2007 audit recommendations had been addressed, but a large number of TEIs needed to make further improvements to have their policies align with good public sector practice.

8.38

We were pleased to note that some TEIs had updated procurement policies in place that reflected our 2007 recommendations and were in line with good public sector practice. We reported the findings of this work to TEI councils in the management letters that accompanied our 2008 audit opinion.

8.39

As part of the 2009 audits, we have asked our auditors to ensure that TEIs have addressed the 2008 audit findings and recommendations about procurement, and to examine the extent to which those policies align with recent good practice documents about procurement. The results of this audit work will be reported to TEI councils, TEI management, and the Minister.

Capital asset management

8.40

Capital asset management is the process of achieving optimal whole-of-life effectiveness of assets at minimum cost. Where asset management is, or should be, a significant part of an entity's activities, the asset management process should be an important part of the entity's decision-making and management control environment. The asset information, including depreciation, reported in the financial statements should be aligned with the underlying information in the asset management plan.

8.41

Since 2006, the Treasury has been leading a work programme about capital asset management in the central government sector. The TEC is leading a set of initiatives in the TEI sector that is aligned to the Treasury's capital asset management work programme. These initiatives include the TEC working collaboratively with the TEI sector in 2009 to encourage stronger capital asset management planning practices, and to seek better information on the TEI capital asset management stock.

8.42

Given the value of the collective asset base of the TEI sector ($7.4 billion),13 the Auditor-General expects TEIs to have comprehensive capital asset management plans in place. As part of the 2008 annual audit, we asked our auditors to determine the extent to which TEIs had an up-to-date capital asset management plan in place, and whether the information aligned with the asset information in the 2008 financial statements.

8.43

We are pleased to report that most TEIs have made some progress in improving the quality of their capital asset management planning since our 2007 audit. However, there is still much work to be done for the TEI sector's capital asset management practices to meet standards of good public sector practice. Therefore, as part of the 2009 audit, we have asked our auditors to follow up on the extent to which TEIs have addressed our 2008 audit findings and recommendations about capital asset management.

Matters arising during the 2008 audits of tertiary education institutions

Funding sourced from capital appropriations

8.44

During the 2008 audit, we identified a financial reporting issue with some TEC funding disbursed to institutes of technology and polytechnics and wānanga, sourced from a capital appropriation. Crown funding provided under the authority of a capital appropriation is most often for capability building and is, therefore, an investment in the Crown's equity in the recipient entity. Some of the funding agreements between the TEC and some institutes of technology and polytechnics and wānanga were not as clear as they could have been about the purpose and intent of some capital funding.

8.45

Where funding has been provided under the authority of a capital appropriation, it will seldom be appropriate for the entity to account for that funding as revenue. Due to the lack of clarity in some of the funding agreements, some TEIs had accounted for this TEC funding, sourced from a capital appropriation, as revenue in their draft financial statements. After discussions with the TEIs concerned and the TEC, most of the matters were resolved before the audits were due to be completed in April 2009.

8.46

We are pleased that the TEC has taken a number of steps to ensure that its future funding agreements will be clearer about the intent and purpose of funding, particularly where funding is sourced from a capital appropriation.

Audit timeliness

8.47

An important aspect of the performance of public entities is the issuing of audited financial statements within statutory time frames. We want those interested in the accountability of public entities to receive our audit assurance as soon as possible after the end of the financial year.

8.48

For the 2008 TEI audits, the statutory deadline was 30 April 2009.14 We have become more concerned about the audit timeliness of the TEI sector. Figure 32 shows an increase in audit arrears in the TEI sector in 2008/09 when compared with the two previous years.15

Figure 32

Tertiary education institution sector – audits outstanding at 30 June 2009

| Total audits due in 2008/09 | Arrears at 30 June 2009 | Arrears at 30 June 2008 | Arrears at 30 June 2007 |

|---|---|---|---|

| 134 | 42 (31%)* | 23 (19%) | 33 (27%) |

* Each arrears figure includes all outstanding audits, including any audits from prior years. The arrears percentages have been calculated using the total number of TEI audits due at 30 June for each year reported. Source: Controller and Auditor-General, Annual Report 2008/09, page 30.

8.49

In the main, it is the timeliness of TEI subsidiary audits that affects the TEI sector's audit arrears figures. We have asked our Appointed Auditors to work closely with TEIs during the 2009 audits to bring any public entity subsidiary audit arrears up to date, and to ensure the timely completion of all TEI sector 2009 audits.

1: We have excluded student support initiatives (for example, student allowance and student loan amounts), which are estimated at about $1.1 billion – see www.minedu.govt.nz/theMinistry/PolicyAndStrategy/TertiaryEducationStrategy/AppendixContextAndTrends.aspx, accessed on 11 January 2010.

2: The 31 TEIs are listed in Figure 31, where their 2008 financial performance is summarised.

3: To preserve the academic integrity of TEIs, only certain provisions of the Crown Entities Act 2004 apply to them. The applicable provisions are set out in Schedule 4 of that Act.

4: See section 222AA of the Education Act 1989.

5: Section 154 of the Crown Entities Act 2004, section 220 of the Education Act 1989.

6: Quality assurance in the universities is carried out by the New Zealand Vice Chancellors' Committee under sections 241 and 260 of the Education Act 1989.

7: For more information on the quality assurance arrangements, see www.nzqa.govt.nz.

8: See www.minedu.govt.nz/theMinistry/PolicyAndStrategy/TertiaryEducationStrategy/MinistersForeword.aspx, accessed on 11 January 2010.

9: See www.beehive.govt.nz/release/minister+releases+tertiary+education+strategy, accessed on 19 January 2010.

10: See www.minedu.govt.nz/theMinistry/PolicyAndStrategy/TertiaryEducationStrategy/PartOneStrategicDirection.aspx, accessed on 19 January 2010.

11: This includes a range of funds, mostly administered by TEC, such as the Quality Reinvestment Programme Fund.

12: Schedule 1 of the Public Audit Act 2001.

13: Financial Statements of the Government of New Zealand for the Year Ended 30 June 2009, page 89.

14: Section 220 of the Education Act 1989.

15: These audit arrears figures include TEI audits in arrears for 2008 and earlier years at 30 June 2009. The Auditor-General's financial period ends on 30 June each year.

page top