Part 4: The non-participation rule

4.1

In this Part, we explain the non-participation rule and how it affects your ability to discuss or vote on matters in which you have a financial interest. In particular, we discuss:

- some points about the non-participation rule;

- how to determine whether you have a financial interest;

- the meaning of "financial interest";

- how to determine at which stage in the decision-making process you have a financial interest;

- the meaning of "interest in common with the public";

- exceptions to the non-participation rule;

- the Auditor-General's role to grant exemptions or issue declarations; and

- managing compliance with the non-participation rule.

4.2

We also provide answers to some frequently asked questions about the non-participation rule at the end of this Part.

Summary of the non-participation rule

4.3

You must not take part in the discussion of, or vote on, any matter before your local authority in which you have a financial interest unless:26

- your interest is "in common with the public";

- one of the exceptions to the non-participation rule applies;

- you apply to us and are granted an exemption allowing you to participate; or

- you apply to us and we issue a declaration authorising you to participate.

4.4

It is an offence under the Act to discuss or vote on any matter before the local authority in breach of the non-participation rule. If convicted, you will be automatically disqualified from office.27 You will have a defence if you can prove that, when you took part in the discussion of, or voted on, the matter, you did not know and had no reasonable opportunity of knowing that you had a financial interest in that matter other than an interest in common with the public.

Some points about the non-participation rule

The non-participation rule is stricter than the equivalent rule in other legislation

4.5

It is important to understand that the non-participation rule under the Act is stricter than the equivalent rule in other legislation such as the Companies Act 1993 or the Crown Entities Act 2004.

4.6

For example, under the Companies Act, directors of a company must declare their interests, but they are not necessarily prohibited from participating in decisions about matters they have an interest in.

4.7

This is not the case for those to whom the Act applies. Under the Act, if you have a financial interest in a matter, it is not enough to declare it. You also cannot participate in any discussion or voting on the matter unless one of the conditions in paragraph 4.3 applies.

The non-participation rule applies only to financial interests, but that does not necessarily mean you can participate if your interest is not financial

4.8

The Act covers only financial interests. Although other types of interest are not covered by the Act, they are still subject to the common law rules that regulate conflicts of interest and bias in the public sector.

4.9

This means that you do not have to worry about the non-participation rule if you have a non-financial interest in a matter. However, you still need to consider whether it is lawful and appropriate for you to participate in the local authority's decision-making under the common law and/or as a matter of ethics and good practice.

4.10

For guidance on non-financial conflicts of interest, and how they might affect your ability to participate in decision-making, see our good practice guide Managing conflicts of interest: A guide for the public sector.

Determining whether you have a financial interest

4.11

When determining whether you have a financial interest in a matter that might prohibit you from discussing or voting on it, you should ask yourself these questions:

- What is the matter under discussion or what is the decision I am being asked to make?

- Do I have a financial interest in that matter or decision?

- Is my interest in common with the public?

- Do any of the exceptions in the Act apply?

- Do I have grounds to apply to the Auditor-General for an exemption or declaration that would allow me to participate?

4.12

The first two questions in paragraph 4.11 are closely linked – you need to assess whether you have a financial interest in the matter under discussion or in the decision you are asked to make, not in the topic or subject matter generally.

4.13

Having a potential financial interest in a matter does not necessarily mean you will have a financial interest in every discussion or every decision made in that matter. It depends on the nature of the discussion or type of decision being made and how it might affect your potential financial interest.

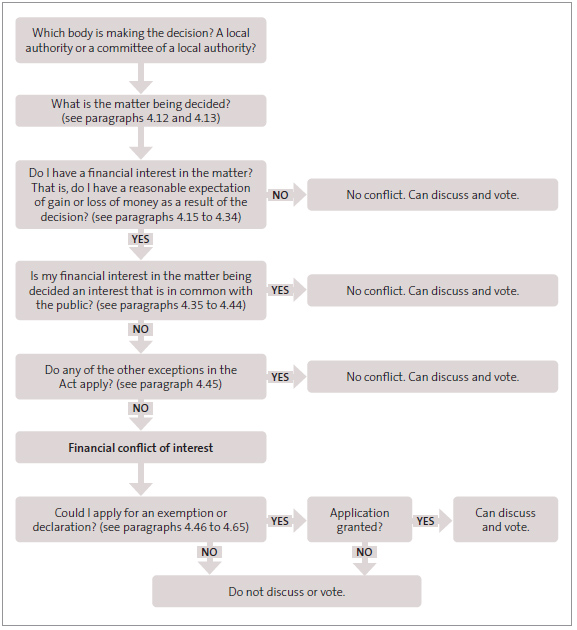

4.14

Figure 1 provides a more detailed flowchart that shows what you need to consider when assessing whether the non-participation rule applies.

