Part 9: Changing the contractor

9.1

In late 2002, the Council selected Simon Engineering as the preferred proponent and began negotiations. In early 2003, it decided to continue those negotiations on a modified basis. In this Part, we set out:

- the due diligence work that was done on Simon Engineering and its parent company;

- the Council's 2003 decision to finalise a contract with Simon Engineering;

- the decision in 2004 that the contract was ready to sign;

- the withdrawal of Simon Engineering's status as preferred proponent in early 2005;

- how the Council engaged with the other two bidders;

- the Council's decision to contract with EarthTech;

- what was finally agreed with EarthTech in 2005; and

- our comments.

9.2

In summary, we conclude that:

- KDC did not have good records of the information it relied on when making decisions about the project. The information that we were able to locate was inadequate in some cases. If this was the only information the Council relied on, then, in our view, the Council would not have been able to properly assess what it was being asked to make decisions on.

- KDC's advisers and the Chief Executive understood that there were risks in negotiating with Simon Engineering. It is not clear that the advisers and Chief Executive communicated those risks to the Council.

- The Council's decision to negotiate with EarthTech and NorthPower, once Simon Engineering's parent company went into administration, was not robust.

- The Council had no information to enable it to determine whether the contract with EarthTech was more cost-effective than KDC building and operating the scheme itself. Nor could it determine whether the price was competitive.

- The Council signed the contract without resolving the disposal site issue.

- The Council failed to get independent legal or financial advice about the contracts with EarthTech.

Due diligence report on Simon Engineering and Henry Walker Eltin

9.3

EPS asked an Australian company to prepare a Due Diligence and Financial Viability Report on Simon Engineering and its parent company, HWE. The report was provided in May 2003. It concluded that:

HWE has demonstrated its short term financial viability for the purpose of acting as guarantor of the obligations of Simon Engineering (Australia) Pty Ltd as contractor on the KDC wastewater treatment plant project. Its longer term viability is more problematic and depends on the company's ability to turn around its financial performance. Our generally positive conclusion is conditional on the implementation of the following recommendations:

1. HWE to provide a satisfactory performance guarantee to KDC to support the obligations of Simon Engineering (Australia) Pty Ltd on this proposed project;

2. KDC to continue monitoring the financial position of Simon Engineering (Australia) Pty Ltd and HWE Group generally, including a review of its audited financial statements of the year ended 30 June 2003, before contractual execution (if possible); and

3. KDC to ascertain whether ABN Amro has provided a firm commitment to finance this project, in the light of recent events which may cast doubt upon the creditworthiness of HWE.

9.4

As a result, EPS suggested to the Chief Executive that the same company do a follow-up review of Simon Engineering's and HWE's 2002/03 financial results and that some amendments be made to the Project Deed. It also recommended that, because of the conservative approach taken in the report, the next meeting of the PSC should just be given a summary. The EPS representative would have a copy of the full report with him at the meeting for discussion.

9.5

KDC has not been able to locate records of any PSC meetings after 2 May 2003, so we cannot establish whether the report was discussed with the PSC. There was no reference to the report in any minutes of Council meetings. We could not establish what KDC did in response to the recommendations in the report.

The Council decides to finalise negotiations with Simon Engineering

9.6

The Council meeting on 28 May 2003 considered a report from the Chief Executive, prepared on behalf of the PSC, as well as an outline for a Statement of Proposal to consult the community with. The report noted that the Council intended to proceed with Simon Engineering, using a DBFO type of PPP, provided that Simon Engineering:

... could demonstrate competitive financing options. This was considered to be the most effective means of progressing the project given the extent of resources committed to date.

9.7

The report discussed the range of financing options that Simon Engineering and ABN Amro had provided. The interest rates payable could be fixed for terms of five, 10, or 15 years. The amount owing at the end of those terms could vary from 100% of the value of the loan being owed at the end of five years (where only interest was being paid) to 0% of the value of the loan being owed at the end of 15 years. The report noted that:

The high risk period is within the first 5 years and therefore the PSC recommends pursuing a Five Year Fixed Interest rate with 100% residual value.

