Controller update on Government spending on Covid-19

The financial data we have examined has not been audited. We will confirm the final amounts as part of our annual audits of government departments and of the Financial Statements of the Government of New Zealand for the year ending 30 June 2020.

Key points

- Given the scale of the Covid-19 pandemic, the substantial funding available for responding to it, the pace of the Government’s emergency response, and the extraordinary conditions under which the public sector is operating, we have been giving special attention to Covid-19-related spending. In this Update, we focus on both spending approved and incurred up to 31 May 2020.

- On 25 March 2020, Parliament passed legislation authorising the Government to spend up to $52 billion more than the $129.5 billion1 already authorised for 2019/20. The extra $52 billion was mainly for the Covid-19 response.

- Most of the new Covid-19 spending approved in May related to the Small Business Cashflow (Loan) Scheme. Cabinet approved $5.2 billion to be set aside for loans and $3.4 billion for write-downs of those loans when they are initially recognised as assets on the Government’s books. Actual loans made at 31 May were just over $1 billion, and the value of those loans was written down by $679 million.2

- We did not identify any spending in response to the Covid-19 pandemic during May 2020 that was outside the approvals provided by Parliament or, where necessary, the subsequent Cabinet approvals to incur additional spending under imprest supply.

- By 31 May 2020, the Government had approved spending of nearly $30.1 billion for responding to the Covid-19 pandemic. This comprises $26.7 billion for new areas of spending that were set up exclusively to deal with the Covid-19 pandemic (Covid-only initiatives) and $3.4 billion to top up existing budgeted areas of spend. Actual spending for Covid-only initiatives has been much lower than the amount of spending approved. As at 31 May, less than half ($12.7 billion) of the $26.7 billion had been spent.

- Together, the Covid-19 Business Support (Wage) Subsidy and Small Business Cashflow (Loan) Scheme make up 98% of the $12.7 billion spent on Covid-only initiatives. The largest item is the Business Support (Wage) Subsidy. As at 31 May, $10.7 billion had been spent on the subsidy.

- Outside the Covid-19 spend, a significant new liability was recognised in the Financial Statements of the Government in May. As a result of a new accounting standard. Defence veterans’ disability entitlements must now be reported as a liability. This has given rise to an expense of $3.5 billion, which was covered by the imprest supply authority.

Our role

Our constitutional arrangements require that the Government must not spend public money unless it is approved by Parliament.

The Controller and Auditor-General is often referred to as the public “watchdog” on government spending. An important part of the watchdog role is the Controller function. In this Controller role, we provide assurance to Parliament and New Zealanders on the extent to which the Government has spent public money in line with the authority it has from Parliament.

Unsurprisingly, the funding approved in the 2019/20 Budget was inadequate for the Government’s Covid-19 response. On 25 March, Parliament approved the Government to spend up to an additional $52 billion; this was mainly to enable the Government to incur expenditure on the Covid-19 measures it had announced and to cover any further measures it might consider necessary. Some of the additional funding was also needed for other activities.

As the independent watchdog on Government expenditure, we will continue to monitor the Covid-19 spending as part of our monitoring of all Government spending. We will provide regular updates to the public and Parliament about the spending and how departments are accounting for it.

How much has been spent on Covid-19 initiatives so far?

We have examined the Treasury’s financial information provided to us to carry out our Controller work. We have determined both the Covid-19 spending approvals and actual spending incurred, based on items specifically identified for Covid-19 or information that links the expenditure to the Covid-19 response.

It isn’t possible to know from the financial data we received exactly how much has been spent on the Covid-19 response and recovery effort so far. That’s because a lot of the Covid-19 expenditure has been applied to existing spending areas, that is, it has been authorised through regular, annual appropriations.3 In those cases, we can determine how much new Covid-19 spending the Government has approved, but the actual Covid expenditure incurred in these categories is combined with non-Covid spending.

