Part 3: Our performance story

In this Part, we report on the outcomes we contribute towards, the impacts we aim to achieve, and the services we are funded to deliver.

Reporting on our outcomes, impacts, and services tells our performance story for 2020/21.

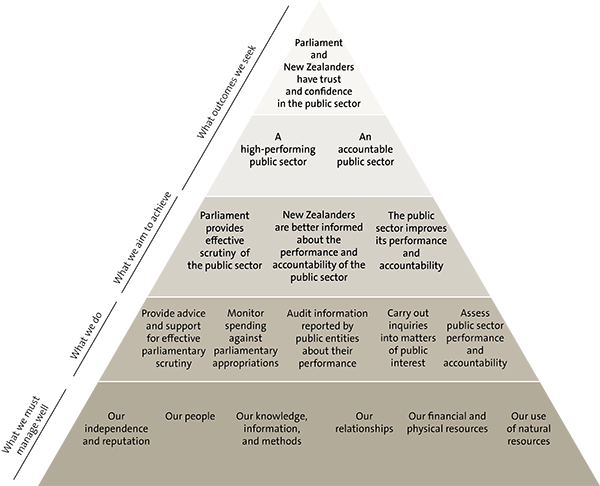

Everything we do is directed towards achieving the outcomes shown in our performance framework below.

The framework has five layers. The top two layers are the outcomes we contribute towards, the third layer is the impacts we are aiming to achieve, and the fourth layer is the work we do.

Each of our outcomes, impacts, and services has performance standards or performance measures and annual targets.

Achieving our targets relies on the quality and effectiveness of each of the components in the fifth layer of the framework. We describe in Part 4 our 2020/21 priorities for each of these components that we must manage well.

The measures for our services are based on quantity, quality, timeliness, or a combination of these. The data and commentaries on the following pages describe the aggregated results for each of our performance indicators or performance measures for 2020/21.

Our performance framework

Reporting on the outcomes we contribute towards

Our purpose is made up of the outcomes we contribute towards and the impacts we aim to achieve. These outcomes and impacts make up the upper three layers of our performance framework.

We have a range of measures for the outcomes and impacts. This section focuses on outcomes, and the following section sets out the results for our impact measures.

Results for our indicators generally show progress towards our outcomes in 2020/21. New Zealanders' trust in public services has increased, and the New Zealand public sector continues to be regarded as having one of the lowest levels of corruption in the world.

Given the ongoing impact of Covid-19, it remains important that public organisations continue to improve how they account for the public resources they use, meet the high standards of governance and integrity expected of them, and improve their performance. We will continue to play our part in influencing these important outcomes.

Outcome 1: Parliament and New Zealanders have trust and confidence in the public sector

Trust and confidence are the foundations of our system of government. They are fundamental to giving the Government the ability to govern on behalf of the people. To maintain New Zealanders' trust and confidence, the public sector must be competent, be reliable, and act with integrity.

Indicators show that New Zealanders' levels of trust in public services (both experience-based and perception-based trust) improved in 2020.

| Indicators | Progress | |||

|---|---|---|---|---|

| Levels of trust in public services (Kiwis Count survey) Target: improving trend (or at least maintained) |

Experience-based trust | 2020 | 2019 | 2018 |

| 81%* | 79% | 80% | ||

| Perception-based trust | 2020 | 2019 | 2018 | |

| 69%* | 49% | 50% | ||

| * These results are an aggregate from the survey results for two quarters of 2020. Covid-19 and several technical issues meant that the survey of trust in public services could be carried out only for two quarters of 2020. The results show an increase in experience-based trust and a spike in perception-based trust. Te Kawa Mataaho Public Service Commission says that the spike in perception-based trust may be attributed to a recent change in methodology. However, some of it is likely related to Covid-19 because the public sector was core to the national response to Covid-19 in 2020. Source: Te Kawa Mataaho Public Service Commission. |

||||

| Indicator | Progress | ||

|---|---|---|---|

| Corruption perception score (Transparency International Corruption Perceptions Index) Target: improving trend (or at least maintained) |

2020 | 2019 | 2018 |

| 88 | 87 | 87 | |

| 1st equal | 1st equal | 2nd | |

| The Corruption Perceptions Index ranks 180 countries and territories by their perceived levels of public sector corruption. The most recent results show that New Zealand maintained its ranking with a score of 88 out of 100. New Zealand ranked first equal with Denmark and remains one of the top-performing countries in the Index. Source: Transparency International. |

|||

Outcome 2: A high-performing public sector

A high-performing public sector is one that delivers services reliably, has strong leadership, builds institutional capacity and capability, and is transparent. It has a public management system that supports and enables it to do this.

| Indicator | Progress | ||

|---|---|---|---|

| Quality of public services (Kiwis Count survey) |

2020 | 2019 | 2018 |

| No data available | 77 | 77 | |

| Because of technical issues and the impact of Covid-19, Te Kawa Mataaho Public Service Commission's survey on the quality of public services was not carried out in 2020. This means that no data is available for 2020. Decisions have yet to be made about the future of the quality of public services survey. Results reported for 2019 and 2018 are out of 100. | |||

Outcome 3: An accountable public sector

For Parliament and New Zealanders to have trust and confidence in the public sector, public organisations need to be effectively held to account for their spending and performance.

Each year, we assess trends for aspects of public sector accountability. These aspects include timely and reliable information, sound management, and good governance. To assess whether the public sector demonstrates accountability for its performance, including its use of public resources, we examine the relevance, reliability, and timeliness of annual reports (including financial and performance reports).

A high-level summary of the results of our indicators and these trends is shown below. Although public organisations maintained the relevance and reliability of their information in 2020/21, Covid-19 continues to significantly affect timeliness. Some public organisations were unable to provide the financial information we needed to complete our audits and issue our audit reports by the applicable statutory deadlines. We provide more detail in Reporting on our services: 3 Audit information reported by public organisations about their performance (see page 27).

| Indicators | Target | Progress | ||

|---|---|---|---|---|

| Number and percentage of unmodified audit opinions from our annual audits | The percentage of unmodified audit opinions from our annual audits is improved (or at least maintained) | 2020/21 | 2019/20 | 2018/19 |

| 3356 | 2836 | 3094 | ||

| 97% | 97% | 97% | ||

| Despite the challenges Covid-19 presented during the year, public organisations have maintained the quality of their reported financial and performance information. | ||||

| Percentage of audit reports that are signed off by the applicable statutory deadline | At least 80% of audit reports are signed off by the applicable statutory deadline | 2020/21 | 2019/20 | 2018/19 |

| 71% | 63% | 81% | ||

| Revised measure for 2020/21 | ||||

| This target was not achieved in 2020/21 or 2019/20. During 2019/20, Covid-19 had a significant adverse effect on our audits, particularly the audits of schools (which are required to have audited financial statements completed by 31 May). Most school audit work is carried out during April and May. For much of April and May 2020, New Zealand was in lockdown. In 2020/21, Covid-19 continued to create challenges for auditors and public organisations in a range of sectors, affecting the timely completion of audits. During 2020/21, timeliness of audits improved, including school audits. Parliament passed legislation in August 2020 to extend the statutory reporting time frame by up to two months for most organisations with 30 June 2020 balance dates. This supported our auditors to complete their audits by the extended statutory deadline. The wording of this indicator was revised for 2020/21. Previously, it was "Percentage of audit reports and opinions that are signed by the applicable statutory deadline". |