Figure 1

Flowchart to assess whether the non-participation rule applies to you

This figure is a flowchart with a series of yes-or-no questions about whether you have a financial interest in a matter before your local authority. Answering the questions will determine whether you have a financial interest and whether you are allowed to discuss and vote on the matter. The rest of Part 4 explains these questions in more detail.

Source: Office of the Auditor-General

Meaning of "financial interest"

4.15

The Act does not define financial interest. Our interpretation, drawn from case law in New Zealand and overseas, is that a financial interest is "a reasonable expectation of financial loss or gain" from the particular decision.28

4.16

A financial interest might be direct or indirect. It might, for example:

- be a quantifiable dollar amount;

- involve cash changing hands;

- relate to an increase or decrease in the value of something (for example, property or shares); or

- be an effect on the turnover of a business.

Meaning of direct and indirect financial interest

4.17

Direct financial interest involves direct financial gain or loss to a member.

4.18

Indirect financial interest involves financial gain or loss to other people or organisations you are connected to, such that you are also treated as being interested in any financial gain or loss.

4.19

The Act does not specify all of the situations in which you might be considered to have an indirect financial interest in a matter. However, we describe two common scenarios that are specified in the Act.

Deemed interest through your spouse or partner

4.20

If your spouse or partner (that is, civil union or de facto partner) has a financial interest in a matter before the local authority, you are deemed, for the purposes of the Act, to have the same interest unless the two of you are living apart at the time of the discussion or vote.29

4.21

The non-participation rule applies whether your spouse or partner's interest is direct or indirect.

Deemed interest through company

4.22

If you or your spouse or partner is involved in a company that has a financial interest in a matter before the local authority, you are deemed, for the purposes of the Act, to have the same interest if you or your spouse or partner:

- singly or together, own 10% or more of the shares in the company or another company that controls it;

- is a shareholder of the company, or another company that controls it, and one of you is the managing director or general manager (by whatever name you are actually called) of the company or the controlling company; or

- is the managing director or general manager (by whatever name you or they are actually called) of the company, and one of you is a shareholder of another company that controls it.30

4.23

The non-participation rule applies whether the company's interest is direct or indirect.

Other ways you might have an indirect financial interest

4.24

There are other ways you can have an indirect financial interest in a matter before your local authority. For example, you might have an indirect financial interest in a matter if you are a beneficiary of a family trust that has a financial interest in that matter. Figure 2 sets out comments made by a judge about indirect financial interests.

Figure 2

Comments made by a judge about indirect financial interest

| Calvert & Co v Dunedin City Council [1993] 2 NZLR 460 The judge in Calvert & Co v Dunedin City Council made the following comments about indirect financial interest: An indirect financial interest under section 6 of the Act may cover a wide variety of factual situations. The indirect financial interest may involve an interest arising from a relationship and not from any specific contract or monetary connection. An indirect financial interest may include a potential benefit or potential liability. A decision as to whether a particular factual situation amounts to an indirect financial benefit is assisted by considering whether an informed objective bystander would conclude that there was a likelihood or reasonable apprehension of bias. The motives and good faith of councillors are irrelevant to whether or not they had an indirect financial interest. |

Situations where you potentially have both a direct and indirect financial interest

4.25

It is possible to have both a direct and indirect financial interest in a matter.

4.26

For example, you are one of several landowners who form a company to develop a community asset in partnership with the local authority in the surrounding area. If matters come up for discussion regarding that asset, you might have an indirect financial interest in those discussions as a result of your shareholding in that company. You might also have a separate and direct interest as a landowner because your land might increase in value as a result of the development of the community asset.

4.27

You need to be careful in these types of situations, even if your involvement in the company is insufficient to meet the "deemed interest" test. You might still be prohibited from participating in discussions because of your potential direct financial interest as a landowner.

