Part 5: The audit reports we issued

5.1

In this Part, we discuss the audit reports we issued on the 2021-31 consultation documents. We cover the:

- types of audit reports that can be issued;

- audit reports we issued compared to previous consultation document rounds;

- adverse audit opinion we issued for Palmerston North City Council; and

- main reasons we included emphasis of matter paragraphs in our audit reports, including uncertainties about the:

The types of audit reports that can be issued

5.2

An audit report will be either standard or non-standard.14 A non-standard audit report is one that contains:

- an adverse opinion; and/or

- a qualified audit opinion; and/or

- an emphasis of matter paragraph; and/or

- an "other matter" paragraph.

5.3

An adverse opinion is quite rare and means that the auditor disagrees with the entity. It indicates that, in the auditor's professional opinion, the underlying information and assumptions in the consultation document were unreasonable (we cover this in more detail in paragraphs 5.15 to 5.20).

5.4

When an auditor expresses a qualified audit opinion because of a disagreement it means that whatever the auditor disagrees with, it matters, but is not pervasive. A qualified opinion can also be called a modified opinion.

5.5

An adverse opinion and qualified opinion can also be called a modified opinion.

5.6

An auditor will include an emphasis of matter paragraph or an "other matter" paragraph in the audit report to draw attention to:

- a breach of law; or

- a matter or matters presented or disclosed that are of such importance that they are fundamental to readers' understanding of the audited information.

5.7

An emphasis of matter paragraph does not necessarily mean that the auditor has found anything wrong. Instead, the auditor wants to draw the readers' attention to a matter or matters that are fundamental to understanding – in this case – the consultation document.

5.8

An audit report can contain more than one modification or more than one emphasis of matter paragraph.

We issued more non-standard audit reports than in previous rounds

5.9

Figure 11 shows the audit reports we issued on consultation documents compared to the previous two consultation document rounds.

Figure 11

The types of audit reports issued on the 2021-31 consultation documents, compared with the 2015-25 and 2018-28 consultation documents

| Audit report issued | 2021-31 | 2018-28* | 2015-25 |

|---|---|---|---|

| Adverse | 1 | 0 | 0 |

| Qualified audit opinion ("except-for" opinion) | 10 | 0 | 0 |

| Unmodified audit opinion that included an emphasis of matter paragraph** | 60 | 7 | 6 |

| Unmodified audit opinion that included an "other matter" paragraph | 0 | 0 | 2*** |

| Standard audit report | 7 | 70 | 70 |

* We did not audit the consultation document prepared by Kaikōura District Council in 2018. An order in Council in March 2018 allowed the Council to prepare a customised unaudited three-year plan due to the exceptional circumstances arising out of the 2016 Kaikōura earthquake.

** As noted in paragraph 5.8, one audit report can contain more than one emphasis of matter paragraph. We issued 121 emphasis of matter paragraphs in total. Full details for each council can be viewed in the Appendix.

*** Unmodified with "scope clarification". We expressed no opinion on some matters contained in two councils' consultation documents. These were for Upper Hutt City Council (relating to statements about a possible amalgamation) and Napier City Council (relating to statements about a Local Government Commission report about potential amalgamation issues).

Source: Our analysis of the consultation documents audit reports.

5.10

Of the 78 consultation documents we audited, only seven (9%) audit reports were standard.

5.11

The seven councils that received a standard audit report were all regional councils. This reflects the decision we took to include an emphasis of matter paragraph for all territorial authorities and Greater Wellington Regional Council that were affected by the uncertainty of the three waters reforms (for more detail, see paragraphs 5.21 to 5.25).

5.12

We issued qualified audit opinions on 10 consultation documents. For the 2018-28 and the 2015-25 consultation documents, we did not issue a qualified audit opinion on a consultation document.

5.13

The 10 councils that received a qualified audit opinion ("except-for" audit opinion) also had at least one emphasis of matter paragraph included in its audit report.

5.14

Sixty audit reports included at least one emphasis of matter paragraph. These emphasis of matter paragraphs highlighted disclosures of uncertainties about:

- the proposed Three Waters Reform Programme (see paragraphs 5.21 to 5.25);

- delivery of the proposed capital expenditure programme (see paragraphs 5.26 to 5.35);

- condition and performance of assets (see paragraphs 5.36 to 5.47); and

- funding and financing assumptions (see paragraphs 5.48 to 5.57).