9.8

The capital costs of the project were now given as $15 million. Annual operating costs in year 1 were $500,300, rising to $1,115,800 by year 25. The report also noted that the disposal site had yet to be finalised. However, Simon Engineering had included in the capital cost the most expensive disposal option at that time, which was discharge to the Carter Holt Harvey forest land south of the estuary.

9.9

The report recommended that the PSC:

- conclude negotiations with Simon Engineering and ABN Amro;

- resolve the preferred disposal site option with Simon Engineering; and

- prepare a final Statement of Proposal, based on the outline, to consult the community with.

9.10

The Council largely accepted the recommendations. It resolved to proceed with a five-year-term loan, under which only interest was paid. At the end of 25 years, 37.5% of the loan would still be owing. The Council agreed that the "start-up fee" would be $1,200 plus GST for existing residents and $14,400 for future residents. It also resolved that ratepayers would be responsible for connecting their properties to the scheme.

9.11

In February 2004, at a workshop, the Council received a presentation from its project managers about the project. The Council meeting later that day also discussed the wastewater scheme. By this time, negotiations with Simon Engineering had been under way for some time. The Chief Executive sought confirmation from the Council that it wanted to proceed with the project and enter into a contract with Simon Engineering.

9.12

The paper the Chief Executive put to the Council set out the process to date, the results of negotiations to date, increases in the construction cost, and the likely rates and development contributions. It also attached advice from Bell Gully on rates and development contributions. The paper also noted that the proposed loan did not comply with the Council's Treasury Management Policy. However, it recommended that the Council use section 80 of the Local Government Act 2002 and treat the debt for the scheme as an exemption to its Treasury Management Policy.1 It noted that the only outstanding issue in the negotiations with Simon Engineering was the disposal site:

Simon Engineering does not wish to do any work on this until it has a contract with Council. Council will recall that the Te Ari (sic) Point option was the most expensive and that savings were envisaged. However, as will be noted under the discussion on subsidy some contingency is being allowed.

9.13

When discussing the risk profile and risk matrix, the paper also set out:

The major changes have resulted from the change from BOOT to DBFO approach with the Council now being required to be the owner of the assets. At the highest level, the inherent commercial risks associated with a DBFO are greater than with a BOOT, as Council must rely on its ability to call the Parent Guarantee if necessary. Under the previous BOOT approach Council would assume ownership of the assets as a first step, with the guarantee called to cover any losses. The assets would always have some inherent value even if performance in some areas was not being achieved.

Whilst this change has occurred the key construction risk remains with Simon Engineering and Council will not be required to commence any payments until Commercial Acceptance has been achieved which means at least 2 months of successful operation. Council will then have five years interest only period after which time the Council's risk position will have improved significantly which is expected to lower refinancing costs regardless of which refinancing option is selected.

9.14

The Council adopted the recommendations in the Chief Executive's report. It confirmed that it wished to proceed with the project. It also confirmed that it would enter into a contract with Simon Engineering, subject to several issues, including that the risk profile adopted by the Council was maintained and that the total cost of the project did not exceed $17.6 million. The Council also resolved to use section 80 of the Local Government Act 2002 and treat the debt of the project as an exemption to its Treasury Management Policy.

The Council decides the contract is ready to sign

9.15

In his monthly reports to the Council, the Chief Executive provided high-level information to the Council on the progress of contract negotiations. In August 2004, the Chief Executive provided the Council with another report on the project. The report noted that there had been "a robust and strenuous negotiation of the contract document" with Simon Engineering. The costs of the project had increased, with construction costs rising to $16.1 million and fees and interest increasing to $2.9 million. However, the rates and charges set out in the Statement of Proposal could still be achieved.

9.16

The report provided some information about the legal documents that were to be signed. However, it provided very limited information about the proposed financing arrangements. There was no information about the bank fees or interest that would be payable or whether the financing costs were competitive.

9.17

The report noted that one of the main changes was that KDC would own the scheme from commercial acceptance. This would mean that KDC would have a greater role "…in monitoring regulatory changes, changes in treatment standards and all proposed reuse arrangements". The report also included a table on the risks that had been identified as part of the initial risk allocation exercise, who these risks were now allocated to, and how they were dealt with in the Project Deed. However, neither the report nor the table identified that KDC might need to increase the amount of its oversight of the construction process. Nor did they mention that KDC would need to check that the scheme was fit for purpose before it took ownership.

