Part 1: Introduction

1.1

In this discussion paper, we have reviewed how a small group of local authorities1 use growth charges, such as development contributions and financial contributions, to fund growth-related assets.

1.2

Development can take place through intensification or infill of existing developed areas or through new development in “greenfield” (previously undeveloped) areas. Development in greenfield areas typically requires totally new infrastructure, while infill development typically requires the existing asset capacity to be upgraded.

1.3

We took a case study approach by selecting five local authorities for review. The five local authorities were Tasman District Council, Tauranga City Council, Western Bay of Plenty District Council, Marlborough District Council, and Timaru District Council (the five local authorities). We selected the five local authorities because each has adopted a different approach to funding growth-related assets.

1.4

For each of the five local authorities, we sought to understand:

- their funding choices and the rationale for their choices;

- the integration of their funding choices and rationale in their financial strategies; and

- issues arising in applying the chosen policies.

1.5

A territorial authority2 can charge a development contribution under the Local Government Act 2002, and a financial contribution under the Resource Management Act 1991, but not for the same purpose for the same development.3

1.6

The purposes of development contributions and financial contributions are slightly different. Development contributions fund the costs of infrastructure, reserves4, or other community facilities arising from new housing or commercial developments. A financial contribution can be imposed as a condition of a resource consent granted under the Resource Management Act 1991 for a purpose set out in a local authority’s regional or district plan (including offsetting any adverse environmental effects of a development or activity).

1.7

Regional councils5can charge financial contributions but not development contributions.

1.8

In the remainder of this Part, we show the forecast development and financial contributions revenue, and the capital expenditure to meet additional demand, reflected in the local authorities’ 2012-22 long-term plans.

1.9

In Part 2 we provide a summary for each of the five local authorities, their forecast development and financial contribution revenue, the capital expenditure to meeting additional demand, their approach to funding growth-related assets, and the basis for how they set their growth charges.

1.10

In Part 3 we discuss matters that the five local authorities have highlighted to us about development contributions and financial contributions to fund growth-related assets.

Development contributions and financial contributions forecast in the 2012-22 long-term plans

1.11

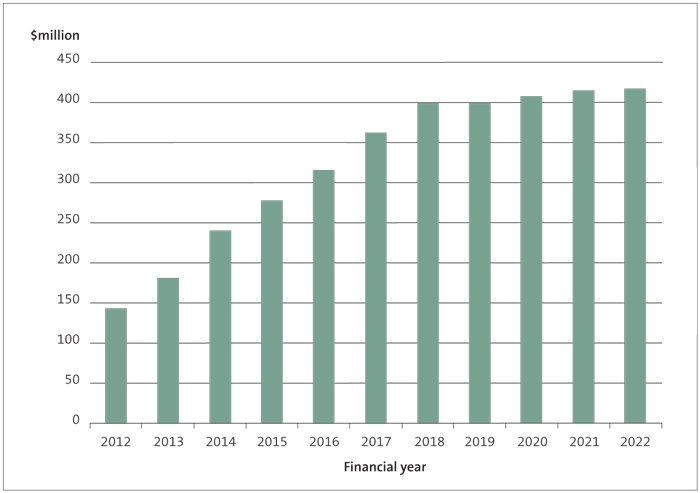

Local authorities forecast to receive $3.4 billion6 in development and financial contributions in the 10 years from 2012/13 to 2021/22 based on their 2012-22 long-term plans. Figure 1 shows forecast development and financial contributions in each of the next 10 years (as well as the 2011/12 estimated actual development and financial contributions revenue from the 2012-22 long-term plans). Figure 1 also shows that the year-on-year increase in contributions is greater in the early years than in the later years.

Figure 1

Forecast development and financial contributions revenue, 2011/12 to 2021/22

1.12

The 10 local authorities with the highest forecast development and financial contributions revenue expect to collect $2.9 billion (84%) of the total contributions revenue over the 10 years. Auckland Council alone is expecting to collect $2.0 billion (59%) of the total contributions revenue.

1.13

Figure 2 shows the 10 local authorities with the highest forecast revenue from development and financial contributions, and the percentage of this revenue source to total operating income.

Figure 2

The 10 local authorities with the highest forecast development and financial contributions revenue over the period 2012/13 to 2021/22

| Local authority | Forecast development contributions and financial contributions revenue, 2012-22 $million | Forecast development contributions and financial contributions revenue, as a % of total operating income, 2012-22 $million | |

|---|---|---|---|

| 1 | Auckland Council | 2,017 | 5% |

| 2 | Tauranga City Council | 209 | 10% |

| 3 | Western Bay of Plenty District Council | 109 | 11% |

| 4 | Waimakariri District Council | 104 | 11% |

| 5 | Waikato District Council | 84 | 7% |

| 6 | Hamilton City Council | 82 | 4% |

| 7 | Selwyn District Council | 73 | 8% |

| 8 | Queenstown-Lakes District Council | 71 | 6% |

| 9 | Thames-Coromandel District Council | 62 | 6% |

| 10 | Hastings District Council | 53 | 4% |

1.14

Twenty-three (30%) local authorities have forecast that they will receive no revenue from development and financial contributions during the next 10 years. Eleven of them are regional councils.

