Part 2: The opinions we issued in our audit reports

2.1

In this Part, we set out the results of the school audits completed between 1 November 2023 and 31 October 2024. Most were audits of schools’ 2023 financial year but some were audits for previous years, completed since our last report.1

2.2

We issued a standard, unmodified, audit report for most schools. This means that, in our opinion, the financial statements for those schools fairly reflect their transactions for the year and their financial position at the end of the year.

2.3

Some of our non-standard audit reports include modified audit opinions and some of them include paragraphs drawing the readers’ attention to important matters. We explain these further below.

Modified audit opinions

2.4

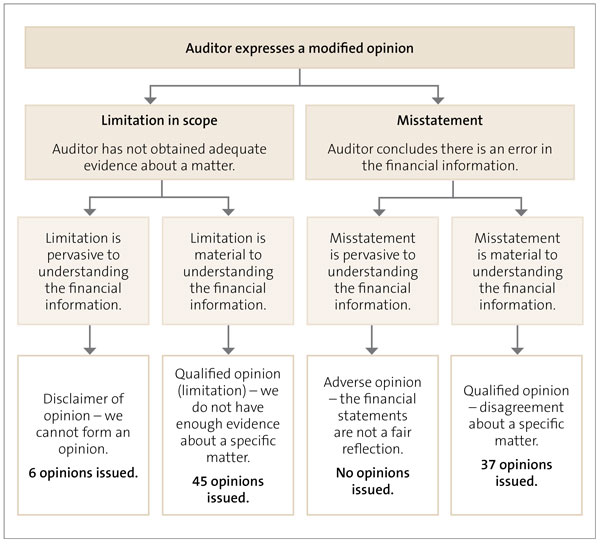

We issue modified audit opinions if we cannot get enough evidence about a matter or if we conclude that there is an error in the financial information that is significant enough to change a reader’s view of the financial statements.

2.5

Figure 2 explains the different types of modified audit opinions and why we issue them. It also notes the number of different types of modified audit opinions we have issued since our report on the results of the 2022 schools audits.

Figure 2

Explanation of the types of modified opinions that can be included in an audit report

2.6

Of the audits completed since we last reported, 88 (less than 4%) had a modified audit opinion. Of the 88 audit reports we issued, 25 related to previous-year audits.2

2.7

We explain the types of modified opinions that we issued below.3

Disclaimers of opinion – an overall lack of evidence

2.8

We issue a disclaimer of opinion when we cannot get enough audit evidence to express an opinion. This is serious because we cannot confirm that the school’s financial statements are a fair reflection of its transactions and balances. We issued disclaimers of opinion on the financial statements of six audits for four schools.

2.9

Figure 3 sets out the schools for which we issued a disclaimer of opinion and the years to which the disclaimer of opinion relates.

Figure 3

Schools with prior audit reports that included a disclaimer of opinion

| School | Financial year | Notes |

|---|---|---|

| Te Kura O Waikaremoana | 2016 and 2017 | The audits of the 2018 to 2023 financial statements have not been completed. We have yet to receive from the school financial statements for 31 December 2018 that are sufficiently complete for audit. |

| Harrisville School | 2017 and 2018 | Harrisville school was issued a qualified opinion for 2019 and an unmodified opinion for 2020. |

| Te Kura Kaupapa Maori O Manurewa | 2020 | The financial statements were prepared on a disestablishment basis because the kura was combined with another as at 2 October 2020 (see below). |

| Combined Board of Te Wharekura O Manurewa and Te Kura Kaupapa Maori O Manurewa | 2020 |

Te Wharekura o Manurewa and Te Kura Kaupapa Maori o Manurewa were both disestablished on 1 October 2020, and the Minister of Education established a combined board from 2 October 2020. The first audit of the combined board was completed for the period 2 October 2020 to 31 December 2020. The audits of the 2021 to 2023 financial statements have not been completed. |

2.10

We issued disclaimers of opinion for Te Kura O Waikaremoana for 2016 and 2017 because of instances of fraud. After an investigation by the New Zealand Police, the perpetrator was prosecuted and found guilty. School funds had been stolen and used to make personal payments, masked by creating fictitious invoices. We were unable to determine the full extent of the fraudulent records.

