Setting rates: Potential issues for councils to watch for

Councils will soon be setting rates for 2022/23. We want to make councils aware of some rate-setting issues we saw when reviewing a small sample of rates set for 2021/22.

Legal requirements for councils when setting rates

Councils’ power to set rates is essentially a power to tax people to pay for the costs of delivering the services that councils provide. There are tightly prescribed legal rules about how that power must be used and what kinds of rates can be set. These rules are set out in the Local Government Act 2002 (the LGA) and in the Local Government (Rating) Act 2002 (the Rating Act). For councils, failing to comply with rating law and the associated accountability requirements can create legal and financial risks.

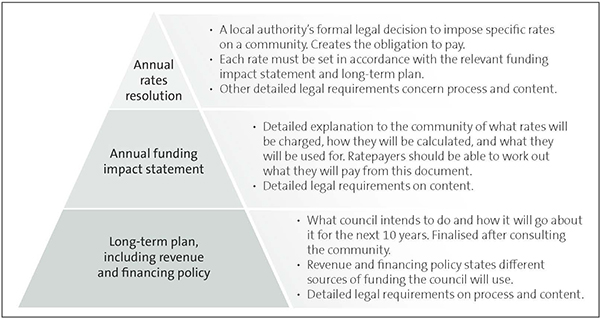

There are three main documents for rates setting:

A council’s rates resolution follows the directions and policies established by the revenue and financing policy (included in the long-term plan) and the detailed information and explanations in the annual funding impact statement (see Figure 1).

It is vital that these formal documents are consistent with each other and meet the legal requirements.

Critical points to note

It is essential that councils:

|

Figure 1

The revenue and financing policy

Every three years, a council prepares a long-term plan, which sets out broad plans for what the council is intending to do, how it will go about it, and how it will fund it. The revenue and financing policy in the long-term plan states the different sources of funding the council will use to fund operating expenses and capital expenditure.

Councils cannot take a different approach without changing the policy through the proper process.

When a council sets rates each year, the Rating Act requires them to be in line with the long-term plan. This requirement covers the activity and use of funds that fit within the long-term plan and the proposed source of funding and means of raising revenue signalled in the long-term plan.

The LGA requires the revenue and financing policy to include specific information on rates. This information is part of the legal foundation for properly setting rates each year. If information is missing, the legality of a rate could be at risk.

The funding impact statement

Each year, a council adopts a funding impact statement as a central part of its planning. The funding impact statement is contained in the council’s annual plan or long-term plan (in a long-term plan year). The LGA sets out the disclosures required in the funding impact statement.

In effect, the funding impact statement tells the community what that year’s rates will be, how they will be calculated, and what they will be used for.

The rates resolution

A council’s rates resolution is critical to setting rates. The rates resolution is how the council formally authorises specific rates imposed on the community each year. The Rating Act sets out the procedure that councils must follow when setting annual rates.

Complying with the detail of the Rating Act is vital. If the rate is not within the range of options and restrictions provided for in the Rating Act, it might not be valid. Therefore, councils need to be meticulous in ensuring that their formal processes for resolving to set rates comply with the procedural requirements and that their rates resolutions are legally effective.

Inconsistencies between the rates resolution and the revenue and financing policy

The requirement for consistency between the rates resolution, the funding impact statement for the year, and the revenue and financing policy in the long-term plan is fundamental. This consistency links community consultation to the rates that ratepayers are required to pay.

As well as ensuring that the rates resolution is in line with the funding impact statement, councils need to ensure that the rates resolution is in line with the long-term plan, that each rate fits within the council’s revenue and financing policy, and that the revenue and financing policy properly supports the rates resolution.

For example, one council set a targeted rate for broadband infrastructure in a particular area. We could trace this back to the funding impact statement but could not find anything in the revenue and financing policy about this activity or a targeted rate as a source of funding for it.

