Part 2: Our audit of the Government's financial statements

2.1

A main focus for our report on the audit of the Government's financial statements is to provide assurance that the Government's financial statements present fairly its financial performance and position. Confidence in the reliability of government reporting allows Parliament to properly scrutinise the Government's financial performance and direction.

2.2

The Government's financial statements allow the reader to track overall spending. At the time of the 2018 Budget, the Government forecast a surplus in the operating balance for 2018/19 of $3.7 billion, measured by the total Crown operating balance before gains and losses. It also forecast net core Crown debt (excluding the New Zealand Superannuation Fund and advances) at $64.2 billion (21.1% of GDP).

2.3

At the end of the reporting period, the Government's financial statements showed a surplus in the operating balance (before gains and losses) of $7.5 billion. This can be explained, in part, by a one-off effect of KiwiRail accounting changes of $2.6 billion. The Government's financial statements reported net core Crown debt of $57.7 billion (19.2% of GDP) – that is, an improved debt position compared with the forecast.

2.4

The Government's net worth at 30 June 2019 was $146.3 billion (2018: $135.6 billion).

2.5

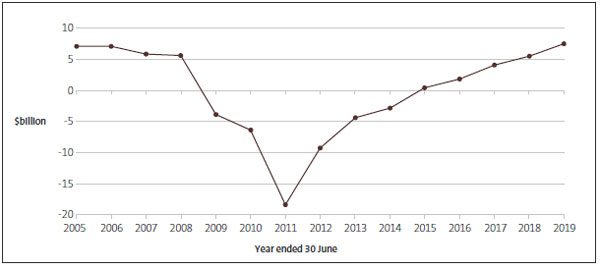

Not all countries have the systems and controls in place to accurately record operating balances or the value of the Government's assets and liabilities. Figure 1 shows the operating balance before gains and losses (which is the difference between revenue and expenses before adding in any changes to the valuation of certain assets).

Figure 1

The Government's operating balance before gains and losses, from 2005 to 2019

The figure shows the operating balance before gains and losses. There was a drop for three years from 2008, but it has gone up each year from 2011.

Source: Adapted from The Treasury (2019) FSG Basics and (2010) Financial Statements of the Government of New Zealand for the year ended 30 June 2010, at treasury.govt.nz.

2.6

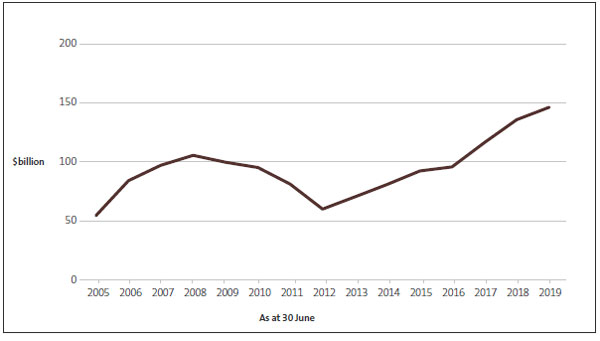

Understanding the value of the Government's assets and liabilities helps with asset management over the lifecycle of those assets. Figure 2 shows how the Government's net worth (the total value of the Government's assets minus the total value of its liabilities) has changed over time. Note the effect of the Global Financial Crisis in 2008 in both Figures 1 and 2.

Figure 2

The Government's net worth, from 2005 to 2019

The figure shows how the Government's net worth has changed over time. There was a drop from 2008 but it has gone up from 2012.

Source: Adapted from The Treasury (2019) FSG Basics and (2010) Financial Statements of the Government of New Zealand for the year ended 30 June 2010, at treasury.govt.nz.

Recognising tax revenue

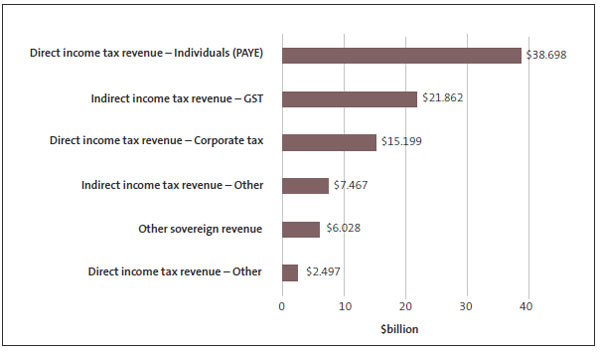

2.7

The largest source of tax revenue for the Government is direct income tax (see Figure 3). It generated $56.4 billion (the total of direct income tax categories in Figure 3) for the year ended 30 June 2019.