9.18

The report recommended that the contract as drafted and agreed between Simon Engineering and the Council be executed and that the project proceed. The Council agreed with this recommendation at its meeting on 25 August 2004.

9.19

This decision was subject to the Chief Executive and KDC's Finance Leader making a final decision about repayment of KDC fees. This related to cash flow difficulties that KDC was having with paying for Beca's services. In September 2004, KDC's Finance Leader and Chief Executive recommended to the Council that ABN Amro loan KDC $800,000 to pay for KDC's costs associated with the project. It is unclear in that paper whether it was intended that this amount was to form part of the larger loan for purchasing the wastewater assets and when it would be paid. The paper noted that the interest and fees ABN Amro charged on the $800,000 loan would be slightly lower than those charged by BNZ. This calculation appeared to assume that this amount was the total of the loan. However, if the amount were to form part of the larger loan for purchasing the wastewater assets, the financing costs would likely be different.

Kaipara District Council withdraws from negotiations with Simon Engineering

9.20

By September 2004, the contract had still not been signed. In mid-September 2004, EPS advised the Chief Executive that there had been significant changes at HWE and Simon Engineering. He noted that HWE's website said that the original Simon Engineering business unit had been split up and that Simon Engineering was the loss-making part of HWE's business. He noted that:

From some of my contacts, the restructure has provided significant staff issues over recent times but it is not being bedded down and the general view is that HWE will be much better for it. Unfortunately all this has occurred since shortlisting although we have always pointed out that [Simon Engineering] would not be as easy to manage thru the negotiations as EarthTech for example but cost has been a major issue…The strong point of the HWE business is its history on delivery of building projects well, and although they are hard players, I believe they will deliver.

9.21

In an email to the Chief Executive dated 27 September 2004, EPS advised that "We are all concerned that, even if a deal is signed with [Simon Engineering], management of the project will now be exceptionally difficult and risky." EPS indicated that it had informally approached EarthTech to see whether that company would be prepared to take up preferred proponent status if it were removed from Simon Engineering. EPS had previously worked with EarthTech on a large project in Australia. The email noted that "They are very professional and I would have great confidence in achieving a good result."

9.22

In early October 2004, the Chief Executive went to Australia and met with Simon Engineering's Chief Executive to discuss the project.

9.23

It appears that HWE, Simon Engineering's parent company, started experiencing financial difficulties around November 2004. In January 2005, the Chief Executive advised the Council that HWE was "undergoing a refinancing programme" and that a new investor was proposing to make a significant investment in the company, subject to a due diligence process. As a result, Simon Engineering could not yet sign the Project Deed. However, on 31 January 2005, HWE was placed in voluntary administration and trading in its shares was suspended.

9.24

On 9 February 2005, the Council held a special meeting. It resolved to withdraw Simon Engineering's preferred proponent status and begin negotiations with EarthTech and NorthPower again. These were the other two companies short-listed in the RFP process in 2002. This meeting took 15 minutes. There are no records of what was discussed at that meeting nor of whether any papers were presented to the Council.

9.25

KDC's former Chief Executive told us that the Council had little choice but to proceed with negotiations with the other two bidders:

Community expectation and opinion was that the Council needed to proceed with the project quickly. There was also official pressure on Council to do this … Had Council not expedited the project it would have been publicly pilloried.

Engaging again with the other two bidders

9.26

EPS had discussions with EarthTech before the Council meeting, and EarthTech indicated it was interested. It wanted a 10-week time line for negotiations. EarthTech indicated that it was comfortable with ABN Amro providing the finance until the end of construction. EarthTech was also comfortable with KDC and ABN Amro entering into a separate loan arrangement for the purchase of the assets. EarthTech had also discussed this with ABN Amro.

9.27

EPS also had discussions with NorthPower, although we were unable to determine when these took place. In emails in KDC's files, dated after the Council meeting on 9 February 2005, NorthPower also indicated that it was interested. However, a NorthPower email dated 11 February 2005 noted that:

The commercial rational[e] that motivated NorthPower to submit its original (BOOT) offer, has changed significantly with the changes to a DBO approach. A good starting point to facilitate the negotiations would be to discuss and agree the commercial principles of the DBO approach with the KDC, before further effort goes into modifying our offer and reviewing the Project Deed.

