Part 2: The current system for managing risks to grid assets

2.1

In this Part, we discuss and evaluate Transpower's system for managing risks to grid assets. We cover:

- Transpower's framework for managing risk;

- how Transpower identifies, analyses, and manages risks to grid assets;

- how Transpower's board monitors risk;

- Transpower's plans to improve how it manages risks to grid assets; and

- how Transpower manages risks to contractors' capabilities.

Our conclusions

2.2

Transpower has established systems for managing corporate risk. However, to more effectively manage risks to grid assets, Transpower has identified that it must have a more detailed and integrated system for gathering and analysing data about the condition of assets.

2.3

We found that the "Top 10" risks (see paragraph 2.22) are reported to the board each time it meets and that the corporate risk register is presented to the board every six months. The board receives regular updates on key projects through the chief executive's report, which includes the risks to and issues with those projects.

2.4

In December 2008, the Network Risk Committee asked how some of the core grid assets had come to be in a poor condition. Managers responded that the focus of governance and management had been elsewhere, rather than on the state of the assets and the risks this presented. The focus has since changed.

2.5

The Network Risk Committee has recently adopted a systematic approach to assessing and reviewing network risk and network risk controls.

2.6

We encourage the board and its relevant committees to continue to actively monitor and hold managers accountable for identifying the extent of problems with grid assets and applying timely solutions.

2.7

Transpower is improving its asset risk register and documented methods for assessing and quantifying risks to assets. We consider that Transpower's adoption of PAS 55 (which includes a methodology for managing risk) should help improve how Transpower manages risks to grid assets.4

2.8

We note that Transpower has begun a quality improvement plan and safety improvement programme under which all contractors will be required to work to approved and standardised maintenance procedures. Transpower is working to improve the training of contractors.

2.9

We consider that Transpower solves problems well and is well placed to respond to unplanned events (risk recovery).

Transpower's framework for managing risk

2.10

Transpower has a Risk Management Policy (the Policy). The Policy includes the Corporate Risk Assessment Matrix, which provides guidance on the likelihood and consequences of an event so that risks can be assessed and quantified. This is aimed at ensuring consistent measuring of risks.

2.11

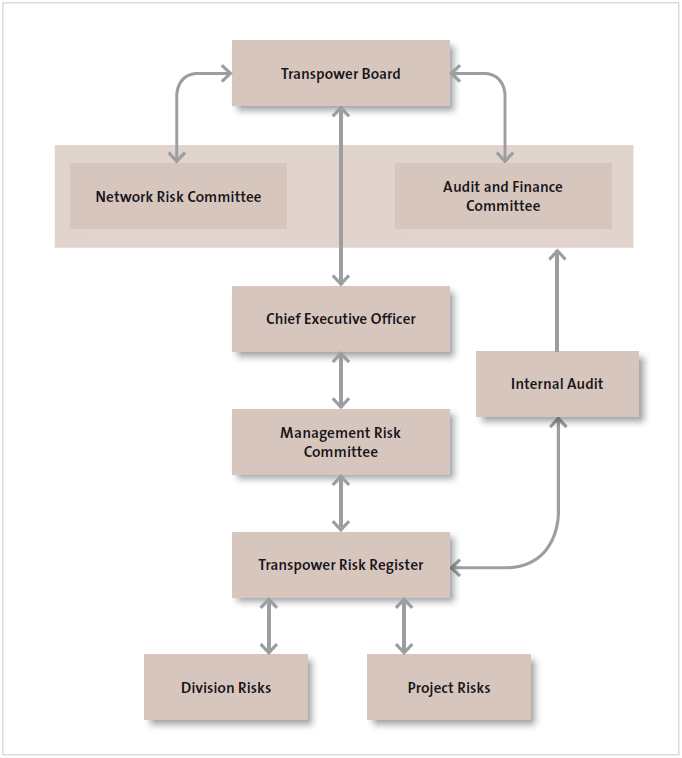

The Policy also sets out a governance structure for managing risk and the responsibilities of the groups within the structure. This structure is shown in Figure 2.

Figure 2

Transpower's governance structure for managing risk

2.12

The responsibilities of the board, the Audit and Finance Committee, the Network Risk Committee, the chief executive, and the Management Risk Committee are set out in Appendix 2.

2.13

All identified risks are recorded in a corporate risk register. Project risks are included in their own project risk registers.

Identifying, analysing, and managing risk to grid assets

Identifying risk to grid assets

2.14

The general managers of each division and the programme and project managers are responsible for identifying, assessing, analysing, and recording risks in the corporate risk register. This includes ensuring that any changes to risks, or new risks, are identified and reported as they arise, and designating risk owners within their divisions.

