Controller update: July to December 2022

Introduction

We have a strong interest in New Zealanders’ trust and confidence in the public sector. A key element in that is our “Controller” function role, which helps to ensure that all government spending is properly authorised and within the law.1 This update covers the six months ended 31 December 2022.

Key points

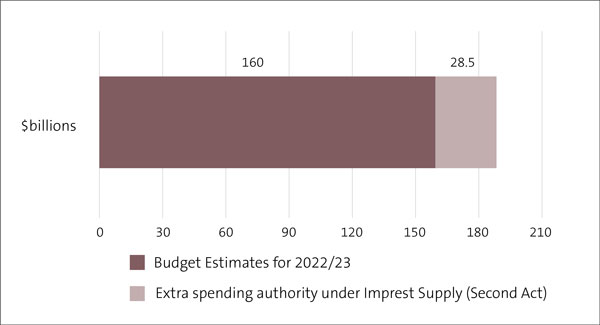

- The Government’s 2022/23 Budget allowed expenditure of up to $160 billion, with an additional $28.5 billion authorised under the second Imprest Supply Act.

- Almost all government spending for the first six months of 2022/23 was properly authorised and within the law. The single confirmed instance of unlawful spending was for Accommodation Supplement payments under Vote Social Development.

- A law change was given Royal Assent on 25 November 2022 to ensure that these payments are made lawfully in future.

Our role

The Controller and Auditor-General is often referred to as the public “watchdog” on government spending. An important part of the watchdog role is the Controller function.

In this Controller role, we provide assurance to Parliament and the public that the Government has spent public money in line with the authority provided by Parliament.

The Controller and Auditor-General carries out the Controller role throughout the year and reports more fully to Parliament and the public after the end of the financial year to 30 June.2

How much did Parliament authorise for 2022/23?

The legislation that enacts the Government’s 2022/23 Budget came into force on 22 September 2022.3 The Budget authorises the Government to incur expenditure of up to $160 billion in 2022/23 (the dark bar in Figure 1).

The Government’s annual Budget is put together before May each year. The Budget mainly covers expenditure for the year beginning on 1 July and ending on 30 June. Much can change between May of one year and 30 June of the following year. The Government cannot be expected to foresee all the spending it will need in the coming financial year. It also needs some flexibility to reprioritise its spending during the year, as circumstances change.4

When the Budget became law, an Imprest Supply Act was also passed into law.5 This is normal and happens every year. The Imprest Supply Act provides flexibility to the Government by authorising expenditure not included in the Appropriation Act. It gives the Government room to respond to changes since the Budget was put together. The Government updates its budget during the year, and the updated Budget is presented to Parliament in the Supplementary Estimates.

For 2022/23, the Imprest Supply Act allows the Government to incur expenses up to a total of $28.5 billion6 (see the light bar in Figure 1) in addition to that authorised under the Appropriation Act (an additional 17.8%).

Figure 1: The Government’s Budget and spending authority for 2022/23, in $ billions

In providing the Government with the authority to incur expenditure not included in the initial Budget (that is, changes to levels of existing authorities and any new spending), Parliament expects the Government to carefully control the use of this spending authority. The Government does this by applying Cabinet rules.

There must be a specific Cabinet decision before the Government accesses the extra spending authority it has available through imprest supply.7 Such decisions approve the use of imprest supply for each particular purpose and agree to the changes being included in the updated Budget.8 In this way, Cabinet controls how and when the Government uses the spending authority provided by Parliament under the Imprest Supply (Second for 2022/23) Act 2022.

Although Parliament has already approved extra between-Budget spending for 2022/23 (through the Imprest Supply Act), the Government still needs to seek “appropriation” for expenditure under imprest supply before the end of the financial year.9 It will do this through the Appropriation (2022/23 Supplementary Estimates) Bill.

The Supplementary Estimates Bill enables the Government to advise Parliament how it has updated its initial Budget for changes to spending levels and areas of new spending. On Budget Day in May 2023, the Government will present its updated 2022/23 Budget to Parliament through this Bill.

Each year, Parliament examines the changes to the current year’s Budget by examining the Supplementary Estimates. Parliament examines the Bill in June and passes the Bill before the 30 June financial year end.10

How does 2022/23 compare with recent years?

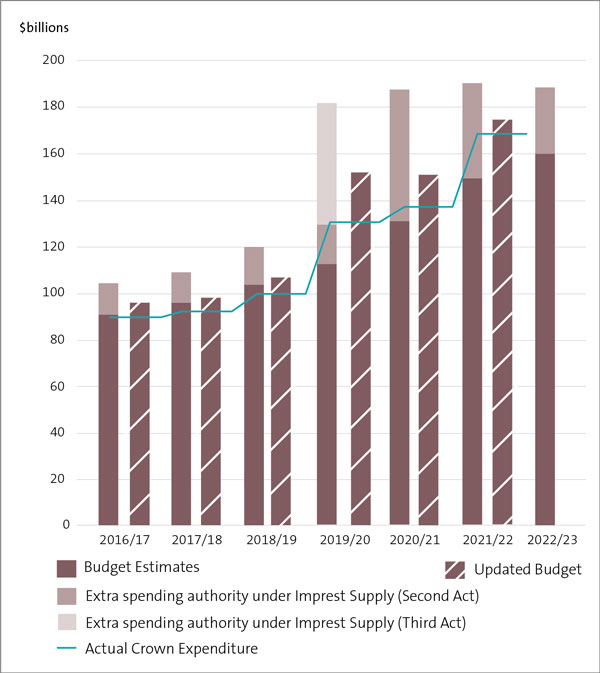

Figure 2 shows the initial budget (in the Budget Estimates), the updated Budget, and the actual Crown expenditure for the last seven years.11

Figure 2: The Government’s budgeted/authorised expenditure from 2016/17 to 2022/23, in $ billions

The total initial spending authority provided by Parliament to the Government each year has increased by 81% ($84 billion) in the last seven years.12

In the six years to 2021/22, there has been an increase of 88% ($79 billion) in actual Crown expenditure incurred against appropriations, with the largest increase occurring in the three years from 2019/20.

