Part 5: Annual audit results for 2012/13

5.1

In this Part, we discuss the social sector entities' 2012/13 audit results, including:

- our audit opinions;

- our assessment of the management control environment, financial information systems and controls systems, and service performance systems and controls; and

- particular areas of audit focus.

5.2

Under section 15 of the Public Audit Act 2001, the Auditor-General is required to audit the financial statements, accounts, and other information that public entities are required to have audited each year. The purpose of the annual audit is to give assurance that an entity's reports fairly reflect its financial and, where appropriate, service performance.

Our audit opinions

5.3

For 2012/13, we issued an unmodified audit opinion for all six social sector entities covered by this report. We had reported the same result for 2011/12.

Management control environment and financial information systems and controls

5.4

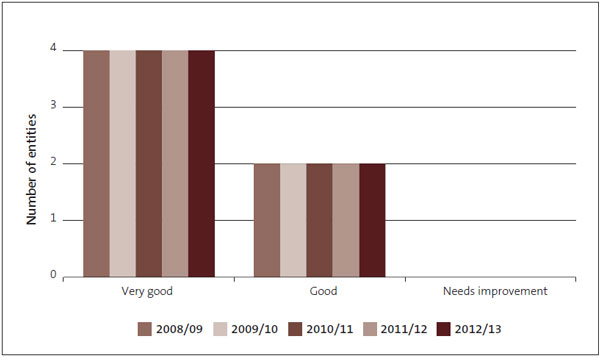

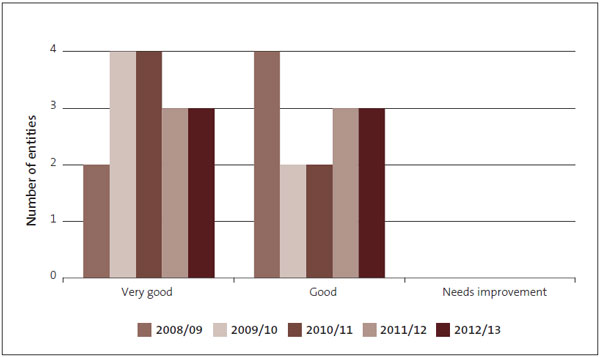

We have assessed the management control (see Figure 10) and financial information systems and controls (see Figure 11) environments of all six social sector entities as good or very good.

5.5

Our grades show a great deal of consistency in the past five years, indicating that we have not found any systematic and material concerns with the entities' systems and controls.

Figure 10

Assessed grades for the social sector entities' management control environments, 2008/09 to 2012/13

Figure 11

Assessed grades for the social sector entities' financial information systems and controls, 2008/09 to 2012/13

Service performance information and associated systems and controls

5.6

Public entities are required to report their plans and their performance against those plans to demonstrate that they deliver the agreed services effectively and efficiently. This supports their accountability to Parliament and to the public for responsibly using the public resources and regulatory powers entrusted to them.

5.7

Performance reporting needs to tell the story about the services the public entity delivers, why it delivers them, and what difference it has made to the community where its services are delivered and/or to society. Reporting should be based on performance measures that are appropriate in the context of the entity's operations – be relevant, reliable, understandable, and comparable.

5.8

The 2013 amendments to the Public Finance Act 1989 will bring some changes to reporting requirements. Public entities will still need to account for their performance by being clear about how they will assess it and then measuring actual achievements against what was planned.

5.9

Our annual audit looks at performance information, entities' reporting against outcome delivery, and associated systems and controls. We assign a grade based on that assessment. We have been working with public entities for some years now to lift the quality of service performance reporting in the public sector.

5.10

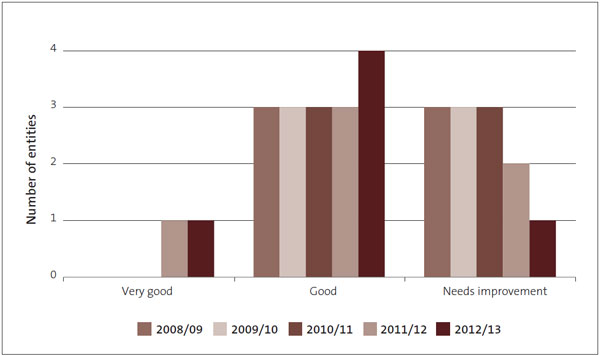

Recently, we have noted improvements in service performance reporting and the associated systems and controls (see Figure 12). Generally, controls for the recording, monitoring, and reporting of service performance are operating effectively. Some areas for improvement remain, particularly with appropriate qualitative measures of the impact of activities and the provision of comparative data showing trends. We also noticed that significant change during the course of the year tends to prove challenging for entities when they report.