9.28

The Chief Executive advised the Council at its meeting on 23 February 2005 that both companies were interested. The Chief Executive also noted that ABN Amro had indicated that it was interested in providing finance on a similar basis to the arrangements with Simon Engineering, with either NorthPower or EarthTech. The Council resolved to award EarthTech and NorthPower preferred proponent status so that discussions could begin with both parties. The proposed timetable for negotiations was tight.

9.29

The Chief Executive sent a letter the next day advising the companies of the Council's resolution and setting out the timetable. Negotiations were to be completed by 8 April 2005, and the contract signed by 22 April 2005. The letter also gave the companies until 4 March 2005 to advise whether they accepted the following terms of negotiation:

• Acceptance of the amendment from a BOOT style contract to that of a DBFO arrangement

• Acceptance of the amended term from 25 years to a maximum of 15 years in line with the LGA 2002

• Acceptance in principle of the current DBFO documentation including Project Deed and Schedules as provided in January 2005

• Acceptance of the concept of Guaranteed Maximum Price for the delivery of the capital component of the project.

9.30

NorthPower declined the invitation on 3 March. The company stated that the commercial rationale that had motivated it to submit its original proposal had changed with the change to a DBFO. It would need to establish a business case, which would require a thorough technical and financial evaluation of the concept. NorthPower stated that it would not be able to do this by the dates specified in KDC's letter. Some informal discussion continued, until NorthPower wrote to KDC on 4 April 2005 advising that it did not wish to be considered a preferred proponent for the project.

9.31

Negotiations continued with EarthTech.

The Council's decision to contract with EarthTech

9.32

On 1 June 2005, EarthTech presented its "concepts for designing, building and operating the EcoCare system" at a Council workshop. At the next Council meeting, on 1 June 2005, the Council agreed to enter into a contract with EarthTech to:

…deliver the Design, Build, Finance and Operate EcoCare System based on their presentation with a maximum construction price of $26,264,000 on a Guaranteed Maximum Price basis and a maximum annual operating cost of $748,000 plus inflation.

9.33

The Council resolved that the Chief Executive should:

- have a financial analysis carried out;

- report to the Council on funding options for the project, including connection fees, development contributions, and annual charges;

- provide a recommendation on the preferred funding option;

- have the funding model checked for compliance with the Local Government Act 2002 and other relevant legislation; and

- report on the legal advice as part of his recommendation on the funding options.

9.34

KDC files included an article to be included in the Mangawhai Memo in June 2005 that advised the community that the project was back on track with EarthTech. It explained that it was "anticipated that costs to the users will be maintained at the same levels as previously advised although they will be indexed to inflation to account for the delays in starting the project". It noted that the financial modelling would need to be redone but that the community would be kept informed. Full consultation would be required "if there are any significant changes to any part of the project".

9.35

The Council held a workshop on 25 August 2005 to discuss the wastewater project and the proposed contract. The Council meeting was held after the workshop. In KDC's files, we found a one-page paper by the Chief Executive included in the minutes of the Council's meeting and a copy of a draft presentation. We could not establish whether any other papers were provided to the Council at the workshop or the formal meeting.

9.36

The minutes of the Council's meeting records that the Chief Executive's paper stated:

The detail of the Project along with the funding models had been fully explained to Council at the workshop that preceded the Council meeting, The funding model will be dealt with as part of the Development Contributions policy item and had been considered by Council in a public item following this item

9.37

The information contained in the Chief Executive's paper and draft presentation was very brief. In particular, the only information about the financing arrangements was that ABN Amro had offered a loan of $31 million and that the project team had reviewed this and considered it appropriate.

9.38

The Chief Executive's paper advised that:

- EarthTech's proposal was "significantly higher" than Simon Engineering's. This was because of several factors, including higher initial capital costs, inflation, and increased financing costs.

- The level of charges for ratepayers agreed in June 2005 could be maintained if KDC got additional SWSS funding of about $3 million. The paper noted that changes to the subsidy scheme meant that the project was likely to qualify.

