Part 4: Making the grid more reliable

4.1

In this Part, we discuss how well Transpower manages the risks to an aged grid to make it more reliable. We cover:

- reliability and performance concerns;

- Transpower's programme to improve how it manages assets; and

- what still needs to be done.

Our conclusions

4.2

We expected that Transpower would have assessed the risks that old grid assets posed when the infrastructure audit that the Ministry of Economic Development commissioned in 2004 raised concerns about the age of the assets.

4.3

We found that Transpower knew that the grid was becoming less reliable and performing worse. While it was still building staff capability, Transpower could not focus on both grid reliability and capacity, so it made the strategic decision in 2003 and 2004 to focus on addressing the grid's capacity issues. The issues of age and necessary replacing and refurbishing of grid assets were given a lower priority.

4.4

Noting Transpower's lack of long-term performance goals, the Commerce Commission considers that such goals are essential to any strategic eff ort to improve performance.17 We agree that performance goals help keep spending strategic and targeted and help measure effectiveness and performance.

4.5

We found that Transpower had asset strategies covering specific groups of assets and management plans to support those strategies. The risk analysis in the asset management plans varies but is high-level only. We note that there is no prioritising or assessing of comparative risks to assets in different management plans. With limited capacity in the grid, it is not possible to establish where the highest risk (in terms of probability and consequence) is, and which assets in which asset management plan should be targeted first. This is especially important given how much replacing and refurbishing work is needed.

4.6

Transpower has begun a five-year programme to improve how it manages its assets. Its asset management system is an integrated and co-ordinated set of policies, strategies, objectives, plans, and processes. Transpower has prepared the foundation for this system. Transpower must improve its long-term targeting, works planning, resource forecasting, and systems for estimating costs and procurement.

4.7

We have reviewed what Transpower intends to do and consider that it will resolve the major issues. Transpower should implement its plans and processes with urgency.

Concerns about reliability and performance

4.8

Transpower knew that the grid was becoming less reliable and performing worse.

4.9

Transpower's benchmarking results in ITOMS in the years 2003, 2005, and 2007 showed a worsening performance and an increasing cost when compared with the study's other participants. By 2009, Transpower's overall asset performance was weak compared to most of the other transmission companies that participated in the benchmarking study.

4.10

Between 2008 and 2010, the grid's performance was variable. Transpower did not meet some of its performance measures. The 2011 results show improvements. In 2011, Transpower met some of its targets for grid performance. There has been less loss of supply to consumers. If the effects of the Christchurch earthquake are removed, the 2011 results look much better than previous years. Transpower's challenge is to consistently meet its performance targets.

4.11

In June 2008, Transpower commissioned an independent review of its maintenance practices and spending. This report concluded:

Discussions with staff from both Transpower and the contractors revealed a workforce that has an innovative approach to solving problems. This has been driven mainly by a need to keep operational an aged asset base as little asset replacement has been undertaken on a broad basis in the last decade. Some 39% of the switch gear assets are of old technology with an average age of around 37 years. Transformers have an even higher average age of around 40 years with approximately 40 per cent of the in-service power transformers ranging from 40 to over 70 years old. Many assets are rapidly approaching end of life and need to be replaced if a satisfactory level of performance and reliability is to be maintained. Even with good care and innovative solutions it is not realistic to expect such assets to continue to be fit for purpose and perform adequately with increasing age. Eventually there comes a point when their reliability needs to be questioned. Best practice shows that initiating a replacement programme early will help to deliver a timely replacement programme of aging assets, and ensure a secure transmission system. Transpower should start immediately to develop an assertive plan to replace aging assets before system integrity is compromised and asset replacement will be difficult to manage proactively.18

4.12

Transpower identified a strategic response to the DuPont report's findings. This response included:

- changing its business model;

- developing a strategy for managing assets; and

- improving how it maintains assets.

4.13

We note that Transpower has made some progress in addressing the issues noted in 4.11. This progress is largely centred on developing strategies for major groups of assets and identifying replacement programmes at an asset group level (see paragraphs 4.27, 4.28, 4.36, and 4.37). Transpower has done much work to address the risk of not having enough strategic spares, especially spare transformers.