Inconsistencies between the funding impact statement and the rates resolution

Every rate in the annual rates resolution must be covered in the council’s funding impact statement for that year. There must be enough background detail to allow ratepayers to work out what rates they will have to pay.

Gaps in the funding impact statement information could put the rate at legal risk. Similarly, if the wording and specification of the rates in the rates resolution differs from the wording of the funding impact statement, that difference could raise questions about the legality of the rates.

These are some of the inconsistencies that we have seen:

- One council’s rates resolution had a targeted rate for refuse collection that was not included in the funding impact statement, although the funding impact statement did include a table of properties for which the rate was set.

- One council used different figures for five rates in the rates resolution than those set out in the funding impact statement.

- Another council provided a definition in its funding impact statement for a “rural” differential category but used the term “rural and defence” to describe this category of land for the purposes of its general rate and two targeted rates. The council then used the term “rural” in its rates resolution.

- Another council’s targeted rate for metered water was set as a fixed amount per cubic metre supplied in excess of 82 cubic metres per quarter in the funding impact statement, but in excess of 207 cubic metres per quarter in the rates resolution.

- One council’s water metered rate in the rates resolution didn’t line up with what the funding impact statement said. The funding impact statement referred to “large volume users depicted as consumers using more than 2,000 cubic metres per quarter” and said that the charges in excess of 80 cubic metres would be per separately used or inhabited part of a rating unit. The rates resolution set a rate for “extraordinary users” (without defining the term) per cubic metre for quantities in excess of 80 cubic metres but did not refer to the rate being per separately used or inhabited part of a rating unit.

- Another council named some rates “Township Amenity Rates” in the funding impact statement, but “Local Amenity Rates” in the rates resolution.

- The same council’s funding impact statement said that the local amenity rates would be set as a rate in the dollar based on the land value of each rating unit, but for two of these local amenity rates the rates resolution did not specify that land value was a factor for calculating the rate liability.

- That council’s funding impact statement also described differential categories for some sewerage rates as “connected” and “serviceable”, with “serviceable” defined by reference to distance to the sewerage reticulation. The funding impact statement noted that “The charging of a serviceable rate does not require us to make a connection available to a rating unit.” However, the rates resolution used the term “connection availability” rather than “serviceable” – potentially confusing, especially given the note in the funding impact statement.

Terminology

It is important that councils use the correct terminology in their rates documents. Ratepayers should be able to read these documents and be clear about the rates set and how they have been set.

Funding impact statements should be clearly identifiable in the council’s long-term plan or annual plan. For example, one council called its funding impact statement “Rating System and Information”. “Funding impact statement” is a statutory term that should be used consistently.

Another council called some of its targeted rates “charges” in both the rates resolution and the funding impact statement. The Rating Powers Act 1988 (repealed in 2003) listed miscellaneous charges that were deemed to be rates; it also referred to “rating systems”.

It is disappointing that councils continue to use incorrect terminology from previous rating legislation – we commented on this in our report Local government: Results of the 2016/17 audits.

General rate

A general rate is set either at a uniform rate in the dollar of rateable value for all rateable land in the council’s district or at different rates in the dollar of rateable value for different categories of rateable land in the council’s district.

Whether the general rate is set uniformly or differentially, a council must use annual value or capital value or land value as the rateable value for the land (section 13(3) of the Rating Act). So, for example, a council that sets its rate differentially cannot use capital value for one category of land and land value for another category. Nor can a council use a mix of capital value and land value as the rateable value.

The rateable value of the land for the purpose of the general rate must be identified in the funding impact statement. The rates resolution must use that same rateable value.

If the general rate is to be set differentially, the funding impact statement must say this, and must also state (clauses 15 and 20 of Schedule 10 of the LGA):

- the categories of land to be used (defined in terms of one or more of the matters listed in Schedule 2 of the Rating Act); and

- the objectives of the differential rate, in terms of the total revenue sought from each category of rateable land or the relationship between the rates set on rateable land in each category.

