Part 3: Maintaining a strong and deliberate focus on benefits management

3.1

In this Part, we discuss:

- benefits planning;

- the programme’s governance arrangements; and

- Inland Revenue’s culture of continuous improvement.

3.2

Benefits management needs an ongoing commitment for the duration of an investment. It should be integrated into an organisation’s programme planning, strategic planning, and performance management and reporting systems.

3.3

Organisations need to regularly test benefit targets and measures to understand whether they are on track to achieving benefits and to ensure that benefits planning is based on the best available information. Effective benefits management helps to ensure that benefits are ultimately realised. It should also support an organisation to continually improve and implement lessons learned.

3.4

The Treasury’s Managing benefits from projects and programmes: Guide for practitioners notes that improving how benefits are managed will increase the value from investments and enable the Government to invest more in critical areas.

3.5

We expected Inland Revenue to have clear and documented benefits management processes, including benefit realisation plans that outline expected benefits, governance roles and responsibilities, and the approach to regular monitoring and reporting on benefit areas. We also expected Inland Revenue to regularly review and improve these processes and have a systematic approach to implementing lessons learned.

Summary of findings

3.6

Inland Revenue maintains a strong and deliberate focus on its benefits management. One way Inland Revenue achieves this is by setting clear expectations and ensuring that its staff are meeting them. These expectations include adequate benefit planning, clearly assigning governance roles and responsibilities, and meeting monitoring and reporting requirements.

3.7

Inland Revenue continually looked for opportunities to improve its benefits management. We saw several examples of Inland Revenue making improvements to its framework for measuring benefits, the way it reports progress, and the activities and plans it has to achieve the benefits.

3.8

In our view, Inland Revenue’s culture of continuous improvement means that it will be well placed to continue managing, measuring, and monitoring the programme’s benefits.

Good quality benefits planning is important

3.9

Inland Revenue prepared a Business Transformation benefits management strategy to clearly set out the expectations for the programme’s benefits management. These expectations were established in the benefits management framework (see paragraph 2.19).

3.10

The strategy sets out and confirms programme’s governance arrangements, as well as the processes for quantifying and measuring benefits, and for tracking progress. It also outlines how the programme will communicate changes to benefits throughout its duration. The programme’s documents frequently refer to the strategy.

3.11

Inland Revenue has prepared and maintained benefits plans at two levels:

- Programme-level benefits management and realisation plan, which Inland Revenue prepared in 2015. The plan describes Inland Revenue’s approach to benefits management for the programme and the wider business.

- Stage and release benefits management and realisation plans, which Inland Revenue prepares before implementing each stage or release of the programme. The plans describe all of the expected benefits and Inland Revenue’s approach to benefits management for each stage or release.

3.12

Both levels of Inland Revenue’s benefits plans were of good quality. The benefits plans we reviewed were clearly set out in a way that was appropriate to the programme. Elements covered by the plans included:

- important outcomes, benefits, measurement sources, and baselines;

- processes to be used to test and validate the benefit measures;

- key risks to the programme and/or the stage or release;

- respective roles and responsibilities;

- reporting and governance requirements; and

- benefit maps that show how each plan’s outputs link to the programme’s investment objectives and benefits.

3.13

We saw evidence that Inland Revenue ran workshops to test and re-test benefit targets and the key performance indicators used to track the delivery of benefits. The purpose of this testing was to check that the targets and indicators were still fit for purpose before each major release. Inland Revenue also tested the benefit assumptions and estimations that it included in the programme update provided to Cabinet in November 2015. Attendees at these workshops included senior managers and subject matter experts from Inland Revenue.

3.14

For example, in the benefit plan for Stage 2, Inland Revenue identified that it would now use “increase in system availability” as a proxy measure for the benefit “revenue system resilience”. This “increase in system availability” replaced the proxy measure “increase in system availability for customer facing eChannels”. This change reflected the programme’s intention to use Inland Revenue’s enterprise performance measures rather than create new measures to measure the programme’s benefits.