2.15

The Grid Performance division is responsible for the maintenance and operation of grid assets and asset management. Regular group meetings identify risks through a mapping process that focuses on what could go wrong.

2.16

The Management Risk Committee focuses on high-impact risks that may affect or involve one or more business units. From our review of the minutes of this committee, we established that the Management Risk Committee focuses on lowprobability high-impact events. These events appear to be identified reasonably well.

2.17

Although we consider that the focus of the Management Risk Committee on these events is appropriate, monitoring and quantifying other risks to the transmission asset base are equally important. We expected this to be done through consideration of risk at a divisional level, but there was little documentary evidence that cross-business risks were identified. We were concerned that the existing systems for managing risks did not contain enough detailed information to accurately and comprehensively analyse risks to the grid and assets.

2.18

In December 2010, an independent review of Transpower's asset management strategies and plans reported that there was no formal methodology for assessing risks at an asset level. The review considered that it would be advantageous to have a company-wide asset risk register and documented methods for quantified risk assessment. The review noted that:

If condition assessment indicates that an asset is displaying distress, then on safety grounds alone, the risk of failure and the implications of failure need to be quantified, and if necessary measures taken to control the risk to within acceptable limits.5

2.19

Transpower is taking steps to better manage risks to assets, in line with current standard industry practice, and is using its Asset Risk Management Journey Plan 2010-2013 to guide this work.

Assessing and prioritising risks to grid assets

2.20

General managers and their divisions assess risks. Transpower's Corporate Risk Assessment Matrix provides guidance when assessing the likelihood of the risk and potential consequences, so that risks can be quantified and assigned a level of risk – low, medium, high, or extreme. Transpower's policy is to manage risks so that they are kept at either a low or medium level.

2.21

The Management Risk Committee is responsible for monitoring the company's highest risks, which includes reviewing and challenging the divisions about the highest risks and the mitigation for these risks. General managers present what they consider their division's five main risks. Each month, a different division presents its five main risks to the Management Risk Committee, so all are covered regularly.

2.22

The Management Risk Committee is responsible for identifying and monitoring Transpower's "Top 10" risks – those risks with the most serious consequences and that require the most managing.

2.23

The Top 10 risk reports did not have enough information about why a risk was included or removed from the Top 10. We expected that, to demonstrate a sound rationale for the Top 10 risks, the reports would include an explanation of the reasons for a risk being included or removed from the Top 10 risks list.

Treating and monitoring risks

2.24

Transpower's policy is to have treatment plans for risks that are assessed to be extreme or high. This policy is in line with Transpower's tolerance of risk, which is that all identified risks should be managed or treated to a low or medium level. We reviewed the January 2011 version of the Corporate Risk Register and found that this is yet to be fully implemented. Treatment plans had been prepared for nine out of 10 of the extreme risks, and 62% (23 out of 37) of the high risks.

How Transpower's board monitors risks

2.25

The Top 10 risks are reported at each board meeting and the Corporate Risk Register is presented to the board every six months. The chief executive's report provides the board with regular updates on the progress and risks of main

projects.

2.26

The board appoints the Network Risk Committee to review particular areas of risk. The board prefers committee members to be expert in relevant technical areas. The committee, which meets quarterly, includes at least three members of the board. It is responsible for considering, assessing, and reviewing risks to assets and the network and controls for those risks.

2.27

In December 2008, the Network Risk Committee asked Transpower's managers how some of the core grid assets had come to be in such poor condition. The managers responded that the focus of governance and management had not been on the state of the assets or the risks this presented, but elsewhere. The focus has since changed.

2.28

The Network Risk Committee has recently adopted a more systematic approach to assessing and reviewing network risk and network risk controls.

2.29

We encourage the board and its relevant committees to actively monitor and hold managers accountable for identifying the extent of problems with the grid assets and applying timely solutions.

Plans to better manage risks to grid assets

2.30

Transpower acknowledges that its maintenance, renewal, and refurbishing work has not been prioritised using a structured standard industry practice approach based on risks to assets. Guided by the Asset Risk Management Journey Plan 2010- 2013, Transpower is working to improve how it manages risks to assets.

2.31

Transpower's work to improve how it manages risks includes introducing an asset risk register and documented methods for assessing and quantifying risks to assets. At the time of our audit, Transpower was considering how the risks would be grouped (such as by substation or asset type or asset) and the risk tools, the risk assessment matrix, and the asset risk information that would be required.

Improving information about risks to assets

2.32

Good information about an asset, including how it performs, is needed to identify the risks to it. Transpower cannot easily access this information.

2.33

Transpower's Maintenance Management System records much asset and condition data. However, this system is primarily a maintenance workflow tool. It does not have the capabilities of a modern asset management system. Importantly, the Maintenance Management System appears to store data in a relatively unstructured way – where different data on the same asset are not linked effectively. This makes it difficult for Transpower to access all the condition

data that it needs to accurately assess the health of a particular asset. Moreover, some individual contractors have maintained their own electronic or paper-based asset condition records.