Figure 3

Breakdown of types of income tax and other revenue for the year ended 30 June 2019

The figure shows the types of income tax and other revenue. Direct income tax revenue – Individuals (PAYE) generates the most revenue.

Source: Adapted from The Treasury (2019), Financial Statements of the Government of New Zealand for the year ended 30 June 2019.

2.8

The calculation of revenue from direct income tax is subject to significant assumptions and judgements because of the timing differences between the reporting date (30 June 2019) and when taxpayers file their tax returns.

2.9

Direct income tax revenue and the associated receivables and payables at 30 June 2019 were estimated for taxpayers yet to file their returns, and where payments had been received but no provisional or final tax return had been filed.

2.10

Inland Revenue implemented a new tax system during the year, which changed the process for estimating income tax revenue. It is now based on individual taxpayer information, rather than macro-economic cash flow forecasts. The change in process for estimating income tax revenue means that some different assumptions and judgements had to be used this year.

2.11

We carried out detailed audit work on these estimates because errors in the underlying assumptions and judgements could result in significant inaccuracies in the Government's financial statements. Our audit work included obtaining an understanding of the systems, processes, and controls in place over the recording of tax revenue, testing underlying data, assessing the reasonableness of key assumptions and judgements applied in the new process, and testing the sensitivities of the estimate to changes in key assumptions.

2.12

Overall, we are satisfied that the assumptions and judgements applied in estimating tax revenue are reasonable.

Valuing property, plant, and equipment

2.13

The Government's physical assets total $178 billion at 30 June 2019. Some assets are more difficult than others to value because of the inherent uncertainties in their valuation, the quality of data available, and the benefits these assets provide. We identified the following significant assets where there were inherent uncertainties involved in the valuations:

- state highway network;

- electricity generation assets; and

- rail network assets.

State highway network

2.14

The state highway network (excluding land) was valued at $37.2 billion at 30 June 2019 by an independent valuer.

2.15

The valuation is based on information from several of the New Zealand Transport Agency's databases that identify the asset components that make up the network and their expected useful lives.

2.16

Because of the unique nature of the state highway network, the value of the assets cannot be measured with precision. Significant estimates and assumptions have been applied to the valuation, which include assumptions on quantities used in the construction of network components, the remaining life of the assets, and the unit costs to apply. Changes to the underlying estimates and assumptions can cause a material movement in the state highway valuation.

2.17

There continue to be uncertainties over the valuation of the state highway network. As part of the continuing valuation improvement programme, the costs relating to the formation component have been updated. The New Zealand Transport Agency continues work on improving the quality of the data that underpins the valuation.

2.18

Some of the costs associated with road construction (for example, traffic management) in urban areas have been assessed as a significant part of the network that might be undervalued. An allowance to recognise these costs has been included since 2014 where a reliable estimate can be made. This year a unit rate was determined for these costs and included in the valuation.

2.19

We obtained an understanding of the valuation of the state highway network, the significant estimates and assumptions used, and their reasonableness. This involved confirming the competence, capabilities, and objectivity of the valuer; challenging the valuer's key assumptions; and assessing the valuation procedures, including the information extracted from databases. We also considered whether there were any limitations placed on the valuer and the appropriateness of centrally calculated rates that were applied to the valuation.

2.20

We have recommended that the New Zealand Transport Agency continue to improve the valuation process, and, if required, refine the disclosures in the Government's financial statements in relation to the resulting changes and the Treasury work with the New Zealand Transport Agency to achieve this.

2.21

Overall, we are satisfied that the value of the state highway network at 30 June 2019 is reasonable and consistent with valuation practices, and the disclosures outlining the inherent uncertainties in the valuation are appropriate.

