Part 2: The context for the property investments

2.1

In this Part, we set out:

- the Council's group structure and how Delta fits into it;

- Delta's history;

- the people involved in the investment decisions;

- the context for the investment decisions;

- the need to seek new business opportunities; and

- our comments about the context for the property investments.

Summary of our findings

2.2

The property investments at Luggate Park and Jacks Point were part of Delta's broad strategy of looking for new ways of securing work in Central Otago. Delta had been looking for new opportunities from 2004. The holding company had endorsed this strategy. Senior council staff, the Mayor, and some councillors were aware of it.

2.3

Because most of the directors of Delta were also the directors of the holding company, scrutiny by the shareholder of Delta's decisions was lacking.

2.4

Since 2006, the Council required increased returns from the holding company group. However, the Council did not give any direction about its appetite for risk.

How Delta Utility Services Limited fits into the Dunedin City Council group

2.5

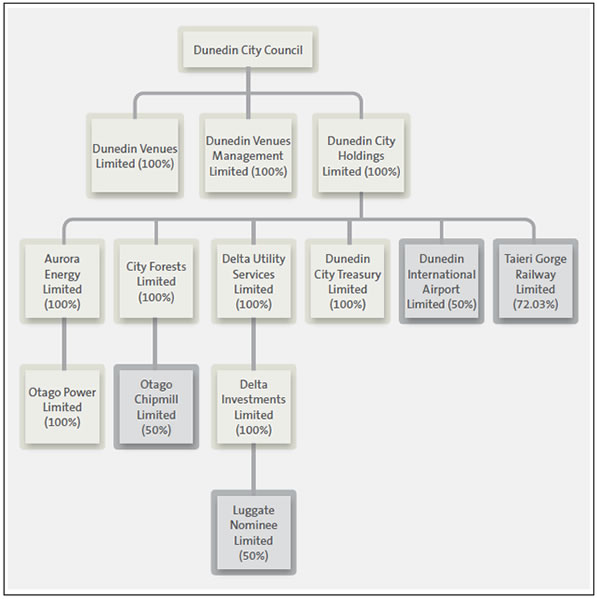

Delta is one of the Council's several council-controlled organisations and is part of the Council group. Figure 1 shows the ownership structure of the Council group (companies only).

Figure 1

Ownership structure of companies in the Dunedin City Council group

2.6

Delta, Aurora Energy Limited, and City Forests Limited are council-controlled trading organisations. They are owned for investment purposes and operate to make a profit rather than to deliver Council-related services to the public.

2.7

The council-controlled trading organisations generate cash for the Council through dividend payments to the holding company. The holding company holds the investments in the council-controlled trading organisations and passes the dividend payments from them to the Council. The holding company also pays market interest to the Council on a shareholder advance provided by the Council. These payments contribute to the Council's cash flow, and it uses the dividend payments to help fund Council activities.

2.8

According to the holding company, the Council has received $178.3 million in dividends from 1994 to 30 June 2012, as well as loan repayments of $67.3 million and interest payments of $56.6 million.2

2.9

Figure 2 shows the dividend payments from the holding company to the Council from 2006/07 to 2012/13.3

Figure 2

Dividend payments from Dunedin City Holdings Limited to Dunedin City Council, from 2006/07 to 2012/13

| 2006/07 $m |

2007/08 $m |

2008/09 $m |

2009/10 $m |

2010/11 $m |

2011/12 $m |

2012/13 $m |

Total $m |

|

|---|---|---|---|---|---|---|---|---|

| Dividend | 12.5 | 11.2 | 9.5 | 14.9 | 15.6 | 10.7 | 4.6 | 79.0 |

2.10

During the same period, Delta has paid dividends of $23.5 million to the holding company (see Figure 3).