Determining at which stage in the decision-making process you have a financial interest

4.28

When assessing whether you have a financial interest, you need to make that assessment for the particular matter under discussion and the particular decision being made, as opposed to the subject matter in general. The fact that you have a potential financial interest in a subject does not mean you necessarily have a financial interest in every decision that is made in relation to that subject. The nature and context of the particular decision will be important.

4.29

This is particularly true in local government, where a local authority might make several decisions during a period of time for a particular subject. It is sometimes helpful to view the different decisions a local authority can make as different stages: the first stage might be discussing a general idea, the second stage might be developing and consulting on that idea, the third stage might be developing a firm proposal, and then the last stage might be taking steps to implement the proposal.31 A member with a potential interest in the subject at the outset will not necessarily be affected financially by all of the stages during the decision-making process.

4.30

There might be a general possibility of a financial benefit or loss at the first stage, but nothing concrete enough to amount to an expectation of financial gain or loss. There might also be situations where the decision being made is procedural or more general, which does not affect the member's interest in the same way as a decision to agree to a specific proposal.

4.31

As a general rule, early decisions to commission work on options or to consult are unlikely to have a financial effect and so the non-participation rule would not apply. However, that is likely to change as the matter moves towards a fully developed proposal ready for adoption and implementation. A later decision to confirm a particular option might have a clear financial effect on the member and so the non-participation rule would apply. Figure 3 describes a situation where a proposed decision was at such an early stage as to make any financial interest of the member uncertain.

Figure 3

Effect of decision not sufficiently certain

| Ashburton District Council decided to designate land for a future bridge project, and one of the members owned land in an adjacent area. The designation did not apply to the member's property, but it did increase the chance that at some future time a significant road might be developed near the member's land as part of the project. We thought that the possible effect of the designation decision on the value of the member's land was not sufficiently certain or significant enough at that point to constitute a financial interest under the Act. This was because attempting to assess the nature and scale of any change to the value of the member's land would be highly speculative. Construction of the road was not planned for 12 years and was contingent on several other factors and steps in the process; it was still possible that it might not proceed at all. |

4.32

You need to be able to recognise when a matter reaches the stage where it can reasonably be expected to affect your interests. At that point, you should no longer participate in the decision-making process.

4.33

See Appendix 2 for summaries of several cases in which the courts have discussed financial interests. We suggest that you refer to these case summaries for guidance.

4.34

If you are unsure whether you have a financial interest, check with local authority staff. You might also want to consider whether you could, or should, apply to us for an exemption or declaration that would allow you to participate.

Meaning of "interest in common with the public"

4.35

You are not prohibited from discussing or voting on a matter you have a financial interest in if it is an "interest in common with the public".

4.36

Having an interest in common with the public means your interest is no different in kind or degree to the general public's interest in it. Whether your interest is in common with the public will depend on the circumstances of the case, and it is always a question of degree. The exception needs to be applied in a realistic and practical way. Figure 4 provides an example of an interest in common with the public.

Figure 4

Example of an interest in common with the public

| If you are a dog owner, and the local authority is proposing to increase dog licensing fees, your interest in the local authority's decision will probably be in common with the public because it is an interest shared by all other "dog owners", and dog owners are a group large enough that they could be reasonably said to constitute "the public". On the other hand, if you are a property developer, and the local authority is considering changes to district or regional plans or its development contributions policy, you might not have an interest in common with the public. This is because, as a property developer, your interest in the local authority's decision is different in kind to most other residents or "ordinary" property owners. |

4.37

When considering whether your interest is in common with the public, you need to consider:

- the nature of your interest (such as the kind of interest, its size or extent, and whether it is direct or indirect);

- the size of the group of people who are also affected and whether that group is big enough to constitute "the public"; and

- whether your interest and the group's interests are affected in a similar way.

What is the nature of your interest?

4.38

The nature of your interest, and how it compares with the interests of the public, will be important. The interests of different people will be affected by a decision in different ways and to different degrees. Some people might be directly affected by a decision, and others indirectly affected by flow-on effects from the decisions. The effect on one person's interest might be substantial, while the effect on another person's interest might be slight.

Is the group affected big enough to constitute the public?

4.39

Whether a group of people should be treated as the public is often a matter of degree. On the one hand, the interest does not need to be shared by all members of the public in the local area. It is enough for a large group of people have an interest.