However, there are other spending categories that were set up exclusively to deal with the Covid-19 pandemic and its effects (Covid-only initiatives). These are “new areas” of spending approved through new appropriations. We are able to report not only the amounts approved for these categories but also the amount actually spent to date.

The dollar amounts for the Covid-only spending categories (as at 31 May 2020) are presented in the Appendix (Figure 4). For those areas of spending, a total of $12.7 billion had been incurred against the $26.7 billion approved for the 2019/20 financial year, that is, 48% had been spent as at 31 May 2020.4 Together, the Covid-19 Business Support (Wage) Subsidy and the Small Business Cashflow (Loan) Scheme amount to 98% of the Covid-only expenditure incurred as at 31 May.

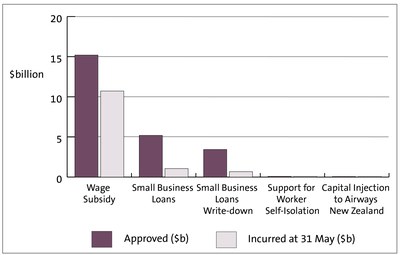

Figure 1 shows the top five areas of spending on Covid-only initiatives as at 31 May (along with the amount approved5). The expenditure “incurred” data in Figure 1 have not yet been audited. We will confirm the final amounts as part of our annual audits of government departments and of the Financial Statements of the Government for the year ended 30 June 2020.

Figure 1

Top five areas of Covid-only spending: Approved and incurred as at 31 May 2020

The largest item of additional spending, the Business Support (Wage) Subsidy, has been extended since it was put in place in March 2020, to 1 September 2020. The initial approval of $9.3 billion was topped up by $2.7 billion in April and increased further by $3.2 billion in May. Of the $15.2 billion approved for 2019/20, $10.7 billion had been spent as at 31 May 2020.

Most of the new Covid-19 spending approved in the month of May related to the Small Business Cashflow (Loan) Scheme. Cabinet approved $5.2 billion to be set aside for loans for 2019/20. The loan amount available is $10,000 per business plus $1,800 per employee,6 up to a maximum amount of $100,000. The maximum term for the loan is five years. Repayments are not required for the first two years, and an interest rate of 3% is applied one year from when the loan is drawn down. If the loan is repaid within a year from draw down, then it is interest free.7 Applications opened on 12 May. Since its introduction, the Small Business Cashflow (Loan) Scheme has been extended to the end of December 2020. As at 31 May, just over $1 billion in loans had been issued to around 62,000 borrowers.

As well as the $5.2 billion approved to cover the loan scheme, a further approval for $3.4 billion was needed to cover the expense of writing down the loans when they are initially recognised as assets on the Government’s books.8 The write-downs are considered necessary because the loans must be recorded in the Government’s accounts at their “fair values”. Fair value is the amount that the loans could theoretically be sold into the market where unrelated buyers and sellers would set a price that reflects both the concessions in the loan (that is, below-market terms such as a period in which they are interest free) and the risk of borrowers defaulting, resulting in loans not being recovered. As a result, the fair value of the loans is not simply the amount that has been lent out.

Figure 4 (Appendix) shows that the fair value write-down on the $1 billion of loans issued to 31 May was $0.678 billion. The amount of write-down is based on a high-level estimate, which includes the effect of interest concessions and a working assumption before the scheme began that around 56% of borrowers might default.

Other than the Wage Subsidy and Small Business Cashflow (Loan) schemes, the only areas of spending specifically created for the Covid-19 response that incurred more than $10 million by 31 May were:

- Financial Assistance to Support Worker Self-Isolation - $78.9 million;

- Covid-19: Capital Injection to Airways New Zealand - $70 million;

- Essential Workers Leave Support Scheme - $24.4 million;

- Protection of Waka Kotahi New Zealand Transport Agency's (NZTA’s) Core Regulatory Functions - $11.1 million; and

- Covid-19 Leave Support Scheme - $10.3 million.