Forecast capital expenditure to meet additional demand in the 2012-22 long-term plans

1.15

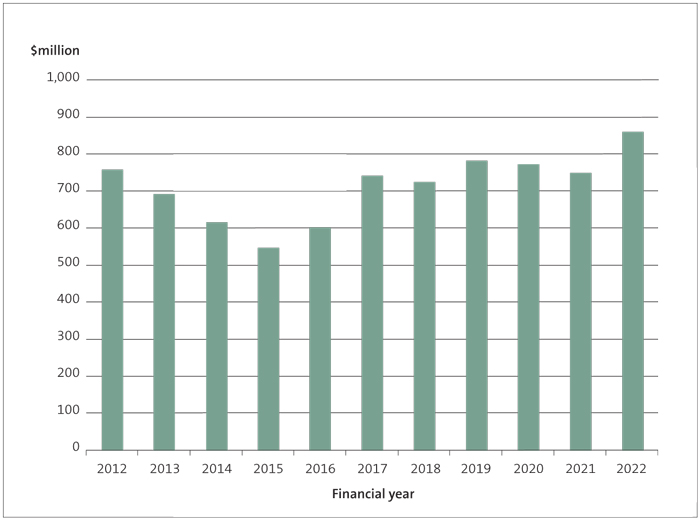

Based on the 2012-22 long-term plans, local authorities have forecast spending $7.076 billion7 on capital expenditure to meet additional demand in the 10 years from 2012/13 to 2021/22. Figure 3 shows forecast capital expenditure to meet additional demand in each of the next 10 years (as well as the 2011/12 estimated actual capital expenditure to meet additional demand from the 2012-22 long-term plans).

Figure 3

Forecast capital expenditure to meet additional demand, 2011/12 to 2021/22

1.16

Twenty (26%) local authorities have forecast no capital expenditure to meet additional demand during the next 10 years. Nine of them are regional councils.

Forecast revenue and expenditure profile

1.17

Figure 3 shows a different pattern to that for the development and financial contributions revenue in Figure 1. There could be several reasons for this, including:

- a number of local authorities have forecast not to receive any development or financial contributions (growth charges) towards capital expenditure to meet demand;

- it typically takes less time to build an asset than it takes to recover the cost of the asset through growth charges;

- local authorities can require a growth charge for growth-related expenditure already incurred in anticipation of a development (reflecting past development), as well as for forthcoming development; and

- receipt of growth charges is not linear each year – the forecast growth charge is based on the forecast pace of development in the community or units of demand (names commonly used include HUE, HEU, or HUD).8 Some local authorities have forecast that the rate of growth and therefore forecast development, will take more time to recover from the recent recession. Because of this, growth charges will reflect a similar recovery pattern.

1.18

A financial strategy of using growth charges to fund growth-related assets is a matter of local authority judgement. A local authority may choose not to recover all or even any growth-related costs from developers, but to fund them in other ways (such as from existing ratepayers). Local authorities have a number of funding tools available and set a funding mix that best suits their local circumstances.

1: A local authority means a regional council or territorial local authority.

2: A territorial authority means a city council or a district council named in Part 2 of Schedule 2 of the Local Government Act.

3: Section 200 of the Local Government Act – Limitations applying to requirement for development contribution.

4: “reserves” is not defined in the Local Government Act, but typically includes areas designated for parks, sports, and recreation.

5: A regional council means a local authority named in Part 1 of Schedule 2 of the Local Government Act 2002. Regional councils are primarily concerned with environmental resource management, flood control, air and water quality, pest control, and, in specific instances, public transport, regional parks, and bulk water supply.

6: This amount is for 77 local authorities, excluding Christchurch City Council, which did not prepare a 2012-22 long-term plan. The Department of Internal Affairs collated all the financial information in the final 2012-22 long-term plans and made the information available to us for further analysis.

7: This amount is for 77 local authorities, excluding Christchurch City Council, which did not prepare a 2012-22 long-term plan.

8: “units of demand” is not defined in the Local Government Act 2002, so definitions vary. For example: Tauranga City Council defines units of demand as “the number of household units, household equivalents, gross floor area, additional allotment of subdivision, or site area”. Marlborough District Council said that units of demand provide the basis for distributing the costs of growth. They illustrate the rates at which different types of development use capacity. The Council has adopted the household equivalent unit (HEU) as the base unit of demand, and describes the demand for capacity from other forms of development as HEU multipliers. Tasman District Council calculates contributions based on household units of demand (HUD) for both residential and business units.