3.15

Inland Revenue’s benefit planning included descriptions of critical success factors and key enablers of benefits (this is, what is needed to realise a benefit). For example, in the benefit plan for Stage 2, the key enabler of the benefit “easier for customers” is “proactive channel management and marketing”. Inland Revenue identified that more self-service options will enable customers to manage their obligations and entitlements with minimal intervention from Inland Revenue.

3.16

Inland Revenue has also refined its planning process over time to bring in more information about key enablers. It used this information to identify broader activities that support the achievement of benefits. For example, because a key enabler of most of the programme’s benefits is “customer buy in”, Inland Revenue ran seminars with customers and tax agents. In our view, working with customers and tax agents has been an important factor supporting “customer buy-in”.

Governance arrangements are fit for purpose

3.17

Organisational commitment and senior management accountability is critical to achieving benefits. This includes having effective governance arrangements in place. We expected the programme to have clearly defined and well-understood governance arrangements to approve and direct benefit plans and changes.

3.18

The programme’s governance arrangements support Inland Revenue in managing, measuring, and monitoring the programme’s benefits.

3.19

Three main factors indicated that the programme’s governance arrangements are effective:

- They have been periodically reviewed and adjustments made to ensure that they remained appropriate.

- Governance members understood them well, and they were presented in the programme’s documentation consistently.

- A specialist advisory group was created to seek information about the programme’s benefits and advise governance members.

3.20

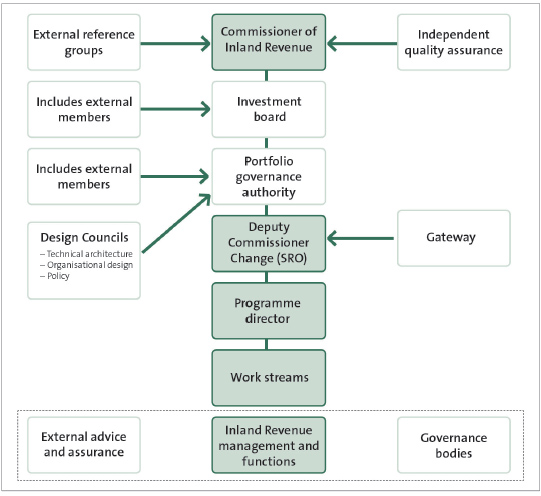

The programme’s original governance arrangements were established in the 2015 business case (see Figure 3).

Figure 3

The programme’s governance arrangements, as at 2015

Figure 3 is the previous organisation chart of the programme’s governance arrangements, and shows the roles and relationships up to 2017.

Source: Adapted from Inland Revenue Department (2015), Programme update and detailed business case: Business Transformation programme – Implementing the future revenue system, Wellington.

3.21

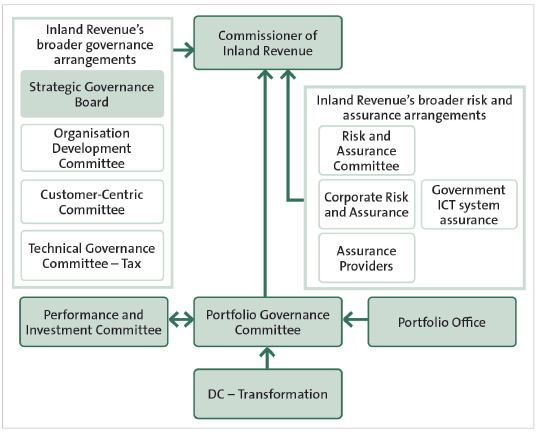

In July 2017, Inland Revenue reviewed and made changes to its organisational governance arrangements. To align with these changes, Inland Revenue made changes to the programme’s governance arrangements. Inland Revenue wanted its governance arrangements to continue to provide strong oversight and support for the changing organisation and reflect the programme moving from design to implementation. Figure 4 shows the new governance arrangements.

Figure 4

The programme’s governance arrangements, as at 2018

Figure 4 is an organisation chart of the programme’s governance arrangements, and shows the roles and relationships.

Source: Adapted from Inland Revenue Department (2018), Programme business case addendum: Business Transformation programme – Implementing New Zealand’s future revenue system.

3.22

Although the governance arrangements appear complex, the roles and responsibilities were clearly distinguished and documented (see Figure 5).