||||

| Percentage of entities with audit reports in arrears as at 30 June | Less than 10% | 2020/21 | 2019/20 | 2018/19 |

| 18% | 25% | New measure for 2019/20 | ||

| Revised measure for 2020/21 | ||||

| Covid-19 significantly affected the timely completion of audits in 2020/21 and 2019/20. A national auditor shortage also emerged in the first half of 2021. This affected the completion of our audits, particularly our school and other smaller public organisations' audits, which make up nearly all audits in arrears. These factors contributed to our not achieving the target. The wording of this indicator was revised for 2020/21. Previously, it was "Percentage of entities with audit opinions in arrears as at 30 June". |

||||

As well as the indicators of an accountable public sector shown in the table above, we draw on other information sources to assess public sector accountability. These indicators provide only supplementary information.

| Indicators | Progress | ||

|---|---|---|---|

| Worldwide governance ranking (Worldwide Governance Indicators) |

2019 | 2018 | 2017 |

| Above 90th percentile | Above 90th percentile | Above 90th percentile | |

| The World Bank's Worldwide Governance Indicators measure the quality of governance in more than 200 countries for six dimensions of governance. Results for the previous calendar year are usually published every September. The 2020 results are not yet available. From 2017 to 2019, New Zealand consistently ranked above the 90th percentile for all six governance dimensions. Source: World Bank. |

|||

| Integrity ranking (International Civil Service Effectiveness Index) |

2021 | 2020 | 2019 |

| Not assessed | Not assessed | 1st | |

| The International Civil Service Effectiveness Index assesses how a country's central government civil service is performing compared with others around the world. The integrity aspect of the Index measures the extent that civil servants behave with integrity, make decisions impartially and fairly, and strive to serve both citizens and Ministers. The most recent results from the University of Oxford's International Civil Service Effectiveness Index show that the New Zealand public sector ranked first on integrity against a total of 38 countries assessed. The next assessment is expected in 2022. Source: University of Oxford. |

|||

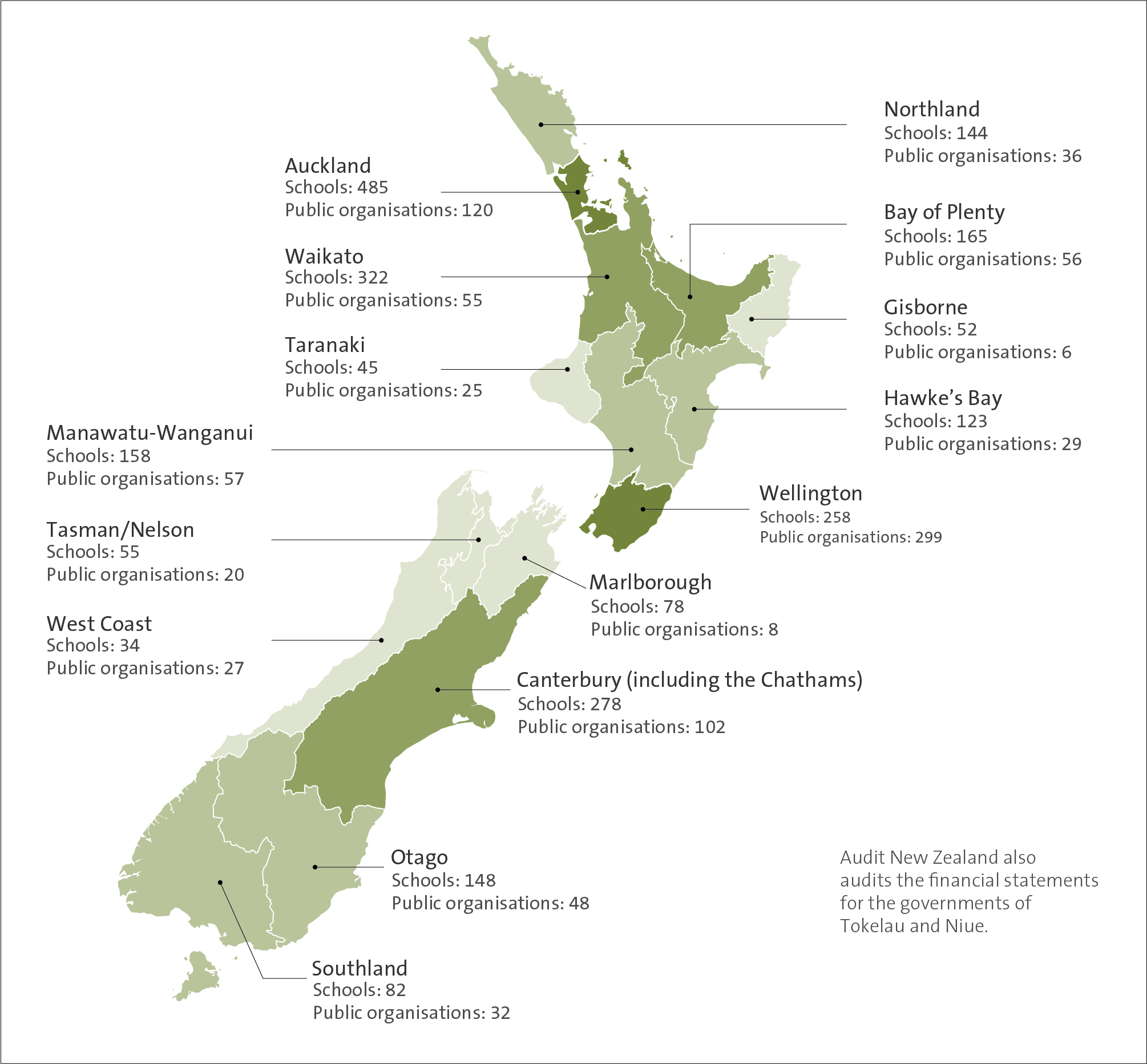

Our audit work is a core part of the Auditor-General's mandate to maintain the financial integrity of the public sector. The following map shows the regional distribution of the schools and the other public organisations we audited in 2020/21.

Regional spread of audits carried out in 2020/21

Reporting on our intended impacts

Our impact indicators show the difference we are making for our key stakeholders – Parliament, public organisations, and New Zealanders. To influence our outcomes, our aim is to achieve the impacts shown in our performance framework.

Results from 2020/21 show that we are progressing towards our intended impacts. Our inquiry reports and the recommendations from our performance audits help public organisations to improve their performance. Encouraging public organisations to implement the recommendations from our annual audits is an important way we can help improve public sector performance and accountability. We would like to see continued improvement in the implementation of our recommendations.

The three areas of impact are described below.