9.39

The draft presentation discussed the effect of the increased costs on the funding options and set out the new proposed charges. We did not find any evidence in KDC's files that the funding options had been legally reviewed, as the Council had asked.

9.40

The Council accepted EarthTech's draft offer and gave the Chief Executive delegated authority to accept the final proposal, provided it did not differ adversely from the draft documentation the Council considered. There were no copies of the draft documentation that was provided to the Council in KDC's files. The final proposal included a construction price of $26,264,000 "and a tolling arrangement that delivered an annual charge of $711,050 based on the scope as currently agreed". The scope was for up to 1970 allotments. The Council also agreed to accept the loan facility offered by ABN Amro up to a maximum of $31 million.

9.41

The Council accepted the contract with EarthTech, subject to EarthTech obtaining the necessary resource consents and the Council adopting the funding proposals in keeping with the Local Government Act 2002.

What was finally agreed with EarthTech in 2005

What did the contract documents provide?

9.42

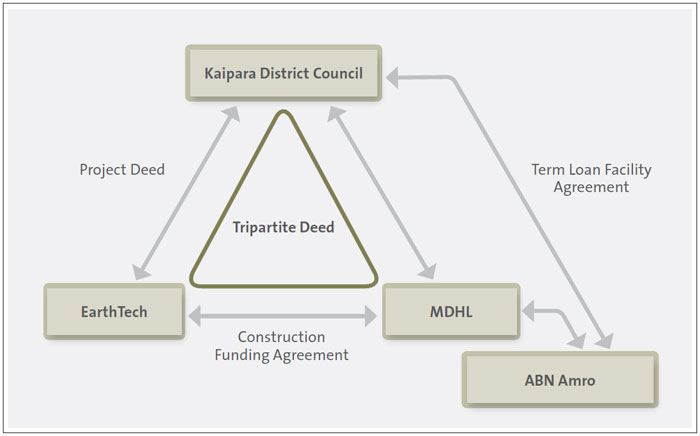

The main contractual and financing documents for the project were signed on 26 October 2005. The documents were:

- a Tripartite Deed between KDC, EarthTech, and Mangawhai Development Holdings Limited (MDHL – a wholly owned subsidiary of ABN Amro);

- a Project Deed between KDC and EarthTech;

- a Term Loan Facility Agreement between KDC and ABN Amro; and

- a Construction Funding Agreement between EarthTech and MDHL.

9.43

Between them, these documents provided that:

- EarthTech would construct the wastewater scheme;

- MDHL would make progress payments to EarthTech for constructing the scheme and would progressively own the scheme as it was constructed;

- MDHL would sell the scheme to KDC once the construction was completed;

- KDC would use a loan from ABN Amro to purchase the scheme from MDHL, secured by KDC's rating revenue;

- EarthTech would operate the scheme for 10 years, with a five-year right of renewal; and

- KDC would make annual payments to EarthTech for the operating costs.

9.44

The relationship between the parties is shown in Figure 6. Other significant points from the contracts are summarised in Figure 7.

Figure 6 Contractual relationships between Kaipara District Council, EarthTech, ABN Amro, and Mangawhai Development Holdings Limited

Figure 7 Significant points from the contracts

| Significant points from the contract documents |

|---|

| Project Deed The Project Deed would not be operative until EarthTech had obtained all consents and KDC had completed all procedures required by the Local Government Act 2002. The scheme would include a wastewater treatment plant with capacity to service up to 2500 sections. The scheme would start by servicing 1216 properties. Ratepayers would arrange their own connections to the network. There would be a guaranteed maximum price of $26,264,923 for construction. If actual costs were lower, EarthTech would get half the value of the difference. Treated effluent would be disposed to Mangawhai Park, but Schedule A noted that "this option will not proceed and the Council will work with the Promoter to identify a suitable alternative site". Beca and EPS would carry out technical audits of the scheme before ownership was transferred to KDC at the end of construction. There would be standards that EarthTech had to meet when operating the scheme and penalty provisions if those standards were not met. There would be an initial annual operating payment of $711,050 and a system for annual recalculation of the operating payment. Separately, KDC would pay EarthTech actual power costs plus 10%. |