2.11

We also issued disclaimers of opinion for Harrisville School for 2017 and 2018 because of fraud. This matter was also investigated, and the perpetrator found guilty. We were unable to verify numerous transactions in the financial statements because either the school had not kept the supporting documents or the perpetrator had destroyed them. The lack of supporting documents also meant that the school did not comply with the Crown Entities Act 2004, which requires schools, as Crown entities, to keep appropriate accounting records.

2.12

We issued a disclaimer of opinion for Te Kura Kaupapa Maori O Manurewa for the period ended 1 October 2020 because it had not kept supporting documents that underpin the financial statements. The school also did not have adequate controls over expenditure, payroll, and the financial reporting process. We could not get enough audit evidence on which to base an opinion.

2.13

We issued a disclaimer of opinion for the combined board of Te Kura Kaupapa Maori O Manurewa and Te Wharekura O Manurewa. The issues with Te Kura Kaupapa Maori O Manurewa remained once the school combined with Te Wharekura O Manurewa – insufficient accounting records and supporting documents that underpin the financial statements. We were unable to get enough audit evidence on which to base an opinion for the period from its establishment on 2 October 2020 to 31 December 2020.

Qualified opinions – not enough evidence about aspects of the financial statements

2.14

We issue a limitation of scope opinion when we cannot get enough evidence about one or more aspects of a school’s financial statements. The audit report explains the aspect of a school’s financial statements for which we could not get enough audit evidence. We explain the types of limitations of scope that applied to 45 audit opinions we issued.

Not enough evidence about cyclical maintenance

2.15

Schools are required to maintain the buildings provided by the Ministry of Education or their proprietor (if they are a state-integrated school). Schools receive funding to maintain the property as part of their operations grant.

2.16

Certain types of maintenance, such as painting the exterior of school buildings, are needed only periodically. Schools must recognise the amount of their obligation to carry out this maintenance as a provision for cyclical maintenance in their financial statements.

2.17

The boards of schools are responsible for reviewing their cyclical maintenance provision and ensuring that it is based on the best information available. Auditing standards require our auditors to understand the method, assumptions, and data the school board used to estimate the provision.

2.18

We issued 26 audit opinions where there was a limitation in the scope of our audit because there was not enough evidence for auditors to form an opinion about cyclical maintenance. The absence of evidence means it is possible the provision for cyclical maintenance could be materially misstated. We reported 30 such limitations in our report on the 2022 school audit results and 26 in the report for the 2021 school audits.

2.19

A school can be uncertain about whether it needs to maintain its buildings because it has significant building works planned. Because of this, the school might not be able to estimate its future obligations for cyclical maintenance. In these cases, we expect the school to explain why it does not have a cyclical maintenance provision in its financial statements. Therefore, we do not issue limitation of scope opinions but draw attention to these disclosures in our audit report because we consider them to be useful information for readers.

2.20

We comment on schools where this was the case in paragraph 2.37.

Locally raised funds

2.21

If a school receives funds from its community (locally raised funds, donations, or canteen revenue), it is important that it has appropriate controls to correctly record all the money it receives.

2.22

We were unable to rely on the controls for recording locally raised revenue in nine schools and related organisations. We could not otherwise get enough evidence to make sure that the revenue from locally raised funds was fairly stated.

Other types of limitations of scope

2.23

There were 11 schools and related organisations where the scope of our audit was limited for one or more of these reasons:

- not having enough evidence about payments to relief teachers;

- not being able to confirm the payment of staff salaries;

- not having an accurate record of the Resource Teacher Learning and Behaviour income and expenditure in the financial statements;4

- not being able to determine the fair value of a building with weathertightness issues;

- not being able to determine the fair value of shares in another organisation; and

- not having assurance over comparative information reported in their financial statements.

Qualified opinions – disagreement about aspects of the financial statements

2.24

If a school has not prepared its financial statements in keeping with accounting standards or we consider the financial statements include a significant error, we issue an opinion that sets out where we disagree with the school.

2.25

As noted earlier, schools have an obligation to the Ministry of Education to keep the buildings in good order and repair. Some of the funding schools receive from the Ministry is to be used for that purpose.