Impact 1: Parliament provides effective scrutiny of the public sector

Our work in providing advice and reports to Parliamentary select committees helps enable them to hold the public sector to account. The information we provide must be relevant, reliable, and timely. We have received feedback that confirms the quality of our reports and advice to Parliament.

| Indicator | Target | 2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Our advice and reports help select committees scrutinise the public sector more effectively Parliamentary select committees confirm our advice and reports were helpful |

100% | 100% when last assessed* | 100% | New indicator for 2019/20 |

| * Our surveys of select committee chairpersons are carried out every two years. This result is from our 2020 survey. | ||||

Impact 2: New Zealanders are better informed about the performance and accountability of the public sector

We aim to focus our work on issues that are relevant and important to New Zealanders. Our work is increasingly receiving more media coverage than in previous years. The 2020/21 increase was mainly driven by a high-profile report on the Covid-19 vaccine roll-out. Our audits of councils' long-term plans and consultation documents, and our response to an inquiry request about land purchased for housing at Ihumātao, also boosted our media coverage.

| Indicator | Target | 2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| New Zealand media provide increased coverage of our reports and letters Number of citations |

Increasing | Increasing | Increasing | Decreasing |

| 1621 | 1454 | 1277 | ||

| In 2020/21, the number of citations in the media about our work increased by 11% from 2019/20. | ||||

Impact 3: The public sector improves its performance and accountability

To assess whether we are having a positive influence on the performance and accountability of the public sector, we look at a range of activities. We assess whether instances of government departments spending public money without Parliamentary authority have reduced. We also look at whether public organisations have improved aspects of their performance in response to our performance audits and inquiries, and whether they have implemented our annual audit recommendations in a timely manner.

Controller function

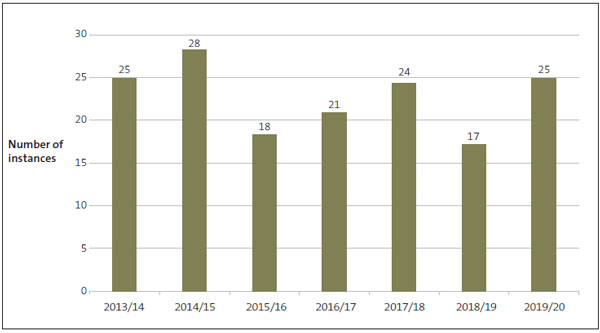

The 2020/21 result is based on information from the 2019/20 financial statements of the Government, and the 2019/20 result is based on information from the 2018/19 financial statements of the Government.

In 2020/21, instances of unappropriated spending increased to 25. Although five of these 25 instances were directly related to the pressing need for spending related to Covid-19, this is the highest number of instances in four years (see the commentary in the table below).

| Indicator | Target | 2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Government departments reduce the instances of public spending without Parliamentary authority* Number of instances of expenditure incurred in excess of, or without, appropriation or other authority from Parliament |

Reducing | Increasing | Reducing | Increasing |

| 25 | 17 | 24 | ||

| * The results for this indicator are from the financial statements of the Government, which are prepared for the previous financial year. The most common reason for unappropriated spending is administrative errors in the documentary requirements. This accounted for $716 million of the $915 million total unappropriated expenditure. The total unappropriated spending equates to 0.6% of the final budgeted amount for 2019/20 in Budget 2019. | ||||

As shown in the following graph, from 2013/14 to 2018/19, the number of instances of unappropriated spending declined overall. However, as referred to above, in 2020/21 this number had increased again, to 25 instances of unappropriated spending.

Number of instances of unappropriated expenditure, from 2013/14 to 2019/20

Source: The Treasury (2020), Financial Statements of the Government of New Zealand for the year ended 30 June 2020.

Annual audits

To help the public sector improve, the Auditor-General's in-house audit service provider, Audit New Zealand, and private sector audit service providers send reports setting out the audit findings and recommendations to the governors of public organisations. This provides those responsible for making improvements with a basis for taking the next steps. We measure the impact of our work by assessing public organisations' implementation of our recommendations.

Our result for 2020/21 provides a benchmark for future reporting. Because of a change in the methodology, we cannot compare the results for 2019/20 to the results for 2020/21. In early 2021/22, we will look at how soon and in what way organisations implement the recommendations we make, including the level of risk of not implementing each recommendation. This will provide greater transparency of reporting.

| Indicator | Target | 2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Public entities implement our annual audit recommendations in a timely manner We will identify and report on how larger entities have responded to recommendations made as part of our annual audits |

Increasing (or maintaining) | 38% | 46% | New indicator for 2019/20 |

| In 2019/20, we introduced a new way of measuring the impact of our work and assessed how tertiary education institutions had implemented the recommendations from our audits. In 2020/21, we assessed how 195 larger public organisations, including district health boards, tertiary education institutions, government departments, and councils, had implemented the recommendations from our audits. Implementing recommendations helps organisations to manage risks and realise benefits of the audit process. In 2020/21, of the 2490 recommendations at the beginning of the year, 937 (38%) of our recommendations were effectively implemented by the end of the financial year. We understand that there can be many reasons why recommendations are not implemented in a timely manner. Some recommendations can take more than one year to implement, particularly where they require underlying system changes. Other recommendations may become irrelevant with time as organisations change processes and their technology. |

||||

Performance audits

Our performance audit reports help public organisations improve their performance and accountability. We continue to look for ways to enhance the impact of our performance audit work so that those with responsibility for making improvements can do so. We provide more details about the effect of our performance audit work in Reporting on our services: 5 Assess public sector performance and accountability.

| Indicator | Target | 2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Public entities have improved aspects of their performance in response to our performance audits | Increasing** | Achieved | Results not available* | Achieved |

| In 2020/21, we trialled a different approach to following up on our performance audits. In 2019/20, we sampled two public organisations to see whether they had implemented our recommendations and if our recommendations had had the intended effect. We published the findings. This year, a sample of audited public organisations were asked to self-assess the progress they had made against each of our recommendations about 12 months after we published our audit. This approach enables us to follow up more audits than previously. We have published the results on our website. * We published the results from our follow up work on our website in 2020/21. ** We revised this target to better reflect the work we carry out. Previously, the target was to report on one to two a year. |

||||

Inquiries

Our inquiries function enables us to inquire into issues of concern that are raised with us. Our inquiries seek to understand what has happened and what lessons there are for the public sector. Our findings help public organisations to improve their performance and accountability. We provide more details of the inquiries process in Reporting on our services: 4 Carry out inquiries into matters of public interest.

| Indicator | Target | 2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Public entities have improved aspects of their performance in response to our inquiries We will identify and report on any effects from our inquiries |

Report on one to two each year | Achieved | Achieved | Achieved |

| In 2020/21, we identified effects from two inquiries. An effect is where the organisation has taken or is taking action in response to the findings of our inquiry. The first effect related to work we carried out in 2017 about the donations schools requested from those seeking out-of-zone enrolments. The second effect related to work on sensitive expenditure we carried out in 2020/21 about the University of Auckland's purchase of a house in Parnell to accommodate the Vice-Chancellor. | ||||

Reporting on our services

Five services contribute to our outcomes and impacts.