4.40

However, if you are in a small and clearly identifiable subset that is affected in a different way to the rest of the public, then your interest is not in common with the public.

4.41

Although the size of the group is important, there is no objective measure that can be used to determine how big a group should be to constitute the public. An overall judgement is required.

Is the public affected in a similar way, and to a similar degree, as you?

4.42

For the "interest in common with the public" exception to apply, not only must the public be affected, but they must be affected in a similar way to you.

4.43

However, you do not need to be affected in exactly the same way as the public. There can be some variation in the degree to which you and the public are affected.

4.44

The question to ask yourself is whether the matter affects you in a different way, or to a materially greater degree, than most other people. We acknowledge that, in answering this question, it is not always easy to draw a clear line. The examples in Figure 5 might help.

Figure 5

Is your interest in common with the public?

| Scenario | Is your interest in common with the public? |

|---|---|

| The local authority is discussing the adoption of a general rate. You are a ratepayer, but have no special interest other than that. | Probably yes. The mere fact that you are affected slightly differently by the adoption of a general rate because of the value of your property does not generally prevent you from having an interest that is in common with the public. |

| The local authority is discussing the adoption of a targeted rate. You are one of a small number of ratepayers affected by that rate. | Probably not. Your interest might not be in common with the public because it is not shared by a group large enough that it could be reasonably said to constitute "the public".* |

| The local authority is considering increasing its charges for a particular type of permit. You are a permit holder. It is likely that, as a result of increasing the permit charge, there will be a corresponding slight decrease in rates. | Probably not. As a permit holder, you will be affected differently by the changes to the permit charges, even though you will be affected in the same way as other ratepayers by the corresponding decrease in rates.† |

| The local authority is considering providing special services or infrastructure, such as an irrigation scheme, to a group of landowners. You are one of the landowners. | Probably not, but it will depend on the size of the group affected.§ |

* These examples are discussed in further detail in Office of the Auditor-General (2007), Local government: Results of the 2005/06 audits, Wellington, at oag.parliament.nz.

† Office of the Auditor-General (2009), Investigation into conflicts of interest of four councillors at Environment Canterbury, Wellington, at oag.parliament.nz.

§ See Office of the Auditor-General (2016), Application for an exemption or a declaration by Cr Hewitt, Wellington, at oag.parliament.nz. About 2.9% of rating units in the region could potentially irrigate their land using water from the proposed irrigation scheme. The group affected was not large enough to constitute "the public".

Exceptions to the non-participation rule

4.45

The Act sets out several matters where the non-participation rule does not apply. This means that you can participate in the matters below even if you have a financial interest:

- You were elected, or appointed, to represent a particular activity, industry, business, organisation, or group of persons, and your financial interest in a matter is no different from the interest of those you represent.32

- Any payment to you or for your benefit where it is legally payable and the amount, or the maximum amount, or the rate, or maximum rate, of the payment has already been fixed, such as payment of remuneration to members in accordance with determinations made under the Local Government Act 2002.

- Any contract of insurance insuring you against personal accident.

- Your election or appointment to any office, notwithstanding that any remuneration or allowance is or may be payable for that office.33

- Any formal resolution to seal or otherwise complete any contract or document in accordance with a resolution already adopted.

- The preparation, recommendation, approval, or review of a district plan under the Resource Management Act 1991, or any section of such a scheme,34 unless the matter relates to:

- any variation or change of, or departure from, a district scheme or section of the scheme; or

- the conditional use of land.35

- The preparation, recommendation, approval, or review of reports as to the effect or likely effect on the environment of any public work or proposed public work within the meaning of the Public Works Act 1981.36

The Auditor-General's power to grant exemptions or issue declarations

4.46

You might be able to apply to us for an exemption or declaration that would allow you to participate if:

- you have a financial interest in a matter that the local authority is considering; and

- your interest in the matter is not in common with the public.

4.47

You can apply for an exemption from the non-participation rule on the grounds that your interest is so remote or insignificant that it cannot reasonably be regarded as likely to influence your voting or participation in discussing that matter.

4.48

You can apply for a declaration allowing you to participate on the grounds that:

- it would be in the interests of the people in the local authority's area that the non-participation rule should not apply; or

- applying the non-participation rule would impede the transaction of business by the local authority.