The Financial Assistance to Support Worker Self-Isolation initiative was set up for people who were unable to work because they were sick, self-isolating, or caring for dependents. This initiative was folded into the Business Support (Wage) Subsidy Scheme on 27 March.9

The Essential Workers Leave Support Scheme was to cover essential workers taking leave to comply with public health guidelines. It enabled them to self-isolate if necessary and to continue to receive an income at the same rates as the Wage Subsidy Scheme.10 The Covid-19 Leave Support Scheme was introduced to broaden the support provided to beyond just essential service workers.

Airways11 is the state-owned enterprise responsible for New Zealand’s air navigation service and air traffic management. Its revenue from commercial charges was affected by the Covid-19 pandemic and, as a result, the Government injected $70 million in funding to cover the revenue lost from the downturn in air traffic.

The $60 million approved for protecting the Waka Kotahi NZTA’s core regulatory functions covers the period to 30 June 2022, with $15 million forecast for 2019/20 ($11.1 million of which was spent by 31 May 2020). This is to cover the costs of some services that were not able to recover revenue from third parties because of Covid-19. Most of Waka Kotahi NZTA’s funding is through the National Land Transport Fund, which is heavily dependent on fuel excise duty. The Government’s financial statements at 31 May 2020 show revenue from petroleum fuels excise tracking at $55 million below forecast.12

Spending decisions approved during May

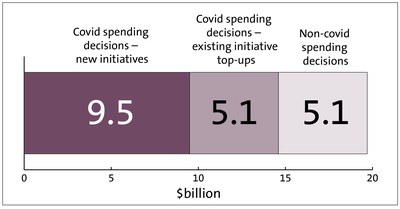

The Treasury’s financial records for May 2020 show Cabinet approvals for new spending (under imprest supply13) of $19.7 billion.14 That brings the total amount of spending approved under imprest supply for the year to 31 May to $45.3 billion, from the $69.3 billion available. The $45.3 billion represents the dollar value of spending decisions the Government has made that weren’t included in Budget 2019.

Based on our examination of the Treasury’s financial data, the $19.7 billion of decisions made in May comprised:

- New initiatives to respond to the Covid-19 pandemic - $9.5 billion (see Appendix, Figure 4)

- Approvals to top-up existing areas of Covid-19 spending - $5.1 billion

- Increased expenditure on areas not related to the Covid-19 response - $5.1 billion.

Figure 2

New spending decisions made during May 2020

As part of our routine Controller checks, we reviewed the Government’s May financial data on departmental spending. We paid particular attention to new approvals attributed to the Covid-19 response.

| We reviewed a sample of Cabinet decisions approving new spending recorded as being for Covid-19. All of the approvals we examined were made correctly. We confirmed that the nature and purpose of the spending, as stated in the approval documents, is related to the Covid-19 response. We examined a sample of approvals for topping up existing appropriations to ensure that the nature of the new spending approval aligns with the scope of the appropriation. We also reviewed a sample of Cabinet decisions on non-Covid-19 spending. No issues arose from our sample testing of approvals. |

|---|

New areas of Covid-19 spending approved in May

Figure 4 in the Appendix includes the $9.5 billion of Covid-19-related initiatives introduced during May 2020. Almost all of the Covid-only spending approved in the month of May related to the Small Business Cashflow (Loan) Scheme.

Of the remaining new initiatives in May, the more significant include the $425 million borrowing facility that allows Waka Kotahi NZTA to manage the cash flow impacts (“revenue shocks”) from the Covid-19 pandemic (with no spending incurred as at 31 May), and the Crown’s $150 million equity injection to New Zealand Post Limited over a three-year period (which also hadn’t been drawn down at 31 May).