Figure 2 shows that, in the six years to 2021/22, actual Crown expenditure has never exceeded the annual total authority. However, there have been many instances of expenditure exceeding individual appropriation limits.

Figure 2 also shows the considerable increase in imprest supply authority in 2019/20 and 2020/21 and, to a lesser extent, 2021/22. This increase was mainly in response to the Covid-19 pandemic. At the outset of the pandemic in 2019/20, Parliament granted the Government additional spending authority for up to $52 billion through a rarely required, third annual Imprest Supply Act. This topped up the existing authority and ensured that the Government could lawfully incur what it needed to on the Covid-19 response. Much of that extra authority was not used in 2019/20. The initial spending authority increased further in 2020/21 as the Government continued to incur expenditure on the Covid-19 response.

Our Controller work for 2022/23

Throughout the financial year, we monitor public spending to determine whether it is in line with the authority provided by Parliament.

We check each month that the amount of new “between-Budget” expenditure agreed by Cabinet13 (that is, the use of imprest supply under the second Imprest Supply Act) is within the $28.5 billion authorised by Parliament.

As at 31 December 2022, Cabinet’s new spending decisions were well within the $28.5 billion limit.

In our Controller work:

- We check a sample of changes made to the Government’s budgeted spending to ensure that the between-Budget changes have been properly approved.

- After spending approval has been given (either through the initial Budget or through Cabinet’s approval of extra, between-Budget spending), we check that the actual spending is in line with the approvals given.

- We draw to the attention of the Government, Parliament, and the public any Government spending that is outside the authority provided by Parliament.14

We carry out the core of the Controller work through annual audits of government departments and associated interactions with those departments. Our auditors examine the financial systems and financial records of government departments to determine whether public expenditure has been properly authorised and accounted for. If it has not, then they will check that the nature and amount of unappropriated expenditure is properly reported to Parliament and the public.15

Unappropriated expenditure so far in 2022/23

A key outcome of interest to the Controller is for “government departments to reduce the instances of public spending without Parliamentary authority”. For the last two years the Government’s financial statements have reported the lowest number of instances of unappropriated expenditure (12) this century.

So far, the low number of occurrences is continuing into 2022/23, with only one confirmed instance of unappropriated expenditure up to December 2022. Since 1993, the Ministry of Social Development has been applying different payment criteria to a group of Accommodation Supplement recipients from that set out in legislation.16 These payments were unlawful under the Social Security Act 2018 and outside the scope of Vote Social Development’s Accommodation Assistance appropriation. This was reported in the Ministry’s 2021/22 annual report and in the financial statements of the Government for the year ended 30 June 2022.

Urgent legislative change was enacted in November 2022 to align the Act with current practice. The legislative change was given Royal Assent on 25 November 2022, by which time $554,000 of Accommodation Supplement payments had been made outside the scope of appropriation in 2022/23.

For more information on our Controller work and past findings, see Part 3 of Observations from our central government audits: 2021/22.

1: Strictly speaking, “expenditure” – we use “spending” for readability reasons.

2: See, for example, Observations from our central government audits: 2021/22, Part 3.

3: The Appropriation (2022/23 Estimates) Act 2022.

4: All governments move funding around during the year. This is done within defined limits and according to strict rules.

5: The Imprest Supply (Second for 2022/23) Act 2022.

6: Includes both operating and capital expenditure.

7: Some decisions may be made jointly by the appropriation Minister and the Minister of Finance (“joint Ministers”).

8: Government departments must gain approval to (1) increase an existing, or establish a new, appropriation through the next Supplementary Estimates Bill and (2) incur expenditure in the meantime under the authority provided by Parliament through the Imprest Supply Act.

9: Appropriations are authorities from Parliament that specify what the Crown may incur expenditure on (specific areas of expenditure). Most appropriations specify limits in terms of the type of expenditure (such as operating or capital expenditure), what it can be used for, the maximum amount, and the time period.

10: See Controller update: What do you know about Supplementary Estimates?

11: Actual Crown expenditure is the total amount of expenditure incurred under each Vote. It includes inter-departmental transfers.

12: That is, through the initial Budget Estimates and Imprest Supply Acts.

13: Or through Cabinet delegation to joint Ministers.

14: We do this through Ministerial letters and briefings to Parliamentary select committees. We also draw it to the attention of Parliament and the public through our annual publication, Observations from our central government audits.

15: That is, through our audits of the financial statements of the Government, and the financial statements of all government departments, for the year ending 30 June 2023.

16: In these cases, the Ministry of Social Development applied the practice of treating the community partner of those in Residential Care as though they are single for the purposes of calculating their Accommodation Supplement entitlement. For more, see the Financial Statements of the Government of New Zealand for the Year Ended 30 June 2022 (treasury.govt.nz), page 162.