Strategic spares

4.14

The DuPont report noted a severe lack of strategic spares in all the main asset areas. It noted that:

This is a significant problem that could severely compromise Transpower's ability to operate a reliable system if not addressed.

4.15

The report pointed out that, given the country's location and manufacturer lead times of about two years, it was essential that the issue of strategic spares be addressed. The report noted that the lack of spare transformers was particularly concerning.

4.16

The report recommended that Transpower:

... critically review the required level of strategic spares in asset categories of transformers and circuit breakers.

4.17

Transpower knew that strategic spares were needed and had identified the need to address this before the release of the DuPont report. In early 2008, Transpower carried out with urgency a programme to buy additional transformers and other equipment as strategic spares.

4.18

Transpower has spare power transformer units to be used in case a transformer fails. Before 1977, most transformers were installed in groups of three singlephase units (referred to as a bank of transformers), which were usually installed with a spare unit onsite. Since 1977, the practice has been to install three-phase transformer banks that have no onsite spare. Therefore, strategically placed spare transformers are needed.

4.19

It will be possible to install the spare transformers within one month of a serious transformer failure. They will provide coverage for 98% of Transpower's threephase transformers.

More spending on renewing and refurbishing assets

4.20

Transpower has increased its capital spending on renewing and refurbishing assets from $52.74 million in 2007/08 to $141.68 million in 2009/10.

Transpower's programme to improve how it manages assets

4.21

Transpower has started a five-year programme to improve its asset management system.

4.22

Transpower has adopted the requirements of PAS 55 as its guide to good asset management practice and plans to get external certification of its asset management system by March 2013.

4.23

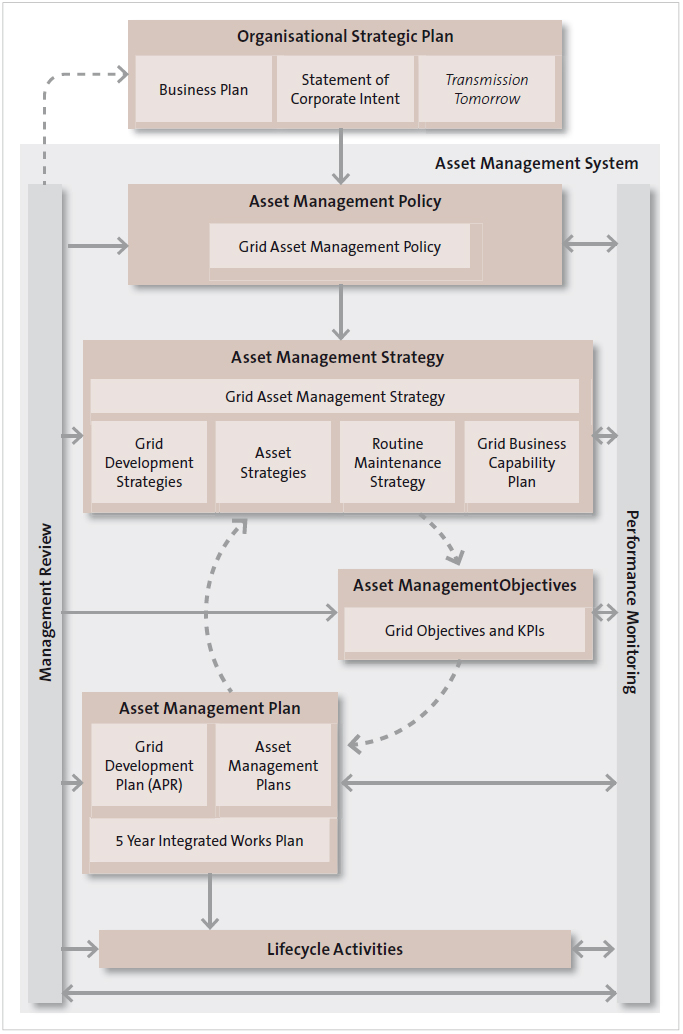

Figure 4 shows the proposed asset management system. The system is an integrated and co-ordinated set of policies, strategies, objectives, plans, and processes which support and help deliver Transpower's organisational strategic plan.

Figure 4

Transpower's proposed framework for managing its assets

Source: Transpower's Grid Asset Management Policy.

How far has Transpower got through this programme?