Performance results for the services we provided in 2020/21 are mixed. For some, we have exceeded or met performance targets, and for others we did not meet the targets. In 2021/22, we will focus our efforts to ensure that our performance for each service improves.

Our indicators for service delivery cover the main dimensions of performance: quality, quantity, and timeliness.

1. Provide advice and support for effective Parliamentary scrutiny

This service is funded through the appropriation Statutory Auditor Function MCA, Supporting Accountability to Parliament Category. The amount appropriated for this category in the Main Estimates for 2020/21 was $5.636 million. For further information on the actual expenditure incurred, see Part 6: Our appropriations.

Drawing on information and insights gathered from our work, we provide advice and support to Parliament and select committees to assist their scrutiny of public sector performance. This includes their annual reviews and their scrutiny of forecast spending through the Estimates of Appropriations examinations after the Government announces its Budget each year.

Drawing on information and insights gathered from our work, we provide advice and support to Parliament and select committees to assist their scrutiny of public sector performance. This includes their annual reviews and their scrutiny of forecast spending through the Estimates of Appropriations examinations after the Government announces its Budget each year.

After the 2020 election, we supported the induction of select committees. We provided briefings on key issues in different sectors, helping select committees decide where to focus their scrutiny. We continued to invest in building our knowledge of the public sector, including of emerging trends and risks. This enables us to tailor our briefings about public organisations and the issues and risks they face.

In 2020/21, we increased our emphasis on cross-agency work in the public sector to reflect select committees' interest in this work. For example, we provided advice in support of select committee annual reviews in the housing sector, briefings on our work on the Joint Venture for Family Violence and Sexual Violence, and briefings for Labour Market and Education Votes.

In 2020/21, demand from select committees for our advice remained high. Select committees asked us to provide 97 briefings in support of annual reviews and 64 briefings on Votes or particular appropriations for their examinations of proposed government spending. We also issued more than 180 letters to Ministers on the findings from our audits of organisations in their portfolio.

We also continue to carry out and report to Parliament on our responsibility to review the service performance of Auckland Council and its subsidiaries under the Local Government (Auckland Council) Act 2009.

Performance for Provide advice and support for effective Parliamentary scrutiny

Our provision of services to Parliamentary select committees during 2020/21 has continued to meet expectations.

Quality

| Performance measure | Performance standard |

2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Percentage of Parliamentary select committees that rate our advice as at least "satisfactory" | 100% | 100% when last assessed* | 100%* | Revised measure for 2019/20 |

| * Our surveys of select committee chairpersons are carried out every two years. This result is from our 2020 survey. | ||||

| Percentage of briefing papers that are submitted to select committees by the agreed deadline | 100% | 100% | 98% | 100% Revised measure for 2019/20 |

| We revised the wording of this measure for 2019/20. Previously, it was "Briefings are given to select committees at least two days before examination, unless otherwise agreed". | ||||

The following diagram shows the workflow pattern of the support we provided to Parliamentary select committees in 2020/21.

Although our support for select committees happens throughout the year, it involves a series of high-productivity periods that reflect the cycle of scrutiny work for the committees. The key periods involve annual review briefings and Estimates briefings. Ahead of annual reviews, we send letters to responsible Ministers about the results of our annual audits and we provide sector briefings to subject select committees.

Our support to Parliament and Ministers

2. Monitor spending against Parliamentary appropriations (our Controller function)

This service is funded through the appropriations Statutory Auditor Function MCA, the Audit and Assurance Services RDA and Audit and Assurance Services. The amount of these appropriations in the Main Estimates for 2020/21 was $111.255 million. For further information on the actual expenditure incurred, see Part 6: Our appropriations.

Our Controller function provides independent assurance to Parliament that public money has been spent lawfully and within Parliamentary authority. It supports the important constitutional principle that the Government cannot spend, borrow, or impose a tax without Parliament's approval.

Our Controller function provides independent assurance to Parliament that public money has been spent lawfully and within Parliamentary authority. It supports the important constitutional principle that the Government cannot spend, borrow, or impose a tax without Parliament's approval.

Every year, we present a report to Parliament that includes an account of the work we carried out under the Controller function, along with our findings and conclusions. In recent years, we have also provided an interim account of our work and findings by publicly reporting on our work at the half-year point.

We have been reporting on the Government's Covid-19 spending as well as our usual Controller reports. We have been tracking the amount of public money that the Government has approved for the response to, and recovery from, Covid-19, as well as the actual spending incurred. We carried out tests to determine whether the Covid-19 spending approvals were properly authorised and whether subsequent spending was incurred in line with those approvals.

We also carry out appropriation audits of government departments. These audits ensure that spending by government departments and Offices of Parliament is lawful and within the scope, amount, and period of the appropriation or other authority.

As mentioned in Reporting on our impacts: Impact 3, five instances of unappropriated spending resulted from administrative errors in the documentary requirements in 2019/20. This was the most common reason for unappropriated spending, accounting for $716 million of the $915 million total unappropriated expenditure. Such errors could and should have been avoided.

Some spending was unappropriated because departments that were anticipating funding transfers from the previous year incurred spending prematurely – that is, before the authority had been confirmed. This is an ongoing problem. We will continue to remind departments to take care in managing the timing of any spending that relies on increased authority, including potential funding transfers between years.

During 2020/21, we worked with the Treasury to share key messages with finance professionals in government departments. These messages are designed to help them avoid unappropriated spending.

Performance for Monitor spending against Parliamentary appropriations

Timeliness

| Performance measure | Performance standard |

2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| The monthly Controller reports (for the months of September to May) are provided to the Treasury within five working days of receiving the Treasury's monthly reports and statements | 100% | 100% | 100% | 100% |

| All nine reports | All procedures were followed and agreed time frames were met for all nine reports | All procedures were followed and agreed time frames were met for all nine reports | All procedures were followed and agreed time frames were met | |

| We issue a report to Parliament and the public on the Auditor-General's exercise of the Controller function for each financial year | At least annually | We issued five public reports on the Controller function | We issued six public reports on the Controller function | New measure for 2019/20 |

| We report annually to Parliament and publish additional reports on our website. | ||||

3. Audit information reported by public organisations about their performance

This service is funded through the appropriations Audit and Assurance Services RDA and Audit and Assurance Services and the amount appropriated in the Main Estimates for 2020/21 was $94.579 million. For more information on the actual expenditure incurred, see Part 6: Our appropriations.

The core work of our Office is annual audits of public organisations. They account for 85% of our resources. Our in-house audit service provider, Audit New Zealand, and private sector audit service providers carry out this work.

The core work of our Office is annual audits of public organisations. They account for 85% of our resources. Our in-house audit service provider, Audit New Zealand, and private sector audit service providers carry out this work.

We also issue reports to those charged with governance on how they could improve their public organisation's performance and reporting. Our annual audits fundamentally support the integrity of the financial and performance reporting of public organisations.

An annual independent review of our audit allocation model for allocating audits helps us to continue to deliver high-quality audits (see Appendix 2). We also carry out quality assurance reviews of appointed auditors once every three years.

Our performance results show that Covid-19 affected the timeliness of our audits.