Figure 12

Assessed grades for the social sector entities' service performance information and associated systems and controls, 2008/09 to 2012/13

Areas of audit focus for 2012/13 audits

Ministry of Social Development

5.11

Our audit of MSD focused on several aspects of MSD's work, reflecting significant business risks. Those aspects included welfare reform, Investment in Services for Outcomes, the Children's Action Plan, procurement, and information technology controls. Our audit also included site visits to look at Work and Income and Senior services, three Child, Youth and Family sites, the National Accounting Centre, Studylink, a Debt Collection Unit, and the Fraud Investigation Unit.

5.12

We noted significant changes in MSD. Phase three of welfare reform went live on 15 July 2013 after a large amount of work by staff right across MSD, and we noted that the implementation of this phase was well run. We will continue to watch welfare reform and other significant changes, and we will review the new Investment in Services for Outcomes contracting arrangements during 2013/14 as they will change how MSD conducts its contracting business.

5.13

We noted that the best of MSD's procurement was supported by excellent records. Individual procurement processes were generally well run, but there was some inconsistency in record-keeping, and there was not always evidence of how aspects of some processes had been carried out.

5.14

We reviewed the systems and controls MSD operates to ensure that its financial information is fairly stated and transactions are valid. We assessed this aspect of MSD's control environment as good but identified some areas for improvement. For example, although the level of compliance with processing standards has continued to improve, we found some areas of non-compliance. We also noted a small number of payments made outside delegations, which we reviewed and judged to be valid expenditure items. None of these matters were significant. MSD has indicated that it has already taken action to address the issues raised. We will follow these matters up in 2013/14 and see how MSD is addressing our recommendations.

5.15

We also performed an IT General Controls review as part of our audit. The review covered, at a high level for relevant systems, entity-level controls and activity-level controls. The focus of our work this year was to confirm controls operated as intended. Generally, controls were operating effectively.

Families Commission

5.16

Organisationally, the Commission has been preparing for the changes expected to follow if the Families Commission Amendment Bill is passed. As part of our audit, we reviewed a sample of redundancy payments made during the year and found no matters of concern.

5.17

The Commission had an independent review carried out of its policies for procurement, recruitment, and employment of contractors and consultants. Sensitive expenditure policies were also separately reviewed. We understand that the management team is updating these policies to address the matters raised by those reviews.

New Zealand Artificial Limb Service

5.18

In addition to the usual areas our audit work covers, an area of focus for our audit was the management of inventory and the appropriate application of accounting treatment to inventory. We noted no issues.

Housing New Zealand Corporation

5.19

We noted a number of significant matters during our audit of Housing New Zealand. Several of those were related to how it manages the significant asset that its housing stock represents, and how it maintains its portfolio of housing.

5.20

We noted that, during 2012/13, Housing New Zealand successfully settled its multiple insurance claims for damage incurred during the Canterbury earthquakes. The settlement amounted to $320 million. Housing New Zealand has started a major programme of repairs to up to 5000 properties, and is constructing an additional 700 dwellings in Canterbury by December 2015.

5.21

The annual revaluation of the social housing portfolio was also an issue of significance. Housing New Zealand has moved to improve its valuation methodology. We have determined that the valuation approach adopted at 30 June 2013 was appropriate for financial reporting purposes.

5.22

During the year, Housing New Zealand implemented new financial management information systems to manage all aspects of its financial reporting, property, and tenancy management. A significant element of this involved changes to how Housing New Zealand interacts with its maintenance providers. The changes are important in the context of a property portfolio that requires regular re-investment and maintenance. Implementing the changes was a challenge for Housing New Zealand. We noted that this area will require continued focus.

5.23

We also identified, as significant matters of interest, the property initiatives arising from the implementation of Housing New Zealand's asset management strategy, mortgage insurance and loans for social housing initiatives, and the pending transfer of responsibilities for social housing functions to MSD.