Figure 3

Dividend payments from Delta Utility Services Limited to Dunedin City Holdings Limited, from 2006/07 to 2012/13

| 2006/07 $m |

2007/08 $m |

2008/09 $m |

2009/10 $m |

2010/11 $m |

2011/12 $m |

2012/13 $m |

Total $m |

|

|---|---|---|---|---|---|---|---|---|

| Dividend | 4.5 | 2.5 | 2.5 | 3.5 | 4.0 | 4.5 | 2.0 | 23.5 |

Directors of Delta Utility Services Limited and Dunedin City Holdings Limited

2.11

Ray Polson was the chairman of the board of Delta when the investments were made. Mr Polson was also the chairman of the board of Aurora Energy Limited. Mr Polson ended his term as chairman of both boards on 1 November 2013.

2.12

Delta was offered the opportunity to take part in a joint venture in Luggate (called Luggate Park) in May 2006. It made its final decision to do so in early 2008. Delta considered and decided to invest at Jacks Point in the first half of 2009. The first six Delta directors shown in Figure 4 were involved in both decisions.

2.13

Figure 4 lists the directors of Delta from 2005/06 to 2012/13.

Figure 4

Directors of Delta Utility Services Limited, as at 30 June, from 2005/06 to 2012/13

| 2005/06 | 2006/07 | 2007/08 | 2008/09 | 2009/10 | 2010/11 | 2011/12 | 2012/13 | |

|---|---|---|---|---|---|---|---|---|

| Ray Polson (chairman) | ||||||||

| Stuart McLauchlan | ||||||||

| Norman Evans | x | |||||||

| Michael Coburn | x | |||||||

| Ross Liddell | x | |||||||

| Paul Hudson | x | |||||||

| George Douglas | x | |||||||

| John Gilks | x | |||||||

| David Frow | ||||||||

| Ian Parton |

x: Left during the financial year.

2.14

Directors McLauchlan, Evans, Coburn, Liddell, Hudson, and Gilks were also directors of the holding company. They were also directors of one or more of its other council-controlled organisations, Aurora Energy Limited, Dunedin City Treasury Limited, or City Forests Limited, when they were directors of Delta.

2.15

The boards of the holding company and the council-controlled trading organisations had the same directors for more than 10 years. After Warren Larsen's review of governance arrangements commissioned by the Council (the Larsen review),4 the Council changed the governance structure to provide that a director could not be on the board of both the holding company and a subsidiary in the group. In October 2011, new directors were appointed to the board of the holding company (see Figure 5).5

Figure 5

Directors of Dunedin City Holdings Limited, as at 30 June, from 2005/06 to 2012/13

| 2005/06 | 2006/07 | 2007/08 | 2008/09 | 2009/10 | 2010/11 | 2011/12 | 2012/13 | |

|---|---|---|---|---|---|---|---|---|

| Stuart McLauchlan | x | |||||||

| Norman Evans | x | |||||||

| Michael Coburn | x | |||||||

| Ross Liddell | x | |||||||

| Paul Hudson | x | |||||||

| John Gilks | x | |||||||

| Bill Baylis | ||||||||

| Denham Shale | ||||||||

| Graham Crombie | ||||||||

| Kathleen Grant |

x: Left during the financial year.

History of Delta Utility Services Limited

2.16

In 1990, the Council set up a company to take over part of the Council's electricity operations. The company was first called The Electric Company of Dunedin Limited and then, from March 1995 to May 1998, Delta Energy Limited. The company has operated under its current name, Delta Utility Services Limited, since May 1998.

2.17

In 2001, Delta took over the staff and activities of the Council's former Citiworks business. It expanded into civil construction, roading, drainage, landscape, and landfill management work.

2.18

Dunedin Electricity Limited owned Delta until the holding company purchased it in 2003. Delta continues to maintain and manage the electricity lines assets of its former parent, and now related, company Aurora Energy Limited.6 Delta and Aurora Energy Limited have the same chief executive.

2.19

Delta has a wholly owned subsidiary, Delta Investments Limited, which held Delta's interest in the land at Luggate and holds Delta's interest in land at Jacks Point. Delta Investments Limited was previously called Newtons Coachways (1993) Limited (Newtons) until it changed its name with effect from July 2011.

2.20

We explain more about the role of Newtons in Part 3.