Performance for Audit information reported by public organisations about their performance

Quantity

| Performance measure | Performance standard | 2020/21 result | 2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Number of annual audit reports signed and issued | Not applicable | 3356 | 2922 | New measure for 2019/20 |

| Based on the number of public organisations, we expect to sign and issue nearly 3400 audit reports each year. Covid-19 significantly affected the timely completion of about 500 audits during 2019/20. Most of these were completed and have now been included in the reported results for the year ended 30 June 2021. Covid-19 continues to affect the timely completion of audits, and about 400 were late in 2020/21. | ||||

| Number of council long-term plan (LTP) audit reports signed and issued | Not applicable | 66 | Not assessed, as not an LTP year | Not assessed, as not an LTP year |

| Twelve councils did not adopt their audited 2021-31 long-term plans by 30 June 2021, the statutory deadline for adopting a new plan. Councils faced several challenges in preparing their 2021-31 long-term plans, and these may have contributed to missing the statutory deadline. We will provide information about the reasons councils did not meet their statutory deadlines in our report on the audits of the 2021-31 long-term plans, which will be published in 2021/22. | ||||

Quality

We are committed to maintaining high standards of auditing. Every three years, we carry out a quality assurance review of appointed auditors to ensure that they have complied with The Auditor-General's Auditing Standards. We expect all our auditors to achieve at least a "satisfactory" grade.

For 2020/21, 90% of our auditors achieved this target. We work with those auditors who do not achieve a "satisfactory" grade to address any immediate concerns, and we carry out a follow-up review the following year. Where necessary, we make changes to auditors' audit portfolios.

The Public Audit Act 2001 requires us to report each year on any significant changes made to The Auditor-General's Auditing Standards. We have made no significant changes to the standards during the year.

We will continue to uphold high standards of auditing. We will also review what factors have contributed to the 2020/21 result and put in place steps to address them.

| Performance measure | Performance standard | 2020/21 result | 2019/20 result | 2018/19 result |

|---|---|---|---|---|

| Percentage of appointed auditors with a quality assurance grade of at least "satisfactory" based on the most recent quality assurance review | 100% | 90% | 93% | 94% |

| The quality assurance grade of appointed auditors is influenced by the rating of audit files subject to quality assurance review. The 10% of appointed auditors who were not graded at least "satisfactory" need to improve the audit approach or audit evidence obtained. Despite the need for this improvement, we were satisfied that the conclusions reached by these auditors and the opinions included in the audit reports were appropriate. | ||||

| Percentage of audit files subject to quality assurance review during the year that achieve a rating of at least "satisfactory" | 100% | 69% | 91% | New measure for 2019/20 |

| This year, 69% of the audit files we reviewed achieved a rating of at least "satisfactory". If the audit files for small audits are excluded, the percentage of audit files that achieved a rating of at least satisfactory is 87% (see Appendix 6). Of the small audits that did not achieve a rating of at least "satisfactory", most were with one audit service provider. After our review, the audit service provider made changes to address our findings. We performed a review of the changes implemented before the audit service provider issued any further audit reports. We concluded the changes made addressed our findings. For the 13% that were not small audits and did not achieve a rating of at least "satisfactory", we made sure that the conclusions reached by the auditors and the opinions included in audit reports were appropriate. We did not require additional audit evidence to be obtained. We also ask appointed auditors to make the improvements needed for all future audit files to be rated at least "satisfactory". We follow up during the following year to check that the improvements have been made. |

||||

| Number of audit opinions withdrawn | No audit opinions withdrawn | 1 Revised measure for 2020/21 |

4 New measure for 2019/20 |

New measure for 2019/20 |

| One audit report was withdrawn and a new report was issued. The original audit report incorrectly referred to a breach of a statutory reporting deadline. The new audit report explained that there had been no such breach. | ||||

| Percentage of public entities that are "satisfied" with the overall quality of their audit service (as determined by responses to our satisfaction survey) | At least 85% | 71% | 82% | 76% |

| Overall client satisfaction reduced this year. This was in part due to delays in completing audits because of Covid-19. | ||||

| Annual independent review confirms the probity and objectivity of the methods and processes we use to allocate and tender audits and to monitor the reasonableness of audit fees | Confirmed | Confirmed by annual independent review (See Appendix 2) |

Confirmed by annual independent review | Confirmed by annual independent review |

Timeliness

Covid-19 had a significant adverse effect on our timeliness in completing audits in 2020/21. Although more audit reports were signed by the statutory deadline this year compared to last year, timeliness has not returned to the levels recorded before Covid-19. New Zealand was in lockdown when most of the more than 2400 school audits would usually be carried out.

In August 2020, legislation was enacted to extend the statutory reporting deadlines for public organisations with a 30 June 2020 balance date. This change enabled us to complete more audits within deadlines during the last half of 2020 than we would have if the deadlines had not been extended.

The ongoing effects of Covid-19, including a national auditor shortage that emerged in the first half of 2021, have continued to have an adverse effect on timeliness.

Although there is no short-term solution to the industry-wide shortage of auditors, legislation was enacted in July 2021 to amend the Crown Entities Act 2004 and Local Government Act 2002 to extend the statutory reporting time frames for public organisations with a 30 June 2021 and 30 June 2022 balance dates.

We are actively working on a range of longer-term approaches to address these issues. For example, we support adding auditors to Immigration New Zealand's list of priority workers and extending the circumstances where some auditing work can be carried out offshore or through virtual secondments (with due consideration of security risks).

The commentaries for the following performance measures explain some of the circumstances affecting the achievement of the corresponding performance standards. We will look at how we can improve the factors within our control for 2021/22.

| Performance measure | Performance standard | 2020/21 result | 2019/20 result | 2018/19 result |

|---|---|---|---|---|

| Percentage of audit reports that are signed by the applicable statutory deadline | At least 80% | 71% Revised measure for 2020/21 |

63% | 81% |

| This target was not achieved in 2020/21 or 2019/20. During 2019/20, Covid-19 had a significant adverse effect on our audits, particularly the audits of schools (which are required to have audited financial statements completed by 31 May). Most school audit work is carried out during April and May. For much of April and May 2020, New Zealand was in lockdown. In 2020/21, Covid-19 continued to create challenges for auditors and public organisations in a range of sectors, affecting the timely completion of audits. During 2020/21, timeliness of audits improved, including school audits. Parliament passed legislation in August 2020 to extend the statutory reporting time frame by up to two months for most organisations with 30 June 2020 balance dates. This supported our auditors to complete their audits by the extended statutory deadline. The wording of this indicator was revised for 2020/21. Previously, it was "Percentage of audit reports and opinions that are signed by the applicable statutory deadline". |

||||

| Percentage of entities with audit reports in arrears as at 30 June | Less than 10% | 18% Revised measure for 2020/2021 |