2.26

There were 32 schools that did not record an adequate provision for the cyclical maintenance obligation they have to the Ministry. Of these, 25 are part of a Ministry-run programme to rebuild schools in Christchurch. Not all had the information needed to prepare a 10-year property plan and this made it difficult to include a reliable provision for cyclical maintenance in their financial statements.

2.27

Some of the 32 were for prior year audits. For the 2022 audits, we issued just one qualified opinion because there was no provision for cyclical maintenance. There were none for 2021, and just one for the 2020 audits.

2.28

We also disagreed with schools for other reasons.

2.29

There were audits of a school for two years where we disagreed with the school for not preparing consolidated (group) financial statements. We considered that group financial statements were required because the school controlled a related trust for financial reporting purposes.

2.30

We also disagreed with a school for not including full budgeted figures in its financial statements for three years. Having full budgeted figures is required by section 11(i) of the Education (School Planning and Reporting) Regulations 2023.

Matters that we drew readers’ attention to

2.31

In certain circumstances, we include comments in our audit reports to either highlight a matter referred to in the financial statements of a school or note a significant matter a school did not disclose.

2.32

These comments are designed to highlight matters (such as when schools are experiencing financial difficulties, there is information that is of public interest, or there has been a breach of legislation) to assist readers of the financial statements. They are not modifications of our audit opinion – the school has still received a “clean” audit opinion.

2.33

There were 65 comments in the audit reports we issued. We set out below the details of the matters that we highlighted.

Sensitive expenditure

2.34

Sensitive expenditure is any spending that could be seen as giving a private benefit to staff in addition to the business benefit. The principles that underpin decision-making about sensitive expenditure include that the spending has a justifiable business purpose, and that all such decisions will be subject to appropriate policies, authorisation, and controls. For schools, spending needs to contribute to educational outcomes for students and be made transparently and with proper authority.

2.35

We highlighted that Bream Bay College spent $24,426 on hospitality and gifts in 2023. This spending included $10,671 for the previous principal’s farewell ($5,610 of which was spent on jackets for the staff for school photos), $2,033 on gifts for the principal, and $5,611 for a new building opening. Although the expenditure was approved by the school board, we considered it relatively high for a school.

2.36

We highlighted that Owairoa School did not get prior approval from the Ministry of Education for some private use by the principal of a school-leased vehicle. The Ministry’s agreement is required if there is anything other than incidental personal benefit.

Uncertainty over maintenance requirements

2.37

We highlighted disclosures about uncertainties with cyclical maintenance provisions for four schools. One school was undergoing major capital works; one was part of a Ministry weathertightness project; and the other two schools were being relocated.

Reporting on whether schools followed laws and regulations

2.38

As part of our audits, we consider whether schools have complied with certain laws and regulations. This includes whether they have complied with financial reporting requirements, and some other specific obligations they have as public organisations.

2.39

The Education and Training Act 2020 and the Crown Entities Act 2004 are the main pieces of legislation that set out the accountability and financial management requirements of schools.

2.40

If a school fails to comply with aspects of the Education and Training Act and the Crown Entities Act, they usually disclose it in their financial statements. If a school does not disclose the non-compliance, or it is of particular significance, we highlight it in our audit report.

2.41

In the past year, we highlighted that eight schools failed to disclose that they had submitted the 2023 audited financial statements after the statutory deadline. Also, for 16 schools, we highlighted that they failed to disclose submitting previous years’ financial statements after the statutory deadline.

2.42

We highlighted that two schools breached legislation by meeting the costs of an international student through a scholarship. Legislation requires schools to charge fees for international students that at least cover the estimated costs of providing tuition and capital facilities.

2.43

We highlighted that a school had board members who did not comply with rules in sections 9 and 10 of Schedule 23 of the Education and Training Act about conflicts of interest. One board member who declared a conflict entered into a contract for more than $25,000 without the required approval of the Secretary for Education.

2.44

We highlighted that a school both borrowed more money than regulation 12 of the Crown Entities (Financial powers) Regulations 2005 allows, and breached the Education and Training Act 2020 by having an investment without the approval of the Ministers of Education and Finance.