Figure 5

Roles and responsibilities in the programme’s governance arrangements

The table lists the roles in the programme’s governance arrangements and a description of their responsibility.

| Role | Responsibility |

|---|---|

| Commissioner of Inland Revenue/Senior responsible owner | Accountable for ensuring that the programme delivers its investment objectives. |

| Portfolio Governance Committee | Oversees all of Inland Revenue’s portfolio work, including the programme. The Committee is responsible for achieving expected programme changes, ensuring that milestones are delivered, and monitoring the health of the programme’s finances. |

| Performance and Investment Committee | Governs the performance of the programme and Inland Revenue’s other projects. The Committee is responsible for understanding the choices and trade-offs needed for an investment to meet its objectives. |

| Deputy Commissioner – Transformation | Is responsible for ensuring that the programme is completed successfully, including achieving its benefits. |

| Portfolio office | Provides advice and guidance around the identification, development, and delivery of benefits. Provides governance forums with information about benefit realisation. |

| Inland Revenue’s broader risk and assurance arrangements | Inland Revenue has a Risk and Assurance Committee, Corporate Risk and Assurance, Assurance Providers, and Government ICT system assurance. These enterprise groups have oversight over the programme and report to the Commissioner of Inland Revenue |

| Inland Revenue’s broader Governance | Inland Revenue’s broader governance arrangements oversee all of its activities, including the programme. The Strategic Governance Board (formerly the Executive Leadership Team) sets the strategic direction for the organisation and is supported by the Organisation Development Committee, the Customer-Centric Committee, and the Technical Governance Committee. Members from these governance groups are the programme benefit owners. These are a tier 2 executive role with operational accountability for the area a programme benefit will affect and who has accountability for realising benefits. Their principles, roles, and responsibilities are:

|

Source: Adapted from Inland Revenue (October 2015), Programme-level benefits management and realisation plan, Wellington, page 8-9; and Inland Revenue (2018), Programme business case addendum: Business Transformation programme – Implementing New Zealand’s future revenue system, Wellington.

3.23

Consistent with the programme’s benefit plans, each of the benefit areas are assigned to a tier 2 executive who has operational accountability for the benefit area. The tier 2 executives are members of Inland Revenue’s Strategic Governance Board and the programme’s governance committees. Those we spoke with were clear on their roles at Inland Revenue and their responsibilities for the programme’s governance.

3.24

Inland Revenue also established additional advisory groups to help support the programme’s governance. In 2016, Inland Revenue established the Benefits Realisation Co-ordination Committee. This later became the Benefits Realisation Co-ordination Group. This group has no decision-making rights and is not part of the programme’s governance. Its role is to provide specialist advice on matters about realising benefits (including how to deliver programme enablers), help to ensure that benefits are not counted twice, and assess progress towards benefit realisation.

3.25

In 2018, the Strategic Governance Board tasked the Benefits Realisation

Co-ordination Group with carrying out a detailed examination of the changes to be implemented in April 2019 (Release 3). These changes involved moving major tax types, such as income tax, to Inland Revenue’s new revenue system and processes, and included implementing major legislative changes.

3.26

The scale of change for major tax products meant that Release 3 was a major milestone and tipping point for benefit realisation. The purpose of this examination of the programme changes was to give Inland Revenue’s governance and benefit owners additional assurance about the benefit assumptions and estimates of the programme’s benefits, especially the administration savings benefit.

3.27

The Group provided the results of the detailed examination to the Strategic Governance Board in September 2018. It found that, in some parts of Inland Revenue, it would take longer than originally estimated to realise the administration savings benefit from Release 3 but that the benefits would be greater. The examination also identified what was needed to achieve the administration savings benefit. We discuss this further in paragraphs 4.41-4.44.

3.28

As a result of the update, the Strategic Governance Board commissioned several actions, including designing Inland Revenue’s future compliance operating model, to gain further insights into when benefits would be realised.

3.29

The future compliance model looks at how the programme will affect the way Inland Revenue works with customers to ensure that they are complying with their tax obligations and identify those not complying. The benefits “administration savings” and “increase Crown revenue” depend on Inland Revenue’s new systems and processes working as anticipated.