2.34

DuPont's 2008 review of maintenance practices noted that:

Although vast amounts of condition data are collected, apart from overhead lines, little use is made of it. The main reason for this is the shortcomings of the Maintenance Management System. It does not allow easy access to data and does not have any tools for data analysis.6

2.35

In addition, the Maintenance Management System lacks the predictive data analysis capability required to apply current industry standard asset management practice.

2.36

This means that, although Transpower collects much information and data relating to the condition of assets, this is not routinely used to determine the type and frequency of routine maintenance, to determine asset health, or to develop asset renewal programmes.

2.37

BW Consulting's independent review of Transpower's asset management in 2010 identified the need for more detailed assessing of risks to assets.7

2.38

Transpower acknowledges that although it has information about condition monitoring and failure analysis, the information is contained in several systems. This affects how Transpower manages assets. Transpower acknowledges that formal risk methodologies for specific asset classes and situations would better inform investment decisions and help meet PAS 55 requirements.

Better managing risks to assets

2.39

Transpower has begun a project to buy, install, populate, and deploy a modern asset management system. Transpower will adopt the requirements of PAS 55 as its guide to good asset management practice in establishing its new asset management system. PAS 55 includes a methodology for managing risks (which is aligned to AS/NZS ISO 31000:2009), which we consider will help to resolve issues with how Transpower manages risks to its grid assets. In Part 4, we discuss Transpower's progress in implementing its new asset management system.

2.40

The PAS 55 methodology for managing risk includes documented processes and procedures for identifying and assessing risks to assets and managing assets, and identifying and introducing necessary control measures throughout the life cycle of assets. It also requires:

- identifying more systematically:

- physical failure risks, such as functional failure or incidental damage;

- operational risks, including the control of assets, human factors, and all other activities which affect the performance, condition, or safety of assets;

- environmental events (such as storms and floods, including the likely effects of environmental change); and

- risks associated with the different phases of the life cycle of assets;

- using information about risks to assets to improve strategies and plans for managing assets; and identifying adequate resources, including staffing levels; and

- improving Transpower's processes to monitor and measure how well the asset management system performs, and the performance and condition of assets.

2.41

PAS 55 requires asset-risk information to improve other strategies and plans, such as asset management plans, and identify training and competency needs.

2.42

Transpower aims to get external certification of its asset management systems by March 2013.

Improving Transpower's ability to manage risks to assets

2.43

Transpower has identified the following steps to improve its ability to manage risks to assets in its Asset Risk Management Journey Plan – Strategic Plan 2010-2013:

- aligning and complementing Transpower's risk management policy with PAS 55 and NZS 7901:2008;

- identifying and quantifying risks to the asset base;

- adopting effective methods for assessing strategies for managing assets to control identified risks;

- establishing and embedding context and risk criteria for investment and operational strategies – thus explicitly linking network investment decisions to the risk framework; and

- analysing risks to justify options for managing risks for different types and sizes of projects, including risks associated with deferring projects.

2.44

To do this, Transpower will need to:

- define the asset level at which risks will be recorded;

- identify any additional information about risks to assets (such as asset criticality and loss events) to be gathered in addition to standard asset information and standard risk information;

- refine the risk assessment matrix to include asset risk consequence descriptors;

- work out how to gather and maintain information about risks to assets, including identifying sources of information (such as condition assessment); and

- identify the information about risks to assets that should be in the companywide risk register.

Implementing an asset-based system for managing public safety

2.45

As a result of the amendments to section 61A of the Electricity Act, Transpower is required to implement an asset-based system for managing public safety. Transpower is required to consider and document asset risks to public safety and risks to public property. To do this, Transpower will comply with NZS 7901:2008.

Managing risks to contractors' capabilities

2.46

The Commerce Commission engaged Geoff Brown & Associates Limited to review Transpower's forecast operating and capital expenditure for the 2012 to 2015 period.8 Under the outsourcing model, it was intended that contractors would be fully responsible for maintaining the condition of the assets within their areas of control. Geoff Brown & Associates Limited consider that this will not happen because the division of responsibility for maintenance outcomes between Transpower and its contractors is not well defined. As a result, it is not clear how accountable contractors are for their performance. Furthermore, contractors' work practices vary widely.

2.47

To address these issues, Transpower's staff have taken responsibility for strategically managing maintenance work.