Top-ups to existing areas of Covid-19 spending approved in May

According to our examination of the Treasury’s financial data, Cabinet approved about $5.1 billion of additional spending in May on existing initiatives to respond to the Covid-19 pandemic and its effects. The major areas where increased spending was approved are:

- Social Development - $3,214.9 million: This was mainly to increase the Business Support (Wage) Subsidy ($3,200 million), along with additional funding for improving employment outcomes ($7.5 million) and community response in the form of support for foodbanks and other community food services as well as funding brought forward from 2020/21 to support local solutions and community resilience in facing the challenges posed by Covid-19 ($4.1 million).

- Tertiary Education - $1,237.2 million: Nearly 96% of the approvals for tertiary education relate to the “Covid-19 Tertiary Education Grant Funding Transfer”. This approval allowed for the transfer of $1,186 million in funding from 2020/21 to 2019/20. The reason for bringing the spending authority forward was to give tertiary education institutions funding certainty in 2020, regardless of any effect on student numbers from Covid-19. Of the remaining approvals, $24.9 million was brought forward from 2020/21 to extend contracts for Centres of Research Excellence, and $20 million was approved to set up a Student Hardship Fund. Some new funding was also targeted to workforce training and development, including the retention of apprentices.

- Health - $310.8 million: This was mainly for public health services ($227.2 million), along with national disability services ($25.4 million), national personal health services, ($22.1 million), primary healthcare strategy ($18 million), and national emergency services ($12.4 million).

- Police - $125.0 million: Allocated across New Zealand Police’s operational activities, the extra spending was to cover costs of responding to Covid-19, including the procurement of personal protective equipment (PPE) and the increased expense associated with the cancellation of annual leave.

What new spending decisions were made for non-Covid reasons?

Our examination of the May financial data indicates that $5.1 billion of new spending approved by Cabinet was for matters not directly related to the Covid-19 response and recovery. However, we note that some of this (for example, scheduled adjustments to “benefits and related expenses” approvals of $370 million) was affected by the impact of Covid-19 on the country’s economic conditions.

Most of the new approvals ($3.5 billion) were needed to cover an expense resulting from a change in accounting standards. The change requires that some commitments not previously required to be treated as liabilities on the Government’s balance sheet must now be accounted for as such.

Under the new standard, the Government must report for the first time a liability for Defence veterans’ disability entitlements. Recognising the liability in the accounts for the first time has resulted in an expense item, which was covered by the imprest supply authority.

It is important to note that the amount of new spending decisions made (under imprest supply) during May does not represent the increase in the Government’s overall budget because, at the same time as making new spending decisions under imprest supply, the Government was reducing some spending previously approved for other areas (as well as bringing forward some spending initially budgeted for 2020/21).

Was the expenditure incurred during May properly authorised?

Because New Zealand’s constitutional arrangements require that the Government must not spend public money unless it is approved by Parliament, it is important for the Controller to determine whether there has been any spending incurred without the necessary approval.

| We did not identify any spending in response to the Covid-19 pandemic during May 2020 that was outside the approvals provided by Parliament or, where necessary, the subsequent Cabinet approvals to incur additional spending under imprest supply. However, we are currently following up a small number of expenditure items of non-Covid spending that could potentially be unappropriated. We will report on these later in the year after our auditors have confirmed their occurrence and amount. |

|---|

What does all this mean for core Government spending in 2019/20?

It is usual for the Government to reprioritise spending and alter its budget during the year. When the Government wants to spend more on a particular area than was authorised in the Budget, it needs Parliament to approve a revised Budget. Because the revised Budget isn’t authorised until June each year,15 the Government obtains interim legal authority through imprest supply.

As at 31 May, the Government had approved extra spending of $45.3 billion under imprest supply, from the $69.3 billion of imprest supply authority available. From our examination of the financial data, nearly $30.1 billion of the $45.3 billion was in response to the Covid-19 pandemic.

As mentioned above, it is important to note that the accumulated approvals under imprest supply to 31 May ($45.3 billion) is not the same as the net increase in planned or actual government spending. The reason for this is that, while the Government has been seeking added authority to spend on areas not initially budgeted for, it has funded some of the new activity by reducing its spending plans in other areas. In addition, funding for some specific Covid-19 initiatives, such as the Worker Redeployment Package, has been directed to different employment initiatives, as planned, as the Package has been drawn on.