Electricity generation assets

2.22

The electricity generation assets, which are at least 51% owned by the Government, were valued at $17.2 billion at 30 June 2019. The valuation of these assets is carried out by specialist valuers because of the complexity and significance of assumptions about the future prices of electricity, the generation costs, and the generation volumes that these assets will create.

2.23

The specialist valuers of each generation company have different assumptions and make different disclosures about the valuation of electricity generation assets.

2.24

Small changes to assumptions, such as for the forecast price of electricity and discount rates used to determine the present value of these prices, could significantly change the value of these assets.

2.25

We will continue to assess the appropriateness of using different valuation approaches and assumptions in the Government's financial statements for the valuation of electricity generation assets, as well as the related disclosures.

2.26

To enhance the disclosure, we recommended that the Treasury work at standardising the valuations for the Government's financial statements, especially for common assumptions used by the different electricity generation companies.

2.27

Overall, we are satisfied that the valuation of electricity generation assets at 30 June 2019 is reasonable and that the disclosures appropriately outline the sensitivity and the complexity of the valuation of these assets.

Rail network assets

2.28

The rail network assets were valued at $6.4 billion at 30 June 2019. In arriving at this value, the entire rail network (used for both freight and metro transport) has been valued on the basis of its public benefit nature.

2.29

In previous years, the freight part of the network was valued on a commercial basis. The extent to which the Government views the freight part of the network as commercial has been a matter we have considered carefully over a number of years.

2.30

The Government is currently reviewing rail to define its purpose, determine the appropriate structure and capital requirements, and determine how to fund it in the future.

2.31

Cabinet received the first of three review reports in May 2019. The paper noted that all rail, including freight, contributes to national and regional economic growth and reduces emissions and congestion, reduces road deaths and injuries, facilitates wider social benefits, and provides resilience and connection between communities.

2.32

Cabinet agreed in principle to the objective of having a resilient and reliable rail system to deliver the outcomes for transport and wider benefits the Government seeks, and budget decisions were made on this basis.

2.33

Because of the above points, the rail network assets are recorded at Optimised Depreciated Replacement Cost in the Government's financial statements, in keeping with Public Benefit Entity accounting standards, because it is no longer appropriate for the Government to value the rail freight network on a commercial basis given the Government's broader objectives for rail. This has resulted in a $5.2 billion net increase in the carrying value of the rail network from the previous year, in the most part due to the reversal of impairment previously expensed of $2.6 billion and a net revaluation increase of $2.3 billion during the year.

2.34

We obtained an understanding of how the rail network is valued, the significant estimates and assumptions used, and the reasonableness of them. This involved confirming the competence, capabilities, and objectivity of the valuer, challenging the valuer's key assumptions, and assessing the valuation procedures, including the information extracted from databases.

2.35

We confirmed that the revaluation movements and reversals of previous impairments were correctly accounted for.

2.36

We are satisfied that the value of the rail network at 30 June 2019 is reasonable and consistent with valuation practices and that the adjustments to reflect the change in the valuation are appropriate.

Valuing insurance and superannuation liabilities

2.37

The valuation of the Government's long-term liabilities is complex and requires actuaries to estimate their fair value, based on assumptions about the future. The two significant long-term liabilities at 30 June 2019 are the Accident Compensation Corporation's (ACC) outstanding claims liability of $53.3 billion and the Government employees' superannuation liability of $13.2 billion. These liabilities are significant by value, and there are inherent uncertainties in valuing them that require a high degree of judgement and estimation.

2.38

The assumptions used to calculate the value of ACC's outstanding claims liability relate to claims incurred before the valuation date, include estimating the length of rehabilitation from injuries, estimating amounts of cash payments and when they will be made, and estimating inflation and discount rates. ACC also includes a risk margin due to inherent uncertainties in valuing the liability because of the high degree of judgement and estimation applied.

2.39

The assumptions used to calculate the value of the Government employees' superannuation liability for past and current members of the Government Superannuation Fund include estimating the return on assets owned by the Fund, expected rates of salary increases for currently employed members of the Fund, inflation and discount rates, and mortality rates.