| Tripartite Deed EarthTech would construct the scheme. MDHL would make progress payments for construction and take progressive ownership of the scheme as it was constructed. Interest would accrue on the progress payments. Once complete, KDC would buy the scheme from MDHL using a loan from ABN Amro. There would be a formula to calculate the purchase price, using actual construction costs, interest on the construction progress payments, and bank fees. If the project was completed on time and for the guaranteed maximum price, the price would be $29,811,423, including bank fees of $1,114,500 and $1,632,000 in interest payments over a 24-month construction period. Bank fees included a commitment fee of $50,000 provided the Project Deed conditions for beginning construction were met within six months. If the conditions were not met by 26 March 2006, additional commitment fees of $8,333 each month were payable until they were achieved. |

| Term Loan Facility Agreement

The loan would be drawn down in one lump sum. The loan would be used to purchase the scheme from MDHL at the price set in the Tripartite Deed. Interest only would be payable on the loan. The loan would be for a five-year term. The loan would be secured against KDC's rating revenue. A bank arrangement fee would be payable (based on 1.5% of the value of the loan), as well as bank expenses in preparing the documentation. |

9.45

KDC's main contractual protections against poor construction and maintenance were:

- the process of endorsement of the design of the scheme;

- the technical auditing process during construction;

- the technical acceptance and commercial acceptance at the end of construction;

- warranties and indemnities provided by EarthTech;

- the ability to reduce the monthly operating payments if performance standards were not met; and

- the requirement for asset condition reports and maintenance to bring the scheme up to standard.

9.46

The contract was now for only a 10-year period (with a five-year right of renewal) instead of 25 years. Because the capital cost was to be paid at the end of construction, the amount paid for the monthly operation of the scheme was significantly lower. This lessened the financial effect on EarthTech if the monthly payments were reduced for non-performance. There was also no parent guarantee. The first three mechanisms were available before construction ended, and the last three mechanisms available once construction ended.

What advice did the Council get?

9.47

EPS sought legal advice about the agreements from Bell Gully. Bell Gully provided a letter to KDC's Chief Executive setting out its involvement in preparing each of the agreements. A schedule to the letter summarised the terms of the agreements. Bell Gully set out that EPS had instructed it to assist with some aspects of the project. In particular, Bell Gully assisted EPS with negotiating and completing the core part of the Deed, excluding the schedules. It also advised EPS on the negotiation of the Tripartite Deed and Term Loan Facility Agreement. Bell Gully confirmed that the Project Deed (not including the schedules), Tripartite Deed, and Term Loan Facility Agreement reflected EPS' instructions to it and its advice to EPS. Bell Gully also confirmed that, on that basis, the documents were appropriate for the Council to execute and rely on. Bell Gully noted that the confirmation assumed that the Council was satisfied with:

…the structure of the Mangawhai EcoCare Project, the matters in respect of which KDC will need to satisfy itself, the commercial terms of each of the Project Documents, and the risks and obligations assumed by KDC under the Project Documents…We have not been privy to the full background of the Mangawhai EcoCare Project or all of the business drivers relevant to it.

9.48

There was no information in KDC's files to show the nature of the legal advice EPS sought from Bell Gully. The Council did not seek its own legal advice about the agreements before signing them. This meant that there was no legal review of the schedules to the Project Deed, which contained core aspects of the agreement.

9.49

Beca told us that the contractual documents were based on similar documents that were used in Australia. EPS had been part of the consortium to bring expertise in these arrangements to the project. Beca noted that the review by Bell Gully had been qualified because Bell Gully had not been directly involved with the Council in risk workshops and similar meetings, so it was not able to know what risks the Council was prepared to accept. Beca stated: "Again there was a reliance on the Chief Executive to obtain advice and recommend a way forward to Council."

9.50

EarthTech told us that, in its experience, the contractual documents were not unusual or inconsistent with what was used in the market.

9.51

The financing arrangements contained in the Tripartite Deed and Term Loan Facility Agreement were complex. There were very few documents in KDC's files about the financing arrangements, which EPS negotiated on KDC's behalf. We found no evidence in KDC's files that KDC staff or EPS sought independent financial advice about the financing arrangements. Nor did we find anything to suggest that there had been any assessment of whether the financing arrangements offered by ABN Amro were competitive or provided value for money. There was no information in KDC's files to show what the Council was told about the financing arrangements at the Council's August 2005 meeting.