The rates resolution must use the same categories of land (section 14 of the Rating Act).

Councils that elect to state the objectives of the differential rate in terms of the relationship between the rates set on rateable land in each category, rather than the total revenue sought from each category, should ensure that the relationship is explained in sufficient detail for ratepayers to understand.

Targeted rates – set for activities or groups of activities

For each targeted rate, the funding impact statement must specify the activities or groups of activities for which the targeted rate is to be set (section 16 of the Rating Act and clauses 15 and 20 of Schedule 10 of the LGA).

Some councils we looked at appear to rely on the name of the rate to meet this requirement, but it is not always clear from the name of the rate what activities the rate is set for. For example, one council’s funding impact statement referred to a “CBD Redevelopment” targeted rate without further explanation. From looking at the council’s revenue and financing policy, it seems that this rate was set for roading – something that was not apparent from its name or its location in the funding impact statement.

Targeted rates – defining categories of rateable land

Councils have flexibility when setting targeted rates. A targeted rate may be set in relation to:

- all rateable land in the council’s district, on a uniform basis (all rateable land in the district pays the targeted rate, and all pay the same amount);

- all rateable land in the council’s district, differentially for different categories of rateable land (all rateable land in the district pays the targeted rate, but different categories pay different amounts);

- one or more categories of rateable land, on a uniform basis (only a specified category or categories of rateable land pay the targeted rate, but all that pay do so at the same rate);

- one or more categories of rateable land, differentially for different categories of rateable land (only a specified category or categories of rateable land pay the targeted rate, and the categories pay different amounts).

Categories of rateable land must be identified in the council’s funding impact statement as categories for setting the targeted rate. They must be defined in terms of one or more of the matters listed in Schedule 2 of the Rating Act (section 17 of the Rating Act and clauses 15 and 20 of Schedule 10 of the Act).

“Where the land is situated” is a Schedule 2 matter that councils can use to define categories of rateable land. If a council’s funding impact statement does not include maps or otherwise describe the boundaries of each area, we would expect the funding impact statement to explain where a ratepayer can find this information, so they can tell which category their rating unit falls into.

For example, one council referred to “Business Area A” and “Business Area B”, but there was no information in the rates resolution, the funding impact statement, or the revenue and financing policy about the boundaries of these business areas.

If the targeted rate is set differentially, the funding impact statement must state the total revenue sought from each category of rateable land or the relationship between the rates set on rateable land in each category (clauses 15 and 20 of Schedule 10 of the Act).

Targeted rates – permitted factors for calculating rate liability

Councils also have flexibility when calculating liability for a targeted rate (how much the ratepayer must pay).

Liability for a targeted rate may be calculated (section 18 of the Rating Act):

- as a fixed amount per rating unit (section 18 of the Rating Act); or

- using a factor or factors listed in Schedule 3 of the Rating Act.

The factor or factors used for calculating liability for a targeted rate must be identified in the funding impact statement as factors that must be used to calculate the liability for the targeted rate (section 18 of the Rating Act and clauses 15 and 20 of Schedule 10 of the Act).

If a targeted rate is set differentially, it does not have to be calculated using the same factors for each category of land.

Note that although a targeted rate for water supply may be set for the quantity of water provided (section 19 of the Rating Act), “volume” or “quantity” is not a factor that may be used in calculating liability for other targeted rates. And although the number of water closets and urinals within the rating unit is a factor listed in Schedule 3 of the Rating Act, a rating unit used primarily as a residence for one household must not be treated as having more than one water closet or urinal.

It should be clear from reading the funding impact statement which Schedule 3 factors are being used to calculate liability for a rate.

One council we looked at set three rates as being “per residential equivalent”, which is not terminology used in Schedule 3. The description in the funding impact statement for one of these rates (sewage treatment) said that a residential equivalent was assumed to be discharge of 600 litres/day and that properties assessed as having multiple residential equivalents would be charged multiple charges based on assessed volume of discharge.