2.45

We highlighted that a school did not have enough board meetings, did not complete an analysis of variance report, did not include its annual budget in the financial statements, and it had too many staff members on the board.

Schools in financial difficulty

2.46

Most schools are financially sound. However, each year we identify some schools that we consider could be in, or are at risk of, financial difficulty.

2.47

When we issue our audit report, we are required to consider whether the school has enough resources to operate for at least the next 12 months from the date of the audit report.

2.48

When carrying out our assessment, we look for indicators of financial difficulty. One such indicator is when a school has a working capital deficit. This means that, at that point in time, the school needs to pay out more funds in the next 12 months than it has immediately available. Although a school will receive further funding in that period, it might find it difficult to pay bills as they fall due, depending on the timing of that funding.

2.49

A school that goes into overdraft or has low levels of available cash is another sign of potential financial difficulty. Because we are considering the 12 months after the audit report is signed, we will also consider the performance of the school and any relevant matters in the period since the end of the financial year.

2.50

When considering the seriousness of any financial difficulty, we usually look at the size of a school’s working capital deficit against its operations grant. Although many schools receive additional revenue, this is often through donations, fundraising, or other locally sourced revenue. Therefore, it varies from year to year. For most schools, the operations grant is their only consistent source of income.

2.51

Not all schools with a working capital deficit at the balance date are in financial difficulty. When making this assessment, our auditors will consider other factors, including the financial performance since the end of the financial year.

2.52

When we have assessed that a school is in financial difficulty, we ask the Ministry of Education whether it will continue to support that school. If the Ministry confirms that it will continue to do so, the school can complete its financial statements on the basis that it will continue to operate.

2.53

If we consider a school to be in serious financial difficulty, we highlight this in the audit report. Figure 4 lists seven schools that received letters confirming the Ministry of Education’s support and shows whether they received such letters in the previous two years. In 2022, the same number of schools received a letter confirming the Ministry’s support.

2.54

Auditors raised concerns about potential financial difficulties in letters to 35 school boards. This was usually because continuing deficits were eroding the working capital they held.

Figure 4

Schools that needed letters of support to confirm they were a going concern

| School | Reason |

|---|---|

| Cambridge East School | The school had a working capital deficit of $270,000 for the year, which represents 31% of its operating grant, and an operating deficit of $45,260. |

| Matipo Road School | The school had a working capital deficit of $266,141 which represents 28% of its operating grant, and an operating deficit of $120,291 for the year. A letter of support was also needed in 2021 and 2022. |

| Ngakonui Valley School | The school had a working capital deficit of $24,884 for the year which represents 5% of its operating grant, an operating deficit of $30,772 and negative equity of $24,864. A letter of support was also needed in 2022. |

| Pouto School | The school had a working capital deficit of $41,462 for the year which represents 22% of its operating grant, and an operating deficit of $78,480. |

| Taumarunui Primary School | The school had a working capital deficit of $92,931 for the year which represents 10% of its operating grant, and an operating deficit of $167,313. |

| Wallacetown School | The school had negative net assets of $13,458 due to ongoing deficits and working capital surplus of $22,852. |

| Te Kura o Ōmanaia | The school had a working capital deficit of $64,645 for the year which represents 16% of its operating grant, and an operating deficit of $41,537. |

Going concern

2.55

We highlighted disclosures in a school and in an organisation related to a school about uncertainties over their future financial sustainability.

Cash not banked in a timely manner

2.56

Although the amounts were not significant, we highlighted that a school did not bank cash received during 2021 to 2023 in a timely manner or investigate discrepancies between cash received and banked throughout this period.

Closed schools

2.57

When a school closes, or is due to close, its financial statements are prepared on a disestablishment basis. In seven audit reports we highlighted disclosures outlining that the financial statements were, appropriately, prepared using the disestablishment basis. The schools either stopped operating or were combined with another to form a new school.

1: Our Results of the 2022 school audits report was published in December 2023.

2: This includes four audit reports that refer to a qualification on the previous year’s figures.

3: These audit reports are for 2023 unless noted otherwise.

4: The Resource Teachers: Learning and Behaviour service provides specialist teacher support for tamariki in Years 1 to 10.