4.49

You should note that:

- an application for an exemption or a declaration must be made before you participate. We cannot grant a retrospective exemption or declaration; and

- we cannot grant an exemption or declaration for a non-financial interest, such as a conflict arising from a personal relationship or conflict of roles. This is because the Auditor-General's power to grant exemptions and declarations derives from the Act, and the Act applies only to financial interests.37

Criteria we use to determine whether to grant an exemption

4.50

In determining whether it is appropriate to grant an exemption from the non-participation rule on the grounds that your financial interest is remote or insignificant, we consider:

- the relationship between your financial interest and the matter under consideration; and

- the significance of the financial interest in terms of its possible influence on you when discussing or voting.

4.51

When we consider an application for an exemption, we need to understand:

- how directly the proposed decision is connected to your financial interest – that is, whether the interest is remote; and

- how large or important the financial interest is.

4.52

That means we need reasonably precise information (if it is available) on the value of the cost or benefit to you that will result from the decision. It is also useful to be able to assess any cost or benefit to you in the context of your overall financial situation or that of your business. A cost that might be significant for an individual person might not be so important if it is borne by a large business.

4.53

Under the Act, it is our opinion that determines whether your financial interest is remote or insignificant. The test is an objective one. Although your views about how significant the interest is, and whether it is influencing your position on the issue, are relevant, they are not determinative. Ultimately, we must assess how significant the interest looks to an outside observer. Figure 6 describes how we assessed requests for exemptions for councillors at Environment Canterbury.

Figure 6

Example of exemptions for members at Environment Canterbury

| Environment Canterbury wanted to recover some of its water management costs through new charges on holders of certain types of consents. Four councillors had a financial interest in upcoming council decisions relating to the final shape of the charging scheme and its implementation, either because they were a consent holder or were deemed to share the interests of a consent holder. Each asked for an exemption to participate in the decisions. The effect of the decisions on each councillor was different; for one councillor, the financial effect was predicted to be under $40; for another, between $50 and $300; for the third, between $600 and $1,800; and for the fourth, between $1,200 and $9,000. We considered these effects against the total expenses of each councillor's businesses. Because these were farming or rural businesses, the total outgoings were generally large. For the first three councillors, we concluded in each case that the effect was insignificant in the context of the individual's financial situation, and could not reasonably be regarded as influencing the councillor's views. We gave exemptions allowing these three councillors to participate in the decisions. However, we decided we could not give an exemption in relation to the fourth councillor, because we regarded a potential charge of up to $9,000 as significant enough that it could reasonably be regarded as influencing their views. |

Criteria we use to determine whether to issue a declaration

4.54

We can issue a declaration allowing you to participate in a decision, despite your potential financial interest in it, if we are satisfied that:

- it would be in the interests of the people in the local authority's area for you to participate; or

- not allowing you to participate would impede the transaction of business by the local authority.

Declaration in the interests of the people in the local authority's area

4.55

When deciding whether to issue a declaration on the grounds that it would be in the interests of the people in the local authority's area, we need information from you and your local authority on why your participation is important.

4.56

Relevant factors for why your participation is important could include:

- whether the matter justifies the involvement of all members because of its significance to the community as a whole – that is, the participation of all members is more important than any individual interests; or

- whether you have any particular expertise in the matter under consideration or have an important link with people in a particular area, organisation, or community group, and if you did not participate then their views would not be adequately represented.

4.57

We might also take into account:

- how direct your financial interest is and its size and nature;

- the extent to which your financial interest is quantifiable; and

- the matter under discussion and the type of decision being made (for example, whether the matter involves decisions focused on the rights, interests, and obligations of individuals – as opposed to matters of high-level policy or matters where the local authority has only advocacy powers or the power to make recommendations).

4.58

Figure 7 provides examples of declarations that we have issued in the past.

Figure 7

Examples of declarations we have issued

| Scenario | What we did |

|---|---|

| A local authority was discussing a submission it was proposing to make on another organisation's long-term plan. The relevant councillor lived in an area where the property values might be affected by aspects of the submission. | We issued a declaration allowing the councillor to participate even though the value of their property was potentially directly affected, on the grounds that:

|

| A local authority was making a decision about a proposed irrigation scheme. The relevant councillor owned land that would be affected by the scheme. | We granted a declaration allowing the councillor to participate even though the value of their land was potentially affected, on the grounds that:

|

* See Office of the Auditor-General (2016), Application for an exemption or a declaration by Cr Hewitt, Wellington, at oag.parliament.nz.