3.30

As mentioned in Part 2, Inland Revenue’s governance groups were actively involved with establishing the programme’s estimated benefits. We also saw evidence that Inland Revenue reviews these governance arrangements for ongoing relevance and that it is open to establishing additional governance support where necessary.

3.31

This demonstrates that the governance groups are actively engaged in overseeing the programme. The governance arrangements for the organisation and the programme appear to work effectively together. We did not find evidence of duplication or confusion of roles and responsibilities.

There is a culture of continuous improvement

3.32

In our view, being open to learning from experience helps an organisation to continually build on and improve its benefits management. We expected Inland Revenue to regularly identify and act on opportunities to improve how it manages and measures the programme and monitors benefits.

3.33

We found that Inland Revenue has a culture of continuous improvement for benefits management. Inland Revenue routinely uses external reviews, stakeholder feedback, and internal sources to identify opportunities to improve. As a result, it has regularly implemented improvements to the programme, including to how it plans for, informs, and supports the outputs designed to achieve the programme’s benefits.

3.34

Inland Revenue carries out workshops with staff after each stage or release to identify what went well and what could be improved.

3.35

For example, after Release 1, Inland Revenue identified that it needed to increase its efforts to ensure that customers:

- were ready for the changes;

- had a good understanding of the changes; and

- understood what these changes meant for them.

3.36

Between Releases 2 and 3, Inland Revenue ran seminars with customers to explain the changes that would be made as a result of the release. Inland Revenue contacted more customers than it did for the previous release (see Figure 6).

Figure 6

Customer readiness work completed by Inland Revenue

The table shows how many customers Inland Revenue contacted to communicate the changes that would come with each release.

| Release 1 February 2017 |

Release 2 April 2018 |

Release 3 April 2019 |

|

|---|---|---|---|

| Seminars for customers | 0 | 250 | 350 |

| Webinars for customers | 3 | 15 | 15 |

| Customers contacted | 630,000 | 368,000 | 2,000,000 |

Source: Adapted from Inland Revenue (2019), Programme business case addendum: Business Transformation programme – Implementing New Zealand’s future revenue system, Wellington.

3.37

After Release 3, Inland Revenue changed its approach to automatically issuing income tax assessments for individual taxpayers. Customers who choose to nominate a tax agent are now removed from the automatic process, and their tax agent completes their tax returns. Inland Revenue told us that it made this change in response to customer feedback.

External reviews help maintain and improve benefits management

3.38

Inland Revenue regularly commissions external reviews of the programme to improve its benefits management. A senior leader of the programme told us that the reviews provided a helpful outside perspective.

3.39

Regular Independent Quality Assurance and Technical Quality Assurance reviews carried out by KPMG, and Gateway reviews that the Treasury facilitates, are part of the programme’s assurance arrangements. These reviews are generally done twice a year.

3.40

The reviews provide assurance to Inland Revenue, Parliament, and the public about the “general health” of the programme. They look at aspects of benefits management, including the suitability of the measures. We met with members of these review teams as part of our audit. External reviewers told us that they consider the programme’s benefits management to be positive. One review team told us that Inland Revenue’s benefits management was best practice.

3.41

We saw evidence of Inland Revenue taking feedback from these reviews seriously. It has implemented a robust approach to managing the recommendations from external reviews. Each recommendation from the Independent Quality Assurance and Technical Quality Assurance reviews is tracked and assigned to an individual staff member. A management response is produced for the recommendation, and a deadline is established for any remedial action.

3.42

One example of a change made from an external review came from the March 2018 Gateway review. This recommended that Inland Revenue “[f]urther develop the KPI reporting related to take up of digital services to track tax product transactions as well as customers, to support the overall monitoring of outcomes and benefits”.18

3.43

Inland Revenue responded by changing the way it measured and reported the uptake of digital services. The original measure was “percentage of returns filed electronically” using cloud-based software. This was subsequently changed to measuring and reporting on the “overall uptake of returns filed electronically”.

3.44

In our view, this better measures the overall progress towards the benefits and outcomes of the programme and demonstrates how Inland Revenue actively uses external reviews to strengthen its benefits management.

18: Gateway review report for Inland Revenue Business Transformation, Strategic Assessment, Readiness for Service.