Improving quality and standards

2.48

Transpower has started a quality improvement programme and an occupational health and safety improvement programme, under which all contractors will be required to work to approved and standardised maintenance procedures. Transpower is building on its service specifications that set out the minimum levels of competence for transmission workers who carry out the following work for Transpower:

- inspecting, building, maintaining, testing, or dismantling transmission lines on the grid (implemented July 2009);

- operating power system equipment on the grid (implemented January 2008); and

- inspecting, constructing, maintaining, testing, or dismantling transmission substations and communications equipment on the grid (implemented July 2010).

2.49

These service specifications are to be applied with a further service specification,

Minimum Requirements for Transpower Fieldwork (most recently reviewed in September 2010). This service specification sets out the responsibilities and policies for the delivery and maintenance of the technical competencies that contracting staff working on the grid must have.

2.50

Specifications for what is required during a substation inspection have been prepared. There are guides to requirements for:

- assessments of the condition of transmission line assets; and

- tree control near transmission assets and accessways.

2.51

In February 2011, Transpower published a routine maintenance strategy.

Training contractors better

2.52

Since 1994, Transpower has been involved in the International Transmission Operations and Maintenance Study (ITOMS).9 Since 2003, Transpower's benchmarking results have shown worsening performance. Transpower recognises that its poor service level performance in the ITOMS benchmarking could be partly because of a lack of suitably trained maintenance staff and technicians. Transpower is acting to improve training.

2.53

Since 1984, Transpower has operated its own training facilities. In 2006, Transpower extended its training regime to cover all aspects of field work. Transpower provides qualified trainers, the training venues, equipment, managers, and materials. Transpower requires its contractors to manage competence and to certify the competence of its field employees. The contractors provide their staff with the on-the-job experience needed and give them the relevant certification when they have the required competency.

2.54

We note that Geoff Brown & Associates Limited reported that the initiatives that Transpower is putting in place in respect of health and safety, quality improvement, and contractor training:

… will result in overall improvements in the management of the assets by increasing the professionalism of contracting staff , improving job satisfaction, increasing ownership of work processes and substantially improving the overall quality of the work.

2.55

Geoff Brown & Associates Limited consider that the new procedures:

... will address the deficiencies in the "how" component of Transpower's current maintenance policy documents and ensure that work by different contractors is undertaken to a consistent standard.

Responding to unplanned events

2.56

The core network design and contingency planning mean that Transpower is well placed to respond to unplanned events.

Core network design

2.57

The need for security of supply lies at the heart of New Zealand's grid. N-1 security describes the level of security required. N-1 security means that, at any particular location in the core grid, the loss of one system component can be tolerated without loss of service.

2.58

In practice, this means that, if an unexpected equipment loss occurs because of a lightning strike or a fault with substation equipment, the system is robust enough and has enough back-up capacity to keep transmitting electricity until the problem is fixed.

Designing for natural hazards

2.59

Transpower's design practices to cope with natural hazards have evolved over many years, taking into account the environment, the historical performance of past designs, and international good industry practice.

2.60

A management paper submitted to the Network Risk Committee in June 2008 examined how the assets had been designed to respond to wind, snow and ice, earthquakes, flooding, and lightning. Transpower's core grid lines and substations are designed and built to comply with international standards.

Contingency planning

2.61

Transpower's maintenance contractors prepare contingency plans to respond to various situations. We note from the Management Risk Committee's minutes that contingency plans are still being prepared for some substations but are in place for critical substations.

2.62

Transpower has three strategically located stores where spares are available. These spares include equipment such as circuit breakers, bushing, and relays. Emergency

towers are available for responding to major lines incidents.

Analysing significant incidents

2.63

Transpower has reviewed all significant incidents (those where there was a significant safety or security risk) to establish their causes, and made recommendations to prevent similar incidents occurring. These reviews were thorough and lessons were identified. Policies and procedures were reviewed to ensure that they reflected these lessons.

2.64

Transpower investigates accidents that cause serious injury and serious incidents affecting public safety or the power system to find their direct and indirect causes, make recommendations, and improve procedures.

4: PAS 55 is a Publicly Available Specification published by the British Standards Institution. This PAS gives guidance and a 28-point requirements checklist of good practices in physical asset management.

5: BW Consulting (2010), Transpower's asset management strategies and plans, page 7.

6: DuPont Operational Excellence: Review of Maintenance Practices & Expenditures Report, page 26.

7: BW Consulting (2010), Transpower's asset management strategies and plans.

8: Geoff Brown & Associates Limited (15 June 2011), Review of Transpower's Forecast Operating and Capital Expenditure for 2012-15, prepared for the Commerce Commission.

9: ITOMS is a consortium of international transmission companies that retains a consultant (UMS Group) to facilitate the International Operations and Maintenance Study. The study compares performance and practices in the transmission industry worldwide. The study compares the performance (including practices, service levels, and costs) of about 27 international transmission companies.

page top