Declaration to prevent impeding the transaction of business

4.59

When deciding whether to issue a declaration on the grounds that it would impede the transaction of business by the local authority if you did not participate, we consider factors such as whether:

- the non-participation rule would prevent most members from participating;

- the decision is minor or procedural in nature; or

- the application of the non-participation rule could unduly distort the way in which the local authority deals with the matter.

4.60

To assess an application for a declaration, it is useful for us to get information on:

- how many members might be prevented from participating;

- how significant the decision is for the community and the local authority; and

- any other information that can help explain why it might be problematic if a member was not allowed to participate.

How to apply for an exemption or declaration

4.61

An application for an exemption or declaration must be in writing. It can be made by you or by your local authority on your behalf.

4.62

Before we can consider an application for an exemption or declaration, we need:

- information about the nature of the decision that is to come before the local authority. In practice, it is often helpful if the local authority is able to provide us with a draft paper of the matter that is to be considered;

- information about the nature and extent of your financial interest in the decision;

- an explanation of how that interest might be affected by the decision; and

- a detailed explanation of why you consider there are necessary grounds for an exemption or declaration.

4.63

This information is important to enable us to assess whether there is a financial interest in the particular decision, and how significant the decision and the financial interest are.

4.64

We generally require detailed information before we can grant an exemption or declaration. However, we are able to receive an initial application and then ask the local authority staff or member for more information.

4.65

We recognise that these issues sometimes arise with urgency because the potential conflict might be identified only shortly before the meeting to make the decision. When a decision on an exemption or declaration is needed within a few days, it is helpful for the initial application to be as comprehensive as possible.

Managing compliance with the non-participation rule

4.66

There are several steps you and your local authority can take to ensure that possible conflicts of interests are managed smoothly and effectively before a matter comes before the local authority for decision.

4.67

When a matter in which you have a financial interest comes before your local authority, you must also ensure that the obligations in the Act, including the obligation to abstain from participating in the matter, are carefully observed.

Before meetings: local authority processes and assistance

4.68

Local authorities should consider implementing systems that allow for identifying and assessing possible conflicts of interest early. These might include:

- maintaining a register of interests for members;

- ensuring that members have early and timely access to agenda papers so they can identify and assess whether they have a financial interest in a particular matter that is to be discussed or voted on;

- providing members with access to legal advice to help them assess whether they have a financial interest in a particular matter that needs to be addressed; and

- ensuring that there is opportunity for members to advise the mayor or chairperson of a financial interest before the relevant meeting.

4.69

As a member, you should be proactive about identifying and assessing possible conflicts of interest by using your local authority's systems for doing so – see paragraph 4.68. In particular, you should read agenda papers before a meeting, and seek assistance from local authority staff if you are unsure whether you have a financial interest in a matter to be discussed or voted on.

During meetings: declare, abstain, and record

4.70

If a matter comes before the local authority in which you have a financial interest, you must:

- declare to the meeting your financial interest;38

- abstain from discussion and voting; and

- ensure that your disclosure and abstention are recorded in the meeting minutes.

4.71

You do not need to inform the meeting about the nature of your interest or why it exists.

4.72

The requirement to abstain from discussion and voting does not mean that you have to leave the meeting room. However, to avoid any doubt about your abstention, we consider that you should leave the table and sit in the public gallery while the matter is being discussed and voted on.

4.73

The quorum of the meeting (that is, the minimum number of people required to have a meeting) is not affected if a member is unable to vote or discuss because of a conflict of interest, provided they are still in the room.39

Frequently asked questions about the non-participation rule

4.74

I think I might have an interest in a matter. How do I tell whether it is financial or non-financial?

Ask yourself whether the decision you are being asked to make about the matter could reasonably give rise to an expectation of a gain or loss of money – either for you personally or, in the case of a deemed interest, for your spouse or partner or a company (see paragraphs 4.15 to 4.27).

4.75

My council is considering some changes to our district plan. I own a property in the affected area. It is unclear whether the proposed changes will increase or decrease the value of my property and, if so, when or by how much. Do I have a financial interest?

Possibly, yes. But it will depend on the type of decision you are being asked to make.