We issued one adverse audit opinion

5.15

We issued an adverse audit opinion on Palmerston North City Council's consultation document.

5.16

We determined that Palmerston North City Council's consultation document did not provide an effective basis for public participation in the Council's decisions about the proposed content of its 2021-31 long-term plan. This was because, in the auditor's opinion, the underlying information and assumptions in the consultation document were unreasonable.

5.17

The Council had included an upgrade to its wastewater treatment plant from year four of its long-term plan. Concurrently with consultation on the long-term plan, the Council was engaged in public consultation about which environment the water would be returned to after treatment and the anticipated annual cost for each household associated with each option. At that time, there was no certainty about the proposed three waters reforms, including whether the Council would be financially responsible for the upgrade. This meant that the Council made the decision, in the interests of transparency, to include the anticipated costs in its long-term plan.

5.18

However, the underlying information and assumptions on which Palmerston North City Council's consultation document were based were inconsistent with the Council's own financial strategy. The Council had adopted a financial strategy that capped the Council's debt at 200% of revenue. With the inclusion of the wastewater treatment plant upgrade, the forecasts underlying the consultation document showed that the Council planned to exceed its own debt cap after year four of the long-term plan (and was forecasting to exceed the debt limits set by the New Zealand Local Government Funding Agency after year five). Further, the Council disclosed in its consultation document that it would be highly unlikely that lenders would be prepared to lend the amounts that were included in the underlying information.

5.19

In our view, this meant that Palmerston North City Council did not have a credible plan for funding its activities and planned projects. In our view, the Council needed to consider other options, such as reducing levels of service, removing or deferring planned projects, and increasing rates further to keep debt amounts within its own parameters.

5.20

We determined that the consultation document would not provide an effective basis for public consultation because of the unreasonable assumptions and underlying information and the inconsistencies with the Council's own financial strategy.

Uncertainty over the proposed Three Waters Reform Programme

5.21

The Government's Three Waters Reform Programme aims to reform local government's three waters service delivery arrangements.

5.22

The Three Waters Reform Programme proposes to create four publicly owned multi-regional entities that have the scale, expertise, operational efficiencies, and financial flexibility to provide three waters services. Currently, most three waters services are provided by territorial local authorities.

5.23

At the time of preparing the consultation documents, the Government had publicly announced its proposal to reform three waters service delivery. However, the reform proposal was not yet fully developed. Additionally, the Government made it clear that assets would remain owned by the community if the reform progressed. Therefore, Taituarā – Local Government Professionals Aotearoa recommended that councils should continue to forecast the three waters services in their underlying information as if they would continue to own three waters assets for the period covered by their plan. This recommendation was followed by the relevant councils. The councils disclosed the uncertainty surrounding the three waters reforms and the basis on which they had prepared their underlying information.

5.24

We supported this approach because, in our view, there was no alternative reasonable and supportable assumption in respect of three waters reform.

5.25

Given three waters infrastructure is significant to most councils, we determined that where a council had significant three waters assets, we expected the audit report to include an emphasis of matter paragraph. This resulted in 67 local authorities (or 86% of all councils) receiving an emphasis of matter paragraph to draw attention to the council's own disclosures on the uncertainty over the proposed Three Waters Reform Programme and the basis on which the underlying information had been prepared.

Uncertainty about the delivery of the proposed capital expenditure programme

5.26

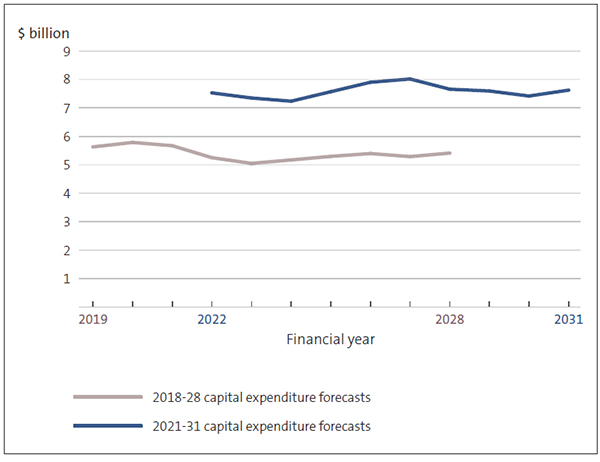

In the 2021-31 consultation documents, councils planned a significant increase in capital expenditure (see Figure 12).