This could suggest that volume was being used as a factor to calculate liability. But the description for the other two rates (for a particular sewerage scheme) suggested that the factor used for calculating liability was the extent of provision of any service to the rating unit by the council, which is a factor listed in Schedule 3.

Another council set targeted rates for some sewerage schemes as being “per household unit equivalent”. The definition for household unit equivalent explained that it corresponded to the extent of provision of the service to the rating unit as objectively measured by floor area. The area of floor space of buildings within the rating unit is a factor listed in Schedule 3, but we found the definition quite complicated.

Finally, if the number of separately used or inhabited parts of the rating unit is used as a factor for calculating liability for a targeted rate, the funding impact statement must state the council’s definition of “separately used or inhabited part of a rating unit” (clauses 15 and 20 of Schedule 10 of the Act). All the councils we looked at did this.

Due date for rates

The rates resolution must state the date on which the rate must be paid, or dates if the rate is payable in instalments (section 24 of the Rating Act). The purpose of this requirement is to ensure that ratepayers know the dates rates are to be paid.

For example, one council’s rates resolution stated that the water consumption rates “will be invoiced twice during the year and the due dates for payment will be 30 days from the date of each invoice being issued”. We do not consider this sufficient – the rates resolution must state the actual date on which the rate must be paid.

Changes to rating units during the year

Rates must be assessed according to the information in the rating information database as at the end of the financial year immediately before the financial year for which the rates are set (section 43 of the Rating Act).

The rates resolution for one council purported to set a sewerage scheme targeted rate on each connected rating unit “including those that will be connected during the year”. This is not permitted under the Rating Act.

The 30% cap

When drafting its funding impact statement, a council should identify the rates revenue it is seeking for that year from:

- its uniform annual general charge; and

- targeted rates that are set on a uniform basis and are calculated as a fixed amount per rating unit or separately used or inhabited part of a rating unit (excluding targeted rates that are set solely for water supply or sewage disposal).

It is important for the council to be clear on what these rates are and the revenue sought from them because councils must not seek more than 30% of the total rates revenue for the year from these rates (section 21 of the Rating Act).

For example, with reference to the 30% cap, one council’s funding impact statement set out what percentage of total rates revenue they sought from the uniform annual general charge. However, this council also set a targeted rate for libraries and swimming pools as a fixed amount per rating unit in the district. The revenue from this rate also needed to be taken into account when considering the 30% cap (and it looks like it was in this case, although that is not what the council described).

Defence land

The total amount of any rates assessed as general rates or targeted rates on defence land must not exceed the amount of the rates that would otherwise have been assessed if they had been calculated on the land value only (section 22 of the Rating Act).

If a council with defence land in its district sets a general rate with capital value as the rateable value, the council must nevertheless assess the amount of the general rate using land value. The same is true for targeted rates, but the caveat here is that, for a general rate, the council must use annual value or capital value or land value as the rateable value for the land. So the council must not purport to set (as opposed to assess) the general rate for defence land using land value if the general rate is set using capital value for all other categories of land.

This is a tricky technical point that the council should briefly explain in the funding impact statement and rates resolution.

The Auditor-General’s role in relation to rates

Rates are a significant component of the revenue of a council. This is reflected in the audited financial statements in the annual report. As part of the annual audit, an auditor seeks reasonable assurance that rates revenue has been properly calculated and that there is no major risk to collecting rates. This requires the auditor to consider whether the legal requirements for setting and charging the main rates appear to have been followed properly.

However, an auditor’s work on rates cannot be taken as equivalent to a full legal review of how well the council complied with aspects of rating law for every rate and from the perspective of every ratepayer.

Sometimes, an audit will identify that a council is not complying with a legal requirement. However, that is an additional benefit of the auditor’s work rather than the main purpose. It does not mean that an audit removes the need for a council to ensure that it complies with all legal obligations.

We encourage councils to get external, independent legal advice on their compliance with rate-setting legislation and their legal risk.