If there is a possibility that the decision will affect the value of your property, it does not matter whether the effect will be to increase or decrease its value, and it does not necessarily matter that you cannot quantify the effect in dollar terms. You potentially have a financial interest in the decision.

However, if the effect that the decision will have on the value of your property is speculative (that is, it might or might not have an effect) or the effect is contingent on several other events or decisions, or will not be for a long time, then it might not be enough to be classed as a financial interest under the Act.

This is a situation where focusing on the particular issue you are being asked to consider, or the decision you are being asked to make, is important. For example:

- If the proposed changes you are being asked to consider are at an early stage, and the decision you are being asked to make is whether to put those options out for consultation, it might be that you do not have a financial interest at that point. This is because deciding to consult on the options will not necessarily affect your property's value.

- However, if the decision you are being asked to make is to approve changes to the district plan, and the changes, if approved, will clearly affect the value of your property, then you probably have a financial interest in the decision and should not participate.

Deciding whether you have a financial interest in a decision that potentially affects the value of property, such as land, shares, or some other sort of interest in a business can be tricky. If you are unsure, we strongly recommend that you consult council staff.

If you have a potential financial interest, but consider it "too remote or insignificant" to influence the way you vote on a particular matter, you can apply to us for an exemption allowing you to participate (see paragraphs 4.50 to 4.53).

4.76

I am a member of the district council, and also belong to various clubs throughout my district. Do I have a financial interest in every matter that comes before the council that relates to those clubs?

Usually, no. Membership of community organisations, such as sporting, cultural, or charitable associations, is unlikely to give rise to a financial interest in matters involving those organisations because of their "not for profit" nature. However, it is possible that your membership of an organisation might entitle you to a share of the organisation's assets if the organisation is dissolved. You should check the rules of the organisations you belong to and see whether you have a financial interest of this type.

A financial interest might also arise in the case of, for example, a golf club occupying land leased from the local authority where the lease rental significantly affects the members' subscription or other fees.

In these sorts of situations, even if you do not have a financial interest, you might still have a non-financial of interest (because of your association with the clubs) that would make it inappropriate for you to participate in these matters.

For guidance on non-financial conflicts of interest, see our good practice guide Managing conflicts of interest: A guide for the public sector.

4.77

I am an employee of a company/organisation that has dealings with my local authority. Do I have a financial interest in any dealings that my company/organisation has with the local authority?

As a general rule, no. An employment relationship, where you receive a fixed level of remuneration, does not, on its own, give rise to a financial interest.

However, a financial interest might exist if there is any link between a decision the local authority is about to make and:

- the level of remuneration paid to you as an employee of the company/organisation; or

- whether you will continue to be employed by the company/organisation.

For example, if you were employed by an organisation that received funding from the local authority and the local authority was deciding on whether to stop funding that organisation, which could result in the loss of your job, you would have a financial interest in that decision.

As an employee, even if you do not have a financial interest, you might still have a non-financial interest (because of your employment) that would make it inappropriate for you to participate in these matters.

For guidance on non-financial conflicts of interest, see our good practice guide Managing conflicts of interest: A guide for the public sector.

4.78

Are financial interests treated more strictly than non-financial interests?

Generally, yes. Under the common law, a financial interest of any size can result in an automatic disqualification – in effect, a financial interest is a presumption of bias. This rule is reflected in the Act, which governs financial interests for members (subject to the powers of exemption and declaration set out in paragraphs 4.46 to 4.49).

Non-financial conflicts of interest involve a more discretionary judgement. You can consider all the circumstances of the situation to determine whether a reasonable observer would consider that a real danger of bias exists.

For guidance on non-financial conflicts of interest, see our good practice guide Managing conflicts of interest: A guide for the public sector.

4.79

Do the legal consequences of not declaring a financial or non-financial conflict of interest differ?

Yes. Breaching the non-participation rule can result in prosecution. If convicted, you will be disqualified from office and could be fined up to $100.

Although failing to declare a non-financial conflict of interest is not an offence, it could result in legal proceedings that challenge the validity of the local authority's decision. Those proceedings would not directly affect you personally, but could seriously affect your and the local authority's reputations if your actions resulted in the local authority's decision being overturned by the courts.

For guidance on non-financial conflicts of interest, see our good practice guide Managing conflicts of interest: A guide for the public sector.

4.80

Can the common law rule about bias apply to financial interests too?