9.52

As we set out later in the report, some of the bank fees – the commitment fees – started running from the date the financing arrangements were signed. To avoid incurring higher fees, the Council needed to ensure that the project deadlines in the financing arrangements were met. However, this did not occur. Given the lack of information about the financing arrangements given to the Council, it is possible that it did not understand that decisions affecting the timing of the project would also increase the financing costs.

Our comments

Kaipara District Council's record-keeping was poor

9.53

We are disappointed at the state of KDC's records, both for regular Council meetings and for this project. Time and again, we have been unable to locate basic documents or to establish what papers were provided at meetings. For something as significant as the wastewater project, this is not acceptable. Records for regular and formal business, such as Council meetings, should also be complete.

9.54

One particular issue highlighted in this inquiry is the practice of providing information to the Council at workshops. Workshops can be a very useful forum for open discussion, but councils can only legally make decisions in council meetings. In our view, there are risks if the council is given information in workshops that is not also provided in some form in the council meeting where the decision is made. Such a practice means that decision-making is not transparent and that accountability is weakened. The public cannot readily understand the reasons for decisions or the information the council relied on in making those decisions.

9.55

In this case, these problems were exacerbated by the very poor records associated with Council meetings.

The Council did not have good enough information when it made decisions

9.56

This contracting process revealed numerous examples of the Council making important decisions with very little information formally before it. We usually expect a council to have full information about all important matters relating to the contract before making a decision. These matters include:

- the full costs of the contract;

- a precise description of what was to be delivered;

- the process for making variations to the contract;

- roles and responsibilities for managing the contract while work was under way;

- the financing arrangements and their cost;

- assurance that appropriate expert checks had been carried out and were satisfactory; and

- copies of any legal advice that had been provided.

9.57

In our view, the information that the Council had formally before it when it took the decision to finalise negotiations with Simon Engineering was not adequate. In particular, it had very little information about the financing costs.

9.58

The decision in August 2005 to accept the terms that had been negotiated with EarthTech was based on even less information. In June 2005, the Council resolved that the Chief Executive provide it with information about the financial analysis, funding options, and legal compliance. This was not done. All we found on the files for the 25 August 2005 meeting was a one-page paper and a draft presentation. The Council does not seem to have objected to the fact that the Chief Executive had not provided it with the information it had asked for.

9.59

We do not consider it satisfactory that, given the large amount of money involved and the long-term nature of the contract, there was not a written paper setting out in some detail the arrangements that the Council was being asked to consider. If the Council had only the information contained in the one-page paper and the draft presentation, the Council could not have had enough information to make an informed decision about whether to contract with EarthTech or whether to obtain loan financing from ABN Amro. Yet, as the Chief Executive noted in the agenda paper for the workshop on 25 August 2005:

This will be one of the largest undertakings this Council will commit itself to and it is essential that all members of Council are fully informed and understand the information provided before the Council considers making a decision.

9.60

When we spoke with some people who had been councillors at the time, they commented that they thought they had good information and were kept informed. We acknowledge that it is possible that a great deal of information was provided to the Council through the regular workshops. However, there are no records of these. We repeat the point that, for accountability purposes, information needs to be clearly provided to the Council as part of the formal meeting process and recorded in the Council's files.

The Council took a risk with Simon Engineering

9.61

Many people expressed concern to us that the Council did not do enough due diligence on Simon Engineering and should not have negotiated with it because there was some risk. Having reviewed what was done, we are satisfied that KDC's advisers carried out reasonable checks, understood the risks associated with this potential partner, and monitored developments. Beca told us that EPS advised KDC not to enter into the contract with Simon Engineering until the due diligence exercises had been completed. Beca considered that this was proved to be sound advice with the voluntary administration of HWE.

9.62

We have not been able to establish how much information was disclosed to the Council about the risk of continuing negotiations with Simon Engineering from May 2003 (when EPS received the due diligence report). We conclude that KDC took a risk that simply did not pay off.