25% | New measure for 2019/20 |

| Covid-19 significantly affected the timely completion of audits in 2020/21 and 2019/20. A national auditor shortage also emerged in the first half of 2021. This affected the completion of our audits, particularly our school and other smaller public organisations' audits, which make up nearly all audits in arrears. These factors contributed to our not achieving the target. The wording of this indicator was revised for 2020/21. Previously, it was "Percentage of entities with audit opinions in arrears as at 30 June". |

||||

| Percentage of finalised reports to governors about the audit (which incorporate responses from management) that are provided within six weeks of signing the audit report | 100% | 90% | 97% | 97% |

| Achieving this target was challenging because of the ongoing effects of Covid-19. Extra audit work also needed to be done for the Institutes of Technology and Polytechnics that were disestablished during 2019/20 (with opinions due 31 July 2020) and the 3-yearly audits of councils' long-term plans and consultation documents about those plans. | ||||

Percentage of Ministerial letters on annual audits that are issued to Ministers and Parliamentary select committees within the expected time period:

|

100% | 61% | 93% | New measure for 2019/20 |

| In 2020/21, we did not achieve our target. Because of the effect of Covid-19 on public organisations and auditors, statutory deadlines for 2020 audits were extended. They changed from 30 September to 30 November 2020 for government departments and from 31 October to 18 December 2020 for Crown entities. Because of the later statutory deadlines, a significant number of Ministerial letters for audits with 30 September deadlines had to be prepared during December and January, when staff take annual leave. This caused delays in finalising some of these letters. Also, after the general election on 17 October 2020, we delayed sending Ministerial letters until new Ministers were sworn in (on 6 November 2020). This contributed to some Ministerial letters not being issued within the expected period. | ||||

Public organisations' satisfaction with our auditing services

We measure public organisations' satisfaction with our auditing services annually through a client satisfaction survey carried out by an external party. In 2020/21, the external party surveyed 440 public organisations and received responses from 70% of them.

Our target is that at least 85% of the public organisations surveyed are satisfied with the overall quality of their audit service (as determined by responses to our satisfaction survey).

Of the organisations that responded to our survey, 71% were satisfied with the services our auditors provide. This is an 11% decrease from the previous year. This decrease was attributed primarily to timeliness and communication, generally because of the disruption and delays that Covid-19 caused to audits.

Other assurance work

Audit New Zealand carries out other assurance work. This work generally focuses on reviewing procurement and contract management, project management, asset management, risk management, governance, and conflicts of interest. However, it can include any services of a kind that it is reasonable and appropriate for an auditor to perform.

Assurance work promotes value by helping public organisations to comply with rules and guidelines, and to adopt good practice.

Audit New Zealand and our other audit service providers also carry out other assurance engagements that are prescribed in other legislation than the Public Audit Act 2001 – for example, work to support disclosure regimes required by the Commerce Commission.

Appointing auditors and monitoring audit fees

The Auditor-General appoints auditors from Audit New Zealand and private sector auditing firms to carry out the annual audits of public organisations on his behalf. Our processes are designed to ensure that these auditors are independent, that they carry out audits of high quality, and that their audit fees are reasonable.1 The annual independent review of the methods and processes we use to allocate or tender audits and to monitor whether audit fees are reasonable confirms their probity and objectivity.

Our audit work is funded by fees charged to each audited public organisation. The fees are agreed after consultation with the organisation within agreed parameters.

There is pressure for fees to increase to reflect such factors as increasing requirements on auditors from auditing standards and regulators' expectations, rising expectations of auditors by the organisations being audited, and increases to charge-out rates as a result of increases in input costs.

The following table summarises changes in audit fees from 2019/20 to 2020/21. The figures exclude additional audit fees negotiated with public organisations because of unforeseen problems arising after audit fees were agreed.

| 2019/20 to 2020/21 | 2018/19 to 2019/20 | |||||||

|---|---|---|---|---|---|---|---|---|

| Sector | Increase in total fee | Because of changes in time | Because of changes in charge-out rate | Number of organisations* | Increase in total fee | Because of changes in time | Because of changes in charge-out rate | Number of organisations* |

| Central government | 2.4% | 0.4% | 2.0% | 329 | 4.9% | 2.8% | 2.1% | 382 |

| Local government | 5.3% | 0.2% | 5.1% | 362 | 4.8% | 8.6% | (3.8%) | 266 |

| Schools | 3.0% | 0.3% | 2.7% | 2443 | 3.1% | 0.5% | 2.6% | 2439 |

| Total | 3.4% | 0.3% | 3.1% | 3134 | 4.5% | 4.1% | 0.4% | 3087 |

* The number of organisations is all those whose audit fees were agreed at the time our analysis was prepared.

4. Carry out inquiries into matters of public interest

This service is funded through the appropriation Statutory Auditor Function MCA, Performance Audits and Inquiries Category and the amount appropriated for the category in the Main Estimates for 2020/21 was $11.040 million. For further information on the actual expenditure incurred, see Part 6: Our appropriations.

This section includes the inquiries we carry out and the work we do to administer the Local Authorities (Members' Interests) Act 1968, which regulates pecuniary interest matters in local government.

This section includes the inquiries we carry out and the work we do to administer the Local Authorities (Members' Interests) Act 1968, which regulates pecuniary interest matters in local government.

Our inquiries work is an important mechanism for improving Parliament's and New Zealanders' trust and confidence in the public sector. Through our inquiries function, we can inquire into matters of concern that are raised with us. Our inquiries aim to understand what has happened and what lessons there are for the public sector. We use the findings from our work to help public organisations improve.

Inquiries can arise from our audit or other work, requests from members of Parliament or a public organisation, or concerns raised by the public. We receive a considerable number of requests every year and we carefully consider all issues raised with us, although not all will result in a full inquiry.

We decide whether issues warrant our investigation when matters of concern arise. The process we use involves three categories:

- Category 1 – Triage/Initial view: where we consider new potential inquiry work (either requested or self-initiated) and form an initial view about whether to proceed with further work within four weeks.

- Category 2 – Assessment: where, having decided under Category 1 to do more work, we carry out inquiry work to understand the facts and form a view on those facts (including whether we conclude our work at this point or carry out a major inquiry). We expect to conclude work under category 2 within six months.

- Category 3 – Major inquiries: where we carry out an in-depth investigation of the issues and prepare a detailed report on that investigation. We expect to complete our major inquiries within the agreed period.