2.40

There can be a large effect on the amount of these liabilities when there are changes in the assumptions, which also affects the amount of actuarial gains and losses. The Government's financial statements set out some of the sensitivities of those assumptions and the effect of them.

2.41

We evaluated the appropriateness of the main assumptions (such as inflation and discount rates) used in valuing the long-term liabilities. For discount rates and inflation assumptions, the Treasury determines a table of risk-free discount rates and inflation assumptions each year, using an agreed methodology. These are required to be consistently applied to valuations of long-term liabilities. We reviewed the table of risk-free discount rates and inflation assumptions at 30 June 2019 and concluded that they had been calculated in keeping with the agreed methodology.

2.42

We have recommended that the Treasury consider the recommendations from our review of the methodology as part of its annual review process.

2.43

Overall, we are satisfied that the assumptions and judgements applied in estimating the Government's long-term liabilities at 30 June 2019 are reasonable and that the disclosures outline the sensitivity of the valuation to changes in assumptions.

Valuing financial assets and liabilities

2.44

The Government had financial assets of $145.1 billion, of which $89.6 billion was measured at fair value and $55.5 billion was measured at amortised cost. It also has financial liabilities of $128.7 billion, of which $8.4 billion was measured at fair value and $120.3 billion was measured at amortised cost. The financial assets and financial liabilities measured at fair value include marketable securities, share investments, advances, and derivatives.

2.45

The fair value of some of the financial assets and financial liabilities cannot be measured using quoted market prices and, instead, must be estimated by applying an appropriate valuation model. Market data are used when available, otherwise non-market data are used, which require the exercise of significant judgement. We paid particular attention to evaluating the appropriateness of inputs to models that had been derived from non-market data.

2.46

The fair value of financial assets and financial liabilities that are valued using non-market inputs are valued at $15.4 billion and $0.2 billion respectively.

2.47

We obtained an understanding of the valuation techniques, controls, and inputs used to determine the fair value of financial assets and liabilities. We also carried out a range of audit procedures that reflected the nature of the financial assets and liabilities being valued, the valuation techniques adopted, and the uncertainties in determining their fair values.

2.48

We are satisfied that the fair values for financial assets and financial liabilities at 30 June 2019 are reasonable and that the disclosures outline the significant judgements.

Entitlements under the Holidays Act 2003

2.49

We had previously raised concerns that some public organisations have not fully worked through issues of non-compliance with the Holidays Act 2003 and the accounting for potential liabilities. In particular, we were concerned with progress made by large employers, such as the Ministry of Education, Department of Corrections, and district health boards (DHBs), to resolve these issues.

2.50

Several public organisations, including the Ministry of Education and Department of Corrections, have already started or completed a review of current and historical payroll calculations to ensure compliance with the Holidays Act and other relevant legislation.

2.51

Where possible, provision has been made in the Government's financial statements for obligations arising from those reviews and where settlement has not been made.

2.52

To the extent that an obligation cannot reasonably be quantified at 30 June 2019, an unquantified contingent liability has been disclosed. Public organisations continue to calculate the potential liability required to remediate the issues associated with these entitlements. In certain sectors, in particular DHBs, there are complexities and the calculation of the liability is taking longer than expected to resolve. Public organisations in these sectors employ thousands of staff and the liabilities to settle these obligations remain uncertain.

2.53

The Government has noted that the indicative potential liability for DHBs could be between $550 million and $650 million. This is largely based on selecting a small, non-statistical sample of former and current employees, applying several assumptions agreed to by the sector, and then calculating an indicative liability by extrapolating the result over the known population. A significant amount of work is still required to finalise the liability and, therefore, there remains a high level of uncertainty over this liability, which could fall outside the indicative liability range.

2.54

A provision of $621 million has been included in the Government's financial statements for outstanding holiday pay obligations of DHBs.

2.55

For those public organisations most affected, we obtained an understanding of the progress made in resolving the payroll calculation issues, and we assessed the reasonableness of the approach to the financial reporting of these issues.

2.56

We carried out a range of procedures to audit the liabilities recognised, which included reviewing processes followed for valuing the liabilities; testing a sample of transactions; assessing the competence, capabilities, and objectivity of independent experts involved in the valuation; challenging critical assumptions and judgements made in the valuation; and reviewing the disclosures made.