Figure 12

Councils' proposed capital expenditure forecasts, as reported in the 2021-31 consultation documents

Source: Our analysis of the 2021-31 consultation documents.

5.27

As well as councils planning to deliver more than they have in the past, the current operating environment is contributing to the uncertainty of delivery of capital expenditure programmes. Councils are competing in an already constrained contracting market, and the sector as a whole is competing with the rest of New Zealand. Covid-19 and lockdowns are likely to affect progress in some areas as well as potential supply chain delivery issues affecting resource availability.

5.28

In the past, most councils have not delivered on their total capital expenditure budgets.15

5.29

Many councils demonstrated that they were working to better deliver on their capital expenditure budgets. Steps taken included recruiting additional or specialist staff, such as project management staff, getting the required consents in place early, or working with other councils. However, this is not a guarantee that the significant increase would be delivered.

5.30

Most councils were aware of the constrained operating environment and potential delivery issues. They made appropriate disclosures around these uncertainties in their consultation documents. We included an emphasis of matter paragraph in 22 council audit reports, which drew attention to the uncertainty over the delivery of their capital expenditure programmes.

West Coast Regional Council's audit qualification

5.31

West Coast Regional Council received a qualified audit opinion because it could not provide our auditor with sufficient evidence to support the capital spending assumptions the Council had made.16

5.32

The Council had planned to spend $30.9 million on its flood and erosion protection assets during the first two years of its plan (compared to delivering an actual spend of $3.5 million on capital works in 2020 and $1.9 million in 2019).

5.33

In its underlying information, West Coast Regional Council had assumed that it would have the required resources, contracted services, and resource consents in place to complete the projects in time.

5.34

We considered that there were risks to delivery of the capital programme, particularly in years 1 and 2 of the forecast period. This was because there was a significant increase in work planned compared to previous delivery, contractors had not yet been awarded most projects, and recent flooding events in the region were likely to further affect contractor availability.

5.35

If West Coast Regional Council were unable to deliver on the planned projects, it could affect the intended levels of service and the community.

Uncertainty over asset condition and performance information used to inform renewals forecasts

5.36

When auditing the underlying information that informed the consultation documents, our auditors consider whether councils have sufficient information about their assets to inform their forecasts.

5.37

In every asset network, there are "critical assets" that will need to be managed to ensure that they do not fail. In a water network, a critical asset would be the water treatment plant. In a roading network, a critical asset might be the main bridges needed for transport through a district. The flood protection works protecting other critical infrastructure (like a hospital or an airport) could be another example of critical assets.

5.38

To manage these critical assets well, good asset information is needed. This information includes the condition of the assets and their current performance. For less critical assets, good asset condition and performance information is not needed to the same level. This is primarily because there is a less adverse impact if the asset fails unexpectedly.

5.39

After the audit of the 2018-28 long-term plans, we recommended that councils increase their knowledge about the condition and performance of critical assets to better inform decisions about when to invest in asset renewals.17

5.40

Much of New Zealand's infrastructure was built in the 1950s and 1960s. This infrastructure is now reaching – or fast approaching – the end of its useful life. This increases the risk that assets will fail. Poor management of assets has real costs to communities. Poor investment decisions can mean using resources that could have funded other priorities or result in unnecessary expenditure if assets are replaced before they need to be.

5.41

In the 2021-31 long-term plans and their associated consultation documents, we expected councils to have improved their asset information. We communicated with councils about what we expected, most recently in a bulletin to elected members about good asset management.

5.42

Our auditors assessed whether councils had enough condition and performance information about their assets. In the absence of this information, our auditors considered whether there was other information that provided assurance that the council had forecast renewals at an appropriate level. What is appropriate depends on how sophisticated a council's asset networks are. This included a council having:

- suitable, reliable age, and remaining useful life information for its assets;

- information about the rate of failure of its assets (that is, what is the actual performance information showing); and

- forecast to adequately reinvest in their affected asset class.

The modified audit opinions we issued

5.43

We issued two qualified audit opinions (Wellington City Council and Gore District Council) for the information that councils held in respect of asset condition and performance.

5.44

Wellington City Council received a qualification because it did not use condition information to inform the renewals of its three waters assets. Given the ageing three waters assets and several high-profile asset failures, we considered the Council's approach of using asset age alone to inform its asset renewals was unreasonable. We considered that the Council's approach could lead to further asset failure, resulting in reduced levels of service and greater than forecast costs.