4.24

Transpower has prepared the foundation for the asset management system. The progress that Transpower has made is discussed in paragraphs 4.26 to 4.46.

4.25

In addition to the plans and strategies that make up its framework for managing assets, Transpower issued a Corporate Business Capability Plan in February 2011. This plan describes the long-term approach for improving business capability for services throughout Transpower's corporate business systems. The budgeted cost of these improvements is $19.2 million spread over the next five years.

Asset Management Policy

4.26

In February 2011, a Grid Asset Management Policy was issued. The strategy is being implemented.

Grid Asset Management Strategy

4.27

Between May 2010 and February 2011, Transpower approved asset strategies covering specific groups of assets.19 These strategies provide a medium to longterm guide for asset management decisions for groups of assets. The strategies include:

- asset performance targets;

- criteria to help decide when to replace assets;

- standardised procuring of new equipment;

- replacing existing equipment;

- monitoring and management regimes; and

- reviewing preparedness for emergencies.

4.28

In February 2011, a Routine Maintenance Strategy was issued. This strategy is meant to improve how Transpower performs in the ITOMS international benchmarking by putting in place many initiatives, including improvements in standardised work practices and workforce training, as discussed in paragraphs 2.44 to 2.45. Initiatives such as the review of outage planning and a transformer online monitoring programme have just begun.

4.29

Transpower has prepared a grid business capability plan for the period from 2010/11 to 2014/15. This plan describes Transpower's long-term approach to developing the grid systems during the next five years. The plan identifies seven programmes of change with a budget cost of $98.4 million.

Grid Asset Management Objectives

4.30

Transpower's Business Plan includes grid objectives and key performance indicators.

4.31

Transpower must improve its long-term targets for what it considers to be the appropriate level of risk at a network level, and the associated network performance and quality measures. The report by Geoff Brown & Associates and the Commerce Commission's draft decision highlight the need for Transpower to improve its performance goals.

4.32

Geoff Brown & Associates Limited noted that all but one of Transpower's priorities in its business plan focus on the quality of inputs, not outcomes. Their report says that the one exception to this input focus – developing the grid to meet "agreed reliability standards" – cannot be used to measure improvement. This is because Transpower has been unable to quantify any "agreed standards", other than reliability targets in its Statement of Corporate Intent.20

4.33

This view is supported by the Commerce Commission, which reported in its draft decision that:

The Commission considers that long-term performance goals are essential to any strategic eff ort to improve performance. Performance goals provide a means of undertaking expenditure in a strategic and targeted manner, and allow the measurement of effectiveness and performance … The Commission does not consider the current targets to be an appropriate longterm level of performance.21

Grid Asset Management Plan

4.34

Asset management plans have been developed to support the asset strategies.22 The management plans outline how particular assets will be managed over their life cycle. Transpower has advised us that the details in the asset management plans have been entered into the asset management database. This database can then be sorted by site, programme, or portfolio.

4.35

Our analysis of the asset management plans found that:

- Some asset management plans23 include asset replacement plans. The detail and extent to which the replacing of individual assets is prioritised diff ers between the plans.

- Some asset management plans analyse risk in terms of the probability of a particular group of assets failing and the consequences of a failure.24 However, in some cases, this analysis is superficial. For example, the asset management plan for some outdoor components does not include an analysis of the important site(s) or circuit(s) and the age and wear of the components at these sites. Only two asset management plans included action that was put in place to mitigate the risks of asset failure.

- There is no prioritising or assessing of risk between the asset management plans. With limited capacity in the grid it is not possible to establish where the highest risk (in terms of probability and consequence) is, and which assets in which asset management plan should be prioritised. This is especially important given how much replacing and refurbishing work must be done.

4.36

Geoff Brown & Associates Limited raised concerns about Transpower's inability to prioritise asset renewal and refurbishment in their report. They noted that:

... Transpower lacks a tool that can prioritise asset renewal and refurbishment programmes across a range of different asset types in a consistent and structured manner …

What is required is an approach that can evaluate maintenance related capex alternatives on a common basis … the industry standard prioritisation tool is condition based risk management (CBRM) …

Under the CBRM approach, the maintenance and renewal requirements of individual assets within a specific asset class are not prioritised in isolation from other asset classes. Instead the health of all assets on the grid is assessed against a consistent set of criteria, which typically include the condition of the asset, the probability of failure or probable rate of deterioration and the consequences of asset failure. This allows the health of each individual asset to be quantified in a way that makes it possible to compare asset health directly across different asset classes and to prioritise asset replacement and refurbishment expenditure accordingly.25

4.37

Transpower has an Integrated Works Programme that addresses the needs identified in the Annual Planning Report and asset management plans in a fiveyear work plan. A resource forecasting model is then used to test the plan's overall deliverability.