Dunedin City Council's requirement for more dividends from 2006

2.21

Bevan Dodds, the chief executive of the holding company when the property investments were made, told us that, in late 2006, the board agreed "under protest" to start a series of higher annual distributions to the Council.7

2.22

The Council had contacted the holding company in May 2006 about this requirement. The Council believed that the after-tax profits and cash flows in the holding company group as a whole over the previous few years could support higher dividends. The Council proposed that annual dividends be increased to a minimum of 90% of the holding company's group profit after tax.8

2.23

In seeking the extra dividends, the Council noted Delta's and Aurora Energy Limited's increasing profits and cash flows. The Council said it did not wish them to reduce their debt or to accumulate their retained earnings. Instead, the Council wanted the ultimate shareholder (the Council) to receive any cash remaining after the companies met their day-to-day capital obligations. The Council also said that the companies should fund any expansion of their business wholly by debt.9

2.24

The Council and the holding company discussed this requirement during the next few months. They formed a joint working party to discuss how the holding company could meet the requirement.

2.25

In October 2006, the holding company told the Council that it would apply its best efforts to pay dividends at the higher level sought, providing it could maintain the company's sound financial position. The company also noted that, if it proceeded with planned capital expenditure, it might need to increase its debt levels to pay dividends.

Delta Utility Services Limited's need to seek new business opportunities

2.26

For some time before the Council required extra dividends in 2006, Delta directors and staff had been looking for ways to expand their business beyond Dunedin. Their broad growth plan was to extend Delta's range of services and operations in the South Island, including in growth areas such as Central Otago.

2.27

Starting in 2002, Delta acquired some roading and drainage businesses in Central Otago and Southland, including a roading company based in Alexandra. In 2007, Delta acquired a Queenstown-based contracting company, Lakes Contracting Services Limited. It also acquired two smaller companies in Christchurch in 2008, one in Nelson in 2009, and another in Southland in 2010. Delta purchased these businesses to expand its workforce and operations in the South Island.

2.28

Delta's growth strategy from about 2004 focused on looking for new business opportunities in any infrastructure area, including commercial and residential property developments.

Governance culture at the time of the investments

2.29

The Council reviewed and changed the governance arrangements in the holding company group after the Larsen review. The Luggate and Jacks Point investments were made under the former governance structure of the holding company group, where largely the same directors were involved in the holding company and subsidiaries.10

2.30

After the Larsen review, the Council changed the structure to provide that a director could not be on the board of both the holding company and a subsidiary in the group.

2.31

We consider that some of the Larsen review's findings and observations about the former governance arrangements are relevant to the Luggate and Jacks Point investments. Those of particular relevance to our inquiry were:

- the unsatisfactory situation of the five holding company directors also being on the boards of each subsidiary and, therefore, not fulfilling a strategic and performance monitoring role for the subsidiaries;

- the related risk that too much collegiality could impede robust debate (between the boards of the holding company and Delta, because they were largely the same);

- the directors of the holding company having mainly accounting and financial skills and not skills adequately in line with the activities of the subsidiaries;11

- the effect on the holding company and its subsidiaries of meeting the Council's requirements for increased dividends;

- the wisdom of participating in residential land development, considering the Council's dependence on consistent cash dividends;12

- the need to review the Council's overall investment policy for its subsidiaries and its other commercial activities to determine the Council's appetite for risk;13

- the need for the holding company's statement of intent to include an expectation that subsidiary companies would focus on core business, unless the holding company agreed to a change in strategy by way of an accepted business case (as opposed to the more simple financial thresholds that applied when the Luggate and Jacks Point investments were made); and

- a need for improved communication within the Council and between councillors, council staff, and the subsidiaries, and a need for improved formal reporting and communication structures and procedures.

Our comments about the context for the property investments

2.32

Delta's decisions to invest in the land at Luggate and Jacks Point need to be assessed in the context of Delta's operations, the expectations of the holding company and the Council, and the governance culture in the Council group at that time.

2.33

The investments were part of Delta's broad strategy of looking for new ways of securing work in Central Otago, which was, at that time, considered a growth area.