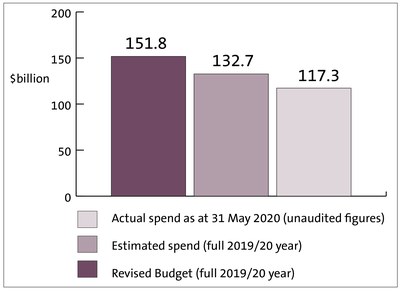

Figure 3 provides an indication of Government expenditure for 2019/20.16

Figure 3

Government expenditure (budgeted and actual for 2019/20) as at 31 May 2020

As at 6 April, the Government was forecasting expenditure of $132.7 billion for 2019/20. Until the Government’s accounts have been completed and audited, we won’t know exactly how much expenditure the Government has incurred for the year. However, according to financial data we have received from the Treasury (which has not been audited), expenditure was tracking at $117.3 billion for the 11 months to 31 May 2020.

Other Covid-19 matters

Our Controller work involves checking that Government spending is in line with the authority provided by Parliament. The Auditor-General’s interest in the Government’s Covid-19 response is much wider than his Controller role of checking authorisations.

In June 2020 we published our report, Ministry of Health: Management of personal protective equipment in response to Covid-19. We have planned to continue providing assurance to Parliament and the public on the Covid-19 pandemic response and recovery throughout 2020/21 and beyond, as outlined in our Annual Plan. For 2020/21, we will document our understanding of the centralised response, including what has been and is being spent. We will also carry out a series of business continuity case studies looking at how effectively agencies were able to maintain service delivery during the lockdown and a targeted piece of work on the management of the Wage Subsidy scheme.

Appendix

Figure 4

Areas of Government spending exclusively for Covid-19, as at 31 May 2020

| Month expenditure initially approved | Portfolio (“Vote”) | Covid-19 initiative | Expenditure approved by Cabinet $million |

Expenditure incurred $million at 31 May |

|---|---|---|---|---|

| March | Social Development | Business Support Subsidy Covid-19 | 15,200.0 |

10,722.7 |

| May | Revenue | Small Business Cashflow (Loan) Scheme | 5,200.0 | 1,060.2 |

| May | Revenue | Initial Fair Value Write-Down Relating to Small Business Cashflow (Loan) Scheme | 3,444.0 | 678.6 |

| March | Social Development | Financial Assistance to Support Worker Self-Isolation | 95.0 | 78.9 |

| March | Finance | Covid-19: Capital Injection to Airways New Zealand | 70.0 | 70.0 |

| April | Social Development | Essential Workers Leave Support Scheme | 34.5 | 24.4 |

| May | Transport | Protection of Waka Kotahi NZ Transport Agency's Core Regulatory Functions | 60.0 | 11.1 |

| April | Social Development | Covid-19 Leave Support Scheme | 97.0 | 10.3 |

| March | Business, Science and Innovation | Worker Redeployment Package | 79.9* | 7.9 |

| March | Transport | Maintaining Airfreight Capacity | 330.0 | 5.4 |

| April | Education | Education Providers With Covid-19-Related Losses of Income | 18.6 | 3.8 |

| April | Arts, Culture and Heritage | Covid 19: Transmission and Other Fees on Behalf of Media Organisations | 7.7 | 2.8 |

| May | Agriculture, Biosecurity, Fisheries and Food Safety | Covid-19 Assistance for Primary Industries | 10.2 | 2.1 |

| April | Prime Minister and Cabinet | Covid-19: Civil Defence Emergency Management Group Welfare Costs | 25.0 | 1.1 |

| March | Justice | Supporting Iwi Covid-19 Responses | 0.5 | 0.5 |

| May | Transport | Meeting fees, charges and levies on behalf of airlines | 74.0 | 0.1 |