4.38

Transpower uses integrated work planning to manage its grid capital and major maintenance works plans, with work grouped into co-ordinated delivery programmes. This helps to minimise the:

- times that a particular asset or site needs to be "visited";

- number of outages required; and

- overall resources required.

4.39

This is intended to lower the overall risk to the system and safety and the overall life-cycle costs.

4.40

We consider that for the Integrated Works Planning process to be effective, Transpower must ensure that the work in the Annual Planning Report is prioritised according to risk.

4.41

BW Consulting's December 2010 independent review notes that:

The plans and strategies contain a considerable amount of information with respect to asset condition but there is little evidence of detailed overhaul plans for asset replacement or refurbishment. Each of the asset groups presents a case for considerable spend in replacement and refurbishment but there are no defined schedules of replacement and refurbishment candidates indicating when the work should be done and at what anticipated cost. Because of the lack of past investment the scale of the replacement and refurbishment requirements is massive particularly if all the strategies were to be implemented.26

4.42

The review says that it would be advantageous if Transpower prioritised all of the strategies and scoped a replacement and refurbishment plan based on safety (to both the public and staff ), risk (to third parties and the system), system needs and cost, given time frames, and budget.

4.43

Transpower has reviewed how it estimates costs and has begun a two-year programme to identify and implement changes needed to get a more accurate, auditable, transparent, and robust cost-estimating system for all grid capital works.

4.44

The main objectives of the programme are to:

- develop an improved and independent estimating tool as Transpower's primary source of information, against which quotes and estimates can be assessed; and

- gain confidence that Transpower is paying equitable and market competitive rates for all work.

| Recommendation 2 |

|---|

|

We recommend that Transpower New Zealand Limited complete its programme for improving how it manages assets and risk; in particular, Transpower must implement:

|

17: Commerce Commission (27 June 2011), Draft Decision: Minor Capital Expenditure and Operating Expenditure Allowances, and Quality Standards to apply to Transpower for the Remainder Period of Regulatory Control Period 1.

18: DuPont Operational Excellence: Review of Maintenance Practices & Expenditures Report, page 3.

19: An asset strategy was developed for each of the following groups of assets: transmission lines, tower painting, substation management systems, secondary assets, outdoor 33kV switchyards, high-voltage outdoor circuit breakers – 66kV and above, power transformers, and synchronous condensers.

20: Geoff Brown & Associates Limited (15 June 2011), Review of Transpower's Forecast Operating and Capital Expenditure for 2012-15, prepared for Commerce Commission.

21: Commerce Commission (27 June 2011), Draft Decision Minor Capital Expenditure and Operating Expenditure Allowances, and Quality Standards to apply to Transpower for the Remainder period of Regulatory Control Period 1.

22: The asset management plans cover the following groups of assets: transmission line towers, Outdoor 33kV switchyards, gas insulated switchgear, indoor switchgear, power transformers, freestanding instrument transformers, tower foundations, outdoor buswork and supporting structures, outdoor disconnectors and earth switches, capacitors and reactors, outdoor circuit breakers, buildings, and grounds.

23: Outdoor 33kV switchyards, indoor switchgear, single phase transformer banks, and free-standing instrument transformers.

24: The following asset management plans included a risk section: Transmission line towers, indoor switch gear, free-standing instrument transformers, tower foundations, outdoor buswork and supporting structures, outdoor circuit breakers, outdoor disconnectors, and earth switches.

25: Geoff Brown & Associates Limited (15 June 2011), Review of Transpower's Forecast Operating and Capital Expenditure for 2012-15, prepared for Commerce Commission, pages 53-55.

26: BW Consulting (2010), Transpower's asset management strategies and plans, page 38.

page top