Performance for Carry out inquiries into matters of public interest

Quantity

| Performance measure | Performance standard |

2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Number of requests for inquiry received (including protected disclosures and monitoring issues) | Not applicable | 64 | 48 | New measure for 2019/20 |

| Number of protected disclosures received (a subset of the number above) | Not applicable | 9 | 6 | New measure for 2019/20 |

| Number of pieces of inquiry work (other than major inquiries) concluded during the year | Not applicable | 62 | 42 | New measure for 2019/20 |

| Number of major inquiries concluded during the year | Not applicable | 4 | 2 | New measure for 2019/20 |

Quality

| Performance measure | Performance standard |

2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Percentage of Parliamentary select committees that rate our reports on performance audits, inquiries, and other studies as at least "satisfactory" | 100% | Not assessed, because this is not a quality assurance review year | 100% | New measure for 2019/20 |

Timeliness

This year, we achieved our timeliness targets for our three inquiry categories. We continue to actively balance the obligations of fairness and natural justice inherent in our work, and the volume and complexity of the issues we consider, with being timely.

| Performance measure | Performance standard |

2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Percentage of requests for inquiries or self-initiated issues that are considered and a view is reached within four weeks | 90% | 94% | New measure for 2020/21 | New measure for 2020/21 |

| Percentage of pieces of inquiry work (except major inquiries) that are concluded within six months | At least 90% | 90% Revised performance standard for 2020/21 |

81% | New measure for 2019/20 |

| We achieved our timeliness target of concluding preliminary inquiry work (except major inquiries) within six months. We concluded 52 out of 58 pieces of inquiry work in this category within six months. | ||||

| Percentage of major inquiries that are concluded and their findings reported within the expected time period | At least 75% | 75% | 50% | New measure for 2019/20 |

| We achieved our timeliness target for concluding major inquiries and reporting their findings within the expected period. We completed three out of four major inquiries within the expected period. | ||||

Case studies

Our inquiry into the University of Auckland's decision to purchase a house in Parnell

Trust and confidence in public organisations are driven by competence, reliability, and honesty. Public organisations need to manage sensitive expenditure deliberately and diligently. As with all spending, they must be able to justify it.

Trust and confidence in public organisations are driven by competence, reliability, and honesty. Public organisations need to manage sensitive expenditure deliberately and diligently. As with all spending, they must be able to justify it.

Our report Inquiry into the University of Auckland's decision to purchase a house in Parnell examined how well the University managed sensitive expenditure when purchasing a house in Parnell, Auckland in November 2019.

We were interested in this matter because it seemed an unusual purchase for the University to make. The house cost about $5 million, and the University entered into a tenancy agreement with the incoming Vice-Chancellor from the start of her five-year term of employment. The rent was set at about 50% of the market rent. This raised questions about the University's use of public resources and how it manages sensitive expenditure.

We decided to carry out a major inquiry – an in-depth investigation of the issues – and concluded that this was sensitive expenditure that the University had not managed well.

Our report outlines the lack of a justifiable business purpose in providing accommodation to the incoming Vice-Chancellor or hosting an anticipated 14 events in two years. We considered that the price of the house and the reduced rent were not moderate or conservative in the circumstances.

Our work helped the University of Auckland to improve its sensitive expenditure policies and practices. After we completed our work, the University reviewed its management of sensitive expenditure. It concluded that it needed stronger internal processes, improved management reporting, and expanded policies on sensitive expenditure. It also identified a need for education and training on sensitive expenditure throughout the University.

Our good practice guide Controlling sensitive expenditure: Guide for public organisations provides further guidance on specific types of sensitive expenditure. It outlines the principles for making decisions about sensitive expenditure.

Auckland light rail city centre to Māngere project

To help build trust and confidence, public organisations need to carry out their procurement in a transparent, accountable, impartial, and equitable way.

In November 2020, we published a letter to the Chief Executive of the Ministry of Transport about the process for selecting a delivery model and partner for light rail in Auckland from the city centre to Māngere.

There were concerns that the process should have been carried out more competitively than simply between two parties – in this case, between the New Zealand Transport Agency/Waka Kotahi and NZ Infra (a proposed joint venture between the New Zealand Superannuation Fund and Canadian institutional investors, Caisse de Depot et Placement du Quebec).

We were also concerned that the process could have resulted in selecting a party to deliver light rail before the policy or design for that light rail system had been determined. There were also questions about whether the process complied with the Government Procurement Rules.

Our response set out the planning and analysis we expect in a procurement of this nature and how the Government Procurement Rules should be applied. After we published our response, the Minister of Transport publicly acknowledged the messages in it and said that he expected that standard procurement processes will be followed in the future.

Quality assurance of our inquiries

In May 2021, we commissioned an independent barrister to carry out a quality assurance assessment of selected aspects of inquiries performed under section 18 of the Public Audit Act 2001.

The reviewer assessed three inquiry reports against the scope/purpose of the work and the available evidence to evaluate whether the conclusions were supported and whether the inquiries complied with the Auditor-General's auditing standard for inquiries (AG-6 Inquiries).

The review found that, in each case, the conclusions contained in the reports were supported and that the inquiries had been carried out in keeping with administrative law principles and AG-6 Inquiries. The reviewer made some minor recommendations to improve processes and streamline the process of conducting an inquiry in certain circumstances.

| Performance measure | Performance standard |

2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Percentage of inquiries that meet the Auditor-General's process and reporting quality criteria (as determined by quality assurance review) | 100% | 100% | New measure for 2019/20 Not assessed, as not a quality assurance review year |

New measure for 2019/20 |

Local Authorities (Members' Interests) Act 1968

The Auditor-General administers the Local Authorities (Members' Interests) Act 1968, which regulates pecuniary interest matters in local government. This year, we received 33 requests to approve contracts under the Local Authorities (Members' Interests) Act.

We measure our timeliness for those requests from the time when we have all the information we need to carry out our work. This year, we completed 88% of requests to approve contracts under the Local Authorities (Members' Interests) Act within our target of 21 days.

Quantity

| Performance measure | Performance standard |

2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Number of Local Authorities (Members' Interests) Act 1968 approval requests received | Not applicable | 33 Revised measure for 2020/21 |

96 New measure for 2019/20 |

New measure for 2019/20 |

| We revised this measure for 2020/21 to reflect requests to approve contracts only. The basis for measurement in 2019/20 was all enquiries received. | ||||

| Percentage of requests under the Local Authorities (Members' Interests) Act 1968 for approval of contracts that are responded to within the expected time period (within 21 days) | At least 90% | 88% | 93% | Revised measure for 2019/20 |

| The previous measure included all work related to the Local Authorities (Members' Interests) Act 1968 (contract approvals, investigations, and declarations). The new performance measure now only measures timeliness for approving contracts. In 2020/21, four approvals were late. Most of these were in the first half of the year. | ||||

5. Assess public sector performance and accountability

This service is funded through the appropriation Statutory Auditor Function MCA, Performance Audits and Inquiries Category. The amount appropriated for the category in the 2020/21 Main Estimates was $11.040 million. For more information on the actual expenditure incurred, see Part 6: Our appropriations.

The Public Audit Act 2001 allows the Auditor-General to assess the performance and accountability of public organisations, particular sectors, or the entire public sector. Performance audits, special studies, and the other evaluation and assessment work we do are an important part of our work programme. Each year, we publish our planned work programme in our annual plan as required by the Public Audit Act. Appendix 5 describes progress on the work in our Annual plan 2020/21.

The Public Audit Act 2001 allows the Auditor-General to assess the performance and accountability of public organisations, particular sectors, or the entire public sector. Performance audits, special studies, and the other evaluation and assessment work we do are an important part of our work programme. Each year, we publish our planned work programme in our annual plan as required by the Public Audit Act. Appendix 5 describes progress on the work in our Annual plan 2020/21.

Performance audits continue to be an important part of our work programme. The purpose of our performance audits is to help improve public sector performance and provide assurance to Parliament and the public that public organisations are delivering what they have been set up and funded to do.

Performance audits enable us to examine areas that we are not able to in our annual audits and to make recommendations to improve public sector performance. We also monitor public organisations' progress in implementing recommendations from our previous performance audits.