5.45

Gore District Council received a qualification because there was a lack of condition and age information for its water supply and wastewater assets. The Council was also unable to demonstrate the availability of other information. Unfortunately, the Council had lost its asset information in a fire in the 1950s and it could not be reproduced.

5.46

Waitaki District Council also received a qualification related to the extent of disclosures made in its consultation document about the management of its assets. In particular, the Council did not explain its approach to maintaining and renewing its three waters assets. A council is required by the Act to disclose the matters of public interest relating to the proposed content of the infrastructure strategy.

5.47

We also included 12 emphasis of matter paragraphs in our audit reports because there was a high degree of uncertainty about how these councils had determined their asset investment. These councils based their forecasting of investment needs for assets or critical asset classes primarily on age information. In our view, not using condition information in forecasting asset renewals means that there is a higher degree of uncertainty on how a council has determined its investment needs. This includes the risk that unbudgeted expenditure might be required to pay for renewals required earlier than planned. This could result in an increased risk of disruption in services.

Uncertainty over funding and financing assumptions

5.48

We issued six qualified audit opinions that related to funding assumptions made by:

- Ashburton District Council;

- Buller District Council;

- Hauraki District Council;

- Horowhenua District Council;

- Kawerau District Council; and

- Wellington City Council.

5.49

These councils had assumed that a significant portion of funding would be provided from an external source. When significant funding assumptions like that are made, we expect the assumption to be adequately supported – for example, by having an agreement or contract already in place or taking active steps to secure funding. We would also consider a council's ability to secure similar funding in the past.

5.50

Additionally, if a council is assuming it will receive funding from central government, we expected that there were relevant appropriate funds available. For example, we considered councils' forecasting funding from Waka Kotahi NZ Transport Agency for road maintenance as being reasonable because this is a known source of local government funding. When there are no such known funds, we considered such an assumption to be unreasonable.

5.51

For these six councils, we determined that the funding assumptions they made were unreasonable because they were unable to provide our auditors with the appropriate level of evidence.

5.52

We also included 15 emphasis of matter paragraphs in our audit reports relating to funding and financing assumptions.

5.53

For 10 of these emphasis of matter paragraphs, councils had made assumptions that external funding would be provided but it had not yet been sought or agreements were not yet in place. However, our auditors were able to ascertain that those councils had a good history of being able to obtain philanthropic or grant funding, those sources were available, and they had clearly disclosed the risk of not achieving funding and what the alternative options would be.

5.54

Auckland Council's audit report for its consultation document included an emphasis of matter paragraph drawing attention to specific assumptions in its financial forecasts that were subject to higher levels of uncertainty. For example, assumptions about Covid-19 border controls remaining to 2022, government capital subsidies for Auckland Transport remaining at the same rate as previously agreed, and asset recycling targets being met. We noted that changes in any of the assumptions could require the Council to reduce its capital expenditure programme or could result in reduced levels of service.

5.55

For Hamilton City Council and Rangitīkei District Council, emphasis of matter paragraphs were included in our audit reports to draw attention to those councils' proposed cost savings plans. Both councils had plans to pursue operational efficiencies resulting in significant savings. The consultation documents detailed that if the councils were unable to achieve the planned savings, then future debt levels, levels of service, and/or ultimately rates rises could be affected.

5.56

Our audit report on Queenstown Lakes District Council's consultation document included an emphasis of matter paragraph because the Council had forecast the introduction of a visitors levy from 2024 to fund visitor-related infrastructure. The preparation of the required legislation to collect such a levy was put on hold due to Covid-19 and uncertainty about when the borders will open and international tourism will return. The consultation document set out that if the proposed visitor levy is unavailable from 2024, the Council will not be able to collect this revenue and its related capital work programme would be significantly affected or rates would need to increase.

5.57

For the details of each non-standard audit report issued see the Appendix.

14: For a plain English explanation of the different forms of audit reports, see our blog post the kiwi guide to audit reports at oag.parliament.nz.

15: For example, see Office of the Auditor-General (2021), Insights into local government: 2020, Part 2.

16: This was not the only qualification that Westcoast Regional Council received (see the Appendix).

17: Office of the Auditor-General (2019), Matters arising from our audits of the 2018-28 long-term plan, page 7.