The decision to negotiate with EarthTech was not robust

9.63

When negotiations with Simon Engineering fell through, KDC approached the two other bidders from the previous tender process. When NorthPower advised that it was not interested, KDC moved to direct negotiation with EarthTech.

9.64

In our view, this was not a sound process. The tender process had taken place three years before and was based on a very different type of arrangement. The information the tender process had provided on the market and what was competitive was unlikely to be very relevant or reliable. We did not see any evidence to suggest that the Council considered going back to the market and running a fresh tender process using current information. The Council had missed the opportunity to rethink its approach when the Local Government Act 2002 changed the nature of the commercial arrangements, and it missed a similar opportunity here.

9.65

In any event, in 2002, EarthTech's bid had been the most expensive and had exceeded the benchmark figure. The purpose of the benchmark is to determine whether it is more cost-effective for the public entity to construct and operate the asset itself compared to the private sector. It was also clear that the cost and affordability of the wastewater scheme was a significant issue for the Mangawhai community. There was no information in KDC's files to suggest that KDC had assessed EarthTech's bid in 2005 against a revised benchmark figure.

9.66

We have concluded that, when the Council agreed to the contract with EarthTech, it had no way of knowing whether the contract provided better value than KDC building and operating the scheme itself or whether the price was competitive.

The contract was signed with a major issue still unresolved

9.67

A major issue was left unresolved in both the contract negotiated with Simon Engineering and the contract signed with EarthTech. The Council was agreeing to pay for a sewerage scheme when a disposal site had not been identified. This created a large degree of uncertainty for the rest of the project. Resource consents could not be applied for, the design of the wastewater treatment plant could not be confirmed, and, most importantly, the costs remained uncertain. This risk was not discussed in the papers that were presented to the Council in August 2005.

9.68

EPS told us that:

All parties understood the risk, however Council elected to proceed as they could lock in the base price for the treatment plant based on EarthTech original proposal. This mitigated the risk of additional cost increases from EarthTech.

9.69

One of the main benefits of PPP approaches such as the BOOT model is that purchasers can avoid detailed specification and checking of requirements along the way, because they are buying "the whole package". Instead, the contract specifies and enforces the outcome or service being purchased. That benefit was undermined in this case, when the contract was signed with a major issue still unresolved. The Council was buying roughly two-thirds of what was needed to deliver the services. This significantly changed the benefits and risks of the arrangement. The Council does not appear to have appreciated that it was increasing its own risks by taking this step.

The contract documents had not been properly reviewed

9.70

In our view, the Council should have had the contract documents reviewed by its own legal and financial advisers before it signed them. The partial advice that Bell Gully provided to EPS when the documents were negotiated was explicitly caveated. It was not a substitute for the Council obtaining its own advice.

9.71

Similarly, we found no evidence in the files to suggest that the Council or the consultants considered whether the financing arrangements provided by ABN Amro were competitive with financing that was available in the local government sector at the time. If the information given to the Council on the financing arrangements was restricted to that contained in KDC's files, then, in our view, that information was woefully inadequate.

9.72

We identified several possible concerns with the contract documentation. These concerns suggest that the detail might not have been properly reviewed by anyone. For example:

- The size of the treatment plant specified in Schedule A is much bigger than the size of the scheme specified elsewhere in the documents.

- As we discuss later in the report, the capacity of elements of the wastewater treatment plant were significantly oversized for the anticipated flows, and their capacity was significantly reduced in the 2007 Project Deed.

- The time allowed for fulfilling the conditions in the Project Deed was probably unachievable. In practice, it took an additional 17 months to reach that point, resulting in additional costs.

9.73

We also consider that the legal arrangements and documentation were overly complex. The speed with which the Council moved from the proposed BOOT arrangement and associated contract documents meant that the parties continued to use those documents as a starting point. Indeed, KDC required that as a condition when it approached the other parties. However, the arrangements were now quite different and much simpler. In our view, the failure to start again when the basic arrangement changed in January 2003 meant that the project worked with unnecessarily complex legal and financial arrangements and documentation.

1: Section 80 enables a council to make a decision that is inconsistent with its own policy. As part of the decision, it must clearly identify the inconsistency, the reasons for it, and any intention of the council to amend the policy or plan to accommodate the decision.

page top