Yes. Although the Act covers financial interests of members, the common law rule about bias could also be used to overturn a local authority's decision on the grounds of a member's financial interest.

4.81

Can my local authority or chairperson order me not to participate on the grounds of a conflict of interest?

No. The decision about whether to participate is yours (although the local authority might be able to resolve to remove you from a committee considering the matter). You should carefully consider any advice offered to you by senior members, the chief executive, or other staff. You should also consider seeking your own legal advice.

It is an offence under the Act to discuss or vote on any matter before the local authority in breach of the non-participation rule. If convicted you will be automatically disqualified from office. You will have a defence if you can prove that, when you took part in the discussion of, or voted on, the matter you did not know and had no reasonable opportunity of knowing that you had a financial interest in that matter other than an interest in common with the public.

4.82

My local authority has resolved that I do not have a financial interest in a particular matter. Does this mean that I can participate?

No. A resolution of a local authority that you do not have a financial interest in a particular matter is not an authoritative statement of the law. If, in fact, you do have a financial interest in the matter and you participate in discussion and voting on it, you will have committed an offence under the Act.

However, if your local authority resolves that you should be able to participate, subject to our approval being obtained, we would take the resolution into account when deciding whether to grant an exemption or declaration enabling you to participate.

4.83

I am fairly sure that I have a non-financial conflict of interest in a matter but I still think it is important for me to participate. Can the Auditor-General grant me an official exemption?

No. We do not have power to grant exemptions or declarations for non-financial conflicts of interest. Nor can we provide you with a formal ruling about whether a legal conflict of interest exists; only the courts can determine that. You should consult a lawyer if you want definitive advice.

4.84

Am I breaching the non-participation rule if I have a financial interest, but vote to my disadvantage?

Yes. If you have a financial interest in the decision, the Act prohibits you from participating, even if you intend to vote against your interest. See the case Brown and Others v Director of Public Prosecutions in Appendix 2.

4.85

My company has an interest in some work that my council is deciding whether to invite tenders for. Can I participate if I decide that my company will not tender for that work?

No. Your company will still be in a position to be invited to tender for the work, and so you have financial interest. See the case Rands v Oldroyd in Appendix 2.

4.86

I know my business will benefit from an upcoming decision, but so will all the other businesses in my area. I am not voting for my benefit, but in the interests of the community. Can I participate?

Probably not. What matters is that you have a financial interest in the decision through your business. Your motives and good faith are irrelevant. However, you might have an interest in common with the public, depending on the size of the group affected by the decision. See the case Re Wanamaker and Patterson in Appendix 2.

26: Section 6(1) of the Act.

27: Section 7 of the Act.

28: See the case of Downward v Babington in Appendix 2.

29: Section 6(2A) and 6(2B) of the Act.

30: Section 6(2) and 6(2B) of the Act.

31: For the recognition of these different stages in a different context, see Easton v Wellington City Council [2009] NZCA 513 at [14].

32: This exception does not apply to councillors elected to represent general constituencies or wards. See Office of the Auditor-General (2009), Investigation into conflicts of interest of four councillors at Environment Canterbury, Wellington, at oag.parliament.nz.

33: This would apply, for example, to the appointment by a local authority of one or more of its members as directors of a council-controlled organisation. However, it would not apply to any subsequent discussion of the directors' remuneration (see Calvert & Co v Dunedin City Council, discussed in Appendix 2).

34: This exception was applied in the case of Auditor-General v Christensen and is discussed in Appendix 2.

35: The terminology about district schemes is based on the repealed Town and Country Planning Act 1977. We interpret it by reference to the Resource Management Act 1991 and plans made under that Act.

36: The Act also includes another exemption for the preparation, recommendation, approval, or review of general schemes under the Soil Conservation and Rivers Control Act 1941 for the preventing or minimising of damage by floods and by erosion. This exemption is no longer available because the relevant provision of that Act, which enabled catchment boards to recommend, approve, or review general schemes, has been repealed.

37: Your ability to participate in decisions in which you have a non-financial conflict of interest is governed by the common law. For information on how the law on non-financial conflicts applies to public officials, refer to our good practice guide Managing conflicts of interest: A guide for the public sector at oag.parliament.nz.

38: Section 6(5) of the Act.

39: See clause 23(1) of Schedule 7 of the Local Government Act 2002.