2.57

We are satisfied that the liabilities recognised for entitlements are materially correct and that, where a liability cannot be reliably measured, the disclosures are appropriate.

Accounting and appropriation implications of the Provincial Growth Fund

2.58

The Provincial Growth Fund enables investment of $3 billion over three years to encourage regional economic development. The Provincial Development Unit in MBIE administers the Provincial Growth Fund, but several public organisations are involved in managing projects within their remit, including the Ministry of Transport, the Ministry for Primary Industries, and the Department of Conservation.

2.59

There are risks associated with the Provincial Growth Fund, including having appropriate systems and controls between the different public organisations and determining the appropriate accounting treatment to apply depending on whether funding is a grant, debt, or capital injection.

2.60

We reviewed the allocation of grants and funding to third parties based on evaluations by the Provincial Development Unit. We reviewed the recognition criteria and accounting treatment of a sample of the awards made during the year to confirm that the accounting treatment matches the underlying contracts.

2.61

We are satisfied that, at a whole-of-government level, the Provincial Growth Fund has been appropriately accounted for during the financial year, but we have more detailed work under way on the operation of this Fund.

Outcomes from reviews currently under way

2.62

As noted in Part 1, the Government has initiated several reviews in the past 18 months. Some of these reviews propose significant changes to the structure and funding of government. If recommendations from these reviews are implemented, there might be a significant effect on the Government's financial statements.

2.63

At the time of signing the audit report, the policy decisions arising from many reviews had not yet been approved by Cabinet. We will continue to monitor the progress with the reviews currently under way. We will consider the effect on the Government's financial statements if and when decisions to implement the recommendations from these reviews are made.

Changes to the Crown Financial Information System

2.64

The consolidation of the Government's financial statements is managed electronically through a system known as the Crown Financial Information System. This system has been updated several times since its introduction in 1999.

2.65

Changes to the system this year include collecting information for the adoption of PBE IFRS 9: Financial Instruments and adding a new department (the Ministry of Housing and Urban Development).

2.66

We assessed the Treasury's process for ensuring the integrity of the system through changes made during the year. We were satisfied that we could continue to rely on the system for our 2018/19 audit.

2.67

We were satisfied that the changes made to the Crown Financial Information System were appropriate and all required information recorded.

Changes to accounting standards

2.68

The Treasury adopted PBE IFRS 9: Financial Instruments early when preparing the Government's financial statements. This standard introduced a number of changes to the recognition and measurement of financial instruments, mainly affecting the measurement of student loans.

2.69

The early adoption of PBE IFRS 9 resulted in an increase of $628 million in the valuation of student loans at 1 July 2018.

2.70

The financial reporting standard PBE IPSAS 39: Employee Benefits is effective for reporting periods beginning 1 January 2019, with early adoption permitted. We considered the accounting for veteran support entitlements under the Veterans' Support Act 2014 as part of our submission to the External Reporting Board on this standard. The New Zealand Defence Force (NZDF) is still continuing to assess the effect of adopting the new accounting standard. We will monitor NZDF's assessment and the Treasury's work in assessing the effect of PBE IPSAS 39 on the Government's financial statements.

2.71

We are satisfied that adjustments made as a result of the adoption of new accounting standards were appropriate and disclosures met requirements.

Reporting of unappropriated expenditure

2.72

The Statement of Unappropriated Expenditure, included in the Government's financial statements, is an important summary of all unappropriated expenditure incurred in the financial year.

2.73

During our audit, we assessed the accuracy and completeness of the disclosure of the unappropriated expenditure. This included:

- confirming that the final listing of unappropriated expenditure is correctly reported in the Government's financial statements;

- confirming the completeness and accuracy of all disclosed unappropriated expenditure with Appointed Auditors of the relevant departments and ministries; and

- confirming with Appointed Auditors of those departments with no unappropriated expenditure disclosed that no unappropriated expenditure was incurred during the year.

2.74

We are satisfied that the Statement of Unappropriated Expenditure is complete, and consistent with reporting entities' own annual reports. More detail on the Controller function and how it supports Parliamentary control over government expenditure is provided in Part 3.