| March | Finance | Covid-19: Loans to Air New Zealand | 900.0 | 0.0 |

| May | Transport | Covid-19 – National Land Transport Fund Borrowing Facility | 425.0 | 0.0 |

| April | Transport | Protection of Transport Sector Agency Core Functions | 236.6 | 0.0 |

| May | Finance | Covid-19: Capital Injections to New Zealand Post Limited | 150.0 | 0.0 |

| May | Social Development | Covid-19 Income Relief Assistance | 113.1 | 0.0 |

| May | Business, Science and Innovation | Research, Science and Innovation: Crown Research Institutes - Covid-19 Response and Recovery | 45.1 | 0.0 |

| April | Social Development | NZ Beneficiaries Stranded Overseas | 28.4 | 0.0 |

| May | Audit | Capital injection | 15.0 | 0.0 |

| April | Housing and Urban Development | Covid-19 Housing Providers Operational Cost | 10.0 | 0.0 |

| May | Arts, Culture and Heritage | Advances and Investments | 9.0 | 0 |

| May | Transport | Maintaining Essential Transport Connectivity | 5.0 | 0.0 |

| May | Arts, Culture and Heritage | Grants and Subsidies | 2.4 | 0.0 |

| May | Māori Development | Te Kaitaonga Hua Pāpori (Social Procurement) | 0.9 | 0.0 |

| May | Business, Science and Innovation | Economic Development: Industry Transformation Plans | 0.4 | 0.0 |

| May | Business, Science and Innovation | Economic Development: Auckland Pacific Skills Shift | 0.1 | 0.0 |

| TOTAL | 26,687.4** | 12,679.9 |

* Expenditure approved under “Worker Redeployment Package” has been redirected to other, existing appropriations in line with its intended application. Hence the amount budgeted against this category has reduced over time. (See Beehive release "$100 million to redeploy workers")

** This total is the amount approved and budgeted by Cabinet as at 31 May 2020. It reflects reductions in funding for some areas subsequent to their initial approval.

1: Budget 2019 ($112.2 billion) and the second Imprest Supply Act ($17.3 billion).

2: The write-downs don’t involve additional cash disbursements.

3: Appropriations are authorities from Parliament that specify what the Crown may incur expenditure on (specific areas of expenditure). Most appropriations specify limits in terms of the type of expenditure, what it can be used for, the maximum amount, and the time period. The “regular, annual appropriations” refer to those that were in place before the Government’s Covid-19 response package.

4: Note that these figures relate to the Covid-only appropriations.

5: Cabinet initially approved the new expenditure under the Imprest Supply Acts. Parliament has subsequently authorised the increases through the Appropriation (2019/20 Supplementary Estimates) Act 2020.

6: That is, a full-time equivalent employee.

7: See www.beehive.govt.nz/release/extended-loan-scheme-keeps-business-afloat

8: The write-downs don’t involve additional cash disbursements.

9: See www.beehive.govt.nz/release/covid-19-further-steps-protect-new-zealanders'-jobs

10: See www.beehive.govt.nz/release/essential-workers-leave-scheme-established

11: Legal name: Airways Corporation of New Zealand.

12: See Interim Financial Statements of the Government of New Zealand For the Eleven Months Ended 31 May 2020, page 22.

13: The first Imprest Supply Act for the year allows the Government to incur expenditure up until the time the Budget is passed into legislation. After that, the second and third Acts (Imprest Supply 2 and 3) allowed the Government to incur expenditure in addition to that included in the original Budget for the year. This gave the Government room to respond to changes since the Budget was put together earlier in 2019.

14: Some approvals were signed off in April but included in the May financials.

15: Through the Appropriation (Supplementary Estimates) Acts

16: The Revised Budget and Estimated spend are included in the Budget 2020 documents (18 May 2020). The Actual spend is based on the Treasury’s financial data as at 31 May 2020.