In 2020/21, we worked on 16 performance audits and completed nine of these. We aim to complete the remaining seven performance audits before December 2021. We provide details of the nine published performance audit reports and the nine other publications we published this year in Appendix 4. These publications are available on our website.

Performance for Assess public sector performance and accountability

Quantity

| Performance measure | Performance standard |

2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Number of performance audit reports issued during the year | Not applicable | 9 | 4 | New measure for 2019/20 |

| Number of other publications issued during the year | Not applicable | 9 | 14 | New measure for 2019/20 |

| The number of other publications issued during the year refers to research reports, sector reports and letters, good practice guides, and any other publications that have been published on our external website but have not already been reported elsewhere. | ||||

Quality

| Performance measure | Performance standard |

2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Percentage of performance audits that substantially meet the Auditor-General's process and reporting quality criteria (as determined by quality assurance review) | 100% | 100% when last assessed |

100% | Revised measure for 2019/20 |

| The Australian National Audit Office carries out an external peer review of our performance audit function every two years. The most recent external review was in 2019/20. Our Quality Assurance team carries out an internal peer review every three years. The most recent internal review was in 2019/20. | ||||

| Percentage of Parliamentary select committees that rate our reports on inquiries, performance audits, and other studies as at least "satisfactory" | 100% | 100% when last assessed |

100% | Revised measure for 2019/20 |

| We carry out our stakeholder surveys every two years. This result is from our 2019/20 survey. Our next survey is planned for 2021/22. | ||||

| Percentage of audited entities that rate our performance audits as at least "satisfactory" | At least 85% | 93% | 88% | Revised measure for 2019/20 |

| We surveyed the 22 public organisations that participated in the nine performance audits we completed in 2020/21. We received 15 responses. Fourteen rated our performance audits as at least "satisfactory" and one was neutral. We use a five-point survey scale, ranging from strongly disagree to strongly agree. We assess that responses were at least "satisfactory" if the organisation responded with agree or strongly agree. | ||||

Timeliness

The performance audits in our work programme can be complex and involve managing many dependencies that can affect timeliness. We continue to look at how we set performance audit time frames, at how we can better manage dependencies, and for ways we can make the insights from our work available in a timely way.

In 2020/21, we completed most of our performance audits within 12 months and 56% within 10 months. We completed our audit of the Covid-19 vaccination programme within three months.

| Performance measure* | Performance standard |

2020/21 result |

2019/20 result |

2018/19 result |

|---|---|---|---|---|

| Percentage of performance audits that are concluded and their findings reported within six months | At least 10% | 11% | New measure for 2020/21 | New measure for 2020/21 |

| Percentage of performance audits that are concluded and their findings reported within 10 months | At least 70% | 56% | New measure for 2020/21 | New measure for 2020/21 |

| Percentage of performance audits that are concluded and their findings reported within 12 months | 100% | 89% | New measure for 2020/21 | New measure for 2020/21 |

| * We revised our timeliness measure for 2020/21 to provide more transparency on timeliness. The previous measure assessed the timeliness of performance audits against expected time frames. The methodology we apply excludes periods where work is delayed because of matters beyond our control. | ||||

| Percentage of other publications concluded, and their findings reported within the expected time-period** | At least 75% | 88% | New measure for 2020/21 | New measure for 2020/21 |

| ** The expected period for other publications is the financial year we first stated the work would be completed in an annual plan. | ||||

Following up implementation of our recommendations

Each year, we assess the progress public organisations have made in acting on the recommendations from a selection of our previous performance audits. Generally, we follow up after 18 to 24 months. This gives public organisations time to make any necessary changes.

We choose which audits to follow up based on the significance of the areas identified for improvement in the performance audit report, the time that has elapsed since we made our recommendations, and the resources we have to assess progress.

In 2020/21, we published two follow-up reports, one on the Accident Compensation Corporation's case management and the other on using information to improve public housing services. We have also trialled a different way of following up on our performance audits.

We will now ask audited organisations to assess the progress they have made against each recommendation 12 months after the audit was published. This will enable us to follow up more audits than previously. We will publish the results of the follow ups on our website when they are available. We will still carry out follow-up audits as resources allow.

Case studies

Rapid real-time performance audits

In February 2021, we agreed with the Ministry of Health to review its preparations for the nationwide roll-out of the Covid-19 vaccine during the early stages of the programme. We carried out this work quickly so the Ministry could make any improvements before it rolled out the vaccine to the general population.

In February 2021, we agreed with the Ministry of Health to review its preparations for the nationwide roll-out of the Covid-19 vaccine during the early stages of the programme. We carried out this work quickly so the Ministry could make any improvements before it rolled out the vaccine to the general population.

We recommended that the Ministry continue to communicate transparently with the public about risks to the roll-out and raise public awareness of the immunisation programme. We also recommended that the Ministry provide more clarity about the roll-out and the Ministry's role in it to district health boards and primary health care providers.

The Ministry was open to receiving and acting on our feedback. When we published our report in May 2021, it had made changes to the roll-out in response to our recommendations. The Ministry released a statement on its website about how it had already responded to our recommendations.

Further information about what we found and recommended is in our report, Preparations for the nationwide roll-out of the Covid-19 vaccine, which is available on our website.

Focusing on the most significant areas of spending

The Wage Subsidy Scheme is the Government's largest single area of spending (more than $13 billion up to 30 June) in response to Covid-19. The Government has estimated that the Wage Subsidy Scheme has indirectly supported about 1.8 million employees. Our report outlines how well the Government has managed the Wage Subsidy Scheme.

The Wage Subsidy Scheme is the Government's largest single area of spending (more than $13 billion up to 30 June) in response to Covid-19. The Government has estimated that the Wage Subsidy Scheme has indirectly supported about 1.8 million employees. Our report outlines how well the Government has managed the Wage Subsidy Scheme.

We found that the agencies involved did a good job of designing and implementing the Wage Subsidy Scheme on a large scale and at speed. On average, the Ministry of Social Development, which was responsible for administering the scheme, made payments to employers within 3.5 days of receiving applications.

The Government decided to use a "high-trust" approach to be able to make payments to employers quickly. However, a high-trust approach has greater risks of fraud and error, and, in our view, the Ministry should have taken more steps to manage that risk. In particular, we recommended that the Ministry test the reliability of its post-payment assurance work and prioritise the remaining enforcement work.

We also recommended that, given the need for these types of schemes when crises occur, the agencies involved evaluate the scheme to inform the Government's preparation for future schemes.

The Inland Revenue Department told us that it followed our recommendations from this work when implementing the Small Business Cashflow Scheme. We also understand that the Ministry of Social Development, the Inland Revenue Department, the Ministry of Business, Innovation and Employment, and the Treasury are discussing how to carry out a timely evaluation of the development, operation, and impact of the scheme so the Government can use the findings to inform its preparation for future crisis-support schemes.

Further information about what we found and recommended is in our report, Management of the Wage Subsidy Scheme, which is available on our website.

1: Section 42 of the Public Audit Act 2001 states that audit fees must be reasonable.