2.34

Delta's broad strategy had been endorsed by its shareholder, the holding company. The strategy was consistent with statements of intent of Delta and the holding company, and pre-dated but fitted with the Council's requiring increased distributions from the group from 2006.

2.35

The Council needed increased cash from dividends, which suggests that the holding company's board should have encouraged the subsidiaries to enter into ventures that would earn more cash rather than ventures that might lock up cash (such as property development). However, it is not quite that simple. As a contracting company, Delta's way of earning cash was through making a profit on its contracting activities. Delta was looking for new ways of getting contracting work to generate more cash, including by investing in property.

2.36

The holding company's records from late 2006 show that senior council staff and the Mayor would have known about Delta's growth strategy of moving into other South Island markets, particularly in Christchurch and Central Otago. The Mayor and senior council staff were attending board meetings of the holding company, and, at that time, the Council and the holding company regularly discussed the Council's requirement for extra dividends.14

2.37

Neither the holding company nor the Council discouraged Delta from seeking growth opportunities, including in residential property developments in Central Otago.

2.38

There were no formal discussions between the Council, the holding company, and Delta about Delta's growth strategy and approach to managing risks. Without any clear direction from either the Council or the holding company, the appetite for risk was essentially a matter for judgement by Delta. Council officers involved at the time saw this as the responsibility of the holding company rather than the Council. The officers said that it was not realistic to expect councillors to articulate to company boards their appetite for commercial risk except in the most general way.

2.39

We agree that the holding company had responsibility for commercial governance of its subsidiaries under the Council's governance structure. However, local authorities are required to consider and express their views on risk management from time to time in their investment policy15 and those with council-controlled trading organisations need to have an effective governance regime to manage their risks, including through the statement of intent process. This is part of prudent financial management, which is a Council responsibility. If councils lack the required capability in that area, they need to get advice from staff or external support.

2.40

We will consider how other local authorities approach this matter in our study on council-controlled organisations.

2: The interest payments began in 2001.

3: In 2011/12 and 2012/13, Dunedin City Holdings Limited also made a net-of-tax subvention payment of $5.25 million (from Aurora Energy Limited) to Dunedin Venues Limited in lieu of an additional dividend payment to the Council – Dunedin City Holdings Limited, 2011/12 Annual Report, page 6 and 2012/13 Annual Report, page 8.

4: Larsen Group (2011), Governance Review of All Companies in Which Dunedin City Council and/or Dunedin City Holdings Limited has an equity interest of 50% or more.

5: Further changes occurred in October 2013. Mr Baylis and Mr Shale resigned and were replaced by two new directors.

6: Called Dunedin Electricity Limited until July 2003.

7: Mr Dodds gave us correspondence between the Council and the holding company that confirmed the request for higher dividends and the holding company's concerns about this.

8: The Council had formed a Financial Review Working Party in March 2006 to review the financial structure of the Council and consider the sustainability of funding arrangements. Increased dividends from the holding company group was one of the proposals considered by the Working Party.

9: Letter from Mayor Peter Chin to the holding company, 1 May 2006.

10: Apart from Ray Polson, who was chairman of Delta and Aurora Energy Limited but who was not on the board of the holding company, and George Douglas, who was a director of Delta but who was not a director of the holding company or other subsidiaries.

11: As we explain in Part 3, this was especially problematic for the Luggate investment, because the director with the most experience was conflicted and unable to take an active role in the decision.

12: Land investments are generally illiquid, which affects the availability and timing of cash flow.

13: Without clear direction from either the Council or Dunedin City Holdings Limited, this was essentially a matter for the subsidiaries' judgement.

14: Minutes of the holding company's board meetings in September and October 2006 refer to Delta looking at developments in Wanaka and the Queenstown Lakes district, and its efforts to move into the Christchurch and Central Otago markets as much as possible.

15: A local authority's investment policy must state the local authority's policies for investments, including how risks associated with investments are assessed and managed (section 105 of the Local Government Act 2002). Council-controlled trading organisations are usually regarded as a form of investment.

page top